Can insurance companies deny coverage Idea

Home » Trending » Can insurance companies deny coverage IdeaYour Can insurance companies deny coverage images are ready. Can insurance companies deny coverage are a topic that is being searched for and liked by netizens today. You can Find and Download the Can insurance companies deny coverage files here. Find and Download all royalty-free photos.

If you’re looking for can insurance companies deny coverage images information related to the can insurance companies deny coverage keyword, you have pay a visit to the ideal blog. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Can Insurance Companies Deny Coverage. Applicants convicted of serious offenses and a few minor traffic violations often have their coverage refused. On the basis of the circumstances of the car accident, your insurance company can deny a claim if your coverage does not apply. An insurer might deny coverage to a driver who it believes poses a higher risk and is more likely to file a claim. They must, however, notify you of their decision and provide you with sufficient time to acquire alternative coverage.

Can Insurance Companies Deny Coverage Can My Car From eminememportugues.blogspot.com

Can Insurance Companies Deny Coverage Can My Car From eminememportugues.blogspot.com

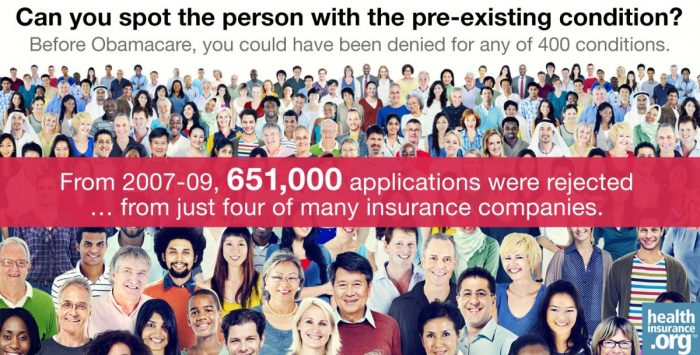

Life insurance companies cannot deny paying a life insurance claim unless they have a valid reason for doing so, such as the policy was no longer in effect. These are strong indicators you’re a risky driver who may cause a car accident and submit a claim. You make a mistake (or lie) on the paperwork. Why can insurance companies deny coverage? In other words, unless the insurance can show that you are a higher risk, they cannot charge you more for the same coverage that someone else is purchasing for a lower amount. States, with the exception of new hampshire.

For example, if the accident occurred due to the other driver’s fault, it is possible for them not to have mandatory liability coverage.

They must, however, notify you of their decision and provide you with sufficient time to acquire alternative coverage. Car insurance with liability coverage is mandatory in most u.s. States, with the exception of new hampshire. As long as this reasonable accommodation relates to an organization, it is allowed under laws like the fair housing act and the americans with disabilities act. You can also file a lawsuit if your insurance company misses the deadline for issuing a payment or breaches the agreement in any other way. You didn�t pay your premiums.

Source: weightlossmaintain.blogspot.com

Source: weightlossmaintain.blogspot.com

The home has lingering fire hazards. Arson is suspected (by you or someone else) the home is missing permits and inspections. You didn’t pay your premiums and let the coverage lapse. Can life insurance companies deny coverage. By detecting these types of risks, insurers can offer insurance protection for those who cause crashes.

Source: argotx.com

Source: argotx.com

You didn�t pay your premiums. The question of legality would have to be determined for each state on an individual level, but the most likely answer is that denying coverage to a spouse is legal. Insurance companies begin denying coverage for vaccine claims. Every person is different and there may be clear indications why one treatment is better (either in efficacy or side effects) than another based on your particular medical situation. * when the procedure, service or item is not covered under the policy * when the policy is lapsed and not in force due to non payment * when the provider is not contracted by the plan *.

Source: introfcsmind.blogspot.com

Source: introfcsmind.blogspot.com

Can life insurance companies deny coverage. What’s more, health plans cannot charge you more to have a policy because you are pregnant. Why can insurance companies deny coverage? As long as this reasonable accommodation relates to an organization, it is allowed under laws like the fair housing act and the americans with disabilities act. The home has lingering fire hazards.

Source: weightlossmaintain.blogspot.com

Source: weightlossmaintain.blogspot.com

A car insurance company can deny coverage for almost any reason. Car insurance with liability coverage is mandatory in most u.s. Life insurance companies cannot deny paying a life insurance claim unless they have a valid reason for doing so, such as the policy was no longer in effect. The home has lingering fire hazards. The top reasons insurance companies deny fire claims are:

Source: eminememportugues.blogspot.com

Source: eminememportugues.blogspot.com

Life insurance companies cannot deny paying a life insurance claim unless they have a valid reason for doing so, such as the policy was no longer in effect. These rules went into effect for plan years beginning on or after january 1, 2014. A plan purchased in america before march 2010 is grandfathered in under the affordable care act. The home has lingering fire hazards. Applicants convicted of serious offenses and a few minor traffic violations often have their coverage refused.

Source: guiomaruparadise.blogspot.com

An insurer might deny coverage to a driver who it believes poses a higher risk and is more likely to file a claim. Insurance companies frequently deny coverage if the applicant has a recent history of accidents, a series of minor traffic tickets or a serious infraction such as a dui. The top reasons insurance companies deny fire claims are: * when the procedure, service or item is not covered under the policy * when the policy is lapsed and not in force due to non payment * when the provider is not contracted by the plan *. You didn’t pay your premiums and let the coverage lapse.

Source: takemycounsel.com

Source: takemycounsel.com

Can life insurance companies deny coverage. Can life insurance companies deny coverage. The top reasons insurance companies deny fire claims are: These are strong indicators you’re a risky driver who may cause a car accident and submit a claim. In other words, unless the insurance can show that you are a higher risk, they cannot charge you more for the same coverage that someone else is purchasing for a lower amount.

Source: eminememportugues.blogspot.com

Source: eminememportugues.blogspot.com

A plan purchased in america before march 2010 is grandfathered in under the affordable care act. Your insurer can deny a claim in different scenarios: Can life insurance companies deny coverage. What’s more, health plans cannot charge you more to have a policy because you are pregnant. By detecting these types of risks, insurers can offer insurance protection for those who cause crashes.

Source: worldwidetweets.com

Source: worldwidetweets.com

When can an insurance company deny a claim? Insurance companies frequently deny coverage if the applicant has a recent history of accidents, a series of minor traffic tickets or a serious infraction such as a dui. You didn�t pay your premiums. Car insurance with liability coverage is mandatory in most u.s. Can insurance companies deny coverage?

Source: eminememportugues.blogspot.com

For example, if the accident occurred due to the other driver’s fault, it is possible for them not to have mandatory liability coverage. A plan purchased in america before march 2010 is grandfathered in under the affordable care act. Most cases, original medicare or private health insurance coverage cannot be used to pay for the acquisition or maintenance of an accessible service dog. They must, however, notify you of their decision and provide you with sufficient time to acquire alternative coverage. Insurance companies begin denying coverage for vaccine claims.

Source: eeventonline.com

Source: eeventonline.com

Every person is different and there may be clear indications why one treatment is better (either in efficacy or side effects) than another based on your particular medical situation. These are strong indicators you’re a risky driver who may cause a car accident and submit a claim. Typically, laws are concerned with higher rates, not outright denials, but it may be worth confirming that the reason your. It is the company’s prerogative to deny you coverage if they believe you are dishonest, have poor health, or are a dangerous driver. You can also file a lawsuit if your insurance company misses the deadline for issuing a payment or breaches the agreement in any other way.

Source: ipbcustomize.com

Source: ipbcustomize.com

Insurance companies begin denying coverage for vaccine claims. Typically, laws are concerned with higher rates, not outright denials, but it may be worth confirming that the reason your. Arson is suspected (by you or someone else) the home is missing permits and inspections. This content is created and maintained by a third party, and imported onto this page to help users provide their email addresses. When can an insurance company deny a claim?

Source: weightlossmaintain.blogspot.com

Source: weightlossmaintain.blogspot.com

In most cases, the insurance company can only deny coverage or charge higher rates for reasons that are directly related to the risk of insuring the person. In other words, unless the insurance can show that you are a higher risk, they cannot charge you more for the same coverage that someone else is purchasing for a lower amount. Most cases, original medicare or private health insurance coverage cannot be used to pay for the acquisition or maintenance of an accessible service dog. The top reasons insurance companies deny fire claims are: When can an insurance company deny a claim?

Source: eminememportugues.blogspot.com

Source: eminememportugues.blogspot.com

(full guide 2022) by editorial staff. This content is created and maintained by a third party, and imported onto this page to help users provide their email addresses. The question of legality would have to be determined for each state on an individual level, but the most likely answer is that denying coverage to a spouse is legal. You didn’t pay your premiums and let the coverage lapse. In other words, unless the insurance can show that you are a higher risk, they cannot charge you more for the same coverage that someone else is purchasing for a lower amount.

Source: ipbcustomize.com

Source: ipbcustomize.com

Life insurance can deny coverage when you are applying for it, if you do not fit that company�s guidelines for age, health, build, or other factors. How can insurance companies deny coverage? Can insurance deny an esa? Life insurance can deny coverage when you are applying for it, if you do not fit that company�s guidelines for age, health, build, or other factors. A car insurance company can deny coverage for almost any reason.

Source: weightlossmaintain.blogspot.com

Source: weightlossmaintain.blogspot.com

Can car insurance companies deny coverage? An insurer might deny coverage to a driver who it believes poses a higher risk and is more likely to file a claim. In other words, unless the insurance can show that you are a higher risk, they cannot charge you more for the same coverage that someone else is purchasing for a lower amount. Qualifying for coverage isn’t guaranteed, however. Can insurance deny an esa?

Source: cheapjordantshirts.blogspot.com

Source: cheapjordantshirts.blogspot.com

The home has lingering fire hazards. The most frequently cited causes of denials are: Typically, laws are concerned with higher rates, not outright denials, but it may be worth confirming that the reason your. Insurance companies begin denying coverage for vaccine claims. An insurer might deny coverage to a driver who it believes poses a higher risk and is more likely to file a claim.

Source: eminememportugues.blogspot.com

Source: eminememportugues.blogspot.com

How can insurance companies deny coverage? What’s more, health plans cannot charge you more to have a policy because you are pregnant. The most frequently cited causes of denials are: As long as this reasonable accommodation relates to an organization, it is allowed under laws like the fair housing act and the americans with disabilities act. (full guide 2022) by editorial staff.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can insurance companies deny coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea