Can my insurance company drop me for filing a claim Idea

Home » Trend » Can my insurance company drop me for filing a claim IdeaYour Can my insurance company drop me for filing a claim images are ready. Can my insurance company drop me for filing a claim are a topic that is being searched for and liked by netizens today. You can Find and Download the Can my insurance company drop me for filing a claim files here. Download all free images.

If you’re looking for can my insurance company drop me for filing a claim images information related to the can my insurance company drop me for filing a claim interest, you have pay a visit to the right site. Our site frequently gives you hints for refferencing the highest quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Can My Insurance Company Drop Me For Filing A Claim. If you make the necessary repair to the property, it is easier for the insurance company to approve your policy. So, the insurance company is paying only $700. Even if you don�t lose coverage, your insurance premiums may spike upward. Can my insurer drop me if i make a claim?

The Importance Of Medical Insurance Infinity Financial From infinitysolutions.com

The Importance Of Medical Insurance Infinity Financial From infinitysolutions.com

When an unfortunate event happens (like a windstorm or a burglary), you’ll likely file a claim with your insurance company. How does a car insurance company cancel a policy? Your car insurance company could drop you if you use your vehicle for commercial purposes because there’s a higher risk of damage. Insurance claims history on a house. Let�s take the flat screen tv for instance. Can an insurance company deny a claim?

An insurance company may not cancel an auto policy that has been in effect for more than 60 days unless you fail to pay your premium you file a fraudulent claim your driver’s license or car registration are suspended or revoked (this also applies to other drivers who live with you or use your car).

There are five main reasons an insurance company might cancel or not renew your policy: Not only can you lose your coverage if you make a claim, you may have a hard time finding a new policy. Keep in mind that your current claim will not transfer to the new insurance company, though, and your old insurer will still be the one that handles the claim until it is either settled or completely denied coverage. Can my insurer drop me if i make a claim? Even if you have an open claim with another insurance company, you can elect to switch your coverage. Auto insurance companies may drop you as a customer if you submit a claim following an accident — but the good news is that you�re more likely to face a nonrenewal rather than a cancellation.

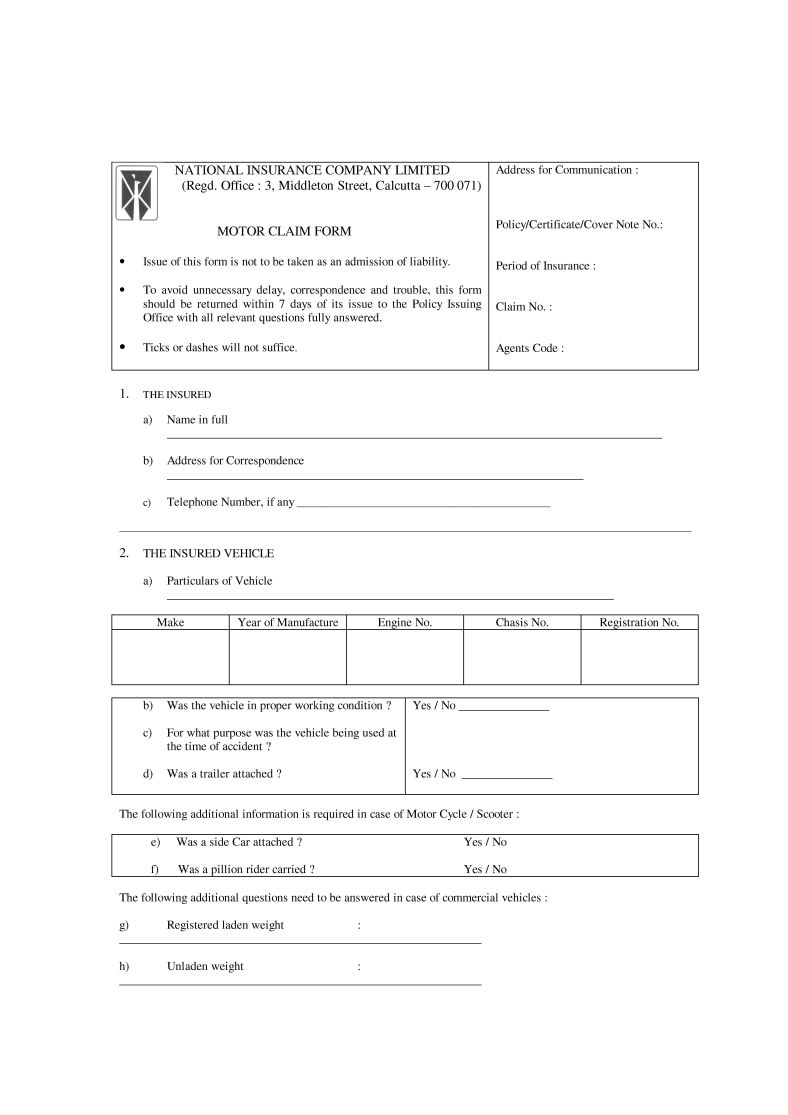

Source: studylib.net

Source: studylib.net

Auto insurance companies may drop you as a customer if you submit a claim following an accident — but the good news is that you�re more likely to face a nonrenewal rather than a cancellation. Some states do allow insurers to cancel a policy within the first 60 days of issue. However, with no warning, information or communication as to the ramifications of filing my third claim, they’re also quick to send a letter canceling a. There are many other reasons why your carrier might not renew your policy, and indeed, filing too many claims is one of those reasons. Not only can you lose your coverage if you make a claim, you may have a hard time finding a new policy.

Source: clvand.com

Source: clvand.com

The short answer is it depends. Not only can an insurer drop you after a single claim, it can drop you before you make any claims at all. So, if a policyholder has a minor accident within that period, the. Keep in mind that your current claim will not transfer to the new insurance company, though, and your old insurer will still be the one that handles the claim until it is either settled or completely denied coverage. Companies can drop you or refuse you even if you�ve never filed a claim.

Source: carlsonattorneys.com

Source: carlsonattorneys.com

Thus, it is important to first properly submit, in writing, your claim to the insurance company, before filing suit. When an unfortunate event happens (like a windstorm or a burglary), you’ll likely file a claim with your insurance company. Companies worried about future risks have cancelled policies in. Generally a single claim shouldn’t boost your rates, unless it removed a discount you were receiving for. There are many other reasons why your carrier might not renew your policy, and indeed, filing too many claims is one of those reasons.

Source: icover.org.uk

Source: icover.org.uk

It is unlikely for an insurance company to drop your insurance just to file a claim. Even if you have an open claim with another insurance company, you can elect to switch your coverage. If you have filed a claim and were dropped during the claims process, you can speak with your agent to get more details on the reason and then contact your state insurance department to file a dispute, if needed. While this isn’t the case for every provider, some companies may drop you for filing too many claims in a short time. So, the insurance company is paying only $700.

Source: atriuminsurancegroup.com

Source: atriuminsurancegroup.com

Too many claims can mean an increase in your premiums. Generally a single claim shouldn’t boost your rates, unless it removed a discount you were receiving for. If you have filed a claim and were dropped during the claims process, you can speak with your agent to get more details on the reason and then contact your state insurance department to file a dispute, if needed. 8 in fact, in most cases, you can be dropped for any reason except for your age, race, gender, marital status, occupation, or physical handicap, all of which are considered discriminatory reasons and are protected. Auto insurance companies may drop you as a customer if you submit a claim following an accident — but the good news is that you�re more likely to face a nonrenewal rather than a cancellation.

Source: revisi.net

Source: revisi.net

There could be reasons for policy cancellation, such as poor claims history, or you may have filed multiple claims with them. If you think that you are wrongly dropped by your insurance company, you may always file for a dispute. Generally a single claim shouldn’t boost your rates, unless it removed a discount you were receiving for. So, the insurance company is paying only $700. So, if a policyholder has a minor accident within that period, the.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Thus, it is important to first properly submit, in writing, your claim to the insurance company, before filing suit. Before you file a claim, think long and hard. Thus, it is important to first properly submit, in writing, your claim to the insurance company, before filing suit. There are many other reasons why your carrier might not renew your policy, and indeed, filing too many claims is one of those reasons. While this isn’t the case for every provider, some companies may drop you for filing too many claims in a short time.

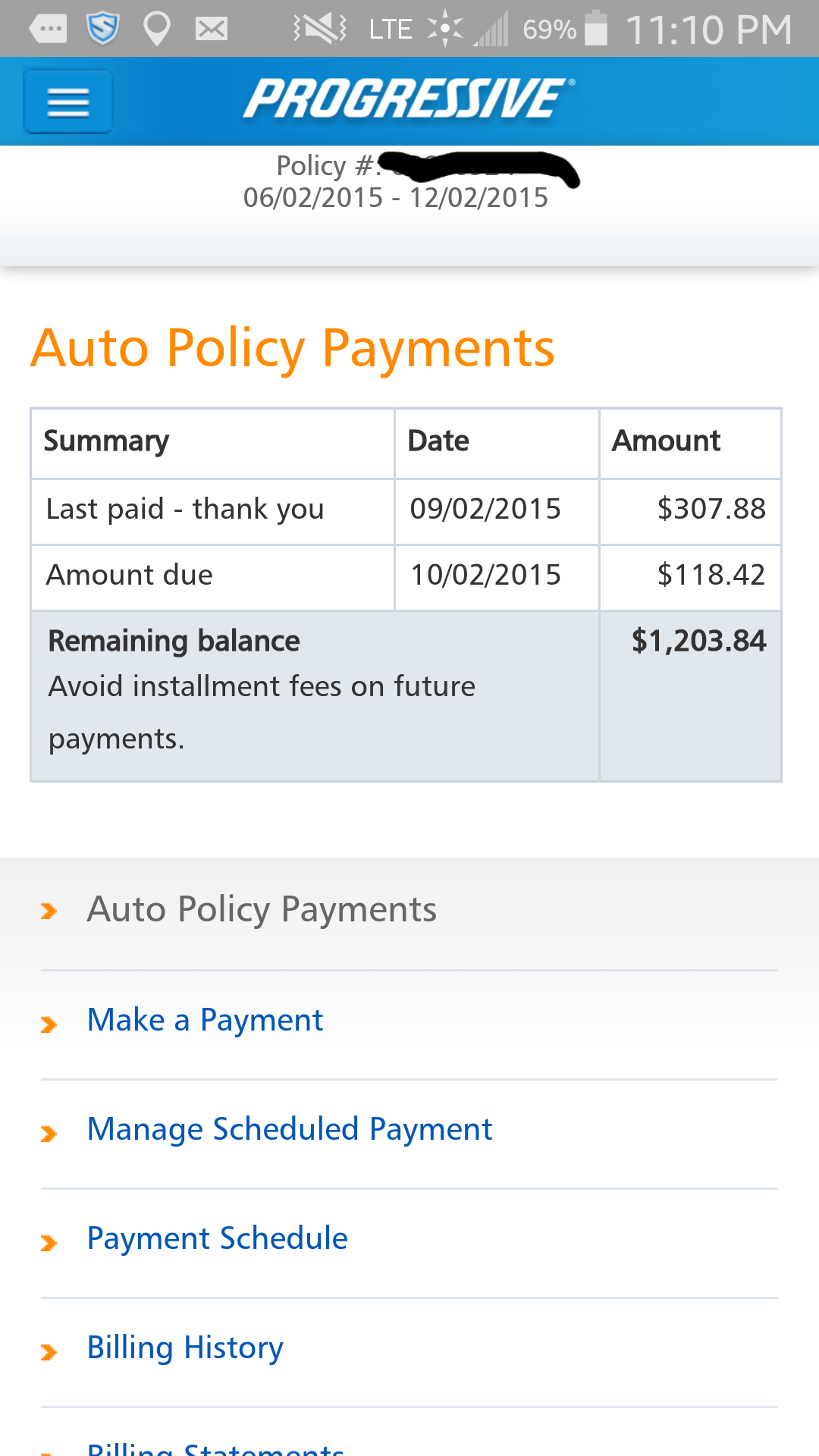

Source: consumeraffairs.com

Source: consumeraffairs.com

So, the insurance company is paying only $700. Even if you don�t lose coverage, your insurance premiums may spike upward. If you are caught in the unfortunate situation of having to file an auto claim, you want to be sure that you’re getting the fairest settlement from your insurance company.if a claim seems wrongly denied, you may need to take action to determine if there’s any way the. Companies can drop you or refuse you even if you�ve never filed a claim. However, insurance companies are required by law to timely pay out a properly filed insurance claim.

Source: xithemes.com

Source: xithemes.com

The insurance companies are more worried about future risks and can cancel your policy , especially if you live in areas prone to mudslides or hurricanes. While this isn’t the case for every provider, some companies may drop you for filing too many claims in a short time. An insurance company may not cancel an auto policy that has been in effect for more than 60 days unless you fail to pay your premium you file a fraudulent claim your driver’s license or car registration are suspended or revoked (this also applies to other drivers who live with you or use your car). Insurance claims history on a house. Companies can drop you or refuse you even if you�ve never filed a claim.

Source: cincinnaticaraccident.attorneys.us

Source: cincinnaticaraccident.attorneys.us

But your life will be even more stressful if you make a mistake filing. 8 in fact, in most cases, you can be dropped for any reason except for your age, race, gender, marital status, occupation, or physical handicap, all of which are considered discriminatory reasons and are protected. While this isn’t the case for every provider, some companies may drop you for filing too many claims in a short time. So, if a policyholder has a minor accident within that period, the. Some claims are not worth filing.

Source: basementbashberlin.com

Source: basementbashberlin.com

Before you file a claim, think long and hard. Keep in mind that your current claim will not transfer to the new insurance company, though, and your old insurer will still be the one that handles the claim until it is either settled or completely denied coverage. The short answer is it depends. Before you file a claim, think long and hard. Companies worried about future risks have cancelled policies in.

Source: issuu.com

Source: issuu.com

Your well pump costs only $1,000. Of course, your insurance company may choose not to renew your policy for many reasons. How does a car insurance company cancel a policy? While this isn’t the case for every provider, some companies may drop you for filing too many claims in a short time. When an unfortunate event happens (like a windstorm or a burglary), you’ll likely file a claim with your insurance company.

Source: xithemes.com

Source: xithemes.com

Keep in mind that your current claim will not transfer to the new insurance company, though, and your old insurer will still be the one that handles the claim until it is either settled or completely denied coverage. Keep in mind that your current claim will not transfer to the new insurance company, though, and your old insurer will still be the one that handles the claim until it is either settled or completely denied coverage. Can my insurance company drop me? Insurance claims history on a house. Your insurance company may cancel you for nonpayment, or it may find your situation too risky and decide to cancel your policy.

Source: infinitysolutions.com

Source: infinitysolutions.com

So, if a policyholder has a minor accident within that period, the. Companies worried about future risks have cancelled policies in. It is unlikely for an insurance company to drop your insurance just to file a claim. While this isn’t the case for every provider, some companies may drop you for filing too many claims in a short time. If you make the necessary repair to the property, it is easier for the insurance company to approve your policy.

Source: management.ind.in

Source: management.ind.in

So, the insurance company is paying only $700. If you are caught in the unfortunate situation of having to file an auto claim, you want to be sure that you’re getting the fairest settlement from your insurance company.if a claim seems wrongly denied, you may need to take action to determine if there’s any way the. The insurance companies are more worried about future risks and can cancel your policy , especially if you live in areas prone to mudslides or hurricanes. Not only can you lose your coverage if you make a claim, you may have a hard time finding a new policy. Your insurance company may cancel you for nonpayment, or it may find your situation too risky and decide to cancel your policy.

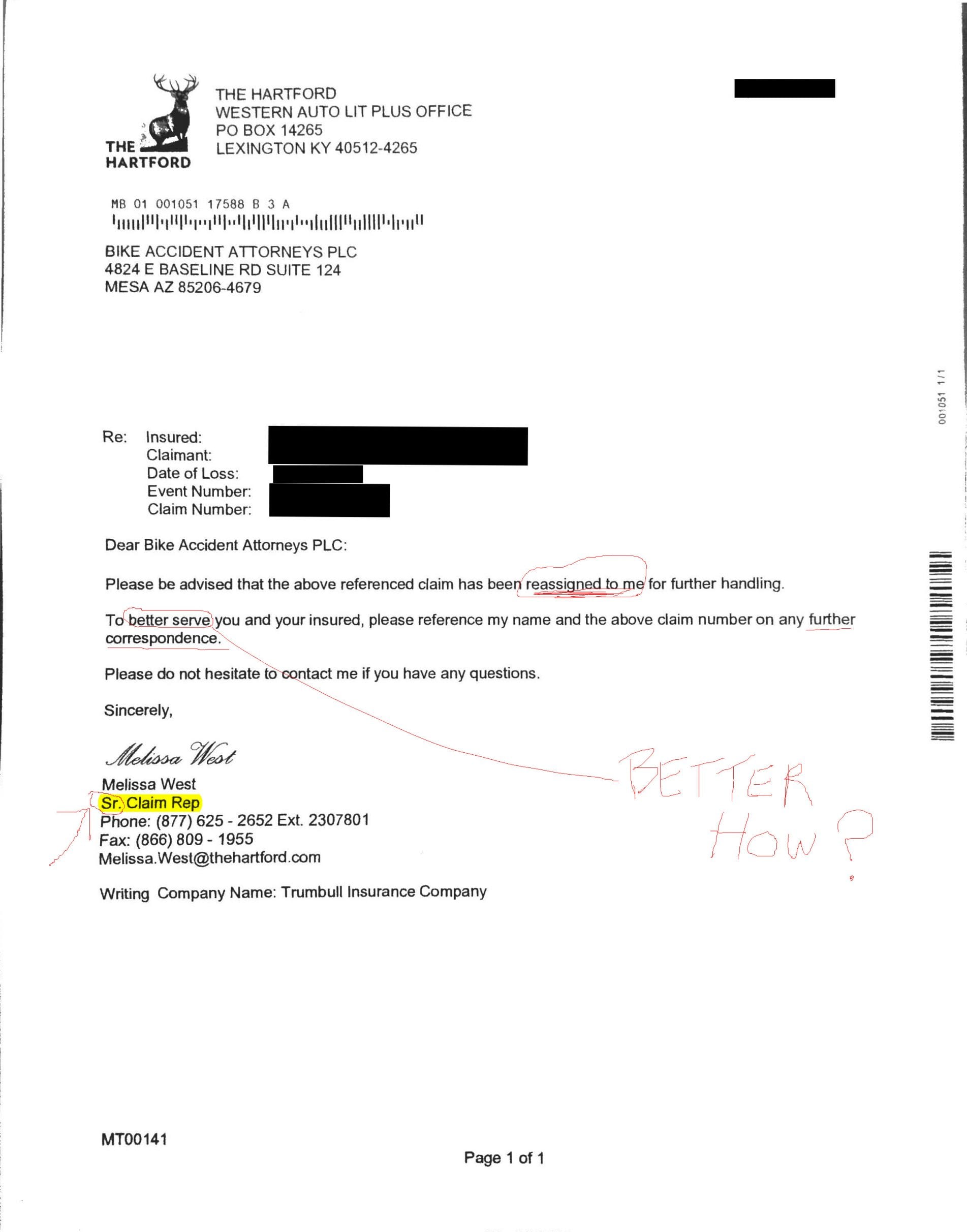

Source: bikeaccidentattorneys.com

Source: bikeaccidentattorneys.com

After hurricane andrew hit south florida in 1992, insurers cancelled as many policies as possible for fear of future losses, and nobody wanted to write new policies. Not only can you lose your coverage if you make a claim, you may have a hard time finding a new policy. If you make the necessary repair to the property, it is easier for the insurance company to approve your policy. Your car insurance company could drop you if you use your vehicle for commercial purposes because there’s a higher risk of damage. Can an insurance company deny a claim?

Source: theinsuranceconfidential.com

Source: theinsuranceconfidential.com

8 in fact, in most cases, you can be dropped for any reason except for your age, race, gender, marital status, occupation, or physical handicap, all of which are considered discriminatory reasons and are protected. Generally a single claim shouldn’t boost your rates, unless it removed a discount you were receiving for. Your well pump costs only $1,000. Let�s take the flat screen tv for instance. An insurance company may not cancel an auto policy that has been in effect for more than 60 days unless you fail to pay your premium you file a fraudulent claim your driver’s license or car registration are suspended or revoked (this also applies to other drivers who live with you or use your car).

Source: icover.org.uk

Source: icover.org.uk

After hurricane andrew hit south florida in 1992, insurers cancelled as many policies as possible for fear of future losses, and nobody wanted to write new policies. Your well pump costs only $1,000. So, if a policyholder has a minor accident within that period, the. The comprehensive loss underwriting exchange service makes your claims history available to other insurers, who can decide to write you off as a bad risk. There are many other reasons why your carrier might not renew your policy, and indeed, filing too many claims is one of those reasons.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can my insurance company drop me for filing a claim by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information