Can you pay home insurance once a year Idea

Home » Trend » Can you pay home insurance once a year IdeaYour Can you pay home insurance once a year images are ready. Can you pay home insurance once a year are a topic that is being searched for and liked by netizens now. You can Find and Download the Can you pay home insurance once a year files here. Find and Download all free photos and vectors.

If you’re searching for can you pay home insurance once a year pictures information linked to the can you pay home insurance once a year keyword, you have visit the right site. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Can You Pay Home Insurance Once A Year. But in other cases, it’s time to move on. Instead of paying the entire premium annually, the premium is divided by 12, and that amount is due each month. If you can’t afford to pay upfront for the full year’s insurance premium, most insurance companies now allow you to pay the premium on a monthly payment plan. One of the benefits of not having a.

State Farm Life Insurance Reviews Retirement Living From retirementliving.com

State Farm Life Insurance Reviews Retirement Living From retirementliving.com

In our case, homeowners insurance runs roughly 0.2% of the value of our home per year. When you pay pmi monthly, you pay 1/12 th of the annual premium. However, you may well find you’re not entitled to a refund if this is the case. If your homeowners insurance policy is $1,200 per year, the lender will want you to pay an additional $100 per month to cover future insurance premiums. This is a good option if you have some cash but not enough to cover the entire premium. While you could technically drop your homeowners policy once your mortgage is paid off, you’d be a fool to do so.

If you can’t afford to pay upfront for the full year’s insurance premium, most insurance companies now allow you to pay the premium on a monthly payment plan.

Also, policy lengths may be different among carriers. The easiest, albeit slowest, way to get rid of your pmi is by making your mortgage payments on time each month. Also, policy lengths may be different among carriers. Most insurance policies have deductibles, which is how much you’re required to pay on a claim before your insurance benefits get paid out. This will continue until the loan is paid in full. How much is a homeowners insurance premium?

Source: happinessman.co.uk

Source: happinessman.co.uk

For example, if you had a $2,000 annual health insurance deductible for surgical care and you had a $5,000 surgery early in the year that required you to pay your full deductible, you would not have to pay your deductible again for further surgical. Should you change home insurance every year? How long will you be in the home? It also helps you avoid your policy from being cancelled altogether in the event you can’t make a monthly payment. Most insurance policies have deductibles, which is how much you’re required to pay on a claim before your insurance benefits get paid out.

Source: revisi.net

Source: revisi.net

You could, but we recommend that you go through your policy every two years and compare your current coverage to plans available from other companies. One of the benefits of not having a. Also, policy lengths may be different among carriers. In our case, homeowners insurance runs roughly 0.2% of the value of our home per year. When it comes to paying monthly for your home insurance, it�s not just a case of dividing your annual premium into 12 equal parts as you might expect.

Source: compareinsurancesonline.ca

Source: compareinsurancesonline.ca

Almost every insurance company offers a paid in full option since it’s less risk for them to take on. In our case, homeowners insurance runs roughly 0.2% of the value of our home per year. For car insurance , this would be your full premium every six or twelve months, depending on the length of your term. You could, but we recommend that you go through your policy every two years and compare your current coverage to plans available from other companies. But this isn’t necessarily a bad thing;

Source: beckinsurance.com

Source: beckinsurance.com

On average, a one year home insurance binder for closing will cost around $1,200 for a $200,000 home. You can pay the premium in monthly, quarterly or annual increments. You could, but we recommend that you go through your policy every two years and compare your current coverage to plans available from other companies. If you up and move after just a few years, you’ve likely wasted a large amount of money. You can usually still cancel a home insurance policy even if you’ve made a claim against it.

Source: eganacsi.com

Source: eganacsi.com

One of the benefits of not having a. When it comes to paying monthly for your home insurance, it�s not just a case of dividing your annual premium into 12 equal parts as you might expect. Even if your escrow account is paying your insurance premiums, changing homeowners insurance is easy—it only requires a few more steps. How long will you be in the home? If your homeowners insurance policy is $1,200 per year, the lender will want you to pay an additional $100 per month to cover future insurance premiums.

Source: frogcars.com

Source: frogcars.com

Once your account is established, as noted above by others, you�ll pay 1/12 of the annual insurance cost into your escrow account, so that sufficient funds will accumulate to allow the lender to pay the next bill that comes due, in a year. This option may be preferred by drivers who struggle making monthly payments. If you insure your home with the same company for several years or more, you may receive a discount of up to 10%. This makes paying your premium in full much more attainable. When it comes to paying monthly for your home insurance, it�s not just a case of dividing your annual premium into 12 equal parts as you might expect.

Source: pinterest.com

Source: pinterest.com

One of the benefits of not having a. If you up and move after just a few years, you’ve likely wasted a large amount of money. This makes paying your premium in full much more attainable. How long will you be in the home? Almost every insurance company offers a paid in full option since it’s less risk for them to take on.

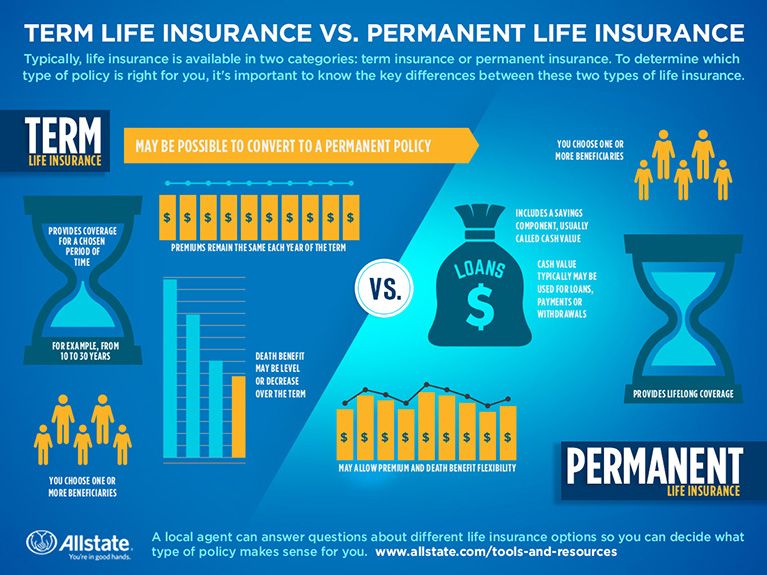

Source: allstate.com

Source: allstate.com

This will continue until the loan is paid in full. This is a good option if you have some cash but not enough to cover the entire premium. The easiest, albeit slowest, way to get rid of your pmi is by making your mortgage payments on time each month. Your mortgage lender will likely require you to pay for a year’s worth of homeowners insurance up front — either before or at closing. You can usually still cancel a home insurance policy even if you’ve made a claim against it.

Source: mabeyinsurance.com

Source: mabeyinsurance.com

You could, but we recommend that you go through your policy every two years and compare your current coverage to plans available from other companies. If you’re willing to take on a higher deductible, then your premiums will be lower. It also helps you avoid your policy from being cancelled altogether in the event you can’t make a monthly payment. But this isn’t necessarily a bad thing; How much is a homeowners insurance premium?

Source: wantknowm.com

Source: wantknowm.com

On average, a one year home insurance binder for closing will cost around $1,200 for a $200,000 home. Your mortgage lender will likely require you to pay for a year’s worth of homeowners insurance up front — either before or at closing. Once your account is established, as noted above by others, you�ll pay 1/12 of the annual insurance cost into your escrow account, so that sufficient funds will accumulate to allow the lender to pay the next bill that comes due, in a year. If you insure your home with the same company for several years or more, you may receive a discount of up to 10%. Even if your escrow account is paying your insurance premiums, changing homeowners insurance is easy—it only requires a few more steps.

Source: jamescolincampbell.com

Source: jamescolincampbell.com

You can usually still cancel a home insurance policy even if you’ve made a claim against it. If your homeowners insurance policy is $1,200 per year, the lender will want you to pay an additional $100 per month to cover future insurance premiums. Almost every insurance company offers a paid in full option since it’s less risk for them to take on. Thankfully, you can pay home insurance once a year and it’s also incredibly common. When it comes to paying monthly for your home insurance, it�s not just a case of dividing your annual premium into 12 equal parts as you might expect.

Source: lovinglittles.com

Source: lovinglittles.com

To answer the question “is homeowners insurance paid monthly or yearly,” you’ll need to consult with your lender. But this isn’t necessarily a bad thing; If you’re willing to take on a higher deductible, then your premiums will be lower. When you pay pmi monthly, you pay 1/12 th of the annual premium. Homeowners insurance is generally more expensive when it’s paid monthly.

Source: wrennefinancial.com

Source: wrennefinancial.com

Also, policy lengths may be different among carriers. In addition, it allows you to pay your entire year’s premium after you get a substantial influx of cash, like many seasonal employees or retirees who receive quarterly. Can you pay annual home insurance and property tax in a lump sum once a year rather than having it go in your mortgage monthly? Almost every insurance company offers a paid in full option since it’s less risk for them to take on. Insurers typically offer a 3% to 5% discount for paying premiums annually.

Source: brightpath.com

Source: brightpath.com

For car insurance , this would be your full premium every six or twelve months, depending on the length of your term. If you are successful in forgoing an escrow account, you will be responsible for paying your taxes and insurance in one or two lump sum payments per year. If you’ve paid off enough of your loan home, or if your bank doesn’t require you to escrow your homeowners insurance, the choice is up to you. This will continue until the loan is paid in full. Can you pay annual home insurance and property tax in a lump sum once a year rather than having it go in your mortgage monthly?

Source: vtalkinsurance.com

Source: vtalkinsurance.com

One of the benefits of not having a. Some insurance policies have annual deductibles that, once met, you do not have to pay again until the next calendar year. If you are successful in forgoing an escrow account, you will be responsible for paying your taxes and insurance in one or two lump sum payments per year. If your homeowners insurance policy is $1,200 per year, the lender will want you to pay an additional $100 per month to cover future insurance premiums. This makes paying your premium in full much more attainable.

Source: moneycrashers.com

Source: moneycrashers.com

If you move after three years, you’d only make 36 payments of pmi. Sometimes, staying in a relationship with a homeowners insurance company can pay big dividends. You could, but we recommend that you go through your policy every two years and compare your current coverage to plans available from other companies. If you move after three years, you’d only make 36 payments of pmi. If you insure your home with the same company for several years or more, you may receive a discount of up to 10%.

Source: revisi.net

Source: revisi.net

If you pay in advance, you only have to remember to pay your premium one time each year, which reduces the odds that you will accidentally forget to make a payment, leading to a gap in your coverage until you remember to pay the bill. If you pay in advance, you only have to remember to pay your premium one time each year, which reduces the odds that you will accidentally forget to make a payment, leading to a gap in your coverage until you remember to pay the bill. If you’re willing to take on a higher deductible, then your premiums will be lower. Sometimes, staying in a relationship with a homeowners insurance company can pay big dividends. Also, policy lengths may be different among carriers.

Source: ticnc.com

Source: ticnc.com

While you could technically drop your homeowners policy once your mortgage is paid off, you’d be a fool to do so. For example, if you had a $2,000 annual health insurance deductible for surgical care and you had a $5,000 surgery early in the year that required you to pay your full deductible, you would not have to pay your deductible again for further surgical. Can you pay annual home insurance and property tax in a lump sum once a year rather than having it go in your mortgage monthly? Once your account is established, as noted above by others, you�ll pay 1/12 of the annual insurance cost into your escrow account, so that sufficient funds will accumulate to allow the lender to pay the next bill that comes due, in a year. On average, a one year home insurance binder for closing will cost around $1,200 for a $200,000 home.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you pay home insurance once a year by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information