Can medicaid take life insurance policy information

Home » Trend » Can medicaid take life insurance policy informationYour Can medicaid take life insurance policy images are ready. Can medicaid take life insurance policy are a topic that is being searched for and liked by netizens today. You can Get the Can medicaid take life insurance policy files here. Get all free photos and vectors.

If you’re searching for can medicaid take life insurance policy pictures information linked to the can medicaid take life insurance policy keyword, you have pay a visit to the right blog. Our website frequently provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

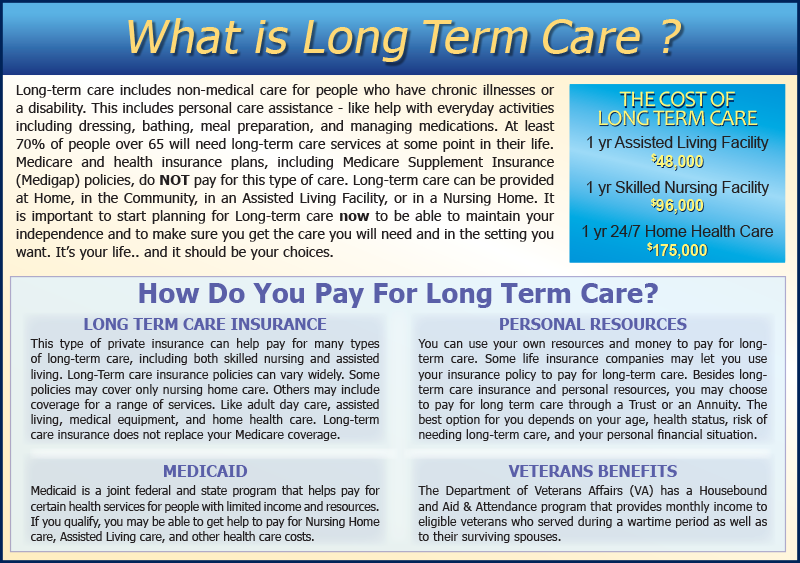

Can Medicaid Take Life Insurance Policy. The cash value of any other whole life policies you. The answer depends on the law in your state regarding medicaid estate recovery. What you can and can’t keep with medicaid: While medicaid can go after your estate medicaid cannot interfere with the payout of your life insurance policy.

Can a Nursing Home Take Your Life Insurance? Fidelity Life From fidelitylife.com

Can a Nursing Home Take Your Life Insurance? Fidelity Life From fidelitylife.com

Life insurance policies are usually either term life insurance or whole life insurance. Life insurance medicaid solution #2: Permanent life insurance is unique because it has a pure life insurance component and an investment component. The investment component has a cash value and can, therefore, be counted as an asset. Cash value in a whole life policy can count towards asset limits and interfere with medicaid eligibility, term policies do not count. Medicaid cannot take your life insurance policy while you are still alive.

Specifically, it depends on the type of policy and whether medicaid was made aware of the policy at the time when the application for benefits is submitted, said jason marx, chair of the tax & estate planning and elder law & special needs planning groups at curcio mirzaian sirot.

In order to qualify for medicaid, your assets must be less than $2,000. If the life insurance policy is paid outside of the estate directly to the nephews and nieces, is medicaid entitled to a lien on these proceeds? In 2022, most states allow the. On the other hand, whole life insurance accumulates a cash value that the owner can. Under federal and new jersey law, medicaid is required to recover funds from the estates of certain. So life insurance can count as an asset depending on the type of life insurance and the value of the policy.

Medicaid law in most states exempts small whole life insurance policies from the calculation of assets. Burial insurance or term life insurance) will not be considered a countable asset for. Medicaid law in most states exempts small whole life insurance policies from the calculation of assets. What you can and can’t keep with medicaid: So life insurance can count as an asset depending on the type of life insurance and the value of the policy.

If a person gets medicaid after taking the cash surrender from their whole life policy. Your life insurance payout will be given to the beneficiary named on your policy, and medicaid has no claim to any of your assets. Permanent life insurance is unique because it has a pure life insurance component and an investment component. Borrow from the cash value, reducing available cash balance so all assets (including life insurance cash value) are below $2,000. If a medicaid applicant has term life insurance, it doesn’t count as an asset and won�t affect medicaid eligibility because this form of life insurance does not have an accumulated cash value.

Source: policyscout.com

Source: policyscout.com

Since you can withdraw cash from the policy, or cash it out when you cancel it, medicaid considers this a countable asset. So life insurance can count as an asset depending on the type of life insurance and the value of the policy. On the other hand, whole life insurance accumulates a cash value that the owner can. Under federal and new jersey law, medicaid is required to recover funds from the estates of certain. The answer depends on the law in your state regarding medicaid estate recovery.

Source: lifeinsurancetypes.com

Source: lifeinsurancetypes.com

Typically, medicaid cannot take your life insurance policy. While medicaid can go after your estate medicaid cannot interfere with the payout of your life insurance policy. On the other hand, whole life insurance accumulates a cash value that the owner can. Can medicaid take this life insurance policy? Life insurance policies are usually either term life insurance or whole life insurance.

Source: fasesdeumaadolescenteb.blogspot.com

Source: fasesdeumaadolescenteb.blogspot.com

In 2022, most states allow the. Life insurance policies that only have a face value and no cash surrender value (e.g. Life insurance policies are usually either term life insurance or whole life insurance. Under certain circumstances, yes, a life insurance policy may be taken by medicaid to cover expenses following the death of the medicaid recipient. Your life insurance payout will be given to the beneficiary named on your policy, and medicaid has no claim to any of your assets.

Source: lifeinsurancetypes.com

Source: lifeinsurancetypes.com

Life insurance life insurance is an asset that is looked at by medicaid when determining eligibility. However, there are ways to protect the policy beforehand. Life insurance medicaid solution #2: Since you can withdraw cash from the policy, or cash it out when you cancel it, medicaid considers this a countable asset. Can medicaid take this life insurance policy?

Source: cremationinstitute.com

Source: cremationinstitute.com

If you name a specific person as your beneficiary, then nobody can claim the payment other than your beneficiary. Can medicaid take this life insurance policy? The answer depends on the law in your state regarding medicaid estate recovery. Medicaid cannot take your life insurance policy while you are still alive. Can medicaid recipients own life insurance?

Source: lifeinsurancetypes.com

Source: lifeinsurancetypes.com

In 2022, most states allow the. Typically, medicaid cannot take your life insurance policy. You can keep all term life policies, and as long as the beneficiary is an individual and not your estate, the money will pass free of medicaid restrictions. Answered on december 11, 2019. The answer depends on the law in your state regarding medicaid estate recovery.

Source: fidelitylife.com

Source: fidelitylife.com

If you name a specific person as your beneficiary, then nobody can claim the payment other than your beneficiary. Life insurance medicaid solution #2: On the other hand, whole life insurance accumulates a cash value that the owner can. For most people, a much bigger concern is how life insurance impacts eligibility for medicaid. Since you can withdraw cash from the policy, or cash it out when you cancel it, medicaid considers this a countable asset.

Source: lifelawfirm.com

Source: lifelawfirm.com

Your life insurance payout will be given to the beneficiary named on your policy, and medicaid has no claim to any of your assets. As for many things related to medicaid, the quick answer to your question is: However, there are ways to protect the policy beforehand. The medicaid beneficiary only lived for two months after. Whole life coverage continues for life and accumulates a cash value.

Source: healthcareworkers-us.blogspot.com

However, things get tricky regarding two factors: Permanent life insurance is unique because it has a pure life insurance component and an investment component. Burial insurance or term life insurance) will not be considered a countable asset for. If you name a specific person as your beneficiary, then nobody can claim the payment other than your beneficiary. Your life insurance payout will be given to the beneficiary named on your policy, and medicaid has no claim to any of your assets.

Source: blog.pauldillonlaw.com

In 2022, most states allow the. In order to qualify for medicaid, your assets must be less than $2,000. Whole life insurance whole life insurance policies accrue cash value and thus count toward the limit. Cash value in a whole life policy can count towards asset limits and interfere with medicaid eligibility, term policies do not count. Burial insurance or term life insurance) will not be considered a countable asset for.

Source: askharry.info

Source: askharry.info

If you name a specific person as your beneficiary, then nobody can claim the payment other than your beneficiary. For most people, a much bigger concern is how life insurance impacts eligibility for medicaid. However, things get tricky regarding two factors: Cash value in a whole life policy can count towards asset limits and interfere with medicaid eligibility, term policies do not count. What you can do is ask your mom to transfer the policy to a funeral home to pay for funeral expenses or surrender it so you can spend down the cash value, but remember to consult a lawyer before doing anything to avoid.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Life insurance life insurance is an asset that is looked at by medicaid when determining eligibility. Medicaid cannot take your life insurance policy while you are still alive. In order to qualify for medicaid, your assets must be less than $2,000. Since you can withdraw cash from the policy, or cash it out when you cancel it, medicaid considers this a countable asset. In 2022, most states allow the.

Source: fidelitylife.com

Source: fidelitylife.com

However, things get tricky regarding two factors: The answer depends on the law in your state regarding medicaid estate recovery. Whole life coverage continues for life and accumulates a cash value. Since you can withdraw cash from the policy, or cash it out when you cancel it, medicaid considers this a countable asset. In 2022, most states allow the.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

If the life insurance policy is paid outside of the estate directly to the nephews and nieces, is medicaid entitled to a lien on these proceeds? You’re limited to carrying life insurance with a cumulative value of between $1500 and $2000 when you apply for medicaid. So life insurance can count as an asset depending on the type of life insurance and the value of the policy. The medicaid beneficiary only lived for two months after. Since you can withdraw cash from the policy, or cash it out when you cancel it, medicaid considers this a countable asset.

Source: insurancebae.blogspot.com

A whole life policy with a face value of $1,500 or less is considered exempt. If a person gets medicaid after taking the cash surrender from their whole life policy. Life insurance policies that only have a face value and no cash surrender value (e.g. Life insurance medicaid solution #2: Your life insurance payout will be given to the beneficiary named on your policy, and medicaid has no claim to any of your assets.

Source: quora.com

Life insurance life insurance is an asset that is looked at by medicaid when determining eligibility. If a medicaid applicant has term life insurance, it doesn’t count as an asset and won�t affect medicaid eligibility because this form of life insurance does not have an accumulated cash value. However, there are ways to protect the policy beforehand. Under certain circumstances, yes, a life insurance policy may be taken by medicaid to cover expenses following the death of the medicaid recipient. You’re limited to carrying life insurance with a cumulative value of between $1500 and $2000 when you apply for medicaid.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can medicaid take life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information