Can you have too much life insurance Idea

Home » Trend » Can you have too much life insurance IdeaYour Can you have too much life insurance images are ready. Can you have too much life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Can you have too much life insurance files here. Find and Download all royalty-free photos.

If you’re looking for can you have too much life insurance pictures information related to the can you have too much life insurance keyword, you have come to the right site. Our website always provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

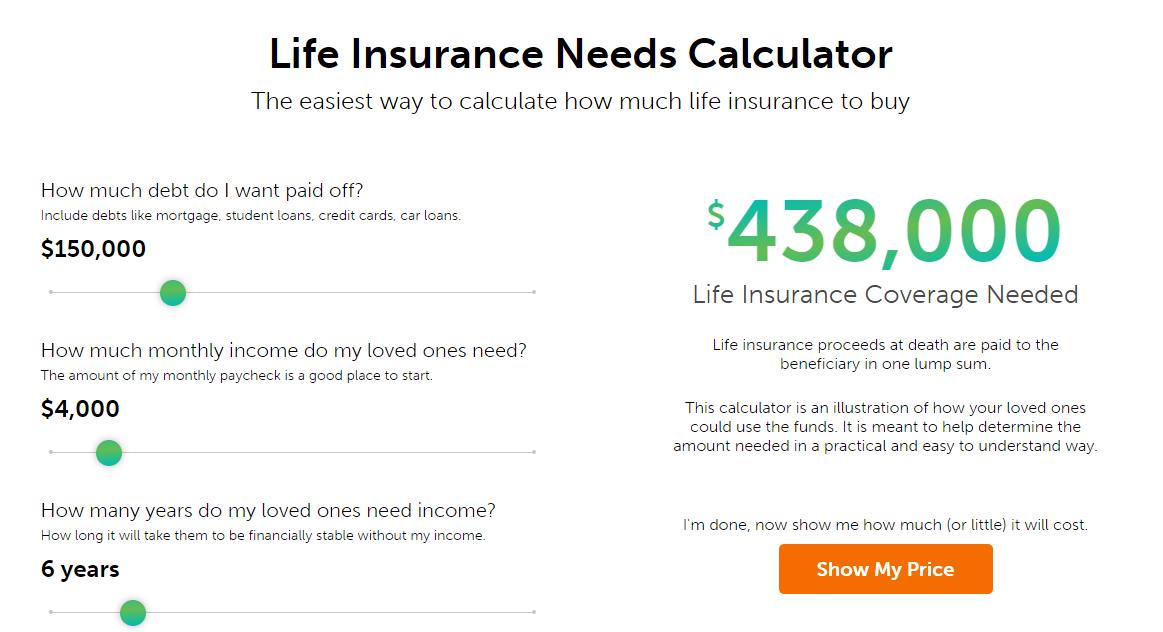

Can You Have Too Much Life Insurance. In contrast to things like car insurance or travel insurance, taking out more than one life insurance policy could actually be the right option for you and your circumstances. Can you have too much life insurance? Avoiding both of these mistakes is important to keeping life insurance costs reasonable while getting the protection loved ones really need. “if you have people who depend on you financially, you should have term life insurance,” says brittney burgett, marketing and.

How much do you pay for your health if you don�t have From pinterest.com

How much do you pay for your health if you don�t have From pinterest.com

The #1 reason why having too much coverage is a bad thing is because of the expense. Can you have too much insurance? The life insurance companies have methods in place to monitor for that. Can you have too much life insurance? It is certainly possible to have too much insurance if policyholders buy coverage longer than necessary or get a higher death benefit than necessary. The amounts typically run into tens of thousands of dollars a year, and.

In theory, there is no limit to how many policies you have, although there are some restrictions.

This stuff can be expensive. Basically, the issue for insurance carriers isn’t how many policies you own, but rather the total amount of life insurance coverage you have. Can you have too much life insurance? In contrast to things like car insurance or travel insurance, taking out more than one life insurance policy could actually be the right option for you and your circumstances. “if you have people who depend on you financially, you should have term life insurance,” says brittney burgett, marketing and. The thought of getting some payout from time to time as bonus or redemptions was enticing.

Source: guardianlife.com

Source: guardianlife.com

Summary purchasing too much life insurance can cause you to overspend on life insurance, and although a larger death benefit may sound appealing, you could be spending more on premiums than necessary and you could have coverage that better suits your financial needs. Can you have too much insurance? They�ve bought these policies in some cases, years ago, when their situation was very different. This can be a mistake. Let’s be honest—no family is going to complain about receiving too much money from an insurance company if their loved one dies.

Source: lion.ie

Source: lion.ie

Even with all these expenses, you may wonder if there’s such a thing as too much life insurance. Here’s how consumers can decide if they’re buying too much insurance. The only time you cannot buy more than one life insurance policy is when you’re trying to get more coverage than you. Can you have too much life insurance? “if you have people who depend on you financially, you should have term life insurance,” says brittney burgett, marketing and.

Source: revisi.net

Source: revisi.net

Your life insurance policies can be with one insurer or more than one insurer, it doesn�t make any difference. Yes, actually, it is possible to have more life insurance than you need. It�s important to have the right amount. Can you actually own too many insurance policies? More people don�t have enough life insurance, but you can have too much.

Source: revisi.net

Source: revisi.net

This stuff can be expensive. Many people have life insurance coverage through their employer in addition to a personal term life insurance or permanent life insurance policy. This can be a mistake. If you have enough in savings that you no longer need life insurance at all, you can sell the whole thing for income and stop making those monthly premium payments. Can you have too much life insurance?

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

This stuff can be expensive. The amounts typically run into tens of thousands of dollars a year, and. Yes, actually, it is possible to have more life insurance than you need. Your life insurance policies can be with one insurer or more than one insurer, it doesn�t make any difference. If you get married, have kids, buy a house, or retire, you should check to see if you need to increase your reduce the amount you�re insured for.

Source: shelterbay.ca

Source: shelterbay.ca

The core insurance product that every investor should have is a term cover. For more information, visit our life insurance page. “if you have people who depend on you financially, you should have term life insurance,” says brittney burgett, marketing and. They�ve bought these policies in some cases, years ago, when their situation was very different. It’s possible to overpay for life insurance or to have too much coverage, but you have plenty of opportunities to avoid overpaying.

Source: revisi.net

Source: revisi.net

Here’s how consumers can decide if they’re buying too much insurance. The amounts typically run into tens of thousands of dollars a year, and. If you get married, have kids, buy a house, or retire, you should check to see if you need to increase your reduce the amount you�re insured for. But is it possible to have too much life insurance? Let’s be honest—no family is going to complain about receiving too much money from an insurance company if their loved one dies.

Source: quotacy.com

Source: quotacy.com

This can be a mistake. Your life insurance policies can be with one insurer or more than one insurer, it doesn�t make any difference. Basically, the issue for insurance carriers isn’t how many policies you own, but rather the total amount of life insurance coverage you have. They�ve bought these policies in some cases, years ago, when their situation was very different. “if you have people who depend on you financially, you should have term life insurance,” says brittney burgett, marketing and.

Source: havenlife.com

Source: havenlife.com

The core insurance product that every investor should have is a term cover. Learn how much life insurance you really. Your best bet is to sit down with a qualified life insurance agent and conduct a complete needs analysis and discover what you want your loved ones to experience if you are gone and that should help you to. It’s possible — and legal — to have multiple life insurance policies.the most common example: Your life insurance policies can be with one insurer or more than one insurer, it doesn�t make any difference.

Source: insurance.policyarchitects.com

Source: insurance.policyarchitects.com

In theory, there is no limit to how many policies you have, although there are some restrictions. 11 rows yes, you can have too much life insurance. For example, a one million dollar umbrella insurance policy can cost you only a few hundred dollars per year. Over the past couple of years, i’ve been approached by several young doctors who all tell similar stories of being weighed down by the amount of money they’re paying in insurance premiums. Forgetting to update your life insurance policy is risky and can leave you with too much or too little insurance.

Source: bestpricefs.co.uk

Source: bestpricefs.co.uk

“if you have people who depend on you financially, you should have term life insurance,” says brittney burgett, marketing and. Avoiding both of these mistakes is important to keeping life insurance costs reasonable while getting the protection loved ones really need. Having sufficient life insurance is important but there’s no reason to pay for unnecessary coverage. Can you have too much life insurance? Basically, the issue for insurance carriers isn’t how many policies you own, but rather the total amount of life insurance coverage you have.

Source: cheapsr22.us

Source: cheapsr22.us

Your best bet is to sit down with a qualified life insurance agent and conduct a complete needs analysis and discover what you want your loved ones to experience if you are gone and that should help you to. Being underinsured is a risk, but being overinsured is expensive. But is it possible to have too much life insurance? At one time, it looked like a nice way to save some money and taxes. They�ve bought these policies in some cases, years ago, when their situation was very different.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Many people have life insurance coverage through their employer in addition to a personal term life insurance or permanent life insurance policy. For example, a one million dollar umbrella insurance policy can cost you only a few hundred dollars per year. The #1 reason why having too much coverage is a bad thing is because of the expense. The life insurance companies have methods in place to monitor for that. Even with all these expenses, you may wonder if there’s such a thing as too much life insurance.

Source: pinterest.com

Source: pinterest.com

Over the past couple of years, i’ve been approached by several young doctors who all tell similar stories of being weighed down by the amount of money they’re paying in insurance premiums. They�ve bought these policies in some cases, years ago, when their situation was very different. Having sufficient life insurance is important but there’s no reason to pay for unnecessary coverage. You can make yourself insurance poor. Forgetting to update your life insurance policy is risky and can leave you with too much or too little insurance.

Source: revisi.net

Source: revisi.net

Can you have too much life insurance? Avoiding both of these mistakes is important to keeping life insurance costs reasonable while getting the protection loved ones really need. If you get married, have kids, buy a house, or retire, you should check to see if you need to increase your reduce the amount you�re insured for. “if you have people who depend on you financially, you should have term life insurance,” says brittney burgett, marketing and. It is definitely possible to have too much insurance if policyholders buy coverage for longer than needed, or get a higher death benefit than necessary.

Source: healthmarkets.com

Source: healthmarkets.com

For example, a one million dollar umbrella insurance policy can cost you only a few hundred dollars per year. For example, a one million dollar umbrella insurance policy can cost you only a few hundred dollars per year. But is it possible to have too much life insurance? Can you have too much life insurance? When it comes to life insurance, you really can have too much of a good thing.

Source: slideshare.net

Source: slideshare.net

11 rows yes, you can have too much life insurance. Avoiding both of these mistakes is important to keeping life insurance costs reasonable while getting the protection loved ones really need. Can you have too much life insurance? If you have enough in savings that you no longer need life insurance at all, you can sell the whole thing for income and stop making those monthly premium payments. Yes, actually, it is possible to have more life insurance than you need.

Source: thediligentadvisor.com

Source: thediligentadvisor.com

“if you have people who depend on you financially, you should have term life insurance,” says brittney burgett, marketing and. “overprotection is a tricky topic. If you have too much life insurance, you can sell a portion that you don’t need. “if you have people who depend on you financially, you should have term life insurance,” says brittney burgett, marketing and. For more information, visit our life insurance page.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you have too much life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information