Can you change life insurance policies information

Home » Trending » Can you change life insurance policies informationYour Can you change life insurance policies images are available in this site. Can you change life insurance policies are a topic that is being searched for and liked by netizens now. You can Get the Can you change life insurance policies files here. Get all royalty-free photos.

If you’re looking for can you change life insurance policies pictures information related to the can you change life insurance policies keyword, you have pay a visit to the right blog. Our site always gives you suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Can You Change Life Insurance Policies. Yes, you can change life insurance companies and take out a policy with another provider. The life insurance industry continues to innovate, offering a wide spectrum of life insurance policies to consumers. But you�ll each need your own life insurance policy, in order to ensure the other person would be taken care of financially should one of you pass away. You can call the life insurance company directly and.

10 MustRead Personal Development Books That Can Change From pinterest.com

10 MustRead Personal Development Books That Can Change From pinterest.com

As the policyholder of your life insurance policy, you are in control of your life insurance policy choices. No one can change beneficiary designations after the insured dies. If you’ve granted someone a power of attorney—a legal document that lets someone make financial, legal, or medical decisions on your behalf—they may have the right to change your beneficiaries. You can call the life insurance company directly and. All you need to do is fill out a simple form and send it to the life insurance company. The application asks the applicant to name the policyowner, insured and beneficiary.

But you�ll each need your own life insurance policy, in order to ensure the other person would be taken care of financially should one of you pass away.

You could get married, or your relationship could break down and you may remarry and have children with a different partner. Switching your insurance may seem daunting, but you can complete the process relatively simply. You can call the life insurance company directly and. No one can change beneficiary designations after the insured dies. Also, make sure when you apply for the new replacement life insurance policy you inform the new insurance company that you intend to cancel your existing policy when you are accepted. Yes, as a legal & general policyholder you can also ask to make other changes such as the length of your life insurance policy.

Source: pinterest.com

Source: pinterest.com

When a person takes out a life insurance policy, he must fill out a life insurance application. If you are the owner of your policy, you can transfer ownership. Or you could switch by cancelling your insurance and finding a new deal that better suits your needs. How can i change the owner of my life insurance policy? If you’ve granted someone a power of attorney—a legal document that lets someone make financial, legal, or medical decisions on your behalf—they may have the right to change your beneficiaries.

Source: moneytothemasses.com

Source: moneytothemasses.com

Simply put, this is a standard clause with most life insurance. No one can change beneficiary designations after the insured dies. When a person takes out a life insurance policy, he must fill out a life insurance application. How to transfer ownership of a life insurance policy. Change the scope of cover on your current policy.

Source: pinterest.com

Source: pinterest.com

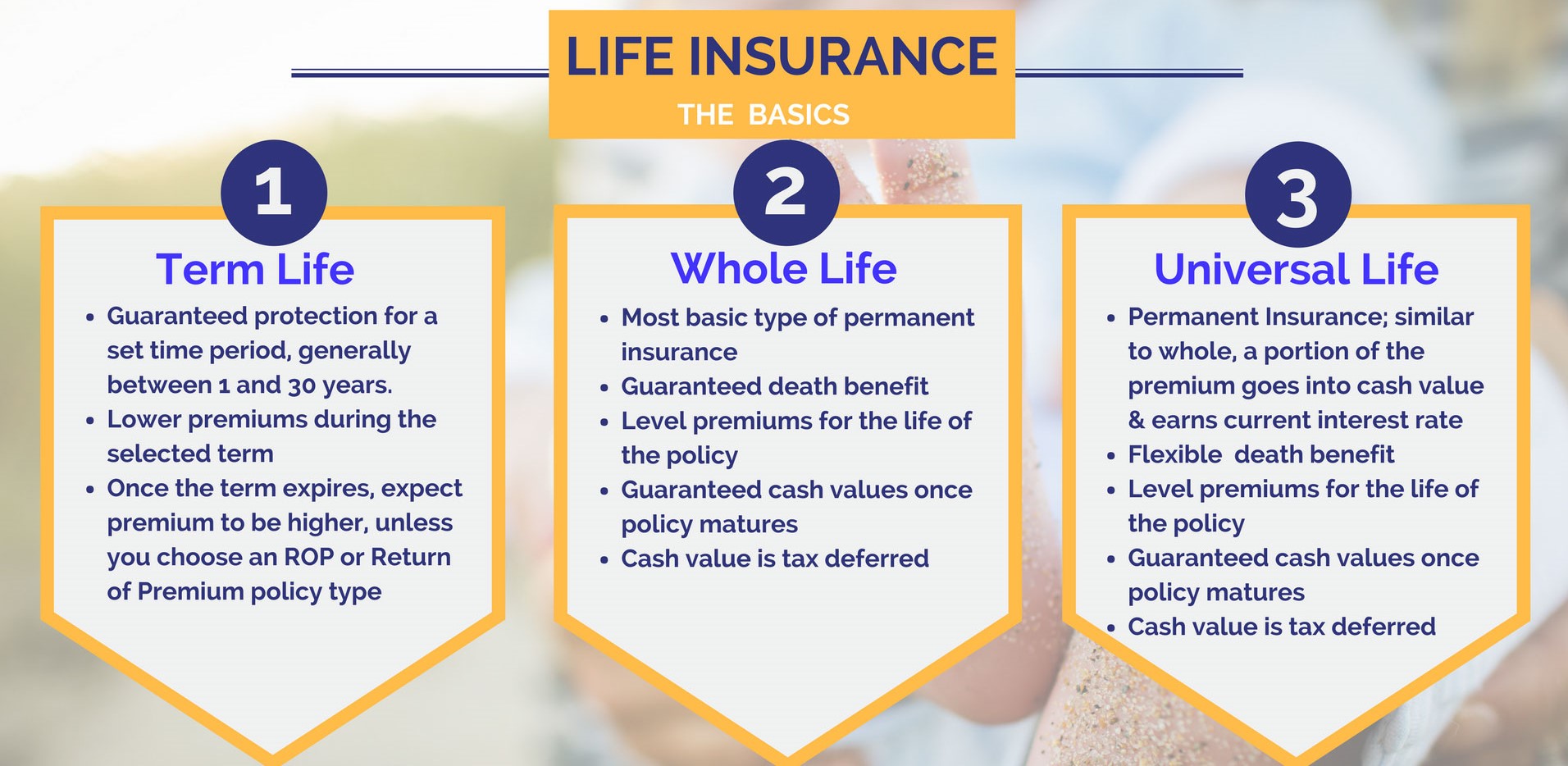

The policyholder is usually the only person allowed to make changes to your life insurance beneficiaries. Some life insurance companies may trend away from selling certain traditional plans of insurance while introducing newer plans to the marketplace. Term life insurance provides protection for a certain time period, such as 10, 15, 20 or 30 years and pays out to beneficiaries if you die within that term, or covers you until you reach a certain age, such as 65. This means that when you are no longer the owner of the policy, you cannot reclaim the policy for any reason, even if you are the person insured under the policy contract. You could amend your life insurance with your current provider.

Source: funeralcoverfinder.co.za

Source: funeralcoverfinder.co.za

You can call the life insurance company directly and. You can call the life insurance company directly and. Choose the type of life insurance you. For maximum ease, you may want to consult the following steps: Yes, you can change life insurance companies and take out a policy with another provider.

Source: usaa.com

Source: usaa.com

Switching your insurance may seem daunting, but you can complete the process relatively simply. Change the scope of cover on your current policy. You can buy additional life insurance for new financial obligations, such as a large loan or a new baby. Canceling a term life policy is pretty straightforward. The simple answer is yes.

Source: slideshare.net

Source: slideshare.net

The life insurance industry continues to innovate, offering a wide spectrum of life insurance policies to consumers. There could be restrictions on when and how often you can make changes. You could amend your life insurance with your current provider. You share appetizers, last names and sink space. Also, make sure when you apply for the new replacement life insurance policy you inform the new insurance company that you intend to cancel your existing policy when you are accepted.

Source: pinterest.com

Source: pinterest.com

You can typically cancel your life insurance policy at any time — either by letting your insurer know or no longer paying premiums. When a person takes out a life insurance policy, he must fill out a life insurance application. Once again, you are unable to roll over a life insurance policy into an individual retirement account, but taking advantage of these other options such as rolling over your policy, surrendering the policy, or taking out a policy loan can be just as beneficial for planning financially for your retirement. So you’ve decided that for whatever reason, your current level of cover is no longer appropriate considering your situation. How can i change the owner of my life insurance policy?

Source: wealthnation.io

Source: wealthnation.io

Yes, you can change life insurance companies and take out a policy with another provider. You now have three options available: A new policy may have a contestable period. Contact the life insurance company and request a change of policyholder form. 10 reasons why you might increase your life insurance coverage or change life insurance policies.

Source: everquote.com

Source: everquote.com

You can call the life insurance company directly and. How can i change the owner of my life insurance policy? If you’ve granted someone a power of attorney—a legal document that lets someone make financial, legal, or medical decisions on your behalf—they may have the right to change your beneficiaries. Once again, you are unable to roll over a life insurance policy into an individual retirement account, but taking advantage of these other options such as rolling over your policy, surrendering the policy, or taking out a policy loan can be just as beneficial for planning financially for your retirement. But you�ll each need your own life insurance policy, in order to ensure the other person would be taken care of financially should one of you pass away.

Source: sentinel-financial.com

Source: sentinel-financial.com

How can i change the owner of my life insurance policy? You can reduce the coverage amount on your term life insurance policy, but the process depends on your life insurance company. So you’ve decided that for whatever reason, your current level of cover is no longer appropriate considering your situation. No, you can’t change your level of coverage on that policy, but you could buy an additional small term life policy to provide the extra coverage you need. Some companies allow you to modify the coverage amount, but they have time and frequency limits.

Source: slideshare.net

Source: slideshare.net

You can reduce the coverage amount on your term life insurance policy, but the process depends on your life insurance company. Before you change or cancel your life insurance. You can buy additional life insurance for new financial obligations, such as a large loan or a new baby. Their goal is to remain competitive, offering newer products with attractive features and better rates because. You now have three options available:

Source: pinterest.com

Source: pinterest.com

If you’ve granted someone a power of attorney—a legal document that lets someone make financial, legal, or medical decisions on your behalf—they may have the right to change your beneficiaries. If you name a child under age 18 as a beneficiary, you should make arrangements for how the money will be managed through a trust. For maximum ease, you may want to consult the following steps: As the policyholder of your life insurance policy, you are in control of your life insurance policy choices. Only the policyholder can give up ownership of the policy.

Source: pinterest.com

Source: pinterest.com

How to change your life insurance policy. Canceling a term life policy is pretty straightforward. The policyholder is usually the only person allowed to make changes to your life insurance beneficiaries. Change the scope of cover on your current policy. Before you change or cancel your life insurance.

Source: outlookindia.com

Source: outlookindia.com

Neither beneficiaries nor life insurance policies can be changed without your consent. If you’ve granted someone a power of attorney—a legal document that lets someone make financial, legal, or medical decisions on your behalf—they may have the right to change your beneficiaries. Before you change or cancel your life insurance. You can buy additional life insurance for new financial obligations, such as a large loan or a new baby. Contact your life insurance agent or insurer should you want to change a beneficiary.

Source: takemycounsel.com

Source: takemycounsel.com

As the policyholder of your life insurance policy, you are in control of your life insurance policy choices. Or you could switch by cancelling your insurance and finding a new deal that better suits your needs. How to change your life insurance policy. If you think that you should be a life insurance beneficiary, and you are not, you can contest the designation and there are multiple grounds for doing so. You can reduce the coverage amount on your term life insurance policy, but the process depends on your life insurance company.

Source: insurance.ohio.gov

Source: insurance.ohio.gov

But you�ll each need your own life insurance policy, in order to ensure the other person would be taken care of financially should one of you pass away. Life insurance policies sometimes have a need to be transferred from the original policy owner to a new policy owner. You could get married, or your relationship could break down and you may remarry and have children with a different partner. Contact the life insurance company and request a change of policyholder form. The simple answer is yes.

Source: bankonyourself.com

Source: bankonyourself.com

There could be restrictions on when and how often you can make changes. No one can change beneficiary designations after the insured dies. A new policy may have a contestable period. And who can authorize a beneficiary change on a policy? Some life insurance companies may trend away from selling certain traditional plans of insurance while introducing newer plans to the marketplace.

Source: slideshare.net

Source: slideshare.net

You can call the life insurance company directly and. Also, make sure when you apply for the new replacement life insurance policy you inform the new insurance company that you intend to cancel your existing policy when you are accepted. The policyholder is usually the only person allowed to make changes to your life insurance beneficiaries. For maximum ease, you may want to consult the following steps: Canceling a term life policy is pretty straightforward.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can you change life insurance policies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea