Can you collect life insurance if someone overdoses Idea

Home » Trend » Can you collect life insurance if someone overdoses IdeaYour Can you collect life insurance if someone overdoses images are available in this site. Can you collect life insurance if someone overdoses are a topic that is being searched for and liked by netizens today. You can Get the Can you collect life insurance if someone overdoses files here. Download all royalty-free photos.

If you’re searching for can you collect life insurance if someone overdoses images information connected with to the can you collect life insurance if someone overdoses interest, you have come to the right blog. Our site frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Can You Collect Life Insurance If Someone Overdoses. In fact, state law in most states actually requires that all life insurance policies include a suicide provision. There are 2 ways you can access the return of premium and collect from your life insurance policy: If you can prove an insurable interest in that person, you can get a life insurance policy on them. If the insured died of suicide from a drug overdose during the contestability period, your life insurance claim will be denied.

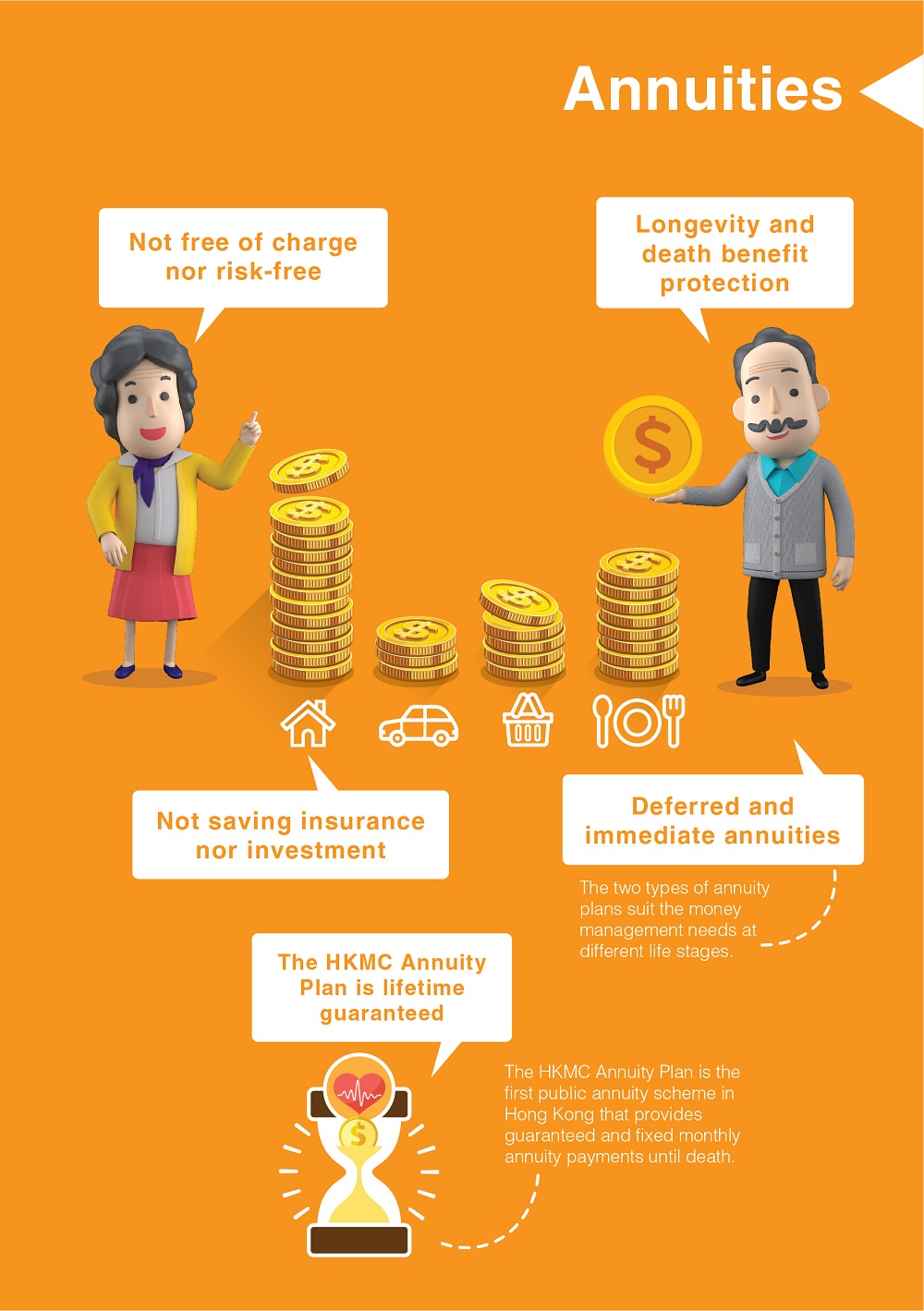

Annuities The Chin Family From ifec.org.hk

Annuities The Chin Family From ifec.org.hk

Keep in mind that there will be a high level of stipulations and illegal drug overdose may not be covered by the policy. A delayed claim is a claim that has not been paid or denied after all the necessary documents were submitted to the insurer. In fact, state law in most states actually requires that all life insurance policies include a suicide provision. Suppose going missing is not an exception to the policy, so some time passes to be sure that the person is indeed missing and the insurance company pays. Would it be possible for someone on death row to get a life insurance policy? Life insurance can provide coverage in the case of suicide, but many policies have special provisions that limit the payment of benefits.

Yes, you can get life insurance if you have been convicted of.

Suppose a person has life insurance and goes missing while the policy is valid. Suppose a person has life insurance and goes missing while the policy is valid. Would it be possible for someone on death row to get a life insurance policy? Yes, you can get life insurance if you have been convicted of. In fact, state law in most states actually requires that all life insurance policies include a suicide provision. It is human nature to procrastinate or to resist paying for something you may not “use.” after all, a life insurance winner buys the coverage today and dies the day after it becomes effective.

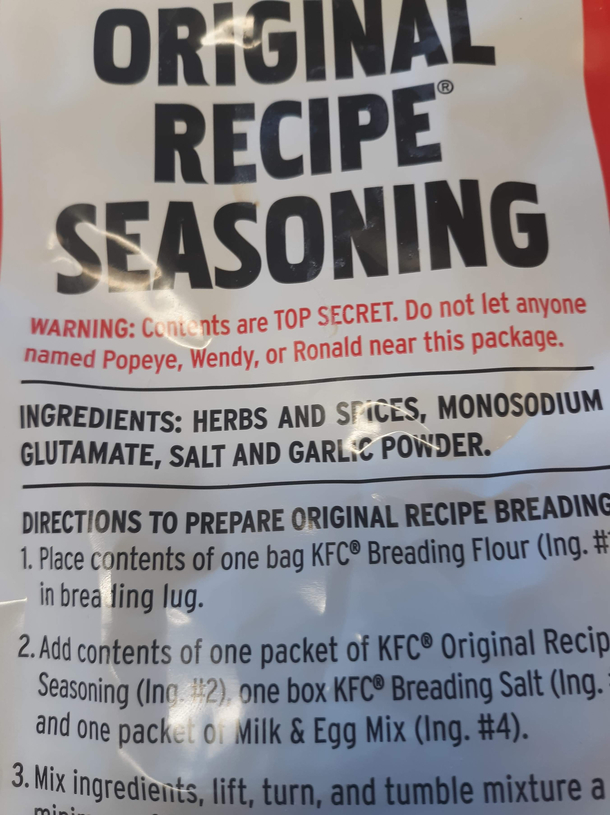

Source: easybestrecipes129.blogspot.com

Source: easybestrecipes129.blogspot.com

The insurer can contest a claim if it occurs during the contestability period or suicide clause waiting period, but the insurer would need to provide. If you can prove an insurable interest in that person, you can get a life insurance policy on them. Ohio 2005), the plaintiff was the beneficiary of her husband’s life insurance policy. Moreover, life insurance plans also exclude the death of an individual due to involvement in adventure sports like skydiving, parachuting, rafting, bungee jumping, etc. There may be policies and clauses which you can add to your existing policy to cover drug overdose.

Source: discover.hubpages.com

Source: discover.hubpages.com

Whether or not the insured was honest about his or her drug use when applying for life insurance As long as you avoid the exceptions detailed above, your beneficiaries will get the life insurance payout when you die. Moreover, life insurance plans also exclude the death of an individual due to involvement in adventure sports like skydiving, parachuting, rafting, bungee jumping, etc. Adventuramarketing.com also, if the insured abused drugs or alcohol but did not die of that abuse but something else, the drugs were incidental. The good news is that you can get life insurance on someone if they are close to you.

Source: infonuartikelen.blogspot.com

Source: infonuartikelen.blogspot.com

There are a number of factors that are taken into consideration to determine if a life insurance company will pay a death benefit for someone who has overdosed on drugs. As long as you avoid the exceptions detailed above, your beneficiaries will get the life insurance payout when you die. Whether or not the insured was honest about his or her drug use when applying for life insurance You will still need their permission and ask them to. There may be policies and clauses which you can add to your existing policy to cover drug overdose.

Source: graniterecoverycenters.com

Source: graniterecoverycenters.com

Adventuramarketing.com also, if the insured abused drugs or alcohol but did not die of that abuse but something else, the drugs were incidental. However, if the insured overdosed on a drug that was prescribed to him or her, his or her life insurance could still pay out. Quickly put, a life insurance claim can be paid, denied, or delayed. You don’t have to file your claim within a specific period after the death of a loved one. At the end of the term, if you are still alive and the policy is active, you would receive all of your money back.

Source: lhlic.com

Source: lhlic.com

In fact, state law in most states actually requires that all life insurance policies include a suicide provision. This provision states that if the deceased dies as the result of suicide within two years (sometimes one year) of signing the life insurance policy, then the policy will be voided and no death benefits will be Yes, you can get life insurance if you have been convicted of. His body is not found, no one saw anything which would be an evidence of the person death. If you had life insurance before becoming a felon, then your policy will still be in force.

Source: revisi.net

Source: revisi.net

You don’t have to file your claim within a specific period after the death of a loved one. There may be policies and clauses which you can add to your existing policy to cover drug overdose. First, there is a distinction between life insurance and accidental death coverage. If you had life insurance before becoming a felon, then your policy will still be in force. Suppose going missing is not an exception to the policy, so some time passes to be sure that the person is indeed missing and the insurance company pays.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

However, life insurance policies accumulate interest until claimed, which means that insurance companies want to pay out on policies as soon as possible. Heart attack, infection, kidney failure, stroke, old age, cancer, or any other natural cause Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident, drowning, poisoning,. Suicide clauses are included in most life insurance policies, and the normal term for them to apply is two years from the date of creation of the policy, although some policies may have shorter or. Beneficiaries need to know that unless.

Source: pinterest.com

Source: pinterest.com

A delayed claim is a claim that has not been paid or denied after all the necessary documents were submitted to the insurer. However, life insurance policies accumulate interest until claimed, which means that insurance companies want to pay out on policies as soon as possible. In fact, state law in most states actually requires that all life insurance policies include a suicide provision. Keep in mind that there will be a high level of stipulations and illegal drug overdose may not be covered by the policy. If the insured died of suicide from a drug overdose during the contestability period, your life insurance claim will be denied.

Source: entrepreneur.com

Source: entrepreneur.com

Life insurance can provide coverage in the case of suicide, but many policies have special provisions that limit the payment of benefits. Would it be possible for someone on death row to get a life insurance policy? It is human nature to procrastinate or to resist paying for something you may not “use.” after all, a life insurance winner buys the coverage today and dies the day after it becomes effective. Besides being 100 percent insane, not to mention wildly immoral (they don’t give out the death penalty for mail fraud, you know), the scheme you’re discussing addresses an issue that doesn’t exist. If you can prove an insurable interest in that person, you can get a life insurance policy on them.

Source: canoncitydailyrecord.com

Source: canoncitydailyrecord.com

Accidental death policies, on the. So, yes, life insurance companies can deny claims and refuse to pay out and if youre here, chances are youre in the same situation. You will still need their permission and ask them to. Beneficiaries need to know that unless. As long as you don’t get killed in the commission of a crime, the policy will payout.

Source: cheapsr22.us

Source: cheapsr22.us

And if the exclusion period is over, the beneficiaries can get cash value and the full death benefit. You will still need their permission and ask them to. The type of drug that the insured overdosed on; As long as you don’t get killed in the commission of a crime, the policy will payout. The good news is that you can get life insurance on someone if they are close to you.

Source: ifec.org.hk

Source: ifec.org.hk

Beneficiaries need to know that unless. Suicide clauses are included in most life insurance policies, and the normal term for them to apply is two years from the date of creation of the policy, although some policies may have shorter or. First, there is a distinction between life insurance and accidental death coverage. Quickly put, a life insurance claim can be paid, denied, or delayed. The type of drug that the insured overdosed on;

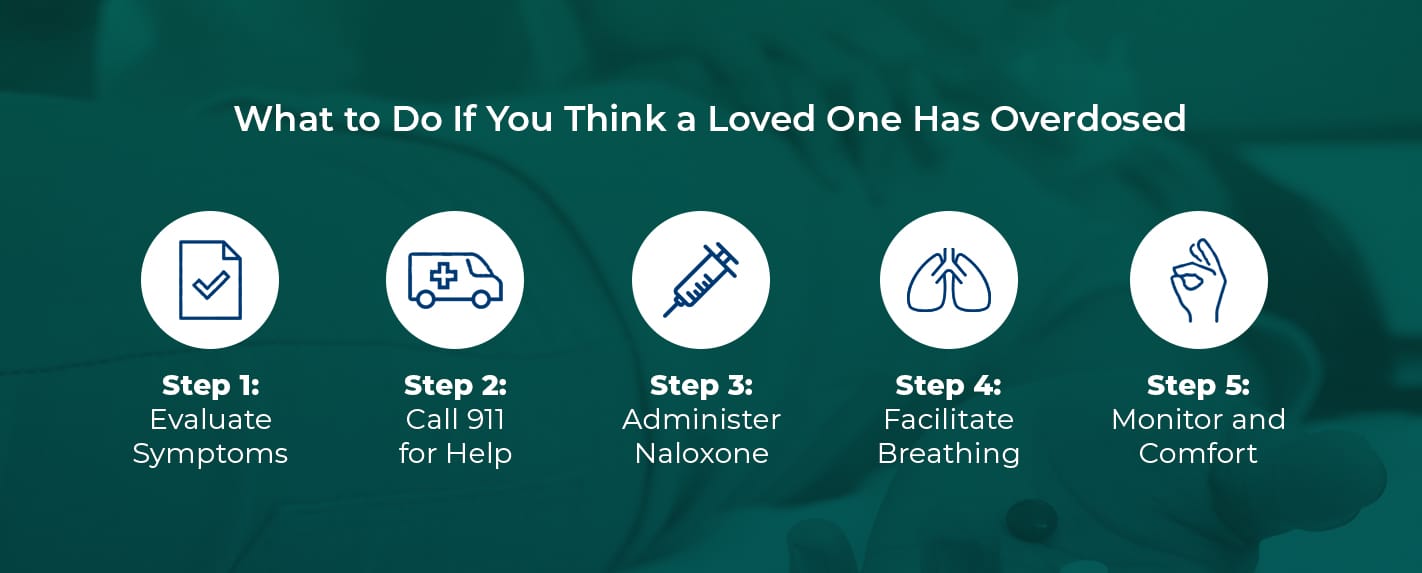

Source: sunshinebehavioralhealth.com

Source: sunshinebehavioralhealth.com

His body is not found, no one saw anything which would be an evidence of the person death. Whether or not the insured was honest about his or her drug use when applying for life insurance If the overdose was not accidental, then a suicide clause may apply. When it comes to what you have to do, many life insurance companies contact beneficiaries to issue the. In fact, state law in most states actually requires that all life insurance policies include a suicide provision.

Source: recreatelifecounseling.com

Source: recreatelifecounseling.com

The life insurance policy was governed by erisa. Under the terms of the life insurance policy, coverage was available only in the event her husband’s death. Quickly put, a life insurance claim can be paid, denied, or delayed. Life insurance can provide coverage in the case of suicide, but many policies have special provisions that limit the payment of benefits. Ohio 2005), the plaintiff was the beneficiary of her husband’s life insurance policy.

Source: everquote.com

Source: everquote.com

As long as you don’t get killed in the commission of a crime, the policy will payout. At the end of the term, if you are still alive and the policy is active, you would receive all of your money back. Besides being 100 percent insane, not to mention wildly immoral (they don’t give out the death penalty for mail fraud, you know), the scheme you’re discussing addresses an issue that doesn’t exist. A delayed claim is a claim that has not been paid or denied after all the necessary documents were submitted to the insurer. Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident, drowning, poisoning,.

Source: infonuartikelen.blogspot.com

Source: infonuartikelen.blogspot.com

Life insurance can provide coverage in the case of suicide, but many policies have special provisions that limit the payment of benefits. This provision states that if the deceased dies as the result of suicide within two years (sometimes one year) of signing the life insurance policy, then the policy will be voided and no death benefits will be An accidental overdose, such as if you accidentally took too much of a prescribed medication, will typically be covered so long as your medications and the reasons for taking them were disclosed when you bought life insurance. The life insurance policy was governed by erisa. Quickly put, a life insurance claim can be paid, denied, or delayed.

Source: infonuartikelen.blogspot.com

Source: infonuartikelen.blogspot.com

Under the terms of the life insurance policy, coverage was available only in the event her husband’s death. This provision states that if the deceased dies as the result of suicide within two years (sometimes one year) of signing the life insurance policy, then the policy will be voided and no death benefits will be At the end of the term, if you are still alive and the policy is active, you would receive all of your money back. However, life insurance policies accumulate interest until claimed, which means that insurance companies want to pay out on policies as soon as possible. You don’t have to file your claim within a specific period after the death of a loved one.

Source: jpricemcnamara.com

Source: jpricemcnamara.com

Keep in mind that there will be a high level of stipulations and illegal drug overdose may not be covered by the policy. If you can prove an insurable interest in that person, you can get a life insurance policy on them. However, if the insured overdosed on a drug that was prescribed to him or her, his or her life insurance could still pay out. There are a number of factors that are taken into consideration to determine if a life insurance company will pay a death benefit for someone who has overdosed on drugs. There may be policies and clauses which you can add to your existing policy to cover drug overdose.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can you collect life insurance if someone overdoses by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information