Capital and surplus insurance information

Home » Trending » Capital and surplus insurance informationYour Capital and surplus insurance images are ready in this website. Capital and surplus insurance are a topic that is being searched for and liked by netizens today. You can Get the Capital and surplus insurance files here. Get all free photos and vectors.

If you’re looking for capital and surplus insurance pictures information related to the capital and surplus insurance interest, you have pay a visit to the ideal site. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Capital And Surplus Insurance. Capital and surplus means, as of any date, (a) as to any insurance subsidiary domiciled in the united states, the total surplus as regards to policyholders (or any successor line item description that contains the same information) as shown in its annual statement or interim statement, or an amount determined in a consistent manner for any date other than one as of which an annual. All states — the jurisdictional level at which insurers are regulated, as opposed to the federal government — impose minimum capital and surplus requirements for. Notwithstanding the capital requirement described in the guideline, canadian life insurance companies will be required to maintain a minimum amount of available capital, as calculated in this guideline, of $5 million or such amount as specified by the minister. An insurer transacting any workers’ compensation insurance business shall possess and thereafter maintain capital or surplus, or any combination thereof, of not less than $5 million.

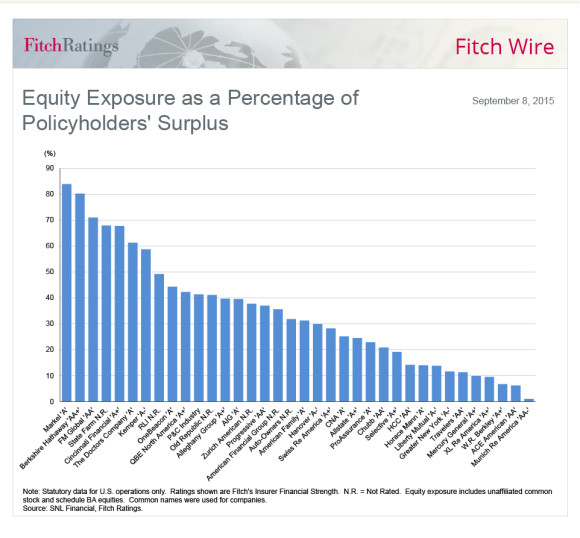

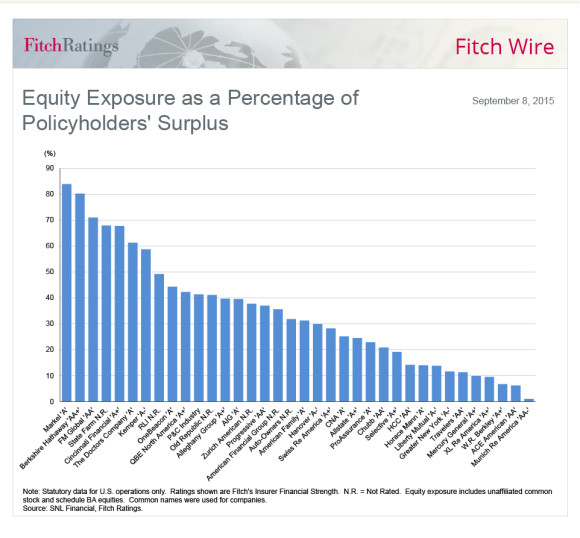

Can U.S. P/C Insurers Handle Equity Market Volatility? From insurancejournal.com

Can U.S. P/C Insurers Handle Equity Market Volatility? From insurancejournal.com

For any two or more classes of insurance, the capital must equal the greater of $750,000 or the sum of total required for each class; Capital surplus can also result from the proceeds of stock bought back and then resold. (i) amounts paid in in excess of the par or stated value of capital stock; It is the equivalent of owners� equity in standard accounting terms. The purpose of capital in any insurance company is to absorb unexpected upward fluctuations in claims and unexpected downward fluctuations in investment. (ii) amounts contributed to the national bank other than for capital stock;

Section 36.001 authorizes the commissioner of insurance to adopt any rules necessary and appropriate to implement the powers and duties of the texas department of insurance under the.

Minimum capital and surplus for any one (c) authority is at least $750,000 and $375,000, respectively. Capital and surplus means, as of any date, (a) as to any insurance subsidiary domiciled in the united states, the total surplus as regards to policyholders (or any successor line item description that contains the same information) as shown in its annual statement or interim statement, or an amount determined in a consistent manner for any date other than one as of which an annual. Capital surplus, or premium, is the excess remaining after common stock is sold for more than its par value. Capital requirements for health insurers 2 february 2020 figure 2: Minimum amount of capital and surplus. (2) capital surplus means the total of those accounts reflecting:

Source: vir.com.vn

Source: vir.com.vn

(2) capital surplus means the total of those accounts reflecting: Insurance company (and captive) capital exists to support the company�s loss reserves; While capital doesn�t replace loss reserves per se, it�s part of the formula that determines asset adequacy. (iii) amounts transferred from undivided profits pursuant to 12 u.s.c. For any two or more classes of insurance, the capital must equal the greater of $750,000 or the sum of total required for each class;

Source: serentcapital.com

Source: serentcapital.com

Section 982.106 specifies the capital, stock, and surplus requirements for foreign or alien insurance companies other than life, health, or accident insurance companies. (i) amounts paid in in excess of the par or stated value of capital stock; The minimum amount of capital and statutory surplus for stock life insurance companies is usually established by state insurance laws or regulations pertaining thereto. Minimum capitalization means, generally speaking, the amount of money you need to deposit into a bank account in the name of the company in which you seek the insurance license before the license will be granted. Notwithstanding the capital requirement described in the guideline, canadian life insurance companies will be required to maintain a minimum amount of available capital, as calculated in this guideline, of $5 million or such amount as specified by the minister.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

(2) capital surplus means the total of those accounts reflecting: (a)(1) in addition to any other capital required to be maintained pursuant to subsection (c) of this section, a captive insurer (except a protected cell captive insurer) authorized to do business in the district shall at all times maintain a minimum unimpaired capital of $ 100,000. It is the equivalent of owners� equity in standard accounting terms. Insurance company (and captive) capital exists to support the company�s loss reserves; The ratio of an insurer�s premiums written to its surplus is one of the key measures of its solvency.

Source: bressler.com

Source: bressler.com

Surplus — the amount by which an insurer�s assets exceed its liabilities. For any two or more classes of insurance, the capital must equal the greater of $750,000 or the sum of total required for each class; (a)(1) in addition to any other capital required to be maintained pursuant to subsection (c) of this section, a captive insurer (except a protected cell captive insurer) authorized to do business in the district shall at all times maintain a minimum unimpaired capital of $ 100,000. Capital surplus can also result from the proceeds of stock bought back and then resold. An insurer transacting any workers’ compensation insurance business shall possess and thereafter maintain capital or surplus, or any combination thereof, of not less than $5 million.

Source: researchgate.net

Source: researchgate.net

Insurance company (and captive) capital exists to support the company�s loss reserves; Capital and surplus requirements are based upon all the kinds of insurance transacted by the insurer in all areas in which it operates or proposes to operate, whether or not only a portion of the kinds of insurance are to be. Of insurance surplus authorized surplus. Surplus, on the other hand, is not part of this formula. Typically, capital management in a life insurance company is based on statutory values because of the regulator�s concern and emphasis with company solvency.

Source: zerodha.com

Source: zerodha.com

Surplus — the amount by which an insurer�s assets exceed its liabilities. It is the equivalent of owners� equity in standard accounting terms. All states — the jurisdictional level at which insurers are regulated, as opposed to the federal government — impose minimum capital and surplus requirements for. And (iv) other amounts transferred from undivided profits. Surplus, on the other hand, is not part of this formula.

Source: revisi.net

Source: revisi.net

Section 36.001 authorizes the commissioner of insurance to adopt any rules necessary and appropriate to implement the powers and duties of the texas department of insurance under the. Surplus — the amount by which an insurer�s assets exceed its liabilities. Capital requirements for health insurers 2 february 2020 figure 2: Of insurance surplus authorized surplus. An insurer transacting any workers’ compensation insurance business shall possess and thereafter maintain capital or surplus, or any combination thereof, of not less than $5 million.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

Surplus, on the other hand, is not part of this formula. Insurance company (and captive) capital exists to support the company�s loss reserves; An insurer transacting any workers’ compensation insurance business shall possess and thereafter maintain capital or surplus, or any combination thereof, of not less than $5 million. Statutory capital and surplus means, as to any insurance subsidiary, as of any date, the sum (without duplication) of the total amounts shown (i) with respect to an insurance subsidiary not legally domiciled in the united states, the shareholders� equity of such insurance subsidiary as determined in accordance with gaap (without regard to the requirements of fas 115), and (ii). While capital doesn�t replace loss reserves per se, it�s part of the formula that determines asset adequacy.

Source: thebalance.com

Source: thebalance.com

Captive insurance minimum required capital and surplus below is a list of the minimum required capital and surplus needs by jurisdiction as of this writing. The ratio of an insurer�s premiums written to its surplus is one of the key measures of its solvency. Notwithstanding the capital requirement described in the guideline, canadian life insurance companies will be required to maintain a minimum amount of available capital, as calculated in this guideline, of $5 million or such amount as specified by the minister. Statutory capital and surplus means, as to any insurance subsidiary, as of any date, the sum (without duplication) of the total amounts shown (i) with respect to an insurance subsidiary not legally domiciled in the united states, the shareholders� equity of such insurance subsidiary as determined in accordance with gaap (without regard to the requirements of fas 115), and (ii). Of insurance surplus authorized surplus.

Source: whatech.com

Source: whatech.com

If reserves prove to be inadequate to meet the company�s liabilities, capital is used to do so. Capital and surplus means, as of any date, (a) as to any insurance subsidiary domiciled in the united states, the total surplus as regards to policyholders (or any successor line item description that contains the same information) as shown in its annual statement or interim statement, or an amount determined in a consistent manner for any date other than one as of which an annual. Of insurance surplus authorized surplus. (c) class of business capital surplus total The purpose of capital in any insurance company is to absorb unexpected upward fluctuations in claims and unexpected downward fluctuations in investment.

Source: amfirstinsco.com

Source: amfirstinsco.com

Of insurance surplus authorized surplus. (2) capital surplus means the total of those accounts reflecting: Capital surplus can also result from the proceeds of stock bought back and then resold. The ratio of an insurer�s premiums written to its surplus is one of the key measures of its solvency. (i) amounts paid in in excess of the par or stated value of capital stock;

Source: insurancejournal.com

Source: insurancejournal.com

Surplus, on the other hand, is not part of this formula. Of insurance surplus authorized surplus. For example, a pure captive could satisfy the minimum capital and surplus requirement by holding $250,000 in stock in a single company, so long as such stock does not comprise more than 25% of the pure captive’s “admitted” assets, and so long as holding such stock does not result in the captive holding more than 5% of its “admitted” assets in. An insurer transacting any workers’ compensation insurance business shall possess and thereafter maintain capital or surplus, or any combination thereof, of not less than $5 million. Surplus — the amount by which an insurer�s assets exceed its liabilities.

Source: actuaries.digital

Source: actuaries.digital

(ii) amounts contributed to the national bank other than for capital stock; Capital and surplus means, as of any date, (a) as to any insurance subsidiary domiciled in the united states, the total surplus as regards to policyholders (or any successor line item description that contains the same information) as shown in its annual statement or interim statement, or an amount determined in a consistent manner for any date other than one as of which an annual. While capital doesn�t replace loss reserves per se, it�s part of the formula that determines asset adequacy. (i) amounts paid in in excess of the par or stated value of capital stock; And (iv) other amounts transferred from undivided profits.

Source: revisi.net

Source: revisi.net

Captive insurance minimum required capital and surplus below is a list of the minimum required capital and surplus needs by jurisdiction as of this writing. Capital and surplus requirements are based upon all the kinds of insurance transacted by the insurer in all areas in which it operates or proposes to operate, whether or not only a portion of the kinds of insurance are to be. For example, a pure captive could satisfy the minimum capital and surplus requirement by holding $250,000 in stock in a single company, so long as such stock does not comprise more than 25% of the pure captive’s “admitted” assets, and so long as holding such stock does not result in the captive holding more than 5% of its “admitted” assets in. The minimum amount of capital and statutory surplus for stock life insurance companies is usually established by state insurance laws or regulations pertaining thereto. Surplus, on the other hand, is not part of this formula.

Source: escolheoesmalte.blogspot.com

Source: escolheoesmalte.blogspot.com

And (iv) other amounts transferred from undivided profits. Since both capital and surplus must equal prescribed minimums, one may conclude that the minimum statutory surplus is that amount which, when added to capital, will produce the All states — the jurisdictional level at which insurers are regulated, as opposed to the federal government — impose minimum capital and surplus requirements for. The minimum amount of capital and statutory surplus for stock life insurance companies is usually established by state insurance laws or regulations pertaining thereto. (2) capital surplus means the total of those accounts reflecting:

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

If reserves prove to be inadequate to meet the company�s liabilities, capital is used to do so. Minimum capital and surplus for any one (c) authority is at least $750,000 and $375,000, respectively. Capital and surplus means, as of any date, (a) as to any insurance subsidiary domiciled in the united states, the total surplus as regards to policyholders (or any successor line item description that contains the same information) as shown in its annual statement or interim statement, or an amount determined in a consistent manner for any date other than one as of which an annual. Statutory capital and surplus means, as to any insurance subsidiary, as of any date, the sum (without duplication) of the total amounts shown (i) with respect to an insurance subsidiary not legally domiciled in the united states, the shareholders� equity of such insurance subsidiary as determined in accordance with gaap (without regard to the requirements of fas 115), and (ii). It is the equivalent of owners� equity in standard accounting terms.

Source: researchgate.net

Source: researchgate.net

The ratio of an insurer�s premiums written to its surplus is one of the key measures of its solvency. The ratio of an insurer�s premiums written to its surplus is one of the key measures of its solvency. Capital and surplus means, as of any date, (a) as to any insurance subsidiary domiciled in the united states, the total surplus as regards to policyholders (or any successor line item description that contains the same information) as shown in its annual statement or interim statement, or an amount determined in a consistent manner for any date other than one as of which an annual. Notwithstanding the capital requirement described in the guideline, canadian life insurance companies will be required to maintain a minimum amount of available capital, as calculated in this guideline, of $5 million or such amount as specified by the minister. The purpose of capital in any insurance company is to absorb unexpected upward fluctuations in claims and unexpected downward fluctuations in investment.

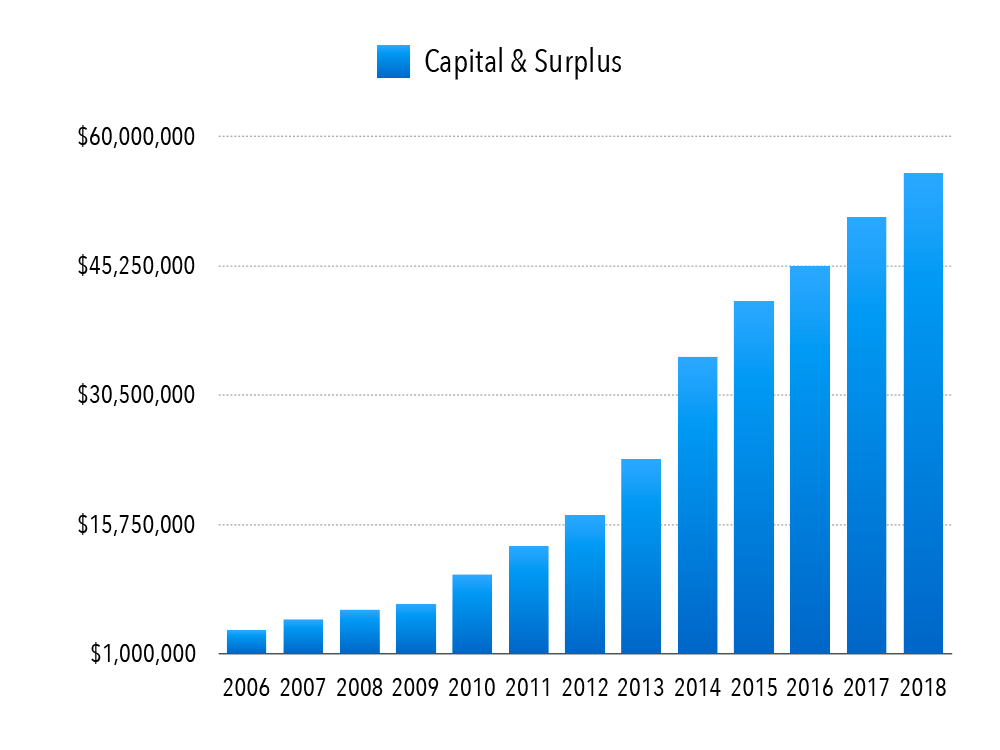

Source: funeraldirectorslife.com

Source: funeraldirectorslife.com

(a)(1) in addition to any other capital required to be maintained pursuant to subsection (c) of this section, a captive insurer (except a protected cell captive insurer) authorized to do business in the district shall at all times maintain a minimum unimpaired capital of $ 100,000. And (iv) other amounts transferred from undivided profits. Surplus — the amount by which an insurer�s assets exceed its liabilities. (c) class of business capital surplus total Section 36.001 authorizes the commissioner of insurance to adopt any rules necessary and appropriate to implement the powers and duties of the texas department of insurance under the.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title capital and surplus insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea