Can irs take life insurance from beneficiary information

Home » Trend » Can irs take life insurance from beneficiary informationYour Can irs take life insurance from beneficiary images are available in this site. Can irs take life insurance from beneficiary are a topic that is being searched for and liked by netizens now. You can Get the Can irs take life insurance from beneficiary files here. Download all free vectors.

If you’re searching for can irs take life insurance from beneficiary pictures information linked to the can irs take life insurance from beneficiary topic, you have visit the ideal blog. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Can Irs Take Life Insurance From Beneficiary. The payout, while it is not taxable income for the beneficiary, will still be reported by the insurer. In general, the internal revenue service (irs) doesn’t consider life insurance proceeds as gross income, which means beneficiaries typically won’t have to pay income taxes on it. When proceeds may be seized if the insured failed to name a beneficiary or named a minor as beneficiary, the irs can seize the life insurance proceeds to pay the insured’s tax debts. An exception would be if the beneficiary filed jointly with the insured, or if the beneficiary owed his/her own money to the irs.

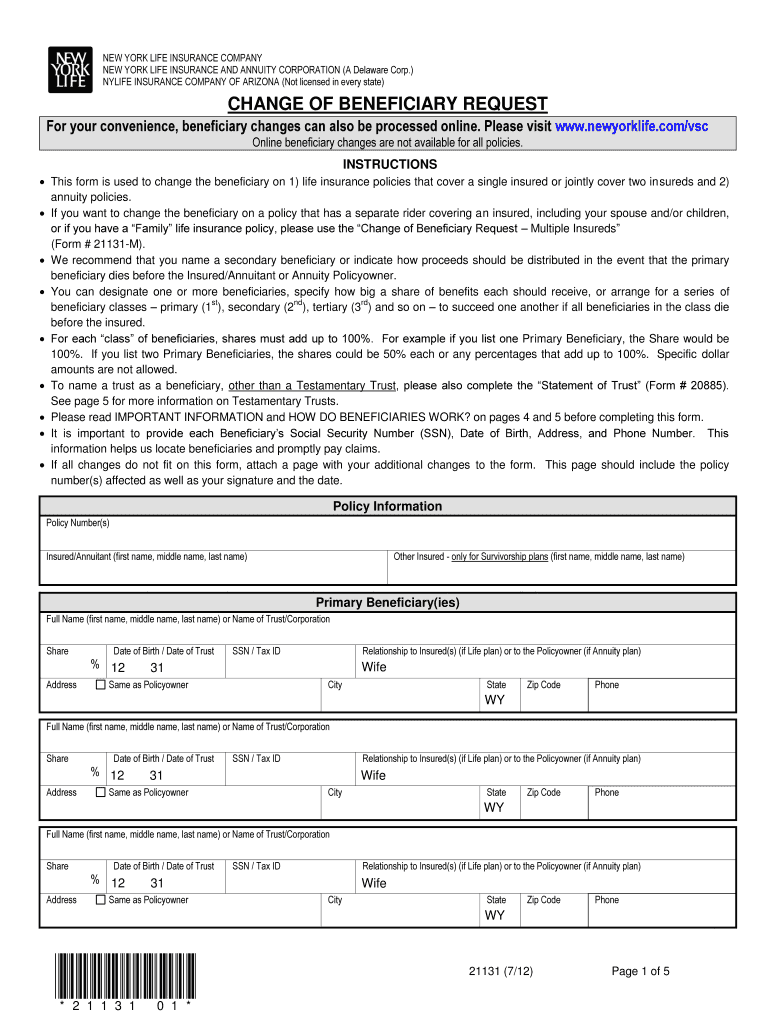

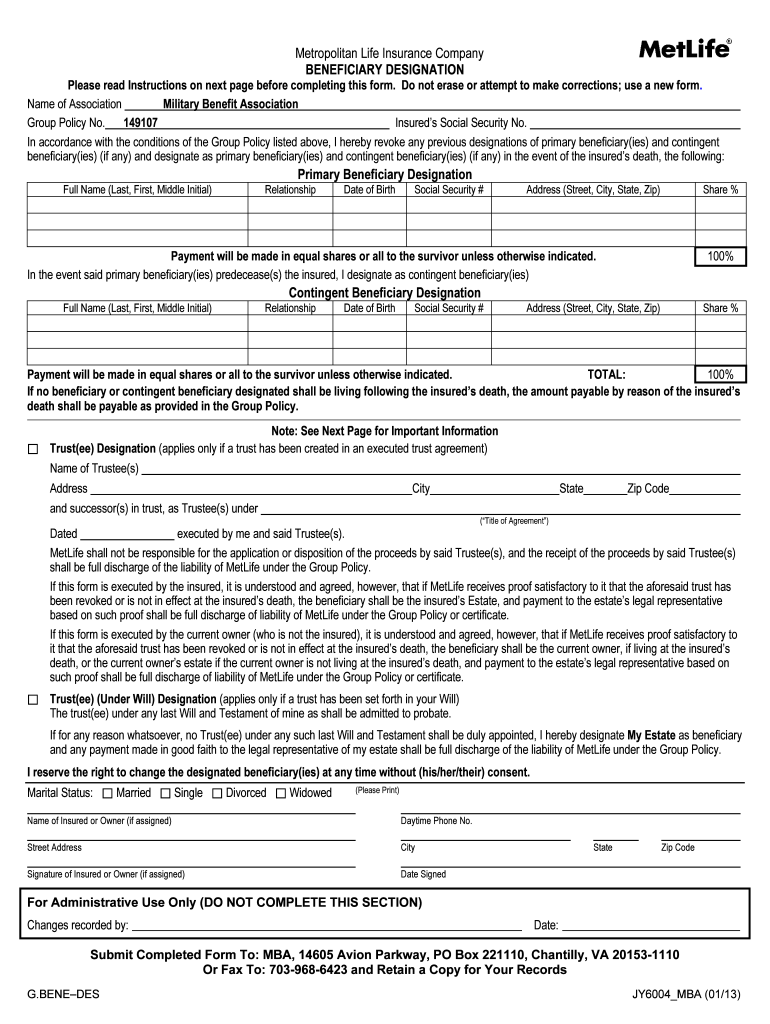

New York Life Forms Fill Online, Printable, Fillable From pdffiller.com

New York Life Forms Fill Online, Printable, Fillable From pdffiller.com

No, death benefits from a life insurance policy which has a named beneficiary is not subject to attachment by the irs, state tax officials, judgment creditors, etc. An exception would be if the beneficiary filed jointly with the insured, or if the beneficiary owed his/her own money to the irs. No, the irs cannot take your life insurance. Also, it will have no recourse, under irc section 6901, against life insurance proceeds payable to named beneficiaries if state law exempts such proceeds from creditors. In cases like this, the irs can mark a taxpayer’s account as cnc and any collection activities, like tax levies, are stopped. Overall, the government and irs can take your life insurance proceeds if you have any unpaid taxes, disability payments, or annuity contracts after you were to pass away.

This means that the irs cannot seize the benefits of a life insurance policy to pay the debts owed by the deceased.

Can the irs take life insurance benefits? When proceeds may be seized if the insured failed to name a beneficiary or named a minor as beneficiary, the irs can seize the life insurance proceeds to pay the insured’s tax debts. No, the irs cannot take your life insurance. For starters, the bulk of your life insurance benefits are likely to be safe from the irs. If the irs places the taxpayer into the cnc status, it means that they are not going to require any payments from the taxpayer and they are going to leave the taxpayer alone until the taxpayer’s financial situation. The life insurance death benefits received by your beneficiaries aren�t included in their gross income as recorded by the internal revenue service (aka irs).

Source: moneywise.com

Source: moneywise.com

If the irs places the taxpayer into the cnc status, it means that they are not going to require any payments from the taxpayer and they are going to leave the taxpayer alone until the taxpayer’s financial situation. Can irs take life insurance from beneficiary? Probate is the place anyone who is owed money by a person who is deceased, can go and make a claim for some of the estate. Sorry to the data dump, but the answer to your question is. The payout, while it is not taxable income for the beneficiary, will still be reported by the insurer.

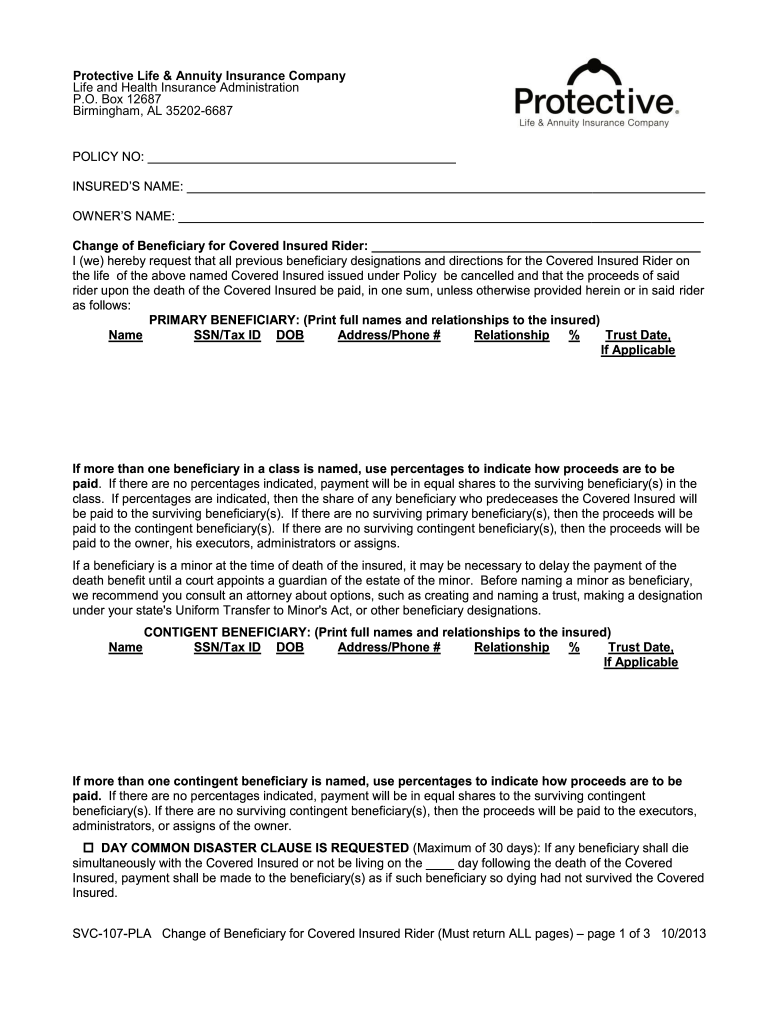

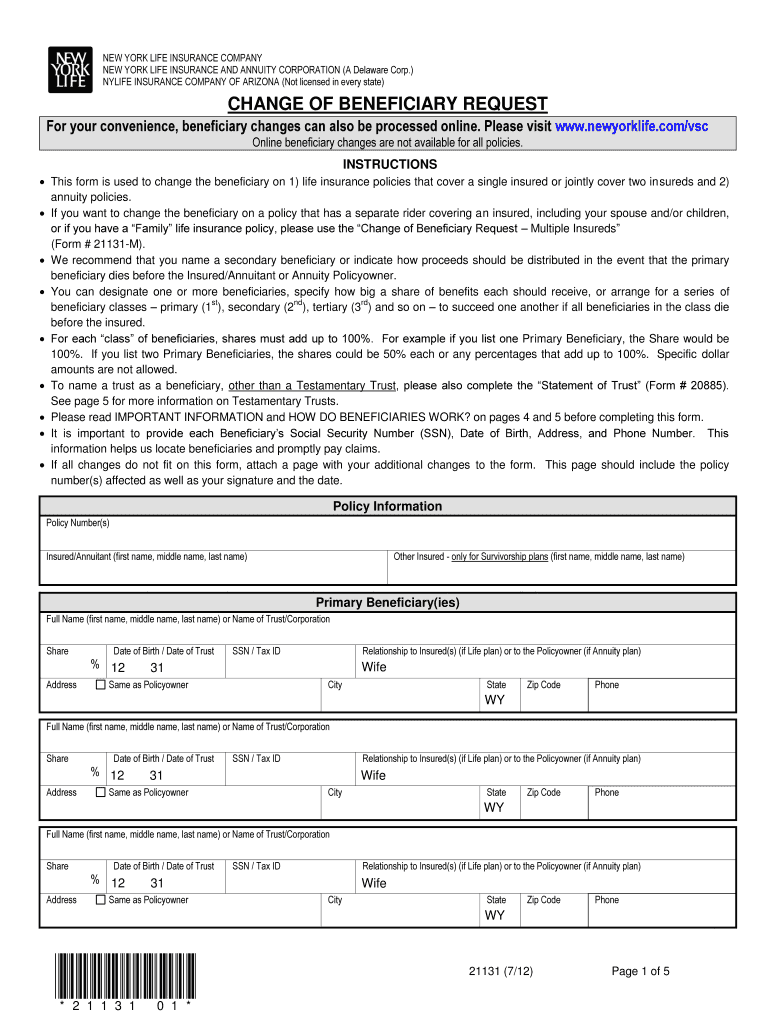

Source: signnow.com

Source: signnow.com

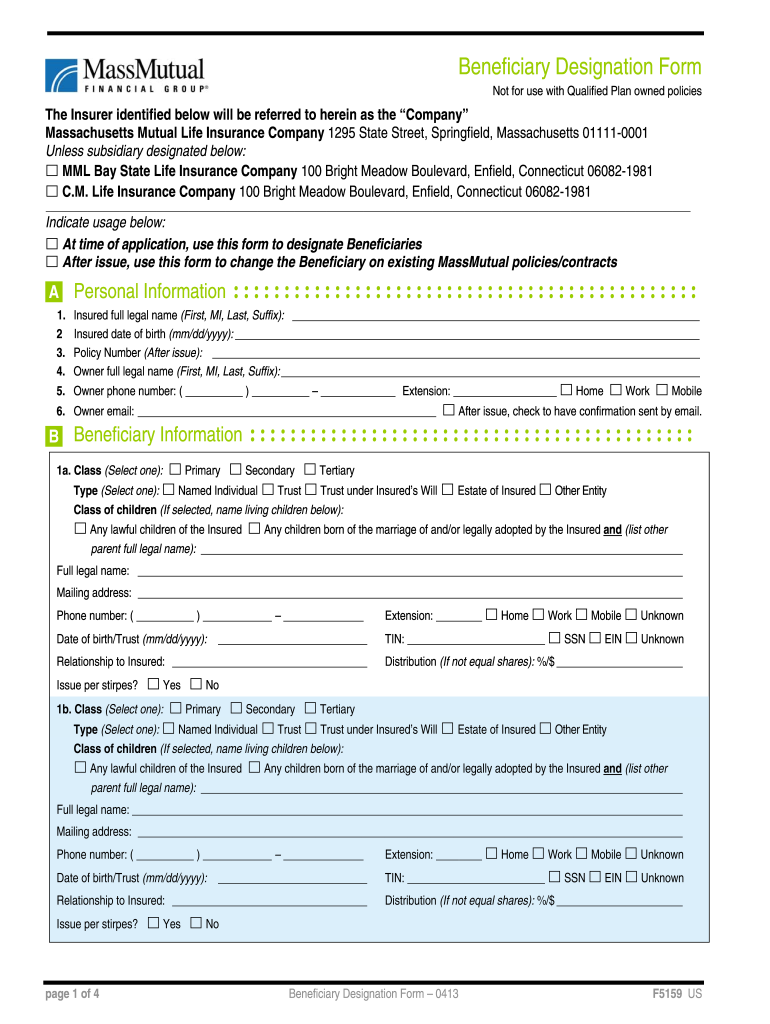

If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. If you’re married or have children, it’s important that you know what these rules are. However, a couple of exceptions may require beneficiaries to pay taxes, including: This is because the owner of the policy provides the coverage for the beneficiary, and the insured’s death is only the qualifying event that causes the money to be paid. A life insurance beneficiary rule is a rule put in place either by the life insurance company or the insurance commissioner of the state you live in.

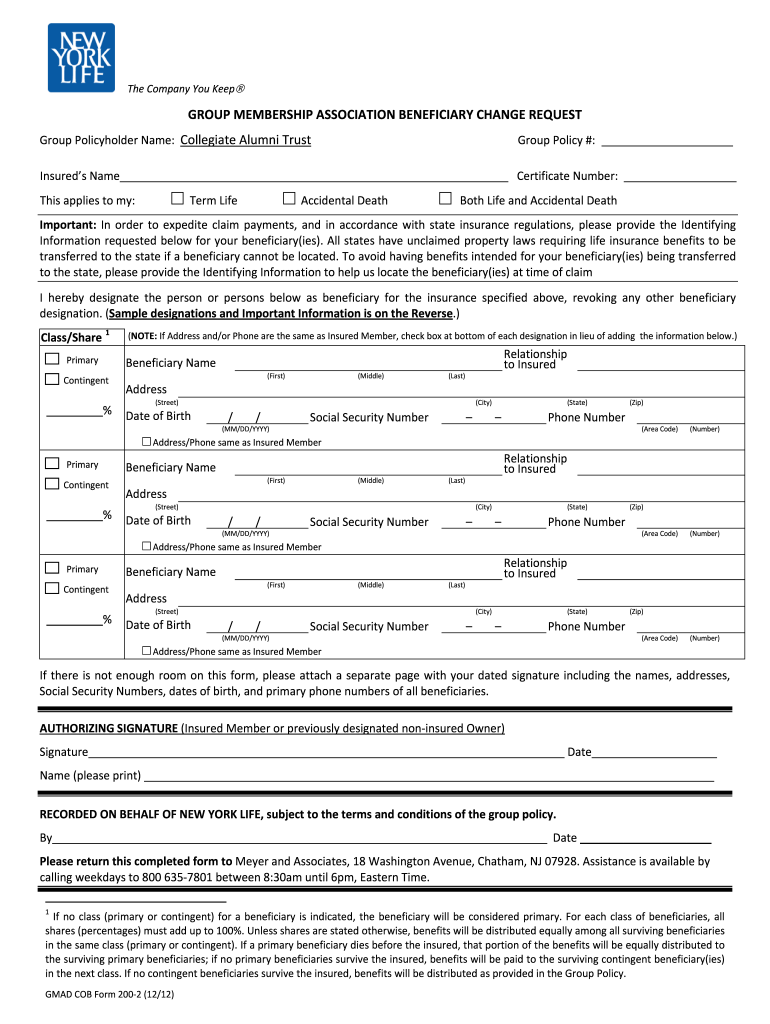

Source: studylib.net

Source: studylib.net

If the insured owed taxes at the time of his death, the irs cannot seize the benefits paid to a beneficiary from his life insurance policy.in other words, the irs cannot seize the money paid to you as the beneficiary of a life insurance policy. In cases like this, the irs can mark a taxpayer’s account as cnc and any collection activities, like tax levies, are stopped. However, a couple of exceptions may require beneficiaries to pay taxes, including: No, the irs cannot take your life insurance. This is because the owner of the policy provides the coverage for the beneficiary, and the insured’s death is only the qualifying event that causes the money to be paid.

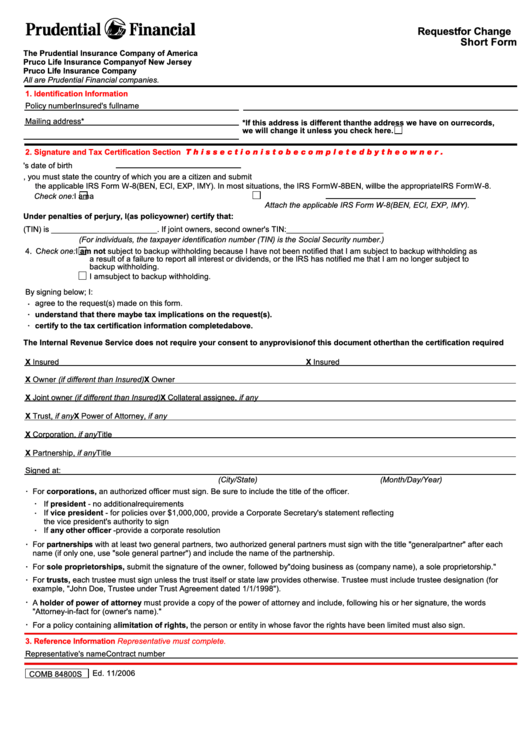

Source: signnow.com

Source: signnow.com

However, a couple of exceptions may require beneficiaries to pay taxes, including: For starters, the bulk of your life insurance benefits are likely to be safe from the irs. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income and you don’t have to report them. If a beneficiary is named on the policy, and the insured is not the owner, the irs cannot take the money from the insurance policy proceeds. In other words, the irs cannot seize the money paid to you as the beneficiary of a life insurance policy for debts owed by.

Source: laisberion.blogspot.com

Source: laisberion.blogspot.com

Unless the life insurance policy is part of the estate and has no listed beneficiaries, the irs cannot take it to pay back taxes. If the insured owed taxes at the time of his death, the irs cannot seize the benefits paid to a beneficiary from his life insurance policy. No, as a general rule your policy�s beneficiaries will not have to pay taxes on the proceeds from the policy. When proceeds may be seized if the insured failed to name a beneficiary or named a minor as beneficiary, the irs can seize the life insurance proceeds to pay the insured’s tax debts. In cases like this, the irs can mark a taxpayer’s account as cnc and any collection activities, like tax levies, are stopped.

No, as a general rule your policy�s beneficiaries will not have to pay taxes on the proceeds from the policy. The irs may not have the right to take money from the benefactor of a life insurance policy, but that does not mean that the beneficiary is safe. When you die, the beneficiary will receive the death benefit. If the insured owed taxes at the time of his death, the irs cannot seize the benefits paid to a beneficiary from his life insurance policy.in other words, the irs cannot seize the money paid to you as the beneficiary of a life insurance policy. Life insurance companies don’t make.

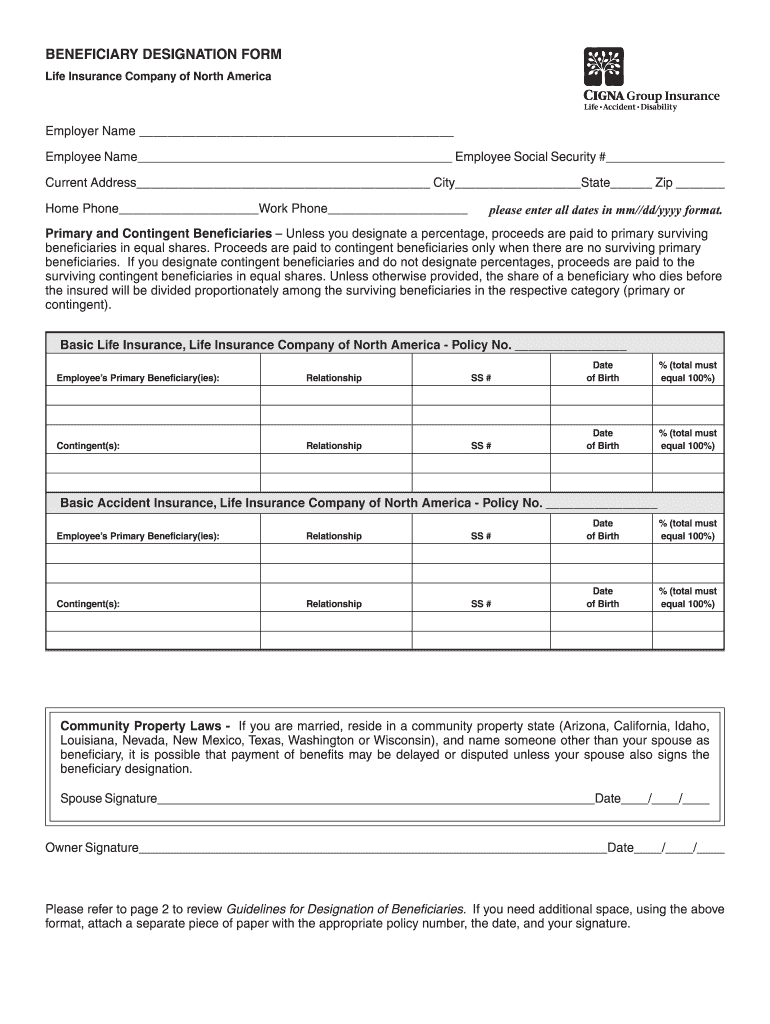

Source: signnow.com

Source: signnow.com

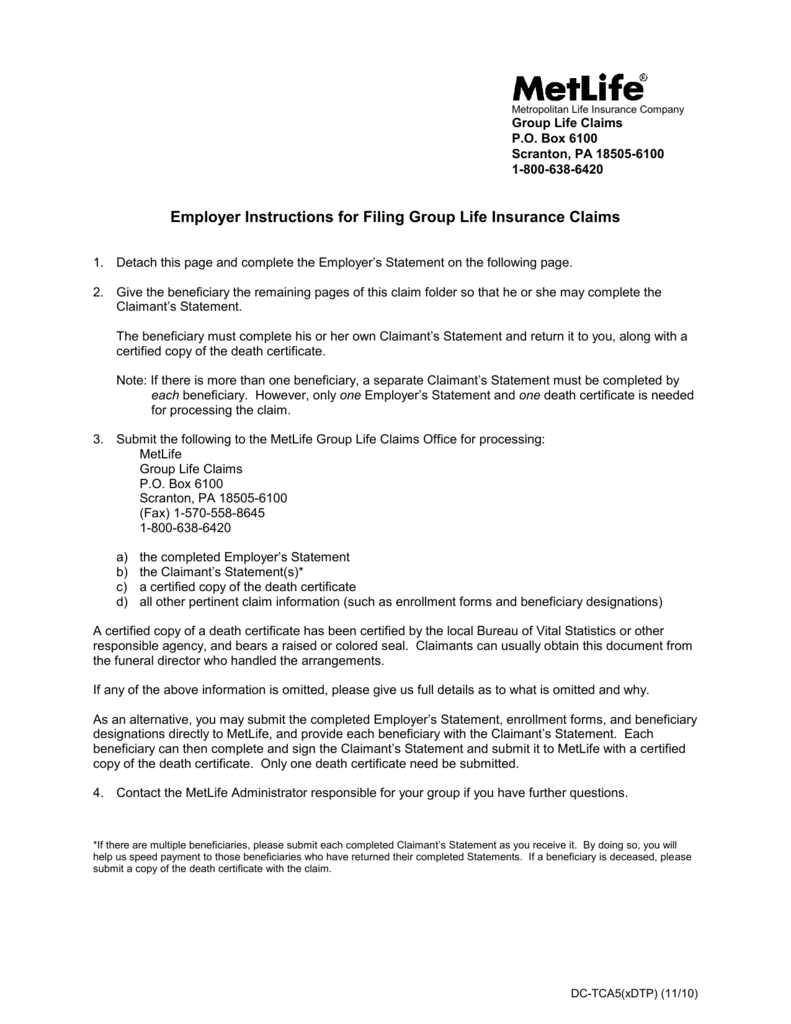

The irs can also seize life insurance proceeds if the named beneficiary is no longer living. The irs will go after the estate to pay any taxes that were owed from the deceased. Overall, the government and irs can take your life insurance proceeds if you have any unpaid taxes, disability payments, or annuity contracts after you were to pass away. No, as a general rule your policy�s beneficiaries will not have to pay taxes on the proceeds from the policy. If a beneficiary is named on the policy, and the insured is not the owner, the irs cannot take the money from the insurance policy proceeds.

Source: takemycounsel.com

Source: takemycounsel.com

However, any interest you receive is taxable and you should report it as interest received. Probate is the place anyone who is owed money by a person who is deceased, can go and make a claim for some of the estate. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. No, the irs cannot take your life insurance. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income and you don’t have to report them.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

If the insured owed taxes at the time of his death, the irs cannot seize the benefits paid to a beneficiary from his life insurance policy. Overall, the government and irs can take your life insurance proceeds if you have any unpaid taxes, disability payments, or annuity contracts (1) generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income (2). It belongs to the beneficiary. Life insurance proceeds will be listed as one of the assets. The life insurance death benefits received by your beneficiaries aren�t included in their gross income as recorded by the internal revenue service (aka irs).

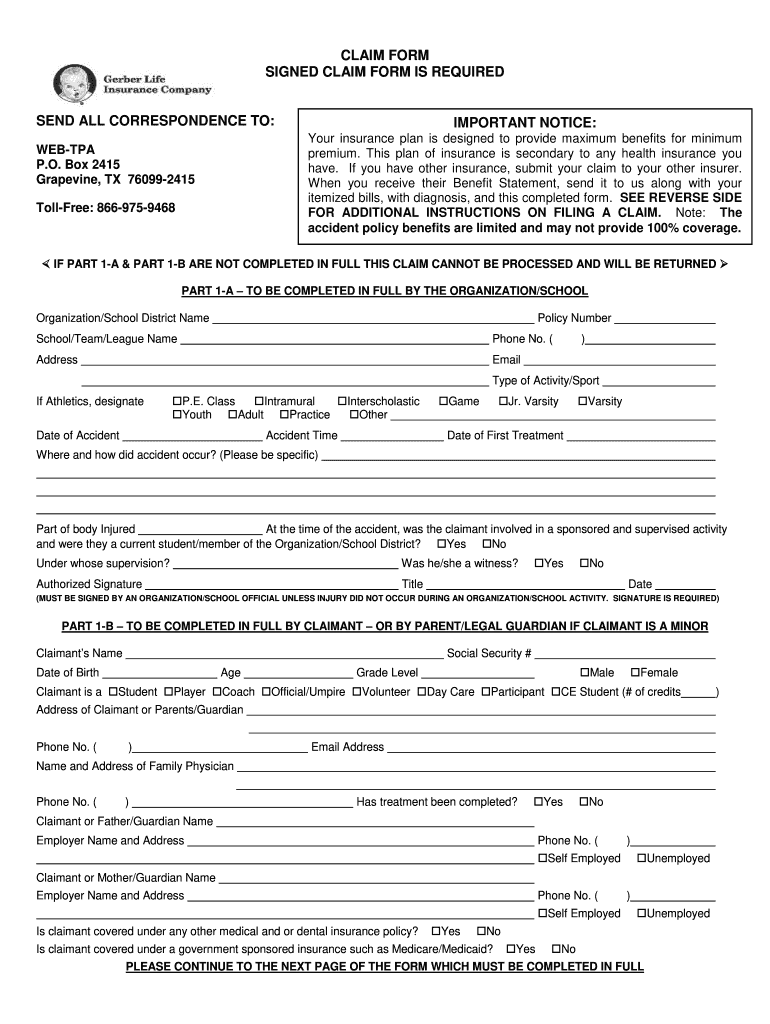

Source: signnow.com

Source: signnow.com

No, as a general rule your policy�s beneficiaries will not have to pay taxes on the proceeds from the policy. The life insurance proceeds become part of the beneficiaries assets. Sorry to the data dump, but the answer to your question is. Overall, the government and irs can take your life insurance proceeds if you have any unpaid taxes, disability payments, or annuity contracts (1) generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income (2). This is because the owner of the policy provides the coverage for the beneficiary, and the insured’s death is only the qualifying event that causes the money to be paid.

Source: pdffiller.com

Source: pdffiller.com

Probate is the place anyone who is owed money by a person who is deceased, can go and make a claim for some of the estate. The irs can also seize life insurance proceeds if the named beneficiary is no longer living. However, any interest you receive is taxable and you should report it as interest received. No, death benefits from a life insurance policy which has a named beneficiary is not subject to attachment by the irs, state tax officials, judgment creditors, etc. No, life insurance premiums are not tax deductible.

Source: pinterest.com

Source: pinterest.com

In cases like this, the irs can mark a taxpayer’s account as cnc and any collection activities, like tax levies, are stopped. This is because the owner of the policy provides the coverage for the beneficiary, and the insured’s death is only the qualifying event that causes the money to be paid. Life insurance proceeds will be listed as one of the assets. When you die, the beneficiary will receive the death benefit. When proceeds may be seized if the insured failed to name a beneficiary or named a minor as beneficiary, the irs can seize the life insurance proceeds to pay the insured’s tax debts.

Source: signnow.com

Source: signnow.com

Life insurance proceeds will be listed as one of the assets. When proceeds may be seized if the insured failed to name a beneficiary or named a minor as beneficiary, the irs can seize the life insurance proceeds to pay the insured’s tax debts. Can the irs take life insurance benefits? When you die, the beneficiary will receive the death benefit. Please talk to a lawyer or accountant to learn of ways to protect your.

Source: lifeinsurance0000.blogspot.com

Source: lifeinsurance0000.blogspot.com

Can irs take life insurance from beneficiary? The life insurance death benefits received by your beneficiaries aren�t included in their gross income as recorded by the internal revenue service (aka irs). Life insurance proceeds will be listed as one of the assets. Sorry to the data dump, but the answer to your question is. In cases like this, the irs can mark a taxpayer’s account as cnc and any collection activities, like tax levies, are stopped.

Source: pdffiller.com

Source: pdffiller.com

It belongs to the beneficiary. If a beneficiary is named on the policy, and the insured is not the owner, the irs cannot take the money from the insurance policy proceeds. Can the irs take life insurance benefits? How can i avoid tax on life insurance proceeds? In cases like this, the irs can mark a taxpayer’s account as cnc and any collection activities, like tax levies, are stopped.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

If the insured owed taxes at the time of his death, the irs cannot seize the benefits paid to a beneficiary from his life insurance policy.in other words, the irs cannot seize the money paid to you as the beneficiary of a life insurance policy. If the insured owed taxes at the time of his death, the irs cannot seize the benefits paid to a beneficiary from his life insurance policy.in other words, the irs cannot seize the money paid to you as the beneficiary of a life insurance policy. Can irs take life insurance from beneficiary? The payout, while it is not taxable income for the beneficiary, will still be reported by the insurer. The irs will go after the estate to pay any taxes that were owed from the deceased.

Source: orangecountyestateplanninglawyer-blog.com

Source: orangecountyestateplanninglawyer-blog.com

Life insurance companies don’t make. It belongs to the beneficiary. If you’re married or have children, it’s important that you know what these rules are. The irs may not have the right to take money from the benefactor of a life insurance policy, but that does not mean that the beneficiary is safe. Unless the life insurance policy is part of the estate and has no listed beneficiaries, the irs cannot take it to pay back taxes.

Source: signnow.com

Source: signnow.com

Do beneficiaries pay taxes on life insurance policies? It belongs to the beneficiary. The life insurance proceeds become part of the beneficiaries assets. Overall, the government and irs can take your life insurance proceeds if you have any unpaid taxes, disability payments, or annuity contracts (1) generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income (2). Life insurance proceeds will be listed as one of the assets.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can irs take life insurance from beneficiary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information