Can you get life insurance if you are terminally ill Idea

Home » Trending » Can you get life insurance if you are terminally ill IdeaYour Can you get life insurance if you are terminally ill images are ready in this website. Can you get life insurance if you are terminally ill are a topic that is being searched for and liked by netizens today. You can Find and Download the Can you get life insurance if you are terminally ill files here. Download all free vectors.

If you’re looking for can you get life insurance if you are terminally ill images information linked to the can you get life insurance if you are terminally ill keyword, you have visit the right site. Our website frequently provides you with hints for viewing the highest quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

Can You Get Life Insurance If You Are Terminally Ill. Can i get life insurance on someone who is terminally ill? You maybe able to get more than one such policy. If you need money to pay for your medical care or comfort, you may be able to use your life insurance policy to get some immediate cash. This type of policy will offer face.

Counselling terminal illness From slideshare.net

Counselling terminal illness From slideshare.net

Unfortunately, for the terminally ill, this is not typical. Life insurance is regarded as a necessity for everyone, even those with preexisting conditions, or terminal illnesses. The only type of life insurance you can buy if you have been diagnosed with a terminal illness is guaranteed issue life insurance. If you have been diagnosed with a terminal illness, depending on your insurer and the terms of your cover, you may be able to claim on the terminal illness. Many life insurance policies offer “accelerated death benefits,” which allow policyholders who have been diagnosed with a. These policies work well as burial insurance for terminally ill or burial insurance for cancer patients.

With life insurance, terminally ill people can access the financial support they need to get through a difficult time, while still providing their loved ones with coverage if any money remains.

Guaranteed issue life insurance may be your only life insurance option after being diagnosed with a terminal illness. With life insurance, terminally ill people can access the financial support they need to get through a difficult time, while still providing their loved ones with coverage if any money remains. Guaranteed life insurance policies will cover you, no questions asked, but there are some downsides. This will take some financial responsibility off your family and allow them to focus on other decisions when the time comes. You can still get life insurance coverage if you have a terminal illness, but your options will be severely limited if you were already insured before your diagnosis, check to see if there are any riders on your policy that could help cover costs while you are still alive getting the news that you are terminally ill is devastating. Guaranteed issue life insurance may be your only life insurance option after being diagnosed with a terminal illness.

Source: protective.com

Source: protective.com

The long answer comes down to. Then, you may choose at least 3 top insurance companies that you prefer and choose who you think has the most reliable agent. With life insurance, terminally ill people can access the financial support they need to get through a difficult time, while still providing their loved ones with coverage if any money remains. Guaranteed life insurance policies will cover you, no questions asked, but there are some downsides. Viatical settlements allow terminally ill individuals to sell their life insurance policies.

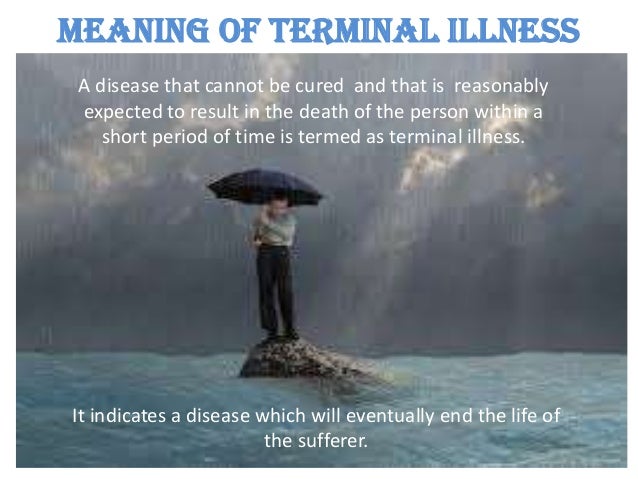

Source: in.pinterest.com

Source: in.pinterest.com

With life insurance, terminally ill people can access the financial support they need to get through a difficult time, while still providing their loved ones with coverage if any money remains. Your terminal illness would exclude you from coverage. Then, you may choose at least 3 top insurance companies that you prefer and choose who you think has the most reliable agent. If you’ve received a terminal illness, you can’t get the typical term or whole life insurance. Learn more about a living benefits rider and how it might be something you want to consider adding to your current or future insurance policy.

Source: afcsnc.com

Source: afcsnc.com

This will take some financial responsibility off your family and allow them to focus on other decisions when the time comes. This type of policy will offer face. Then, you may choose at least 3 top insurance companies that you prefer and choose who you think has the most reliable agent. Many life insurance policies offer “accelerated death benefits,” which allow policyholders who have been diagnosed with a. Unfortunately, for the terminally ill, this is not typical.

Source: infallibleinroad.co.uk

Source: infallibleinroad.co.uk

You can still get life insurance coverage if you have a terminal illness, but your options will be severely limited if you were already insured before your diagnosis, check to see if there are any riders on your policy that could help cover costs while you are still alive getting the news that you are terminally ill is devastating. There is no specific life insurance policy for terminally ill cancer patients, but there is a life insurance policy that you can qualify for as a terminally ill patient, called a guaranteed issue life insurance policy. The first thing that you have to do is to search online and have the details of what kinds of life insurance do you need, for this case, it will be for your terminally ill parent. You may be able to claim on your life insurance cover after you receive a diagnosis of a terminal illness. The long answer comes down to.

Source: lisbonlx.com

Source: lisbonlx.com

Can i get a life insurance policy for my brother? Viatical settlements allow terminally ill individuals to sell their life insurance policies. If you need money to pay for your medical care or comfort, you may be able to use your life insurance policy to get some immediate cash. As mentioned earlier, you have two options: Guaranteed life insurance final expense life insurance

Source: slideshare.net

Source: slideshare.net

There are only three requirements one must meet to qualify for this type of whole life coverage. A terminal illness represents a high level of risk, so they are only willing to issue a specific form of coverage. Then, you may choose at least 3 top insurance companies that you prefer and choose who you think has the most reliable agent. There are only three requirements one must meet to qualify for this type of whole life coverage. You can get life insurance if you are terminally ill if you reside in a state that offers guaranteed issue life insurance and if you fit the age guidelines (most have a minimum age requirement of age 45 or higher).

Source: accomplishinsurance.com

Source: accomplishinsurance.com

Many life insurance policies offer “accelerated death benefits,” which allow policyholders who have been diagnosed with a. Viatical settlements allow terminally ill individuals to sell their life insurance policies. Compared to other policies, guaranteed policy premiums are higher, have lower coverage, and include a two year waiting period before you can. Unfortunately, for the terminally ill, this is not typical. Second, you must be a us citizen.

Source: tagworld.com

Source: tagworld.com

It can be extremely difficult if not impossible to find an insurer who will take a virtually. You can still get life insurance coverage if you have a terminal illness, but your options will be severely limited if you were already insured before your diagnosis, check to see if there are any riders on your policy that could help cover costs while you are still alive getting the news that you are terminally ill is devastating. Many life insurance policies offer “accelerated death benefits,” which allow policyholders who have been diagnosed with a. Viatical settlements allow terminally ill individuals to sell their life insurance policies. There are only three requirements one must meet to qualify for this type of whole life coverage.

Source: surebridgeinsurance.com

Source: surebridgeinsurance.com

Compared to other policies, guaranteed policy premiums are higher, have lower coverage, and include a two year waiting period before you can. You maybe able to get more than one such policy. If you’ve received a terminal illness, you can’t get the typical term or whole life insurance. With life insurance, terminally ill people can access the financial support they need to get through a difficult time, while still providing their loved ones with coverage if any money remains. It can be extremely difficult if not impossible to find an insurer who will take a virtually.

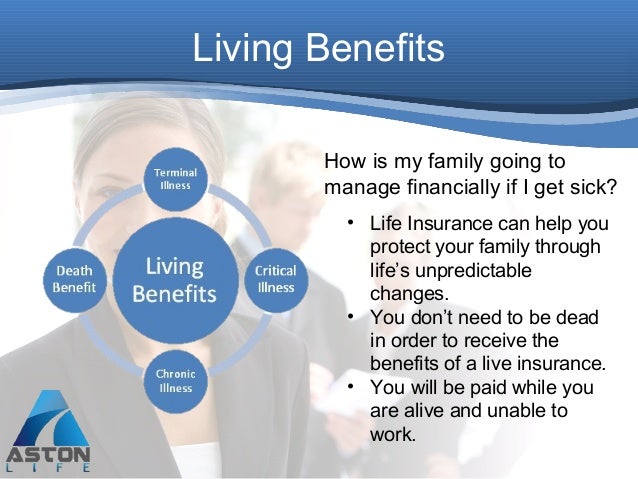

Source: slideshare.net

Source: slideshare.net

Unfortunately, a diagnosis of a terminal illness often comes with many expenses. If you just got diagnosed with a terminal illness and are wondering if you could still buy life insurance to protect your family’s financials then the answer is yes. Life insurance for the terminally ill. Can i get life insurance on someone who is terminally ill? With life insurance, terminally ill people can access the financial support they need to get through a difficult time, while still providing their loved ones with coverage if any money remains.

Source: fourseasonshospicesatx.com

Source: fourseasonshospicesatx.com

Then, you may choose at least 3 top insurance companies that you prefer and choose who you think has the most reliable agent. They both have medical exams and strict underwriting guidelines. Life insurance for the terminally ill. You may be able to claim on your life insurance cover after you receive a diagnosis of a terminal illness. If you’ve been diagnosed with a terminal illness and don’t have any life insurance, consider purchasing a burial policy.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Can i get life insurance on someone who is terminally ill? The problem that you may face in this situation is that the risk of insuring a terminally ill parent is much higher, and that translates into having to pay higher premiums or even resorting to limited life insurance policy choices. A life insurance policy can protect your loved ones financially when you pass away. This type of policy will offer face. Many life insurance policies offer “accelerated death benefits,” which allow policyholders who have been diagnosed with a terminal illness to access a portion of the policy’s death benefit while they are still alive.

Source: pinterest.com

Source: pinterest.com

The only type of life insurance you can buy if you have been diagnosed with a terminal illness is guaranteed issue life insurance. If you’ve received a terminal illness, you can’t get the typical term or whole life insurance. A terminal illness represents a high level of risk, so they are only willing to issue a specific form of coverage. This will take some financial responsibility off your family and allow them to focus on other decisions when the time comes. Guaranteed life insurance policies will cover you, no questions asked, but there are some downsides.

Source: mychildmagazine.com.au

Source: mychildmagazine.com.au

If you have been diagnosed with a terminal illness, depending on your insurer and the terms of your cover, you may be able to claim on the terminal illness. Life insurance is regarded as a necessity for everyone, even those with preexisting conditions, or terminal illnesses. Guaranteed life insurance final expense life insurance Yes, you can get a “graded life” policy for up to $50,000. With life insurance, terminally ill people can access the financial support they need to get through a difficult time, while still providing their loved ones with coverage if any money remains.

Source: spikysnail.com

Source: spikysnail.com

Life insurance carriers are in the business of risk assessment. However, you should be aware that your options are very limited. Can i get life insurance on someone who is terminally ill? Second, you must be a us citizen. A terminal illness represents a high level of risk, so they are only willing to issue a specific form of coverage.

Source: lhlic.com

Source: lhlic.com

The only type of life insurance you can buy if you have been diagnosed with a terminal illness is guaranteed issue life insurance. Life insurance is regarded as a necessity for everyone, even those with preexisting conditions, or terminal illnesses. Guaranteed issue life insurance may be your only life insurance option after being diagnosed with a terminal illness. If you need money to pay for your medical care or comfort, you may be able to use your life insurance policy to get some immediate cash. If you just got diagnosed with a terminal illness and are wondering if you could still buy life insurance to protect your family’s financials then the answer is yes.

Source: accomplishinsurance.com

Source: accomplishinsurance.com

Guaranteed life insurance final expense life insurance A life insurance policy can protect your loved ones financially when you pass away. Unfortunately, for the terminally ill, this is not typical. These policies work well as burial insurance for terminally ill or burial insurance for cancer patients. There is no specific life insurance policy for terminally ill cancer patients, but there is a life insurance policy that you can qualify for as a terminally ill patient, called a guaranteed issue life insurance policy.

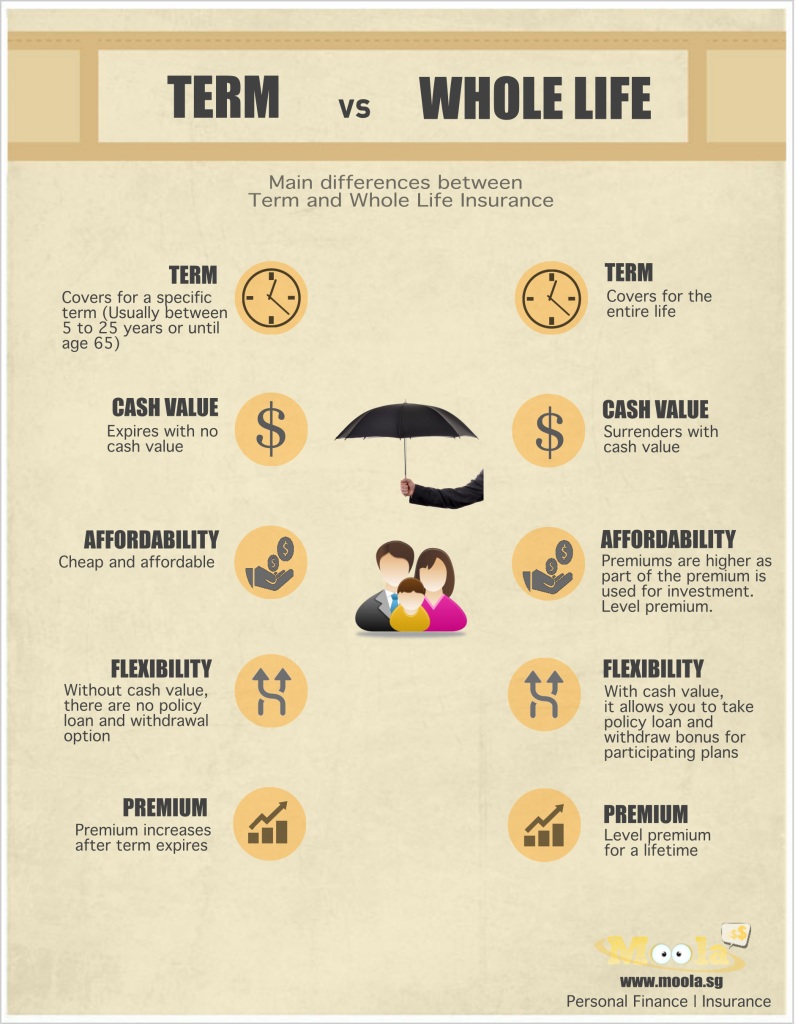

Source: moneydigest.sg

Source: moneydigest.sg

Guaranteed issue life insurance may be your only life insurance option after being diagnosed with a terminal illness. You can get life insurance if you are terminally ill if you reside in a state that offers guaranteed issue life insurance and if you fit the age guidelines (most have a minimum age requirement of age 45 or higher). Life insurance carriers are in the business of risk assessment. Then, you may choose at least 3 top insurance companies that you prefer and choose who you think has the most reliable agent. This means that the company only returns premium if the insured dies before 2 years, but if they live beyond that, the full insurance benefit is paid.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you get life insurance if you are terminally ill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea