Can insurance deny cancer treatment information

Home » Trending » Can insurance deny cancer treatment informationYour Can insurance deny cancer treatment images are available. Can insurance deny cancer treatment are a topic that is being searched for and liked by netizens now. You can Find and Download the Can insurance deny cancer treatment files here. Find and Download all royalty-free vectors.

If you’re looking for can insurance deny cancer treatment images information connected with to the can insurance deny cancer treatment interest, you have pay a visit to the ideal blog. Our site always provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

Can Insurance Deny Cancer Treatment. Can i refuse to have chemotherapy? If your insurer refuses to pay for your cancer treatment or services, you have the right to appeal. Children with cancer cannot be turned down for coverage. Cancer treatment can be an extremely costly undertaking.

ERISA Cancer treatment denial From plaintiffmagazine.com

ERISA Cancer treatment denial From plaintiffmagazine.com

The treatment will cost around $125,000 in total, none of it is being covered by insurance. Health insurers may deny such treatments as not “medically necessary” based upon their own definitions of the term. Certain forms of cancer treatment may also be denied as not medically necessary. These are plans that were created before the affordable care act. Greedy insurance companies deny cancer treatment in the face of expert medical advice. Not only do we have to fight breast cancer, we also have to fight our insurance company to authorize our treatment.

The treatment will cost around $125,000 in total, none of it is being covered by insurance.

They may not limit the benefits of this condition. Can i refuse to have chemotherapy? If you need a treatment or test, and it isn�t considered part of the standard of care for your medical problem, then they may have a reason to save their money by denying that test or treatment for. Such insurance cancer treatment denials can mean the difference between life and death. Your doctor presents what he or she feels are the most appropriate treatment options for your specific cancer type and stage. Published on may 27, 2019.

Source: keeptalking79.blogspot.com

Source: keeptalking79.blogspot.com

When you have insurance, they cannot refuse treatment for your previous condition. A company cannot cancel your insurance if they find a mistake in your application. When you have insurance, they cannot refuse treatment for your previous condition. Countless others have declined treatment because it was ineffective for. Can i refuse to have chemotherapy?

Source: empowerbrokerage.com

Source: empowerbrokerage.com

The majority of relapses are caught by symptoms, rather. Padcev had been approved in december 2019 for the treatment of advanced bladder cancer if the patient had received a platinum containing chemotherapy such as cisplatin or carboplatin, and received immunotherapy such as keytruda. The majority of relapses are caught by symptoms, rather. Your insurance company cannot stop paying its part of your bills. A delay of such treatment can reduce the amount of time one has left to live.

Source: keeptalking79.blogspot.com

Source: keeptalking79.blogspot.com

If you need a treatment or test, and it isn�t considered part of the standard of care for your medical problem, then they may have a reason to save their money by denying that test or treatment for. Not only do we have to fight breast cancer, we also have to fight our insurance company to authorize our treatment. They cannot limit benefits for that condition either. Countless others have declined treatment because it was ineffective for. Greedy insurance companies deny cancer treatment in the face of expert medical advice.

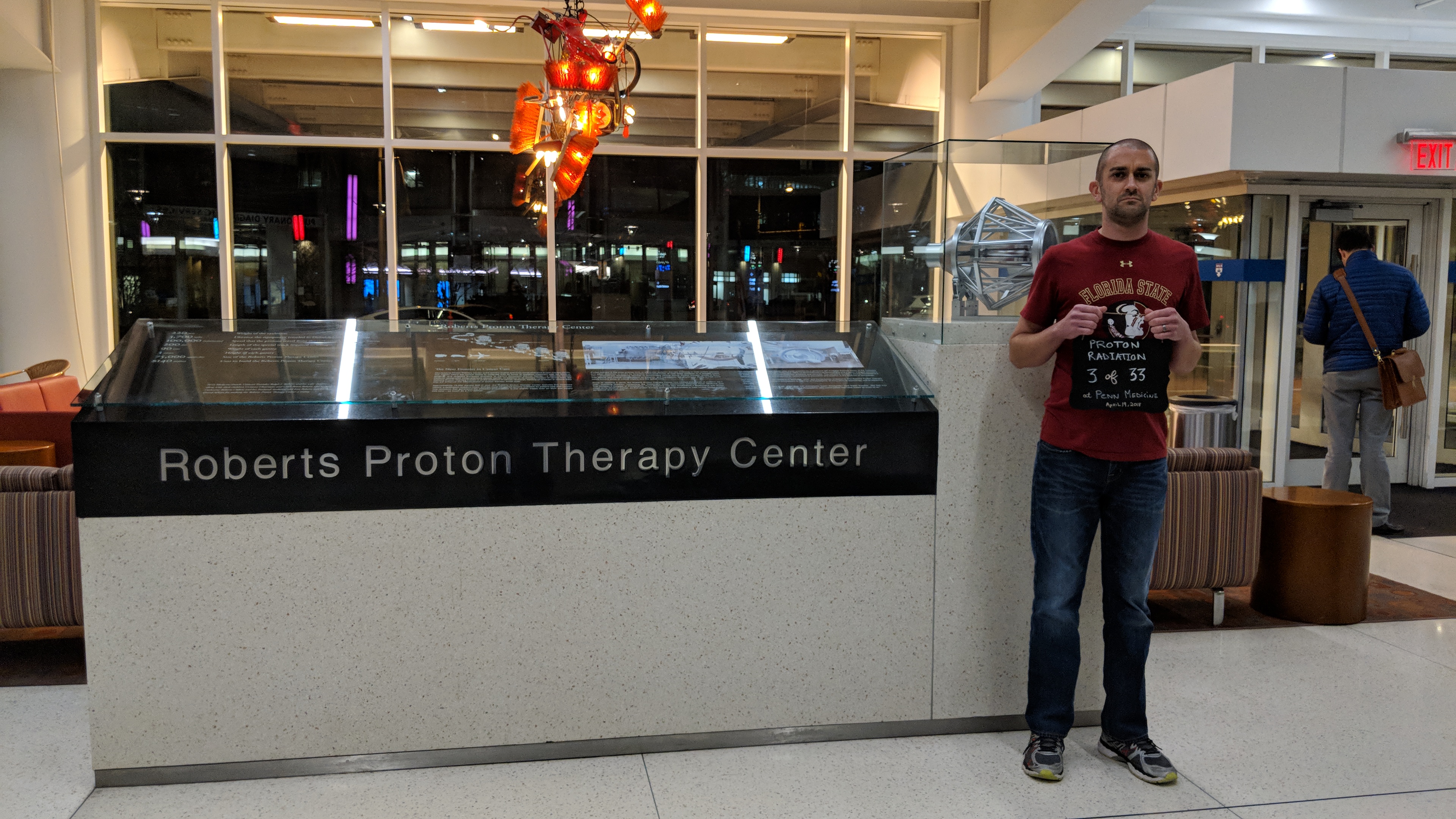

Source: johnsjourneytoacure.com

Source: johnsjourneytoacure.com

Because providers can deny treatment to cancer patients without insurance when they lack the financial capacity to pay themselves, you may need to file for social security disability as a first step. They may not limit the benefits of this condition. Because providers can deny treatment to cancer patients without insurance when they lack the financial capacity to pay themselves, you may need to file for social security disability as a first step. In the 1960s, film actress joan crawford refused treatment for her pancreatic cancer because of her faith as a christian scientist. Countless others have declined treatment because it was ineffective for.

Source: dailykos.com

Source: dailykos.com

They cannot limit benefits for that condition either. Children with cancer cannot be turned down for coverage. Sometimes, for any number of reasons, insurers can refuse to pay for the medications or services ordered. This is true unless you or someone else commits fraud, or cheating. You cannot be denied insurance if you have cancer.

Source: winknews.com

Source: winknews.com

A delay of such treatment can reduce the amount of time one has left to live. Health insurers may deny such treatments as not “medically necessary” based upon their own definitions of the term. Your doctor presents what he or she feels are the most appropriate treatment options for your specific cancer type and stage. If your insurer refuses to pay for your cancer treatment or services, you have the right to appeal. If you qualify and want to take part in a clinical trial, your health plan must help pay.

Source: keeptalking79.blogspot.com

Source: keeptalking79.blogspot.com

The majority of relapses are caught by symptoms, rather. It’s not unusual for insurers to deny some claims or say they won’t cover a test, procedure, or service that doctors order. These are plans that were created before the affordable care act. For instance, sighted adults under 65 without dependent children are ineligible for medicaid until completing this task. I think in principle, once fda approves the treatment, insurer has to pay.

Source: allianceforprotontherapy.org

Source: allianceforprotontherapy.org

They cannot limit benefits for that condition either. For instance, sighted adults under 65 without dependent children are ineligible for medicaid until completing this task. Certain forms of cancer treatment may also be denied as not medically necessary. A company cannot cancel your insurance if they find a mistake in your application. Published on may 27, 2019.

Source: keeptalking79.blogspot.com

Source: keeptalking79.blogspot.com

These are plans that were created before the affordable care act. A delay of such treatment can reduce the amount of time one has left to live. If you need a treatment or test, and it isn�t considered part of the standard of care for your medical problem, then they may have a reason to save their money by denying that test or treatment for. Published on may 27, 2019. Not only do we have to fight breast cancer, we also have to fight our insurance company to authorize our treatment.

Source: youtube.com

Source: youtube.com

If you qualify and want to take part in a clinical trial, your health plan must help pay. This is true unless you or someone else commits fraud, or cheating. If your insurer refuses to pay for your cancer treatment or services, you have the right to appeal. Health insurers may deny such treatments as not “medically necessary” based upon their own definitions of the term. When you receive a medical treatment or service, your doctor or pharmacist must send a bill to your insurer.

Source: keeptalking79.blogspot.com

Source: keeptalking79.blogspot.com

Sometimes, for any number of reasons, insurers can refuse to pay for the medications or services ordered. Countless others have declined treatment because it was ineffective for. If your insurer refuses to pay for your cancer treatment or services, you have the right to appeal. In what cases, however, can they refuse? They may not limit the benefits of this condition.

Source: plaintiffmagazine.com

Source: plaintiffmagazine.com

They cannot limit benefits for that condition either. Now, your insurance company must keep paying for care. It’s not unusual for insurers to deny some claims or say they won’t cover a test, procedure, or service that doctors order. A delay of such treatment can reduce the amount of time one has left to live. My liver is swollen which is causing extreme pain.

Source: youtube.com

Source: youtube.com

Insurance companies have developed written policies and protocols about the standard of care for treatment of particular cancers, but such policies can quickly become outdated. In what cases, however, can they refuse? A health problem, like asthma, diabetes, or cancer, you had before the date that new health coverage starts. Not only do we have to fight breast cancer, we also have to fight our insurance company to authorize our treatment. This is true even if you need a lot of care, such as for cancer.

Source: fox17online.com

Source: fox17online.com

When you receive a medical treatment or service, your doctor or pharmacist must send a bill to your insurer. It’s not unusual for insurers to deny some claims or say they won’t cover a test, procedure, or service that doctors order. Now, your insurance company must keep paying for care. Such insurance cancer treatment denials can mean the difference between life and death. Some may be familiar with my story, i have stage 4 breast cancer which has spread to my liver.

Source: youtube.com

Source: youtube.com

In what cases, however, can they refuse? Children with cancer cannot be turned down for coverage. Your doctor presents what he or she feels are the most appropriate treatment options for your specific cancer type and stage. Such insurance cancer treatment denials can mean the difference between life and death. However, health insurers still deny coverage in such circumstances.

Source: keeptalking79.blogspot.com

Source: keeptalking79.blogspot.com

The treatment will cost around $125,000 in total, none of it is being covered by insurance. Countless others have declined treatment because it was ineffective for. Not only do we have to fight breast cancer, we also have to fight our insurance company to authorize our treatment. You cannot be denied insurance if you have cancer. I think in principle, once fda approves the treatment, insurer has to pay.

Source: federalprisonauthority.com

Source: federalprisonauthority.com

When you receive a medical treatment or service, your doctor or pharmacist must send a bill to your insurer. Insurance companies have developed written policies and protocols about the standard of care for treatment of particular cancers, but such policies can quickly become outdated. Because providers can deny treatment to cancer patients without insurance when they lack the financial capacity to pay themselves, you may need to file for social security disability as a first step. You cannot be denied insurance if you have cancer. If a health insurer sends you a cancer treatment denial due to medical necessity despite.

Source: debofsky.com

Source: debofsky.com

You can appeal medicare claim denials, too. If a health insurer sends you a cancer treatment denial due to medical necessity despite. Insurance companies have developed written policies and protocols about the standard of care for treatment of particular cancers, but such policies can quickly become outdated. If you qualify and want to take part in a clinical trial, your health plan must help pay. Some may be familiar with my story, i have stage 4 breast cancer which has spread to my liver.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can insurance deny cancer treatment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea