Can you sign over an insurance check information

Home » Trending » Can you sign over an insurance check informationYour Can you sign over an insurance check images are available in this site. Can you sign over an insurance check are a topic that is being searched for and liked by netizens today. You can Get the Can you sign over an insurance check files here. Get all royalty-free images.

If you’re looking for can you sign over an insurance check images information related to the can you sign over an insurance check interest, you have come to the ideal site. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more informative video content and graphics that match your interests.

Can You Sign Over An Insurance Check. Signing it over to someone else with a special endorsement that designates this person by name is. You can turn the check over to them along with a copy of the repair estimate and ask the lender to make its own check out for the cost of repairs. You can dispute a total loss settlement, but you’ll need lots of evidence to back up your dispute. Usually, a totaled car goes to a salvage yard, but you can choose to keep your vehicle.

Identity Theft From waxy.org

Identity Theft From waxy.org

When you receive a check with your name as the payee you have various options for cashing it. If the check bounces you could be left on the hook. On the other hand, if the car title uses the term “or,” they do not all have to sign. When in doubt, call your insurance professional before you sign. This money might be for a mortgage insurance or for homeowner�s insurance claim. The insurance company didn’t want to pay that out to that company because they didn’t work with that shop directory.

When depositing a check make sure you trust the person who wrote it or is signing it over to you.

Here’s how to sign a check over to someone the right way to avoid potential hiccups. You will likely need the second entity on the check to sign off so that you can cash it, which means you will probably be required to use it for repairs. You could be sitting on the phone for around 20 minutes—and that’s with a relatively smooth verification process. If the check bounces you could be left on the hook. Your insurance company will generally declare your car a total loss if the cost to repair it exceeds a certain percentage of the car’s value. You should make sure they are willing and able to accept your check before you attempt to sign it over.

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

Your insurance company will generally declare your car a total loss if the cost to repair it exceeds a certain percentage of the car’s value. This should be confirmed before the check is endorsed to avoid causing confusion with multiple signatures. You will likely need the second entity on the check to sign off so that you can cash it, which means you will probably be required to use it for repairs. You should see a place to endorse the check with your. Keep all the details required such as name, location of the accident (if known), date of the accident, mobile number, email id, vehicle registration number and the address.

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

You can dispute a total loss settlement, but you’ll need lots of evidence to back up your dispute. The bulk of the reason why you should start the verification process early is that it can take some time to complete this second step. You will likely need the second entity on the check to sign off so that you can cash it, which means you will probably be required to use it for repairs. So the car was taken to a. If you do not have a user id, you can create one when you check your record.

Source: thebalance.com

Source: thebalance.com

Usually, a totaled car goes to a salvage yard, but you can choose to keep your vehicle. This money might be for a mortgage insurance or for homeowner�s insurance claim. They likely have a process in place for having you sign the check over to them, along with documentation they�ll need to review your case and release any payments owed. You will likely need the second entity on the check to sign off so that you can cash it, which means you will probably be required to use it for repairs. You could be sitting on the phone for around 20 minutes—and that’s with a relatively smooth verification process.

Source: arkadvisors.co

Source: arkadvisors.co

And 3) need to pay a third party the amount of the check written to you, this is the only real scenario in which. In either case, you have no choice but to reach out to your lienholder if the check says and so you can get a signature. Check that your recipient can accept the check. On the other hand, if the car title uses the term “or,” they do not all have to sign. You could be sitting on the phone for around 20 minutes—and that’s with a relatively smooth verification process.

Source: money.stackexchange.com

Source: money.stackexchange.com

The easiest way to endorse (but also the most dangerous) is to simply sign the check without adding any restrictions. When you receive a check with your name as the payee you have various options for cashing it. The easiest way to endorse (but also the most dangerous) is to simply sign the check without adding any restrictions. If the check bounces you could be left on the hook. If you do not have a user id, you can create one when you check your record.

Source: enoanggra.blogspot.com

Source: enoanggra.blogspot.com

This should be confirmed before the check is endorsed to avoid causing confusion with multiple signatures. Check that your recipient can accept the check. When to sign your title over to your insurance company you’ll typically only sign your title over to your insurance company if your vehicle is declared a total loss. Below are the steps you must follow to check your car or bike insurance status online: And 3) need to pay a third party the amount of the check written to you, this is the only real scenario in which.

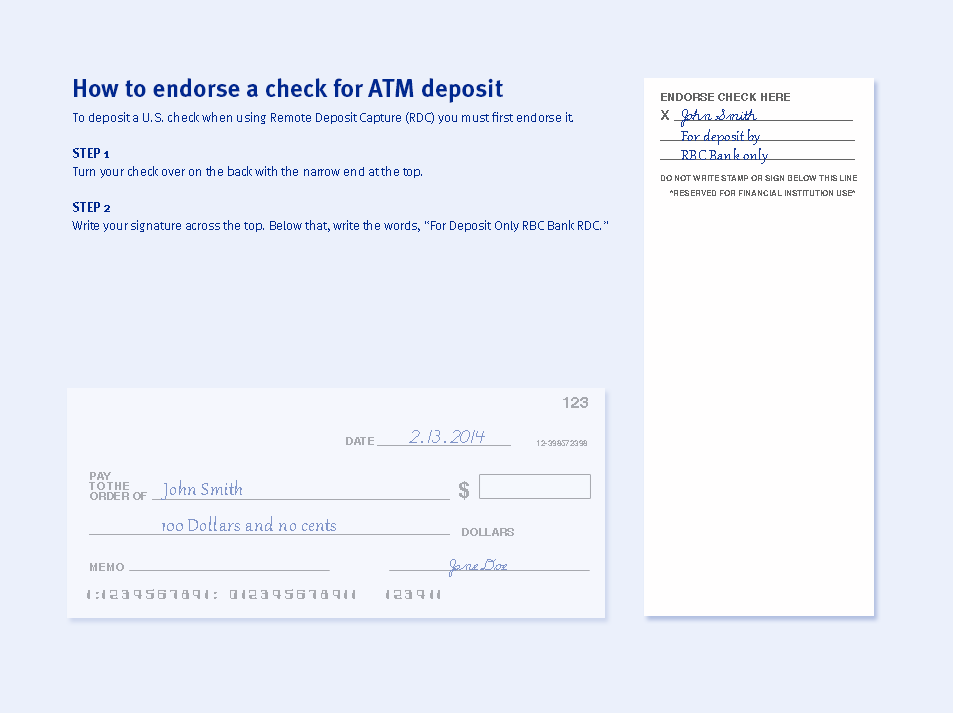

Source: rbcbank.com

Source: rbcbank.com

You should make sure they are willing and able to accept your check before you attempt to sign it over. You should make sure they are willing and able to accept your check before you attempt to sign it over. Contact the insurance company before the patient’s initial visit. Keep all the details required such as name, location of the accident (if known), date of the accident, mobile number, email id, vehicle registration number and the address. Your insurance company will generally declare your car a total loss if the cost to repair it exceeds a certain percentage of the car’s value.

Source: revisi.net

Source: revisi.net

In either case, you have no choice but to reach out to your lienholder if the check says and so you can get a signature. If the check bounces you could be left on the hook. Assigning your entire insurance claim to a third party takes you out of the process and gives control of your claim to the contractor. This money might be for a mortgage insurance or for homeowner�s insurance claim. Signing it over to someone else with a special endorsement that designates this person by name is.

Source: covedisa.com.ar

Source: covedisa.com.ar

You could be sitting on the phone for around 20 minutes—and that’s with a relatively smooth verification process. When the title uses the term “and,” all owners have to sign the title. To use that method, known as a blank endorsement, sign your name in the endorsement area. You will likely need the second entity on the check to sign off so that you can cash it, which means you will probably be required to use it for repairs. Usually, the title will use words like “and” or “or” to show how the owners are linked.

Source: de.wikihow.com

Source: de.wikihow.com

It may seem obvious, but the first step is a candid talk with your recipient. You could be sitting on the phone for around 20 minutes—and that’s with a relatively smooth verification process. Personal tax account signing in to the ‘check your national insurance record’ service activates your. In either case, you have no choice but to reach out to your lienholder if the check says and so you can get a signature. If you do not have a user id, you can create one when you check your record.

Source: pocketsense.com

Source: pocketsense.com

The insurance company didn’t want to pay that out to that company because they didn’t work with that shop directory. Turn the check over and sign the check on the reverse above the line on the back of the check. You could be sitting on the phone for around 20 minutes—and that’s with a relatively smooth verification process. Here’s how to sign a check over to someone the right way to avoid potential hiccups. That means you have to go to the bank or, even worse, mail your check to the financial institution for its signature.

So the car was taken to a. Contact the insurance company before the patient’s initial visit. Keep all the details required such as name, location of the accident (if known), date of the accident, mobile number, email id, vehicle registration number and the address. You can turn the check over to them along with a copy of the repair estimate and ask the lender to make its own check out for the cost of repairs. It may seem obvious, but the first step is a candid talk with your recipient.

Source: express.netblogpro.com

Source: express.netblogpro.com

Turn the check over and sign the check on the reverse above the line on the back of the check. It�s important to know that at this point, your mortgage company may opt to hold some or all of the payments until they can verify you�ve reached a certain milestone in the rebuilding process. 1) have a check written to you; It may seem obvious, but the first step is a candid talk with your recipient. You should make sure they are willing and able to accept your check before you attempt to sign it over.

Source: waxy.org

Source: waxy.org

You can dispute a total loss settlement, but you’ll need lots of evidence to back up your dispute. Things are a bit different if you were involved in a crash where the other driver was at fault and their liability coverage is paying the claim. They likely have a process in place for having you sign the check over to them, along with documentation they�ll need to review your case and release any payments owed. When to sign your title over to your insurance company you’ll typically only sign your title over to your insurance company if your vehicle is declared a total loss. Sign the back of the check in the top section of the endorsement area

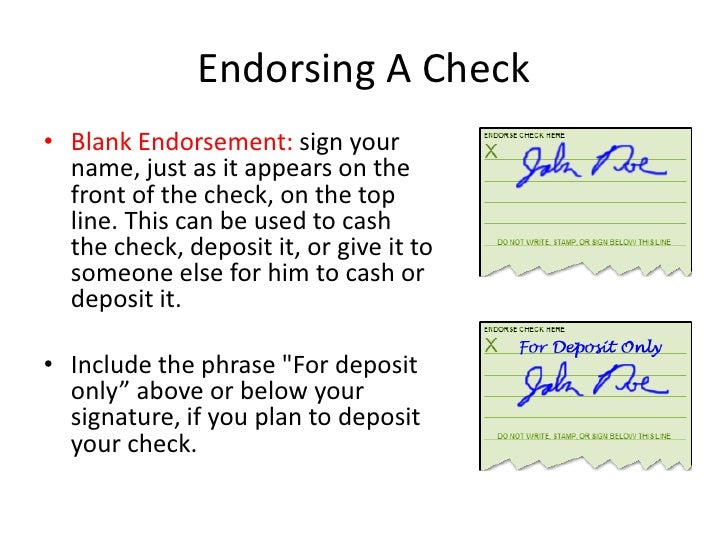

Source: slideshare.net

Source: slideshare.net

Here’s how to sign a check over to someone the right way to avoid potential hiccups. If you do not have a user id, you can create one when you check your record. Keep all the details required such as name, location of the accident (if known), date of the accident, mobile number, email id, vehicle registration number and the address. Assigning your entire insurance claim to a third party takes you out of the process and gives control of your claim to the contractor. 1) have a check written to you;

Source: thebalance.com

Source: thebalance.com

Anything left over would likely be applied to your loan balance. You can turn the check over to them along with a copy of the repair estimate and ask the lender to make its own check out for the cost of repairs. Sign the back of the check in the top section of the endorsement area So the car was taken to a. It is imperative to read carefully and understand all the language in any release form before you sign.

Source: wikihow.com

Source: wikihow.com

Signing it over to someone else with a special endorsement that designates this person by name is. I sent it to one shop they ended up estimating the damage after tear down that it was over $11,000 in damage…. Your insurance company will generally declare your car a total loss if the cost to repair it exceeds a certain percentage of the car’s value. When to sign your title over to your insurance company you’ll typically only sign your title over to your insurance company if your vehicle is declared a total loss. You will likely need the second entity on the check to sign off so that you can cash it, which means you will probably be required to use it for repairs.

Source: revisi.net

Source: revisi.net

You should make sure they are willing and able to accept your check before you attempt to sign it over. Anything left over would likely be applied to your loan balance. You can dispute a total loss settlement, but you’ll need lots of evidence to back up your dispute. The person or entity that you choose to sign the check over to will need to ensure that their bank will accept the check, as a bank is not obligated to do so. You can simply sign the back of the check and cash it.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you sign over an insurance check by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea