Can nri take term insurance in india information

Home » Trend » Can nri take term insurance in india informationYour Can nri take term insurance in india images are available in this site. Can nri take term insurance in india are a topic that is being searched for and liked by netizens today. You can Find and Download the Can nri take term insurance in india files here. Find and Download all free photos and vectors.

If you’re looking for can nri take term insurance in india pictures information connected with to the can nri take term insurance in india keyword, you have visit the right site. Our website frequently provides you with hints for viewing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Can Nri Take Term Insurance In India. However, there are many things that they should keep in mind while buying such a plan. Term insurance offers financial protection to the family of the insured in case of demise. In the context of the indian lifestyle, life insurance remains one of the most common and widespread financial programs in which citizens invest. An nri can easily purchase a policy abroad.

Term Insurance plan in India for NRIs Nri Help Info From nrihelp.info

Term Insurance plan in India for NRIs Nri Help Info From nrihelp.info

Yes, nris and persons of indian origin (pios) (as defined by fema) who are resident abroad are allowed to buy life insurance in india. Can an nri take term insurance in india, posted by karpagarajan natarajan on january 21, 2013 1:21 pm comments (3) can an nri take pure term cover plan in india. Nris are allowed insurance on their visit to india where all formalities are completed during their stay in india. You can take term insurance even while living outside the country apart from being of indian origin, nris can also take advantage of this policy. Can nri take life insurance in india? Click to know how to buy nri term insurance & the documents required.

The person can purchase the policy while she/he is on a visit to india.

However they have to be present in india, while taking the insurance. The person can purchase the policy while she/he is on a visit to india. The best part is that not only indians living in india see the need to invest in life insurance. The kyc documents must prove that you belong to a certain place in india. The foreign exchange management act (fema) allows this transaction without any reservations. Thus, all persons of indian origin, whether citizens of india or not.

Source: smartmoneygoal.in

Source: smartmoneygoal.in

The person can purchase the policy while she/he is on a visit to india. In such cases they would be treated at par with indian lives for the purpose of allowing insurance. An nri can easily take out a suitable term insurance plan and there are two ways in which this can be done. Yes, an nri can buy icici pru iprotect smart online. To put it simply, yes.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

An nri can easily purchase a policy abroad. Term insurance offers financial protection to the family of the insured in case of demise. Foreign exchange management act (fema) allows nris to buy any plan that meets their. Can an nri purchase a term plan in india? According to experts, the foreign exchange management act has made it possible for nris and pios to take term insurance in india.

Source: tataaia.com

Source: tataaia.com

However, there are many things that they should keep in mind while buying such a plan. An nri can purchase a term policy from india by residing in the foreign country via mail order business facility. Can nri take life insurance in india? You can directly purchase the. According to experts, the foreign exchange management act has made it possible for nris and pios to take term insurance in india.

Source: smartmoneygoal.in

Source: smartmoneygoal.in

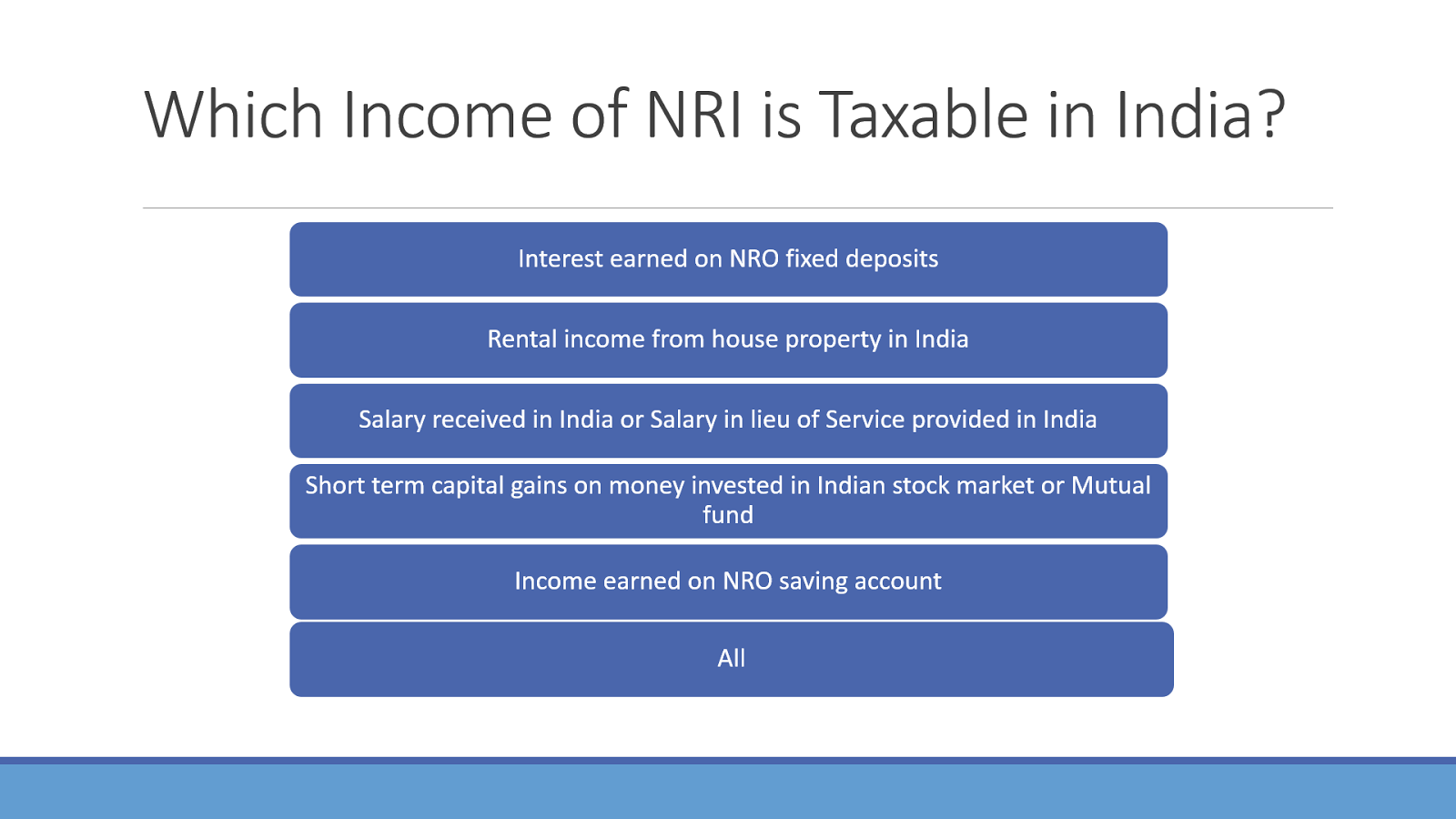

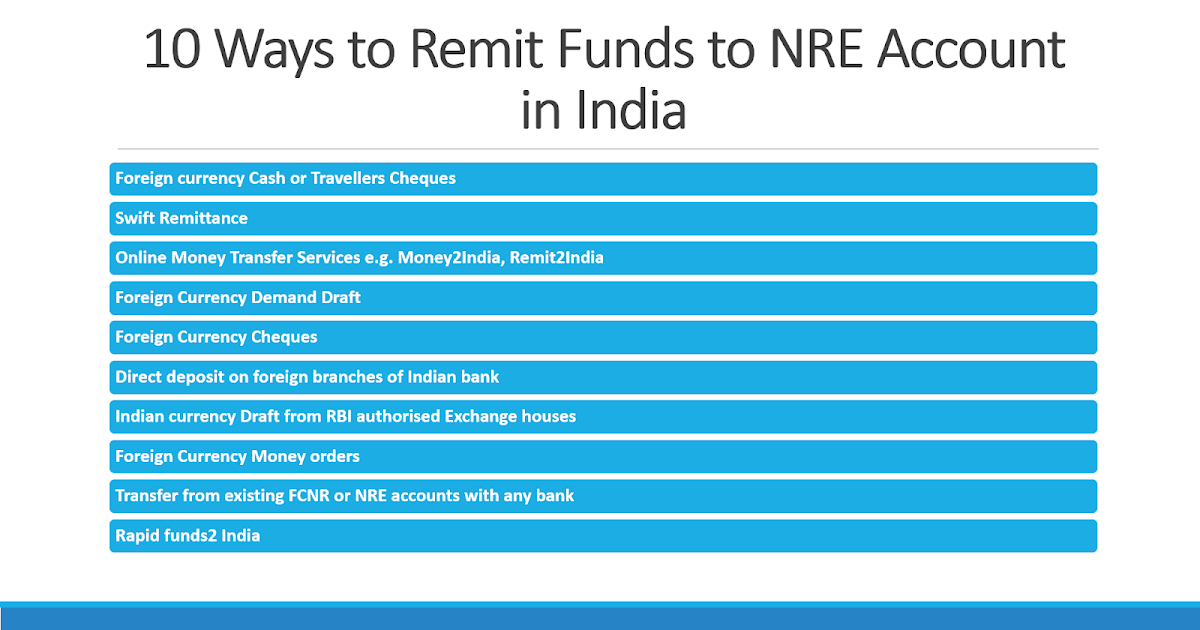

An nri can opt for any one of the two alternatives in order to buy term insurance. The kyc documents must prove that you belong to a certain place in india. Term insurance for nri in india. According to experts, the foreign exchange management act has made it possible for nris and pios to take term insurance in india. One important point, is that the premiums should be paid from an nre account, if the maturity value is to be repatriable, else only the partial amount will.

Source: savingsfunda.blogspot.com

Source: savingsfunda.blogspot.com

In some cases, however, it is better to buy the policy while in india. You can directly purchase the. To put it simply, yes. You can take term insurance even while living outside the country apart from being of indian origin, nris can also take advantage of this policy. The whole procedure is simple and is executed in the same manner as it is for an indian citizen.

Source: livemint.com

Source: livemint.com

The foreign exchange management act (fema) allows this transaction without any reservations. Purchasing a term insurance plan in india for nri s has been made easier by the foreign exchange management act. They should therefore plan to buy the insurance when they are on a trip to india. However, there are many things that they should keep in mind while buying such a plan. Consider complete understanding of policy wordings

Source: masstamilan.tv

Source: masstamilan.tv

Can an nri take term insurance in india, posted by karpagarajan natarajan on january 21, 2013 1:21 pm comments (3) can an nri take pure term cover plan in india. The first option is to purchase the policy when he is on a visit to india wherein the process of purchase will be executed in the same manner as it is for an indian citizen the second option is to purchase the policy from the current country of residence In the context of the indian lifestyle, life insurance remains one of the most common and widespread financial programs in which citizens invest. The foreign exchange management act (fema) allows this transaction without any reservations. You can purchase a plan which would secure the future of your loved ones and protect them in your absence.

Source: bharti-axagi.co.in

Source: bharti-axagi.co.in

Nris are allowed insurance on their visit to india where all formalities are completed during their stay in india. An nri can buy a term insurance plan and save money in most of the saving and investment plans such as ulips and endowment plan provided under life insurance policies in india. You can purchase a plan which would secure the future of your loved ones and protect them in your absence. Nris are allowed insurance on their visit to india where all formalities are completed during their stay in india. According to experts, the foreign exchange management act has made it possible for nris and pios to take term insurance in india.

Source: quora.com

Yes, nris and persons of indian origin (pios) (as defined by fema) who are resident abroad are allowed to buy life insurance in india. You can take term insurance even while living outside the country apart from being of indian origin, nris can also take advantage of this policy. In some cases, however, it is better to buy the policy while in india. Consider complete understanding of policy wordings Can an nri take term insurance in india, posted by karpagarajan natarajan on january 21, 2013 1:21 pm comments (3) can an nri take pure term cover plan in india.

Source: staeti.blogspot.com

Source: staeti.blogspot.com

This piece looks at things an. Term insurance for nri in india. Yes, nris can buy a term life insurance plan from insurance companies in india, as long as they satisfy a set of terms and conditions. They must check whether their chosen plan will provide the needed cover in their country of residence. However they have to be present in india, while taking the insurance.

Source: savingsfunda.blogspot.com

Source: savingsfunda.blogspot.com

To put it simply, yes. However they have to be present in india, while taking the insurance. According to experts, the foreign exchange management act has made it possible for nris and pios to take term insurance in india. In such cases they would be treated at par with indian lives for the purpose of allowing insurance. You can purchase a plan which would secure the future of your loved ones and protect them in your absence.

Source: savingsfunda.blogspot.com

Source: savingsfunda.blogspot.com

The person can purchase the policy while she/he is on a visit to india. This piece looks at things an. The best part is that not only indians living in india see the need to invest in life insurance. An nri can opt for any one of the two alternatives in order to buy term insurance. The kyc documents must prove that you belong to a certain place in india.

Source: m3india.in

Source: m3india.in

To put it simply, yes. Yes, nris can buy insurance in india; To put it simply, yes. The first option is to purchase the policy when he is on a visit to india wherein the process of purchase will be executed in the same manner as it is for an indian citizen the second option is to purchase the policy from the current country of residence However they have to be present in india, while taking the insurance.

Source: securenow.in

Source: securenow.in

One important point, is that the premiums should be paid from an nre account, if the maturity value is to be repatriable, else only the partial amount will. According to experts, the foreign exchange management act has made it possible for nris and pios to take term insurance in india. Thus, all persons of indian origin, whether citizens of india or not. Yes, nris are free to purchasing term policies in india. In some cases, however, it is better to buy the policy while in india.

Source: livemint.com

Source: livemint.com

Thus, all persons of indian origin, whether citizens of india or not. They should therefore plan to buy the insurance when they are on a trip to india. An nri can easily take out a suitable term insurance plan and there are two ways in which this can be done. In some cases, however, it is better to buy the policy while in india. Can nri take life insurance in india?

Source: flashydubai.com

Source: flashydubai.com

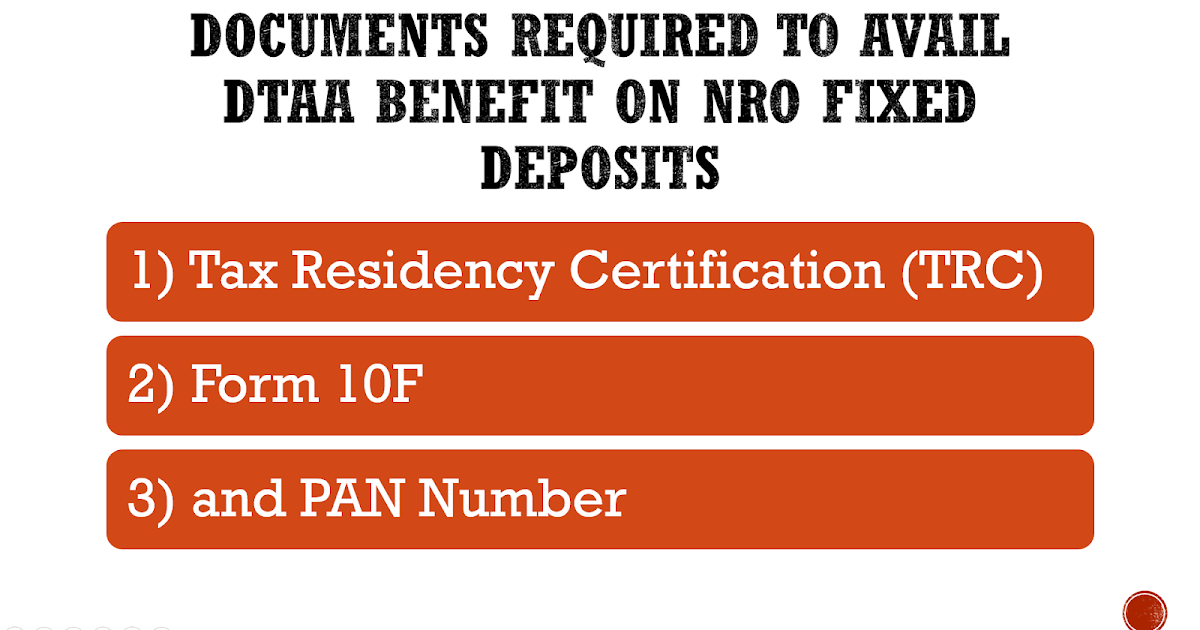

The policy purchase is subject to verification by a notary, indian diplomat, or an official of the concerned indian embassy abroad. According to experts, the foreign exchange management act has made it possible for nris and pios to take term insurance in india. Consider complete understanding of policy wordings So, can nris buy term insurance from an indian company? In such cases they would be treated at par with indian lives for the purpose of allowing insurance.

Source: savingsfunda.blogspot.com

Source: savingsfunda.blogspot.com

An nri is eligible to purchase a health insurance plan in india and just needs a proof of residence, itr and other related documents for making the purchase. An nri can opt for any one of the two alternatives in order to buy term insurance. Yes, nris can buy a term life insurance plan from insurance companies in india, as long as they satisfy a set of terms and conditions. Foreign exchange management act (fema) allows nris to buy any plan that meets their. Consider complete understanding of policy wordings

Source: coverfox.com

Source: coverfox.com

In such cases they would be treated at par with indian lives for the purpose of allowing insurance. Yes, nris can buy a term life insurance plan from insurance companies in india, as long as they satisfy a set of terms and conditions. An nri can easily take out a suitable term insurance plan and there are two ways in which this can be done. To put it simply, yes. Let’s take a look at the common guidelines about coverage for nris.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can nri take term insurance in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information