Can my s corp pay my health insurance Idea

Home » Trend » Can my s corp pay my health insurance IdeaYour Can my s corp pay my health insurance images are available in this site. Can my s corp pay my health insurance are a topic that is being searched for and liked by netizens now. You can Download the Can my s corp pay my health insurance files here. Download all royalty-free photos.

If you’re looking for can my s corp pay my health insurance images information linked to the can my s corp pay my health insurance topic, you have come to the ideal site. Our site frequently gives you hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Can My S Corp Pay My Health Insurance. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; If the company has more than one employee, the. If you own more than 2% of your business on any given day of the year and your business pays for your health insurance, then the money paid for your insurance is considered taxable income. The s corporation can then deduct the cost of their premiums from their taxes as a business expense.

Medical Services From intermountainhealthcare.org

Medical Services From intermountainhealthcare.org

For those who file a schedule c such as with an s corporation, you will need to put the cost of your health insurance on line 29 of your personal 1040 tax return. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; If you own more than 2% of your business on any given day of the year and your business pays for your health insurance, then the money paid for your insurance is considered taxable income. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. You�ll need to get in touch with your health provider for your payment options. Pay insurance costs through your s corporation your s corp must pay your health insurance costs to get the personal tax deduction.

You�ll need to get in touch with your health provider for your payment options.

If you own more than 2% of your business on any given day of the year and your business pays for your health insurance, then the money paid for your insurance is considered taxable income. The employee doesn’t get taxed for it, and the company can deduct the contributions on its business tax return. Can you give me any more details about your issue? Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. From my initial research, it appears that i can only deduct health insurance if it is purchased by my corporation. For those who file a schedule c such as with an s corporation, you will need to put the cost of your health insurance on line 29 of your personal 1040 tax return.

Source: ayusyahomehealthcare.com

Source: ayusyahomehealthcare.com

If you own more than 2% of your business on any given day of the year and your business pays for your health insurance, then the money paid for your insurance is considered taxable income. In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; If the company has more than one employee, the. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. For those who file a schedule c such as with an s corporation, you will need to put the cost of your health insurance on line 29 of your personal 1040 tax return.

Source: ayusyahomehealthcare.com

Source: ayusyahomehealthcare.com

I�m the sole owner and only employee. For those who file a schedule c such as with an s corporation, you will need to put the cost of your health insurance on line 29 of your personal 1040 tax return. 0 reply mniccola new member june 3, 2019 4:45 pm In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; In previous years, my wife and i were insured through her employer.

Source: dailycaller.com

Source: dailycaller.com

The s corporation can then deduct the cost of their premiums from their taxes as a business expense. S corporations are able to provide health insurance benefits to their employees as a perk. You�ll need to get in touch with your health provider for your payment options. You must pay income tax on the health insurance premium payments made by your s corporation. The employee doesn’t get taxed for it, and the company can deduct the contributions on its business tax return.

Source: intermountainhealthcare.org

Source: intermountainhealthcare.org

If the company has more than one employee, the. The employee doesn’t get taxed for it, and the company can deduct the contributions on its business tax return. Can you give me any more details about your issue? Pay insurance costs through your s corporation your s corp must pay your health insurance costs to get the personal tax deduction. If you own more than 2% of your business on any given day of the year and your business pays for your health insurance, then the money paid for your insurance is considered taxable income.

Source: health.iastate.edu

Source: health.iastate.edu

0 reply mniccola new member june 3, 2019 4:45 pm As of this year, i started purchasing my own health insurance through healthcare.gov. If you are a greater than 2% owner of your s corporation, you can have your health insurance premiums paid by your business. Can i write off life insurance premiums? Specifically, the shareholder can now deduct the insurance premiums as an above the line deduction on line 29 of form 1040.

Source: avera.org

Source: avera.org

From my initial research, it appears that i can only deduct health insurance if it is purchased by my corporation. Can i write off life insurance premiums? As an example if i have health insurance for my employees that also covers me as an owner, i write one check for the health insurance premium on a company check. When you pay your premiums with personal money, make sure that. For those who file a schedule c such as with an s corporation, you will need to put the cost of your health insurance on line 29 of your personal 1040 tax return.

Source: intermountainhealthcare.org

Source: intermountainhealthcare.org

For those who file a schedule c such as with an s corporation, you will need to put the cost of your health insurance on line 29 of your personal 1040 tax return. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. My s corp pays for my health insurance. Can an s corp pay health insurance premiums? The owner’s health insurance can no longer be called an insurance expense or employee.

Source: marhaba.qa

Source: marhaba.qa

0 reply mniccola new member june 3, 2019 4:45 pm Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. Pay insurance costs through your s corporation your s corp must pay your health insurance costs to get the personal tax deduction. You must pay income tax on the health insurance premium payments made by your s corporation. My s corp pays for my health insurance.

Source: bdiplayhouse.com

Source: bdiplayhouse.com

0 reply mniccola new member june 3, 2019 4:45 pm Specifically, the shareholder can now deduct the insurance premiums as an above the line deduction on line 29 of form 1040. S corporations are able to provide health insurance benefits to their employees as a perk. From my initial research, it appears that i can only deduct health insurance if it is purchased by my corporation. The employee doesn’t get taxed for it, and the company can deduct the contributions on its business tax return.

Source: topcrazypress.com

Source: topcrazypress.com

Pay insurance costs through your s corporation your s corp must pay your health insurance costs to get the personal tax deduction. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. If you own more than 2% of your business on any given day of the year and your business pays for your health insurance, then the money paid for your insurance is considered taxable income. Life insurance premiums are considered a. Specifically, the shareholder can now deduct the insurance premiums as an above the line deduction on line 29 of form 1040.

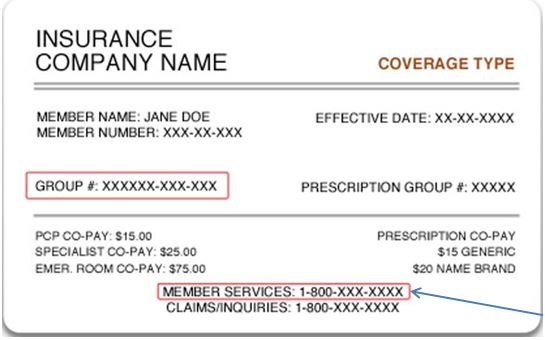

Source: imoney.ph

Source: imoney.ph

Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. Can you give me any more details about your issue? Pay insurance costs through your s corporation your s corp must pay your health insurance costs to get the personal tax deduction. The owner’s health insurance can no longer be called an insurance expense or employee. As an example if i have health insurance for my employees that also covers me as an owner, i write one check for the health insurance premium on a company check.

Source: ayusyahomehealthcare.com

Source: ayusyahomehealthcare.com

The owner’s health insurance can no longer be called an insurance expense or employee. Specifically, the shareholder can now deduct the insurance premiums as an above the line deduction on line 29 of form 1040. When you pay your premiums with personal money, make sure that. If you are a greater than 2% owner of your s corporation, you can have your health insurance premiums paid by your business. For those who file a schedule c such as with an s corporation, you will need to put the cost of your health insurance on line 29 of your personal 1040 tax return.

Source: ayusyahomehealthcare.com

Source: ayusyahomehealthcare.com

Life insurance premiums are considered a. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. If the company has more than one employee, the. In previous years, my wife and i were insured through her employer. If you are a greater than 2% owner of your s corporation, you can have your health insurance premiums paid by your business.

Source: wayneunc.org

Source: wayneunc.org

In previous years, my wife and i were insured through her employer. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. If you own more than 2% of your business on any given day of the year and your business pays for your health insurance, then the money paid for your insurance is considered taxable income. I�m the sole owner and only employee. Specifically, the shareholder can now deduct the insurance premiums as an above the line deduction on line 29 of form 1040.

Source: ayusyahomehealthcare.com

Source: ayusyahomehealthcare.com

You must pay income tax on the health insurance premium payments made by your s corporation. Health insurance premiums paid by an s corp for more than 2% shareholders must be treated as wages to that owner. From my initial research, it appears that i can only deduct health insurance if it is purchased by my corporation. As of this year, i started purchasing my own health insurance through healthcare.gov. As an example if i have health insurance for my employees that also covers me as an owner, i write one check for the health insurance premium on a company check.

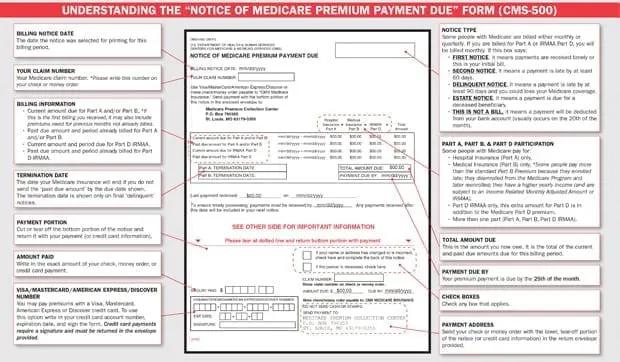

Source: medicaretalk.net

Source: medicaretalk.net

If you own more than 2% of your business on any given day of the year and your business pays for your health insurance, then the money paid for your insurance is considered taxable income. Can i write off life insurance premiums? As an example if i have health insurance for my employees that also covers me as an owner, i write one check for the health insurance premium on a company check. From my initial research, it appears that i can only deduct health insurance if it is purchased by my corporation. You must pay income tax on the health insurance premium payments made by your s corporation.

Source: carespot.com

Source: carespot.com

Can i write off life insurance premiums? In previous years, my wife and i were insured through her employer. Can i write off life insurance premiums? The employee doesn’t get taxed for it, and the company can deduct the contributions on its business tax return. My s corp pays for my health insurance.

Source: chicagojewishnews.com

Source: chicagojewishnews.com

In other words, the only way an s corp can deduct the amount paid for shareholder health insurance is to include it as part as part of the shareholder’s salary; I�m the sole owner and only employee. Specifically, the shareholder can now deduct the insurance premiums as an above the line deduction on line 29 of form 1040. You must pay income tax on the health insurance premium payments made by your s corporation. The owner’s health insurance can no longer be called an insurance expense or employee.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can my s corp pay my health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information