Can insurance pay for formula information

Home » Trend » Can insurance pay for formula informationYour Can insurance pay for formula images are ready. Can insurance pay for formula are a topic that is being searched for and liked by netizens now. You can Get the Can insurance pay for formula files here. Get all royalty-free images.

If you’re looking for can insurance pay for formula pictures information connected with to the can insurance pay for formula interest, you have visit the right blog. Our site frequently provides you with hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

Can Insurance Pay For Formula. Insurance expense is the charge that a company takes on for the insurance policy or policies it wants to protect itself and its workers. In some cases, insurance does cover formula, but the requirements are pretty strict. The company will record the payment with a debit of $12,000 to prepaid insurance and a credit of $12,000 to cash. Covering the cost of formula through insurance many families who need specialty formula for their children find the cost to be high and burdensome.

Solved Monthly Mortgage Payments Can Be Calculated Using From chegg.com

Solved Monthly Mortgage Payments Can Be Calculated Using From chegg.com

Medical coinsurance a health insurance policy has a $500 deductible and a 20% coinsurance clause. The actual amount of claim is determined by the formula: The formula for edli calculation = 35 times of average monthly basic salary in the last 12 months + 50% of epf balance. Depending on the insurance policy, you might pay the premium each month or on a semiannual basis. Both the insurer and the insured then bear the loss in proportion to the covered and uncovered sum. Formula to calculate idv is:

The formula for edli calculation = 35 times of average monthly basic salary in the last 12 months + 50% of epf balance.

Begin by dividing the actual amount of coverage on the house by the amount that should have been. Present value of annuity is calculated using the formula given below. Now we want to get $10,000 starting from year 51 to year 75 (25 years). Medical coinsurance a health insurance policy has a $500 deductible and a 20% coinsurance clause. If he can only get insurance by paying one dollar more (i.e., for $77), buying In some cases, insurance does cover formula, but the requirements are pretty strict.

Source: brighton-hove.gov.uk

Source: brighton-hove.gov.uk

Claim = loss suffered x insured value/total cost. Without a medical condition, the formula is considered a food product, which is why most policies don’t. The agreement is that, as the policyholder, the. It depends, of course, on the type of business. Let�s assume that a company is started on december 1 and arranges for business insurance to begin on december 1.

Source: pinterest.com

Source: pinterest.com

(required amount of insurance) inserting the amounts above in the formula produces the following calculation: Insurance expense is the charge that a company takes on for the insurance policy or policies it wants to protect itself and its workers. Now we want to get $10,000 starting from year 51 to year 75 (25 years). Insurance companies won’t cover infant formula unless there is a medical need such as a gastrological condition or a food allergy. It depends, of course, on the type of business.

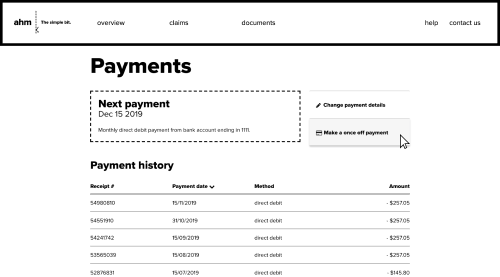

Source: help.ahm.com.au

Source: help.ahm.com.au

Formula to calculate idv is: Medical coinsurance a health insurance policy has a $500 deductible and a 20% coinsurance clause. Insurance expense is the charge that a company takes on for the insurance policy or policies it wants to protect itself and its workers. The coinsurance percentage dictates the fraction of covered medical expenses the insured must pay, after having met a flat deductible. The object of such an average clause is to limit the liability of the insurance company.

Source: vertex42.com

Source: vertex42.com

Begin by dividing the actual amount of coverage on the house by the amount that should have been. On december 1 the company pays the insurance company $12,000 for the insurance premiums covering one year. Insurance expense is the charge that a company takes on for the insurance policy or policies it wants to protect itself and its workers. That’s why we provide insurance specialists — completely free — who will work with your insurance to determine if you are eligible for insurance covered formula. The object of such an average clause is to limit the liability of the insurance company.

Source: ablebits.com

Source: ablebits.com

Let�s assume that a company is started on december 1 and arranges for business insurance to begin on december 1. (actual amount of insurance) * amount of loss = amount of claim. It depends, of course, on the type of business. Getting insurance to cover medical foods, including enteral formula, isn’t a new problem. In a health insurance policy, coinsurance is a form of deductible.

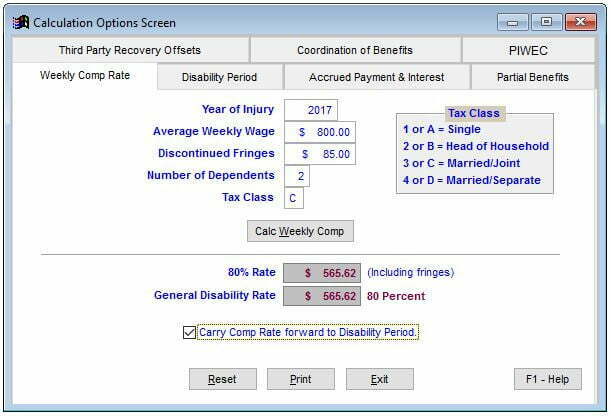

Source: workerscomplawyerhelp.com

Source: workerscomplawyerhelp.com

(actual amount of insurance) * amount of loss = amount of claim. Begin by dividing the actual amount of coverage on the house by the amount that should have been. The formula for edli calculation = 35 times of average monthly basic salary in the last 12 months + 50% of epf balance. Besides using the formula to calculate the new car insurance price, one can use a car insurance premium calculator to determine the premium of your new car. In some cases, insurance does cover formula, but the requirements are pretty strict.

Source: wealthyeducation.com

Source: wealthyeducation.com

In some cases, you might be required to pay the full amount up front, before coverage starts. On december 1 the company pays the insurance company $12,000 for the insurance premiums covering one year. Both the insurer and the insured then bear the loss in proportion to the covered and uncovered sum. In some cases, insurance does cover formula, but the requirements are pretty strict. However, there seems to be an increasing number of insurance companies that are choosing not to cover medical formulas, despite the medical.

Source: ratiosys.com

Source: ratiosys.com

If he can get full insurance for one dollar less (i.e., for $75), buying the insurance will increase his expected utility, so he will want to buy the insurance. Insurance expense is the charge that a company takes on for the insurance policy or policies it wants to protect itself and its workers. Getting insurance to cover medical foods, including enteral formula, isn’t a new problem. It depends, of course, on the type of business. Insurance companies won’t cover infant formula unless there is a medical need such as a gastrological condition or a food allergy.

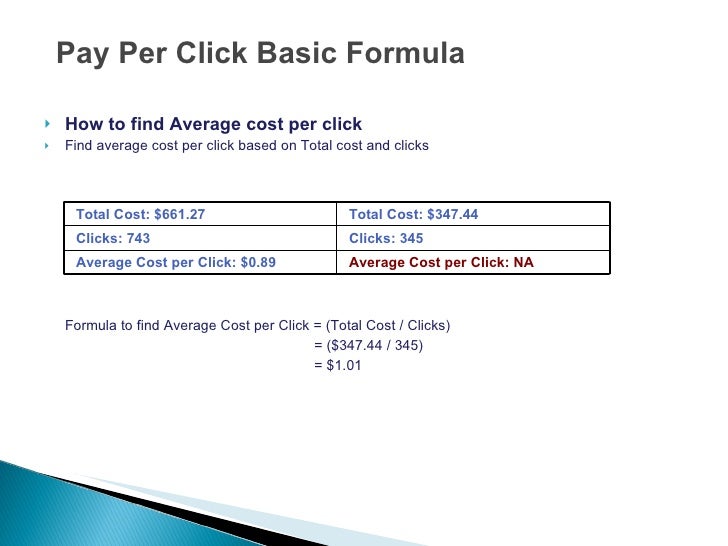

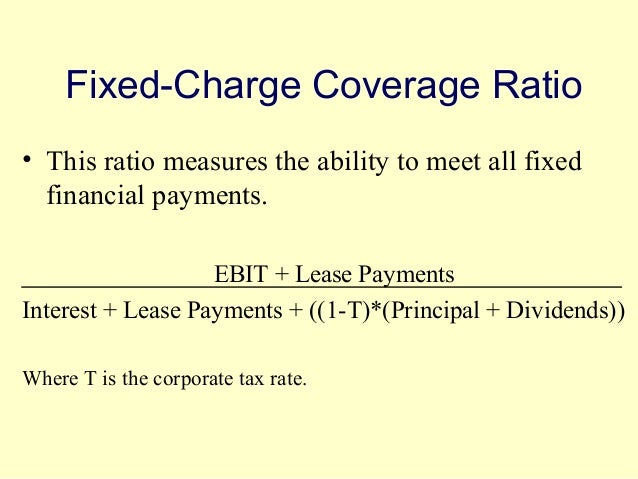

Source: slideshare.net

Source: slideshare.net

It depends, of course, on the type of business. Individuals on elemental diets have two delivery methods: (actual amount of insurance) * amount of loss = amount of claim. Let�s assume that a company is started on december 1 and arranges for business insurance to begin on december 1. Begin by dividing the actual amount of coverage on the house by the amount that should have been.

Source: activerain.com

Source: activerain.com

In some cases, you might be required to pay the full amount up front, before coverage starts. Both the insurer and the insured then bear the loss in proportion to the covered and uncovered sum. Medical coinsurance a health insurance policy has a $500 deductible and a 20% coinsurance clause. In some cases, you might be required to pay the full amount up front, before coverage starts. Covering the cost of formula through insurance many families who need specialty formula for their children find the cost to be high and burdensome.

Source: wealthyeducation.com

Source: wealthyeducation.com

Formula to calculate idv is: The formula for edli calculation = 35 times of average monthly basic salary in the last 12 months + 50% of epf balance. If your car is totaled how much does insurance pay? Due to this enormous cost, many parents wonder if the baby formula can be covered by insurance. Insurance companies won’t cover infant formula unless there is a medical need such as a gastrological condition or a food allergy.

Source: excel-pmt.com

Source: excel-pmt.com

(actual amount of insurance) * amount of loss = amount of claim. However, there seems to be an increasing number of insurance companies that are choosing not to cover medical formulas, despite the medical. The actual amount of claim is determined by the formula: In some cases, you might be required to pay the full amount up front, before coverage starts. (required amount of insurance) inserting the amounts above in the formula produces the following calculation:

Source: youtube.com

Source: youtube.com

Even after the insurance claim, the totaled car may still have value. The actual amount of claim is determined by the formula: The coinsurance formula is relatively simple. Depending on the insurance policy, you might pay the premium each month or on a semiannual basis. If your car is totaled how much does insurance pay?

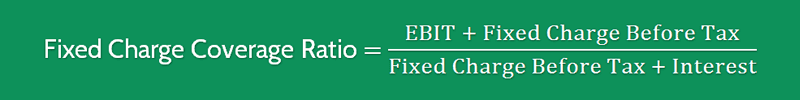

Source: wolfram.com

Source: wolfram.com

The formula for edli calculation = 35 times of average monthly basic salary in the last 12 months + 50% of epf balance. The actual amount of claim is determined by the formula: Even after the insurance claim, the totaled car may still have value. The agreement is that, as the policyholder, the. If he can get full insurance for one dollar less (i.e., for $75), buying the insurance will increase his expected utility, so he will want to buy the insurance.

Source: slideshare.net

Source: slideshare.net

The coinsurance percentage dictates the fraction of covered medical expenses the insured must pay, after having met a flat deductible. Used car prices causing turmoil for insurers. Getting insurance to cover medical foods, including enteral formula, isn’t a new problem. That’s why we provide insurance specialists — completely free — who will work with your insurance to determine if you are eligible for insurance covered formula. Besides using the formula to calculate the new car insurance price, one can use a car insurance premium calculator to determine the premium of your new car.

Source: brainly.com

Source: brainly.com

The coinsurance percentage dictates the fraction of covered medical expenses the insured must pay, after having met a flat deductible. If your car is totaled how much does insurance pay? That’s why we provide insurance specialists — completely free — who will work with your insurance to determine if you are eligible for insurance covered formula. The formula for edli calculation = 35 times of average monthly basic salary in the last 12 months + 50% of epf balance. Without a medical condition, the formula is considered a food product, which is why most policies don’t.

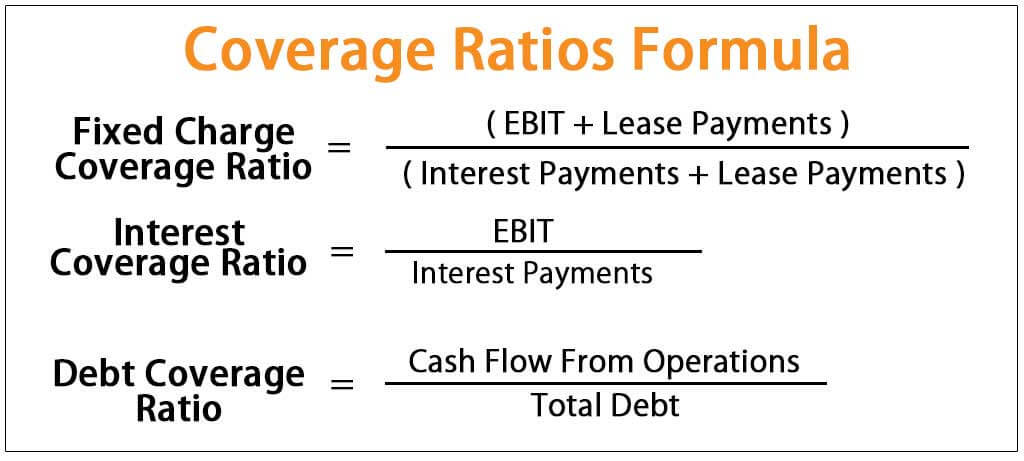

Source: wallstreetmojo.com

Source: wallstreetmojo.com

However, there seems to be an increasing number of insurance companies that are choosing not to cover medical formulas, despite the medical. Covering the cost of formula through insurance many families who need specialty formula for their children find the cost to be high and burdensome. A penalty could be applied and the insurance company will pay only a portion of the loss. Insurance expense is the charge that a company takes on for the insurance policy or policies it wants to protect itself and its workers. Individuals on elemental diets have two delivery methods:

Source: chegg.com

Source: chegg.com

It depends, of course, on the type of business. It depends, of course, on the type of business. Getting insurance to cover medical foods, including enteral formula, isn’t a new problem. Covering the cost of formula through insurance many families who need specialty formula for their children find the cost to be high and burdensome. (required amount of insurance) inserting the amounts above in the formula produces the following calculation:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can insurance pay for formula by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information