Can you have liability insurance on a financed car Idea

Home » Trending » Can you have liability insurance on a financed car IdeaYour Can you have liability insurance on a financed car images are ready. Can you have liability insurance on a financed car are a topic that is being searched for and liked by netizens now. You can Find and Download the Can you have liability insurance on a financed car files here. Find and Download all royalty-free photos.

If you’re searching for can you have liability insurance on a financed car pictures information linked to the can you have liability insurance on a financed car topic, you have visit the ideal blog. Our site frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

Can You Have Liability Insurance On A Financed Car. Ad handyman, carpenter, painter, electrician & more. This policy allows the financing company to protect its asset, the vehicle, which secures the loan in case of default.10 mai 2021 Banks and lenders require minimum coverage for a financed car, usually in the form of a full coverage policy that combines comprehensive, collision, and liability insurance. You don�t want liability only because the car will not be sufficiently protected.

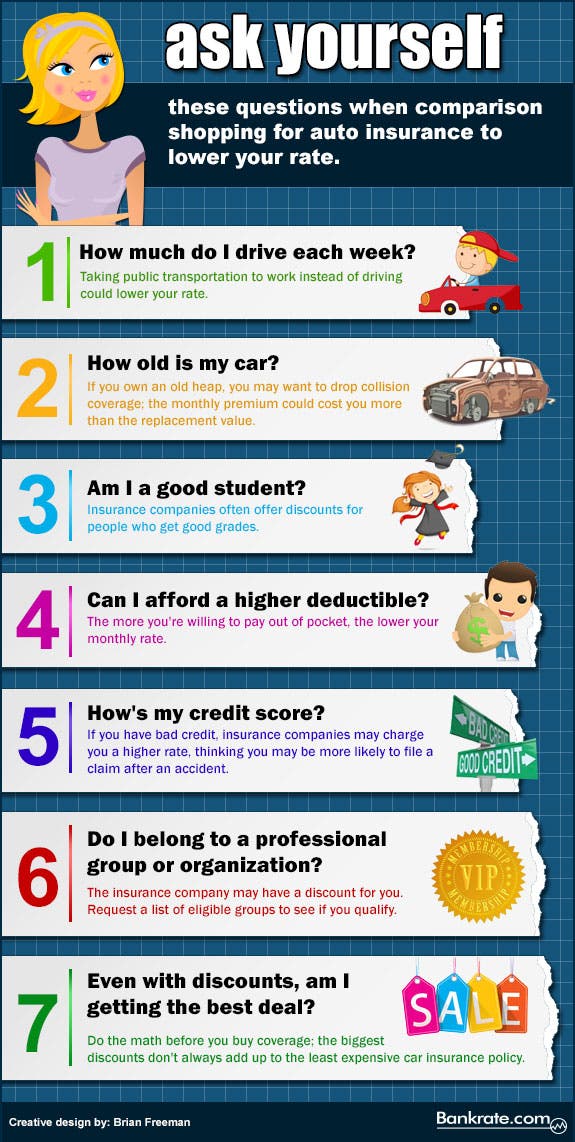

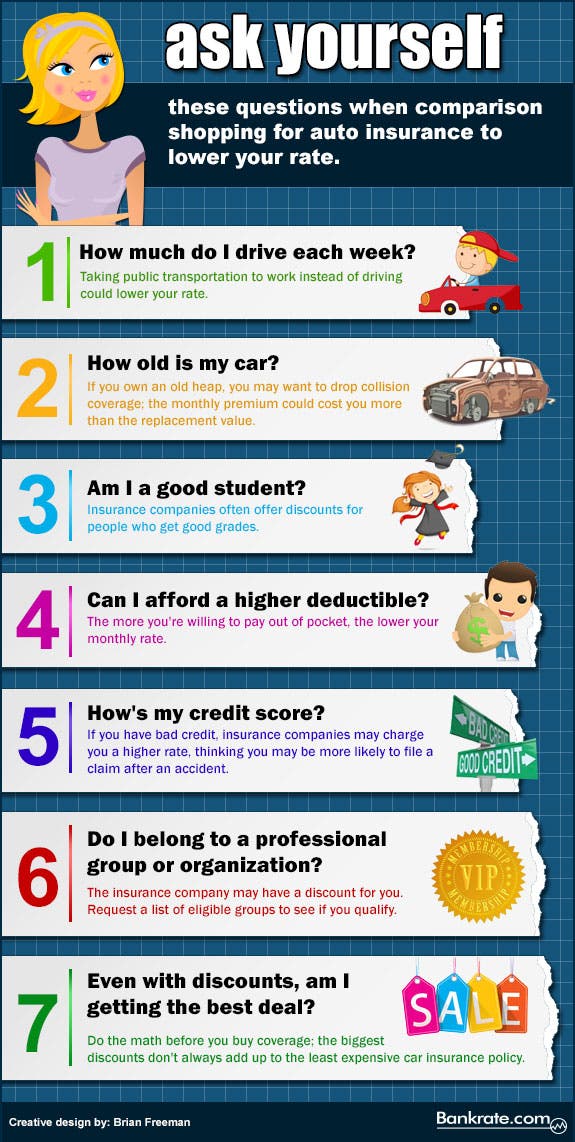

7 Questions To Get Cheap Auto Insurance From bankrate.com

7 Questions To Get Cheap Auto Insurance From bankrate.com

This applies regardless of whether the vehicle is new or used. Until your financed car is completely paid off, the car is owned by your lienholder, and the lienholder determines what level of insurance coverage is needed. The lender can tell you how much liability coverage you need, but not where to purchase it. Nobody likes to think about something like this happening, but when you�re faced with a serious car accident, the last thing you want to have to worry about is if there will be enough money or car insurance to cover. If you depend upon the insurance through the lender to provide liability coverage, you may end up with a citation for failure to purchase liability insurance. You must purchase full coverage auto insurance when you initially finance the vehicle.

When buying full coverage insurance for a car with a loan, you should notify your insurer that the car is financed, because your lender will need to be listed on the policy.

What insurance do you need for a financed car? If you’re looking to finance a car but find you can’t afford the full coverage auto insurance with the loan payment, perhaps we can help. Just like with a financed vehicle, you will likely be required by the leasing agent (typically the dealership. Ad handyman, carpenter, painter, electrician & more. $15,000 per person/$30,000 per occurrence. The limitations when you are financing a vehicle are the same as the state minimum, which is as follows:

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

Full coverage is required on financed cars to protect the lender’s investment. Driving a financed vehicle impacts your insurance coverage options. Underinsured motorist coverage can help if the other driver doesn’t have enough insurance to cover your costs after an accident, while uninsured motorist coverage can help if the other driver has no insurance. Limitations based on financing a vehicle. Can you have no insurance on a financed car?

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

Many drivers fail to realize that if a financed car is declared a total loss due to a natural disaster or accident damage, you will still need to repay any remaining loan balance. This policy allows the financing company to protect its asset, the vehicle, which secures the loan in case of default.10 mai 2021 While liability insurance is all you need to meet your state’s requirements, the lender of an auto loan will require full coverage. Buy policy online in 5 mins! Limitations based on financing a vehicle.

Source: bankrate.com

Source: bankrate.com

Ad handyman, carpenter, painter, electrician & more. You must purchase full coverage auto insurance when you initially finance the vehicle. These are two different types of coverage that help pay for damages if you’re in an accident with a driver who either has very minimal car insurance or doesn’t have any at all. Liability auto insurance is the best way to protect yourself against substantial financial loss in the event of a car accident where you�re at fault. Banks and lenders require minimum coverage for a financed car, usually in the form of a full coverage policy that combines comprehensive, collision, and liability insurance.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

What insurance do you need for a financed car? This policy allows the financing company to protect its asset, the vehicle, which secures the loan in case of default.10 mai 2021 Ad handyman, carpenter, painter, electrician & more. This applies regardless of whether the vehicle is new or used. What insurance do you need for a financed car?

Source: carsdirect.com

Source: carsdirect.com

Just like with a financed vehicle, you will likely be required by the leasing agent (typically the dealership. That means they’re legally allowed to cancel your auto loan and take the vehicle away from you. What insurance do you need for a financed car? The lender can tell you how much liability coverage you need, but not where to purchase it. If you’re looking to finance a car but find you can’t afford the full coverage auto insurance with the loan payment, perhaps we can help.

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

Yes, you need full coverage on a financed car. Can you have no insurance on a financed car? But if you drive a financed car, your lender will require you to carry liability insurance, collision insurance, and comprehensive insurance, often called full coverage. Until your financed car is completely paid off, the car is owned by your lienholder, and the lienholder (7). If you depend upon the insurance through the lender to provide liability coverage, you may end up with a citation for failure to purchase liability insurance.

Source: everquote.com

Source: everquote.com

What insurance do you need for a financed car? These are two different types of coverage that help pay for damages if you’re in an accident with a driver who either has very minimal car insurance or doesn’t have any at all. This applies regardless of whether the vehicle is new or used. The lender’s insurance typically does not provide liability insurance, just insurance on the automobile. If you depend upon the insurance through the lender to provide liability coverage, you may end up with a citation for failure to purchase liability insurance.

Source: motor1.com

Source: motor1.com

Banks and lenders require minimum coverage for a financed car, usually in the form of a full coverage policy that combines comprehensive, collision, and liability insurance. To drive legally, you have to have your state’s required minimum liability insurance coverage. Until your financed car is completely paid off, the car is owned by your lienholder, and the lienholder determines what level of insurance coverage is needed. If you’re looking to finance a car but find you can’t afford the full coverage auto insurance with the loan payment, perhaps we can help. Yes, financed cars have to be insured.

Source: financeviewer.blogspot.com

Underinsured motorist coverage can help if the other driver doesn’t have enough insurance to cover your costs after an accident, while uninsured motorist coverage can help if the other driver has no insurance. When buying full coverage insurance for a car with a loan, you should notify your insurer that the car is financed, because your lender will need to be listed on the policy. Can you have no insurance on a financed car? Ad handyman, carpenter, painter, electrician & more. While liability insurance is all you need to meet your state’s requirements, the lender of an auto loan will require full coverage.

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

Yes, you need full coverage on a financed car. Ad handyman, carpenter, painter, electrician & more. If you depend upon the insurance through the lender to provide liability coverage, you may end up with a citation for failure to purchase liability insurance. You must purchase full coverage auto insurance when you initially finance the vehicle. Banks and lenders require minimum coverage for a financed car, usually in the form of a full coverage policy that combines comprehensive, collision, and liability insurance.

Source: financeviewer.blogspot.com

If you’re looking to finance a car but find you can’t afford the full coverage auto insurance with the loan payment, perhaps we can help. To drive legally, you have to have your state’s required minimum liability insurance coverage. Limitations based on financing a vehicle. But if you drive a financed car, your lender will require you to carry liability insurance, collision insurance, and comprehensive insurance, often called full coverage. The lender’s insurance typically does not provide liability insurance, just insurance on the automobile.

Source: carfinance2u.co.nz

Source: carfinance2u.co.nz

To legally drive in your state, carinsurance.com states that you must have at least liability insurance. But if you drive a financed car, your lender will require you to carry liability insurance, collision insurance, and comprehensive insurance, often called full coverage. Can you have no insurance on a financed car? Liability auto insurance is the best way to protect yourself against substantial financial loss in the event of a car accident where you�re at fault. Yes, financed cars have to be insured.

Source: bankonus.com

Source: bankonus.com

But if you drive a financed car, your lender will require you to carry liability insurance, collision insurance, and comprehensive insurance, often called full coverage. Having only the state minimum amount of liability insurance won�t be sufficient. Read on to learn more about insurance requirements for financed cars. Underinsured motorist coverage can help if the other driver doesn’t have enough insurance to cover your costs after an accident, while uninsured motorist coverage can help if the other driver has no insurance. $15,000 per person/$30,000 per occurrence.

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

Banks and lenders require minimum coverage for a financed car, usually in the form of a full coverage policy that combines comprehensive, collision, and liability insurance. (2022) yes, financed cars have to be insured. But if you drive a financed car, your lender will require you to carry liability insurance, collision insurance, and comprehensive insurance, often called full coverage. These are two different types of coverage that help pay for damages if you’re in an accident with a driver who either has very minimal car insurance or doesn’t have any at all. To drive legally, you have to have your state’s required minimum liability insurance coverage.

Source: enoanggra.blogspot.com

If you choose to downgrade to liability insurance while you still owe money on the car, you are violating the contract with your lender. This applies regardless of whether the vehicle is new or used. Can you have just liability insurance on a financed car? Until your financed car is completely paid off, the car is owned by your lienholder, and the lienholder (7). Yes, you need full coverage on a financed car.

Source: gobankingrates.com

Source: gobankingrates.com

These are two different types of coverage that help pay for damages if you’re in an accident with a driver who either has very minimal car insurance or doesn’t have any at all. Until your financed car is completely paid off, the car is owned by your lienholder, and the lienholder (7). (2022) yes, financed cars have to be insured. Banks and lenders require minimum coverage for a financed car, usually in the form of a full coverage policy that combines comprehensive, collision, and liability insurance. If you depend upon the insurance through the lender to provide liability coverage, you may end up with a citation for failure to purchase liability insurance.

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

Driving a financed vehicle impacts your insurance coverage options. $15,000 per person/$30,000 per occurrence. That means they’re legally allowed to cancel your auto loan and take the vehicle away from you. The lender’s insurance typically does not provide liability insurance, just insurance on the automobile. If you depend upon the insurance through the lender to provide liability coverage, you may end up with a citation for failure to purchase liability insurance.

Source: revisi.net

Source: revisi.net

Banks and lenders require minimum coverage for a financed car, usually in the form of a full coverage policy that combines comprehensive, collision, and liability insurance. Can you have no insurance on a financed car? When buying full coverage insurance for a car with a loan, you should notify your insurer that the car is financed, because your lender will need to be listed on the policy. These are two different types of coverage that help pay for damages if you’re in an accident with a driver who either has very minimal car insurance or doesn’t have any at all. Can you have just liability insurance on a financed car?

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can you have liability insurance on a financed car by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea