Can you sue a life insurance company Idea

Home » Trend » Can you sue a life insurance company IdeaYour Can you sue a life insurance company images are available in this site. Can you sue a life insurance company are a topic that is being searched for and liked by netizens today. You can Find and Download the Can you sue a life insurance company files here. Get all royalty-free vectors.

If you’re looking for can you sue a life insurance company pictures information related to the can you sue a life insurance company keyword, you have pay a visit to the ideal site. Our site frequently gives you hints for seeing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Can You Sue A Life Insurance Company. To sue an insurance company for bad faith, you file a lawsuit in the appropriate court. You can sue your insurance company if they violate or fail the terms of the insurance policy. But when there are disputes between an individual and an life insurance company, it is highly recommended that you hire an attorney who understands insurance or practices in the security field if variable products are involved. You tried to convince the insurance company to reconsider, but your claim was still denied.

Can You Sue an Insurance Company? Atkinson Law Firm From scottatkinsonlaw.com

Can You Sue an Insurance Company? Atkinson Law Firm From scottatkinsonlaw.com

Someone who was an irrevocable beneficiary to a life insurance policy might also sue the life insurance company if the beneficiary designation was changed. Common violations include not paying claims in a timely fashion, not paying properly filed claims, or making bad faith claims. Many individuals who try and pursue this lawsuit ultimately lose because they do not have enough evidence to prove that their insurance policies were at fault. The same “privity of contract” requirement applies in determining who may be sued. The style is, la mirage homeowners association, inc. In the lawsuit, you state what the insurance company did or failed to do that amounts to good faith.

A bad faith life insurance lawsuit is possible because the law reads an implied covenant of good faith and fair dealing into every insurance contract.

If someone owes you money, you may be able to sue a person with a life insurance policy in force (or someone who has just received death benefit proceeds), though you wouldn�t normally be suing them directly for the proceeds. If they don’t, you may have the basis to file a lawsuit against your insurer. In the lawsuit, you state what the insurance company did or failed to do that amounts to good faith. You can�t sue the insurance co, but you can sue their insured, the defendant. If you want to increase the chances that you win your case over your insurance company, then you need to file your lawsuit in a. You tried to convince the insurance company to reconsider, but your claim was still denied.

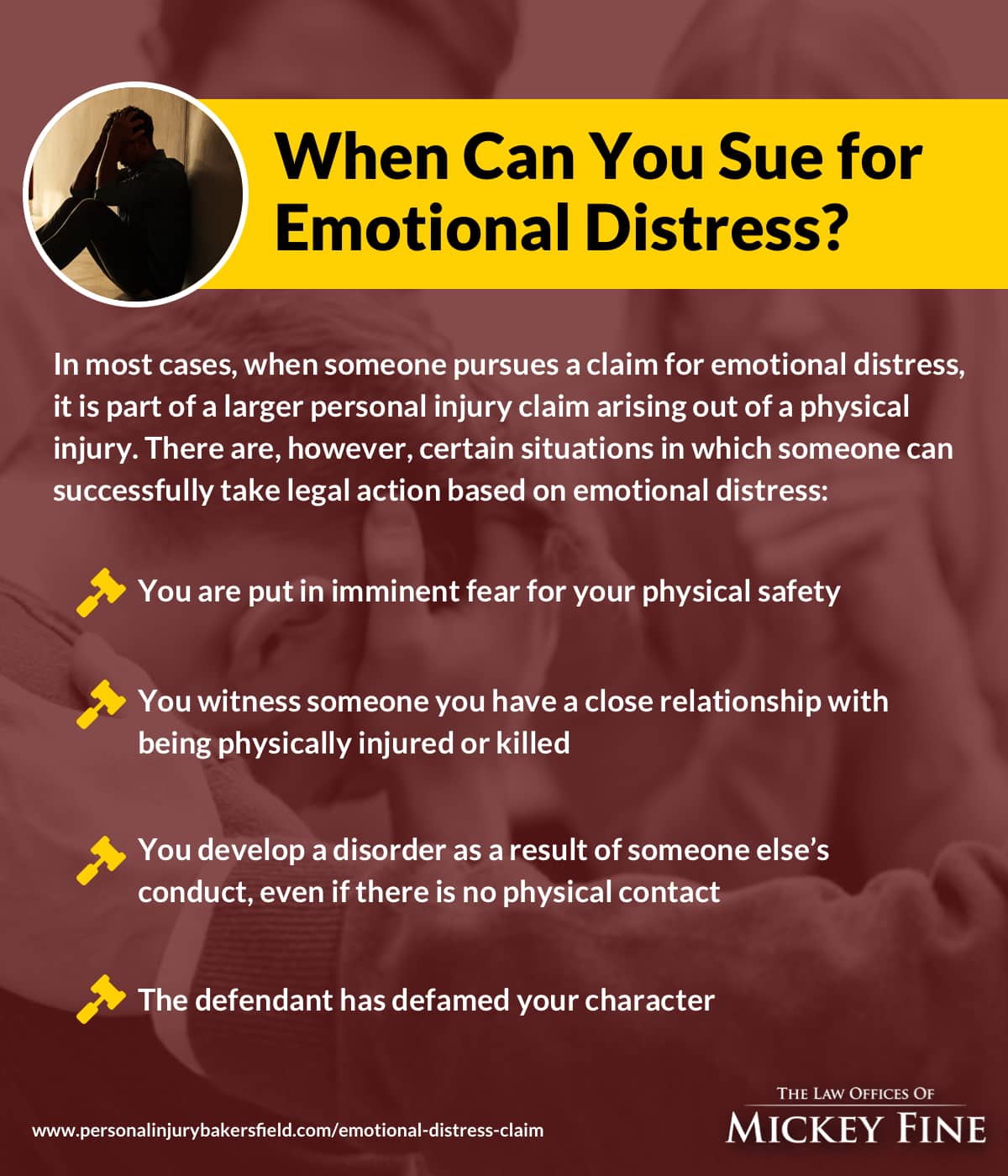

Source: personalinjurybakersfield.com

Source: personalinjurybakersfield.com

Many individuals who try and pursue this lawsuit ultimately lose because they do not have enough evidence to prove that their insurance policies were at fault. If your insurance claim was denied in bad faith or if the insurance company made an error, you have the right to sue for coverage. The attorney will examine the facts and help you decide if you should be forward with your suit. Southern district, corpus christi division, issued an opinion in 2018, that deals with the subject of which court a case should be litigated. An insurance policy is a contract between an insured party and an insurance company.

Source: nulty.com

Source: nulty.com

In many states, such as pennsylvania, there is law that requires insurance companies to act in good faith toward their policyholders. You must show that the insurance company failed to act in good faith when it comes to processing your claim and honoring the terms of your policy. Life insurance lawsuits occur because life insurance companies refuse to pay claims or delay payment on claims for death benefits. There are generally three different approaches that a victim of a wrongful repudiated insurance policy can take based on the. Insurance customers who have been forced to wait an unreasonable length of time for a response to a claim for benefits have a right to damages for the insurer’s bad faith conduct, and an experienced los angeles bad faith insurance lawyer can help.

Source: pintas.com

Source: pintas.com

Further, if the insurance company accepts an unreasonably low settlement for the insured’s claim while representing them, the insured may. Unum life insurance company of america, 269 f.3d 974 (9th cir. You filed an insurance claim and it was denied. Many individuals who try and pursue this lawsuit ultimately lose because they do not have enough evidence to prove that their insurance policies were at fault. An attorney would be able to provide a thorough insight into what exactly you can and can not do in terms of suing for life insurance benefits.

Source: wikihow.com

Source: wikihow.com

Lawsuits for wrongful repudiation of an insurance policy can be based on breach of contract law. If they don’t, you may have the basis to file a lawsuit against your insurer. A bad faith life insurance lawsuit is possible because the law reads an implied covenant of good faith and fair dealing into every insurance contract. Diamond , an insurance attorney in atlanta, he asks them for a few items. There are generally three different approaches that a victim of a wrongful repudiated insurance policy can take based on the.

Source: lifeinsurancequotesro.com

Source: lifeinsurancequotesro.com

You filed an insurance claim and it was denied. This includes “primary,” “excess” and “umbrella” insurers. Unum life insurance company of america, 269 f.3d 974 (9th cir. You must show that the insurance company failed to act in good faith when it comes to processing your claim and honoring the terms of your policy. Know exactly why your claim was denied when a policyholder whose coverage has been denied comes to jeffrey d.

Source: douglasandlondon.com

Source: douglasandlondon.com

Further, if the insurance company accepts an unreasonably low settlement for the insured’s claim while representing them, the insured may. In the lawsuit, you state what the insurance company did or failed to do that amounts to good faith. Someone who was an irrevocable beneficiary to a life insurance policy might also sue the life insurance company if the beneficiary designation was changed. Generally, only the insurer (s) on the risk as the party to the contract can be sued. If they deny a claim that is due or owed, or act unreasonably or recklessly, you probably have a right to bring a suit.

Source: dllawgroup.com

Source: dllawgroup.com

In most states, suing an insurance company is sanctioned by the law if the company has wrongfully repudiated their insurance policy. Since the insured has a valid policy, the insurance co is obligated to represent him. This is one of the reasons why many people end up losing this lawsuit. The style is, la mirage homeowners association, inc. In the lawsuit, you state what the insurance company did or failed to do that amounts to good faith.

Source: meetbreeze.com

Source: meetbreeze.com

Adapted mother passed away and put me and my brother and beneficiary and signed it over to my grandmother if anything was to happen to her we would be taken care of. You tried to convince the insurance company to reconsider, but your claim was still denied. Having the proper documentation with help your pawleys island attorney present the best case possible against the insurer and get you the money you deserve. The style is, la mirage homeowners association, inc. Lawsuits for wrongful repudiation of an insurance policy can be based on breach of contract law.

Source: moodyinsurance.com

Source: moodyinsurance.com

Know exactly why your claim was denied when a policyholder whose coverage has been denied comes to jeffrey d. You tried to convince the insurance company to reconsider, but your claim was still denied. The attorney will examine the facts and help you decide if you should be forward with your suit. However, this would have to be proven in a court of law. You can sue your insurance company if they violate or fail the terms of the insurance policy.

Source: paradise-simple.blogspot.com

Source: paradise-simple.blogspot.com

Colony insurance company, et al. Having the proper documentation with help your pawleys island attorney present the best case possible against the insurer and get you the money you deserve. You tried to convince the insurance company to reconsider, but your claim was still denied. Insurance customers who have been forced to wait an unreasonable length of time for a response to a claim for benefits have a right to damages for the insurer’s bad faith conduct, and an experienced los angeles bad faith insurance lawyer can help. This includes “primary,” “excess” and “umbrella” insurers.

Source: mynursinghomelawyer.com

Source: mynursinghomelawyer.com

Someone forge my grandmother signature and took insurance money. A bad faith life insurance lawsuit is possible because the law reads an implied covenant of good faith and fair dealing into every insurance contract. 2001), the court agreed with dishman that he could sue unum for tortious invasion of privacy committed by investigative firms hired by unum. In the lawsuit, you state what the insurance company did or failed to do that amounts to good faith. Unum life insurance company of america, 269 f.3d 974 (9th cir.

Source: shiirs.com

Source: shiirs.com

You filed an insurance claim and it was denied. Adapted mother passed away and put me and my brother and beneficiary and signed it over to my grandmother if anything was to happen to her we would be taken care of. To sue an insurance company for bad faith, you file a lawsuit in the appropriate court. You filed an insurance claim and it was denied. Another common reason why an insured may sue their insurance company is if their insurance company refuses to defend them in a lawsuit against them, as provided under the insurance policy.

Source: insuranceparrot.com

Source: insuranceparrot.com

A bad faith life insurance lawsuit is possible because the law reads an implied covenant of good faith and fair dealing into every insurance contract. You can file a claim in your state and then seek damages from the life insurance company. Know exactly why your claim was denied when a policyholder whose coverage has been denied comes to jeffrey d. If they don’t, you may have the basis to file a lawsuit against your insurer. Can you sue the life insurance company for giving the wrong person the life insurance proceeds?

Source: pinterest.com

Source: pinterest.com

Someone forge my grandmother signature and took insurance money. You tried to convince the insurance company to reconsider, but your claim was still denied. 2001), the court agreed with dishman that he could sue unum for tortious invasion of privacy committed by investigative firms hired by unum. Lawsuits for wrongful repudiation of an insurance policy can be based on breach of contract law. If they don’t, you may have the basis to file a lawsuit against your insurer.

Source: forbes.com

Source: forbes.com

But when there are disputes between an individual and an life insurance company, it is highly recommended that you hire an attorney who understands insurance or practices in the security field if variable products are involved. You can sue your insurance company if they violate or fail the terms of the insurance policy. The attorney will examine the facts and help you decide if you should be forward with your suit. Diamond , an insurance attorney in atlanta, he asks them for a few items. An insurance policy is a contract between an insured party and an insurance company.

Source: diattorney.com

Source: diattorney.com

In this case, the investigative firms in question aggressively attempted to find out employment information on dishman by (1) falsely claiming. You can sue your insurance company if they violate or fail the terms of the insurance policy. You filed an insurance claim and it was denied. Although the contract may not explicitly state such covenant, the law requires insurance companies to act fairly and in good faith in processing and paying claims. If they deny a claim that is due or owed, or act unreasonably or recklessly, you probably have a right to bring a suit.

Someone forge my grandmother signature and took insurance money. If you want to fight your insurance company, the next step is to file a lawsuit over your claim. You must show that the insurance company failed to act in good faith when it comes to processing your claim and honoring the terms of your policy. Since the insured has a valid policy, the insurance co is obligated to represent him. Insurance customers who have been forced to wait an unreasonable length of time for a response to a claim for benefits have a right to damages for the insurer’s bad faith conduct, and an experienced los angeles bad faith insurance lawyer can help.

Source: wolfgraminsurance.com

Source: wolfgraminsurance.com

Unum life insurance company of america, 269 f.3d 974 (9th cir. This includes “primary,” “excess” and “umbrella” insurers. Many individuals who try and pursue this lawsuit ultimately lose because they do not have enough evidence to prove that their insurance policies were at fault. However, this would have to be proven in a court of law. If they deny a claim that is due or owed, or act unreasonably or recklessly, you probably have a right to bring a suit.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you sue a life insurance company by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information