Can life insurance be paid to a trust Idea

Home » Trend » Can life insurance be paid to a trust IdeaYour Can life insurance be paid to a trust images are available. Can life insurance be paid to a trust are a topic that is being searched for and liked by netizens now. You can Download the Can life insurance be paid to a trust files here. Get all royalty-free images.

If you’re searching for can life insurance be paid to a trust images information connected with to the can life insurance be paid to a trust interest, you have pay a visit to the ideal site. Our site frequently gives you suggestions for seeking the maximum quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

Can Life Insurance Be Paid To A Trust. In fact, there are several strategic reasons why people frequently name a trust as the beneficiary of a life insurance policy. It can be a charity, a church, or even a trust. You may not be able to establish a new trust with your life insurance policy because there’s no entity already existing to keep the trust open and valuable. It can be a charity, a church, or even a trust.

Northwestern MutualVoice 3 Considerations For An From forbes.com

Northwestern MutualVoice 3 Considerations For An From forbes.com

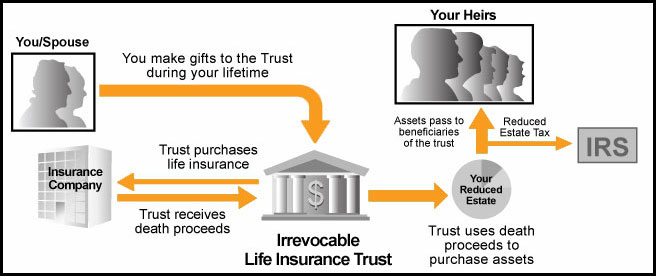

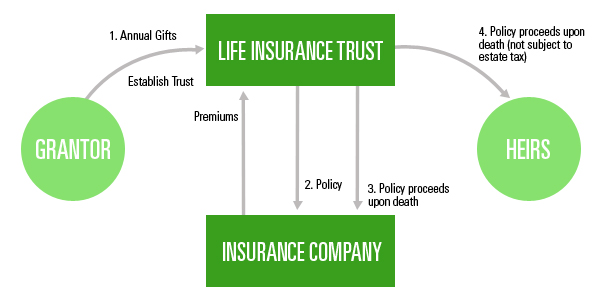

But this is not as burdensome as it seems at first. This article will go over life insurance and how they can be included in revocable living trusts.read more to find out more! When the grantor passes away, the life insurance benefit is paid out to the trust rather than to an individual beneficiary. The irrevocable life insurance trust (ilit), when structured properly, is a staple of estate planning for high net worth families. A life insurance trust is an inter vivos or a living trust. One of the main benefits of this approach is that the value of your policy is generally not considered part of your estate.

The trust would then become an empty vessel when the policy lapses.

You normally cannot undo an irrevocable trust after you�ve set it up. Life insurance proceeds are typically paid all at once to the named beneficiary, after which you have no say over how the money is spent. You may not want to make the trust the successor beneficiary on your life insurance policy if you have very simple wishes, such as the death benefit being paid directly to your spouse and, if your spouse is not then living, divided equally among adult children in their 30s. You may not be able to establish a new trust with your life insurance policy because there’s no entity already existing to keep the trust open and valuable. It can be a charity, a church, or even a trust. You normally cannot undo an irrevocable trust after you�ve set it up.

Source: rassmanlaw.com

Source: rassmanlaw.com

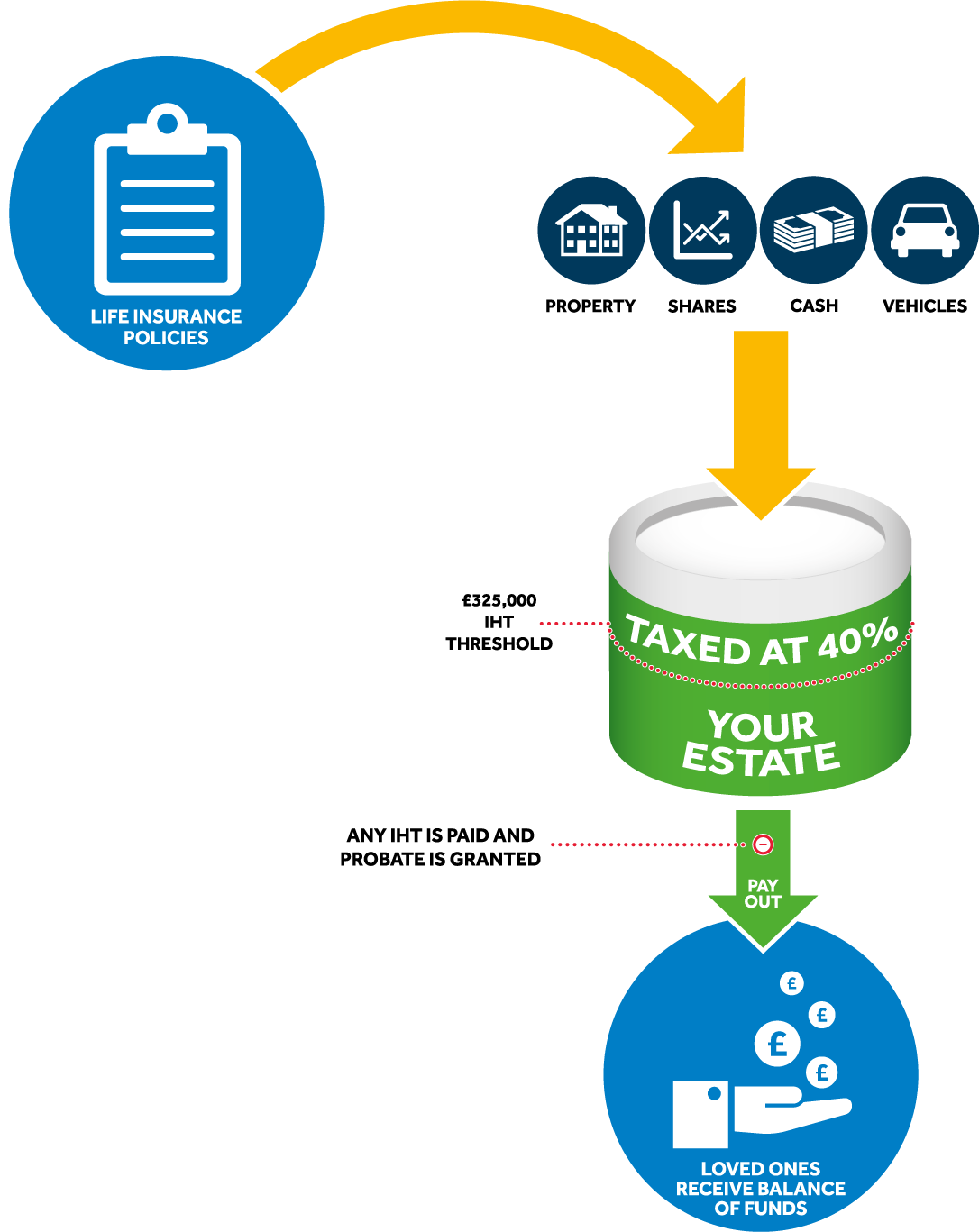

Life insurance policies can be put into a trust (known as writing it in trust), affecting the manner of the pay out in the event of your death. But because ongoing premiums must be paid to keep the life insurance policy in effect, all you�d have to do to cancel the trust would be to stop making payments for the premiums. You may wish to place your life insurance policy in a trust and appoint either a legal professional or trusted friend/family member to disburse the proceeds according to your wishes. The ilit is designated as the beneficiary of the life insurance policy. One of the main benefits of this approach is that the value of your policy is generally not considered part of your estate.

Source: premiertrust.com

Source: premiertrust.com

An irrevocable life insurance trust is a tool that can help beneficiaries erase the tax burden. By placing ownership of the policy with a trust — not the insured — it removes the death benefit from your estate. But because ongoing premiums must be paid to keep the life insurance policy in effect, all you�d have to do to cancel the trust would be to stop making payments for the premiums. Paying proceeds to a trust when you purchase a life insurance policy you must name at least one beneficiary. The designated trustee would then manage the trust assets on.

Source: pinterest.com

Source: pinterest.com

Can life insurance be paid to a trust? You may wish to place your life insurance policy in a trust and appoint either a legal professional or trusted friend/family member to disburse the proceeds according to your wishes. An irrevocable life insurance trust is a tool that can help beneficiaries erase the tax burden. Life insurance proceeds are typically paid all at once to the named beneficiary, after which you have no say over how the money is spent. A living trust gives the power of the insured to move assets into the trust before death which keeps the property from going through probate.

Source: trustage.com

Source: trustage.com

Revocable life insurance trust a living trust is designed to circumvent the complex and expensive legal process of probate. The trust would then become an empty vessel when the policy lapses. Because your life insurance payout will be paid into your trust and not as a lump sum to your beneficiaries, the taxes on the life insurance policy may not count against your beneficiaries. Instead, the payout will be distributed in smaller. Trusts are not considered individuals;

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

If the parents pass away, the life insurance policies would pay out to the trust. But because ongoing premiums must be paid to keep the life insurance policy in effect, all you�d have to do to cancel the trust would be to stop making payments for the premiums. The ilit is designated as the beneficiary of the life insurance policy. By placing ownership of the policy with a trust — not the insured — it removes the death benefit from your estate. Therefore, life insurance proceeds paid to trusts are generally subjected to estate tax.

Source: capitolbenefits.com

Source: capitolbenefits.com

An irrevocable life insurance trust is a tool that can help beneficiaries erase the tax burden. When the insurance proceeds are paid to the trust after the grantor’s death, the trustee will collect the funds, make them available to pay estate taxes and other expenses (if so directed), and then distribute Can life insurance be paid to a trust? Can a beneficiary be a trustee for a life insurance trust? You may not want to make the trust the successor beneficiary on your life insurance policy if you have very simple wishes, such as the death benefit being paid directly to your spouse and, if your spouse is not then living, divided equally among adult children in their 30s.

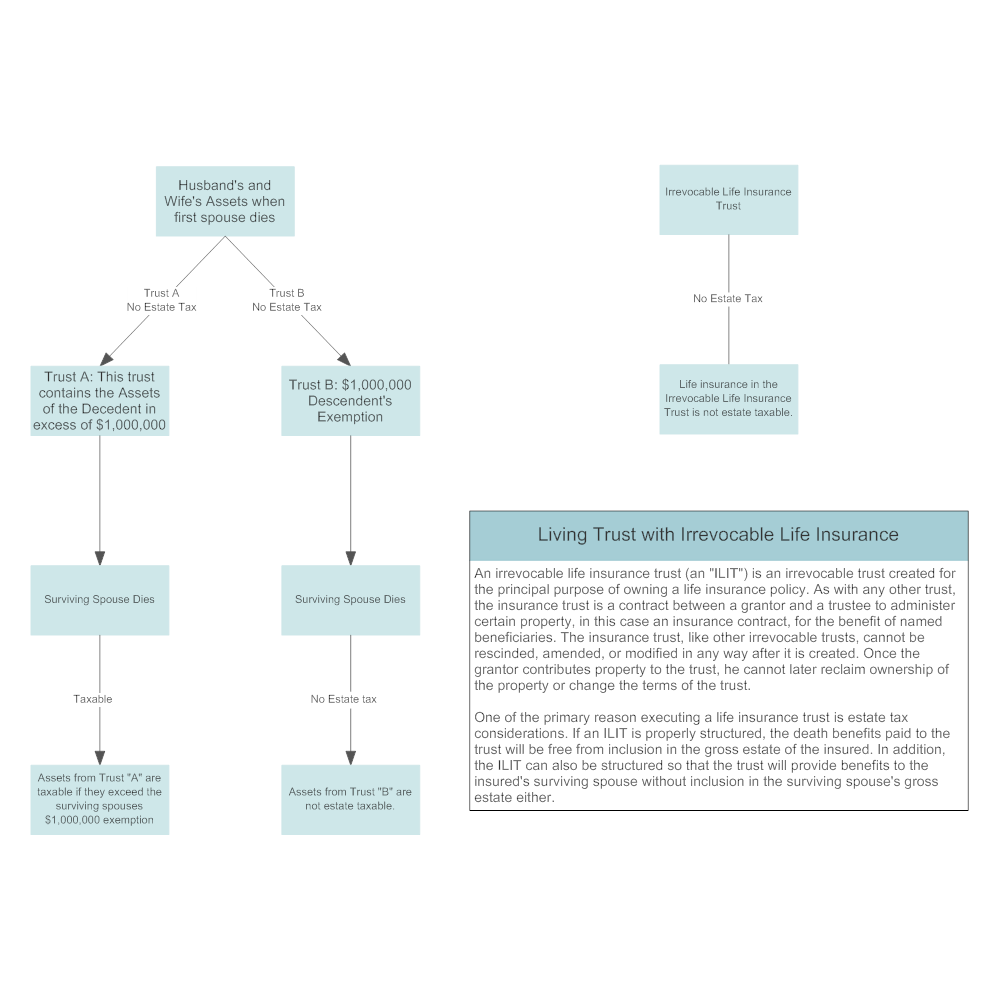

Source: smartdraw.com

Source: smartdraw.com

Life insurance beneficiaries trusts are not considered individuals; Avoid inheritance tax and probate Trusts are not considered individuals; The trust would then become an empty vessel when the policy lapses. It can be a charity, a church, or even a trust.

Source: bpsuk.co.uk

Source: bpsuk.co.uk

A living trust gives the power of the insured to move assets into the trust before death which keeps the property from going through probate. Life insurance beneficiaries trusts are not considered individuals; It can be a charity, a church, or even a trust. Revocable life insurance trust a living trust is designed to circumvent the complex and expensive legal process of probate. Trusts are not considered individuals;

Source: drdisabilityquotes.com

Source: drdisabilityquotes.com

But this is not as burdensome as it seems at first. The trustee pays any expenses or taxes that may be required (though typically beneficiaries aren’t on the hook for any estate tax). You may wish to place your life insurance policy in a trust and appoint either a legal professional or trusted friend/family member to disburse the proceeds according to your wishes. Ideally, the trust is drafted prior to application for and purchase of the life insurance policy Can life insurance be paid to a trust?

Source: forbes.com

Source: forbes.com

A living trust gives the power of the insured to move assets into the trust before death which keeps the property from going through probate. You may not want to make the trust the successor beneficiary on your life insurance policy if you have very simple wishes, such as the death benefit being paid directly to your spouse and, if your spouse is not then living, divided equally among adult children in their 30s. Trusts are not considered individuals; Avoid inheritance tax and probate That is the same with life insurance, and then the trust controls the distribution of the life insurance proceeds at death.

Source: youtube.com

Source: youtube.com

Therefore, life insurance proceeds paid to trusts are generally subjected to estate tax. The ilit is designated as the beneficiary of the life insurance policy. In fact, there are several strategic reasons why people frequently name a trust as the beneficiary of a life insurance policy. A living trust gives the power of the insured to move. You may not be able to establish a new trust with your life insurance policy because there’s no entity already existing to keep the trust open and valuable.

Source: financialsamurai.com

Source: financialsamurai.com

Revocable life insurance trust a living trust is designed to circumvent the complex and expensive legal process of probate. The trust “owns” your life insurance policy, pays the premiums, and gives the death benefit to your beneficiaries when you die. An ilit can provide a means to make leveraged transfers to heirs free of both estate and income tax. Ideally, the trust is drafted prior to application for and purchase of the life insurance policy But this is not as burdensome as it seems at first.

Source: pinterest.com

Source: pinterest.com

Paying proceeds to a trust when you purchase a life insurance policy you must name at least one beneficiary. A trustee is the legal owner of assets and property that flow into a living trust. Life insurance policies can be put into a trust (known as writing it in trust), affecting the manner of the pay out in the event of your death. That is the same with life insurance, and then the trust controls the distribution of the life insurance proceeds at death. That beneficiary does not have to be a person.

Source: orangecountyestateplanninglawyer-blog.com

Source: orangecountyestateplanninglawyer-blog.com

An irrevocable life insurance trust can help save significant money when it comes to estate taxes. Life insurance proceeds are typically paid all at once to the named beneficiary, after which you have no say over how the money is spent. Trusts are not considered individuals; If the parents pass away, the life insurance policies would pay out to the trust. A living trust gives the power of the insured to move.

Source: boonebankiowa.com

Life insurance policies can be put into a trust (known as writing it in trust), affecting the manner of the pay out in the event of your death. The ilit is designated as the beneficiary of the life insurance policy. When the insurance proceeds are paid to the trust after the grantor’s death, the trustee will collect the funds, make them available to pay estate taxes and other expenses (if so directed), and then distribute A trustee is the legal owner of assets and property that flow into a living trust. Paying proceeds to a trust when you purchase a life insurance policy you must name at least one beneficiary.

Source: legacyplanninglawgroup.com

Source: legacyplanninglawgroup.com

Paying proceeds to a trust. Therefore, life insurance proceeds paid to trusts are generally subjected to estate tax. One of the main benefits of this approach is that the value of your policy is generally not considered part of your estate. You may wish to place your life insurance policy in a trust and appoint either a legal professional or trusted friend/family member to disburse the proceeds according to your wishes. Paying proceeds to a trust when you purchase a life insurance policy you must name at least one beneficiary.

Source: banerlawfirm.com

Source: banerlawfirm.com

One condition that most life insurance companies have when it comes to paying your benefit to your trust is that the trust must already exist. A trustee is the legal owner of assets and property that flow into a living trust. Life insurance proceeds are typically paid all at once to the named beneficiary, after which you have no say over how the money is spent. Trusts are not considered individuals; You may not be able to establish a new trust with your life insurance policy because there’s no entity already existing to keep the trust open and valuable.

Source: pinterest.com

Source: pinterest.com

When the insurance proceeds are paid to the trust after the grantor’s death, the trustee will collect the funds, make them available to pay estate taxes and other expenses (if so directed), and then distribute Life insurance policies can be put into a trust (known as writing it in trust), affecting the manner of the pay out in the event of your death. Avoid inheritance tax and probate If the parents pass away, the life insurance policies would pay out to the trust. Paying proceeds to a trust.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can life insurance be paid to a trust by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information