Capital benefit insurance definition information

Home » Trend » Capital benefit insurance definition informationYour Capital benefit insurance definition images are ready in this website. Capital benefit insurance definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Capital benefit insurance definition files here. Get all free vectors.

If you’re searching for capital benefit insurance definition pictures information related to the capital benefit insurance definition interest, you have come to the right site. Our website always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

Capital Benefit Insurance Definition. Credit high correlation between financial risks. The rbc requirement is a statutory minimum level of capital that is based on two factors: The insurer�s risk profile (i.e., the amount and classes of business it writes) is used to. You can complete the definition of capital benefit given by the english cobuild dictionary with other english dictionaries :

What is Third Party Administrator (TPA) in Health From blog.investyadnya.in

What is Third Party Administrator (TPA) in Health From blog.investyadnya.in

Marine insurance refers to a contract of indemnity. Capital investment is the money used by a business to purchase fixed assets, such as land, machinery, or buildings. The amount initially needed to set up a captive, or the initial amount paid in; And 2) the inherent riskiness of its financial assets and operations. Lump sum if a member becomes physically disabled or impaired due to an accident or illness. Such assets are also to improve the efficiency or capacity of the company.

The capital an insurance company should hold differs from the risks it is taken in its insurance and investment operations.

An entity which provides insurance is known as an insurer, an insurance company, an insurance carrier or an underwriter.a person or entity who buys insurance is known as a policyholder, while a person or entity. Securus , safe, free from care] Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. A shareholder must own a minimum of one share in a company’s stock or mutual fund to make them a partial owner. Our capital disability and impairment benefit is designed to provide financial security for members and their loved ones, as it pays a cash. It is an assurance that the goods dispatched from the country of origin to the land of destination are insured.

Source: responsiblemillennials.blogspot.com

Source: responsiblemillennials.blogspot.com

For example, a company that is investing in risky assets will probably have to hold more capital than a company that is investing in government bonds. Cbhi is currently being provided in some rural areas in developing countries and there is ongoing research about its. A shareholder must own a minimum of one share in a company’s stock or mutual fund to make them a partial owner. In an interview posted on this electronic discussion group, anne harrison discusses the distinction between a social insurance scheme with a savings component and a pure saving Such assets are also to improve the efficiency or capacity of the company.

Source: goldenageofgaia.com

Source: goldenageofgaia.com

Insurance is a means of protection from financial loss. Invested capital is the investment made by both shareholders. Or the sum of these two plus accumulated surplus. 1) an insurance company’s size; You can complete the definition of capital benefit given by the english cobuild dictionary with other english dictionaries :

Source: blog.investyadnya.in

Source: blog.investyadnya.in

In medicaid or chip, covered benefits and excluded services are defined in state program rules. That is, the company must hold capital in proportion to its risk. The money may be in the form of cash, assets, or loans. This financial security can help a member. Invested capital is the investment made by both shareholders.

Source: thebalance.com

Source: thebalance.com

Insurance is a means of protection from financial loss. Lump sum if a member becomes physically disabled or impaired due to an accident or illness. Capital is a broad term that can describe any thing that confers value or benefit to its owner, such as a factory and its machinery, intellectual property. Learn more about capital investment, how it works, and how it relates to the economy. A shareholder must own a minimum of one share in a company’s stock or mutual fund to make them a partial owner.

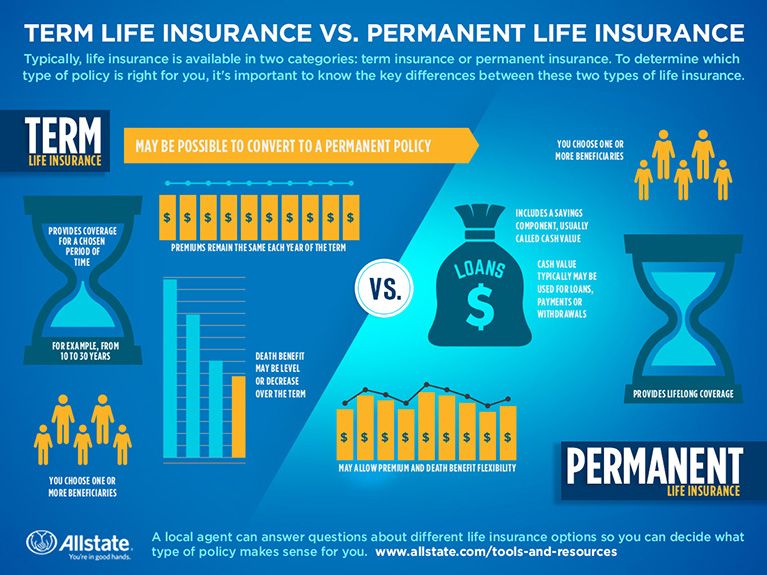

Source: allstate.com

Source: allstate.com

The indemnity plans are traditional health covers which cover hospitalization costs from the sum assured. This financial security can help a member. Rbc is intended to be a regulatory standard and not necessarily the full amount of. The indemnity plans are traditional health covers which cover hospitalization costs from the sum assured. The insurer�s risk profile (i.e., the amount and classes of business it writes) is used to.

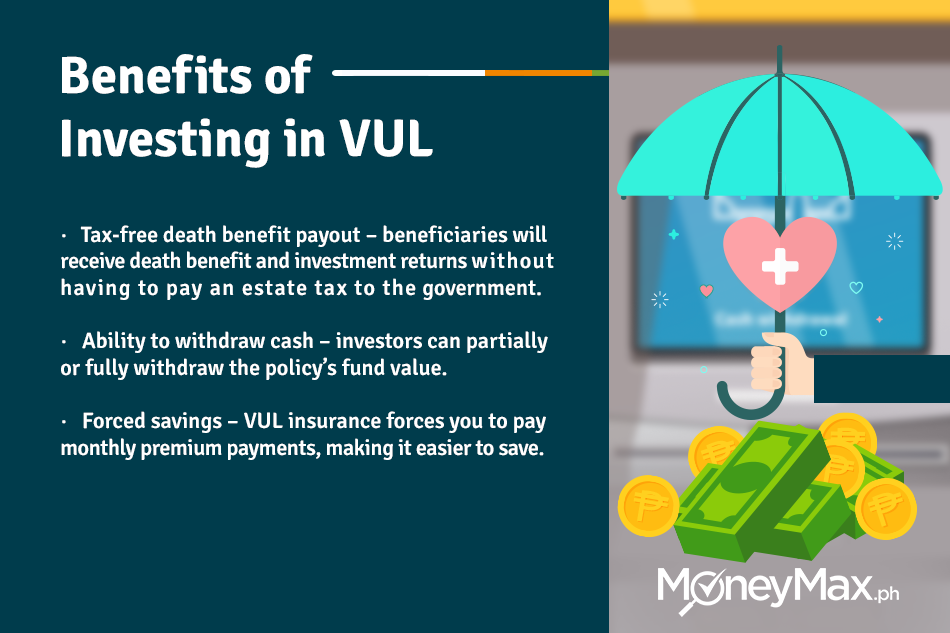

Source: news.abs-cbn.com

Source: news.abs-cbn.com

Invested capital is the investment made by both shareholders. Covered benefits and excluded services are defined in the health insurance plan�s coverage documents. The definition of a social insurance scheme and its classification as defined benefit or defined contribution john pitzer june 30, 2003 i. Read this tip to make your life smarter, better, faster and wiser. The value of such instrument is linked to the capital instrument of a financial institution.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Insurance company is solvent enough to do their regular insurance business. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Shareholder a shareholder can be a person, company, or organization that holds stock (s) in a given company. Or the sum of these two plus accumulated surplus. It is an assurance that the goods dispatched from the country of origin to the land of destination are insured.

Source: insurancesamadhan.com

Source: insurancesamadhan.com

You can complete the definition of capital benefit given by the english cobuild dictionary with other english dictionaries : Such assets are also to improve the efficiency or capacity of the company. How a capital sum benefit option in a disability income insurance policy could help you. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; If the item costs less than $5,000.

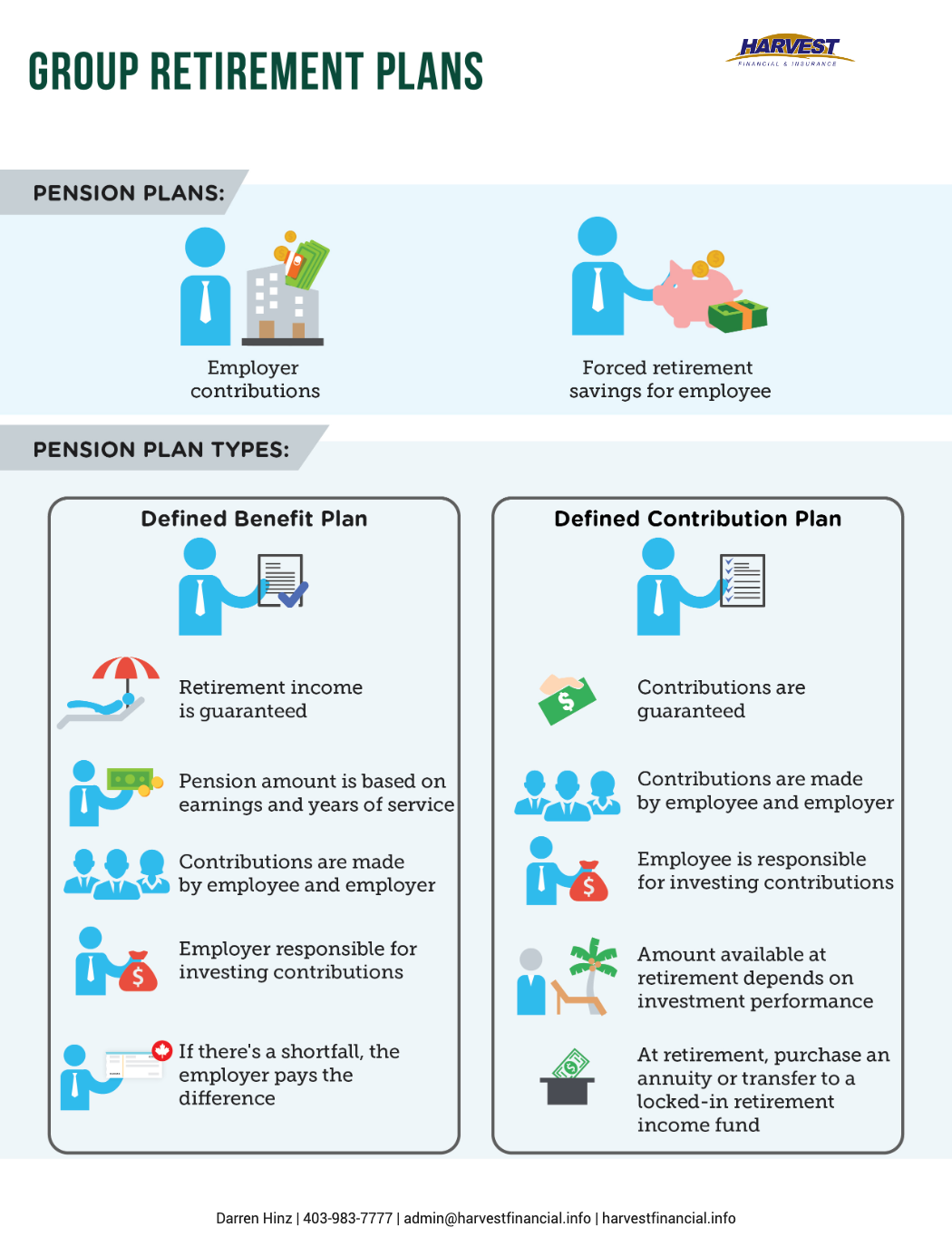

Source: harvest-financial.ca

Source: harvest-financial.ca

In medicaid or chip, covered benefits and excluded services are defined in state program rules. This financial security can help a member. It is an assurance that the goods dispatched from the country of origin to the land of destination are insured. The indemnity plans are traditional health covers which cover hospitalization costs from the sum assured. If the item costs less than $5,000.

Source: partners4prosperity.com

Source: partners4prosperity.com

It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Insurance low low 100% low low persistency medium medium low 100% low operational low low low low 100% diversification benefit is largest for smaller or uncorrelated risk types 0 10 20 30 40 50 60 70 80 90 100 standalone diversified market/ alm insurance operatio nal risk diversificatio n benefit: Capital is a broad term that can describe any thing that confers value or benefit to its owner, such as a factory and its machinery, intellectual property. Lifetips is the place to go when you need to know about disability insurance plan options and other disability insurance topics. 1) an insurance company’s size;

Source: slideserve.com

Source: slideserve.com

Marine insurance refers to a contract of indemnity. Shareholder a shareholder can be a person, company, or organization that holds stock (s) in a given company. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. The definition of a social insurance scheme and its classification as defined benefit or defined contribution john pitzer june 30, 2003 i. In medicaid or chip, covered benefits and excluded services are defined in state program rules.

Source: researchgate.net

Source: researchgate.net

Invested capital is the investment made by both shareholders. It is an assurance that the goods dispatched from the country of origin to the land of destination are insured. Covered benefits and excluded services are defined in the health insurance plan�s coverage documents. How a capital sum benefit option in a disability income insurance policy could help you. This financial security can help a member.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

You can complete the definition of capital benefit given by the english cobuild dictionary with other english dictionaries : In an interview posted on this electronic discussion group, anne harrison discusses the distinction between a social insurance scheme with a savings component and a pure saving Capital investment is the money used by a business to purchase fixed assets, such as land, machinery, or buildings. And 2) the inherent riskiness of its financial assets and operations. Invested capital is the investment made by both shareholders.

Source: tyonote.com

Source: tyonote.com

The indemnity plans are traditional health covers which cover hospitalization costs from the sum assured. Lifetips is the place to go when you need to know about disability insurance plan options and other disability insurance topics. Cbhi is currently being provided in some rural areas in developing countries and there is ongoing research about its. You can complete the definition of capital benefit given by the english cobuild dictionary with other english dictionaries : It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

It must have a useful life of at least one year and is not consumed in the normal course of business. You can complete the definition of capital benefit given by the english cobuild dictionary with other english dictionaries : Enseurer , to make certain, fr. The health care items or services covered under a health insurance plan. And 2) the inherent riskiness of its financial assets and operations.

Source: sappscarpetcare.com

Source: sappscarpetcare.com

Insurance is a means of protection from financial loss. The amount initially needed to set up a captive, or the initial amount paid in; The value of such instrument is linked to the capital instrument of a financial institution. And debtholders in a company. How a capital sum benefit option in a disability income insurance policy could help you.

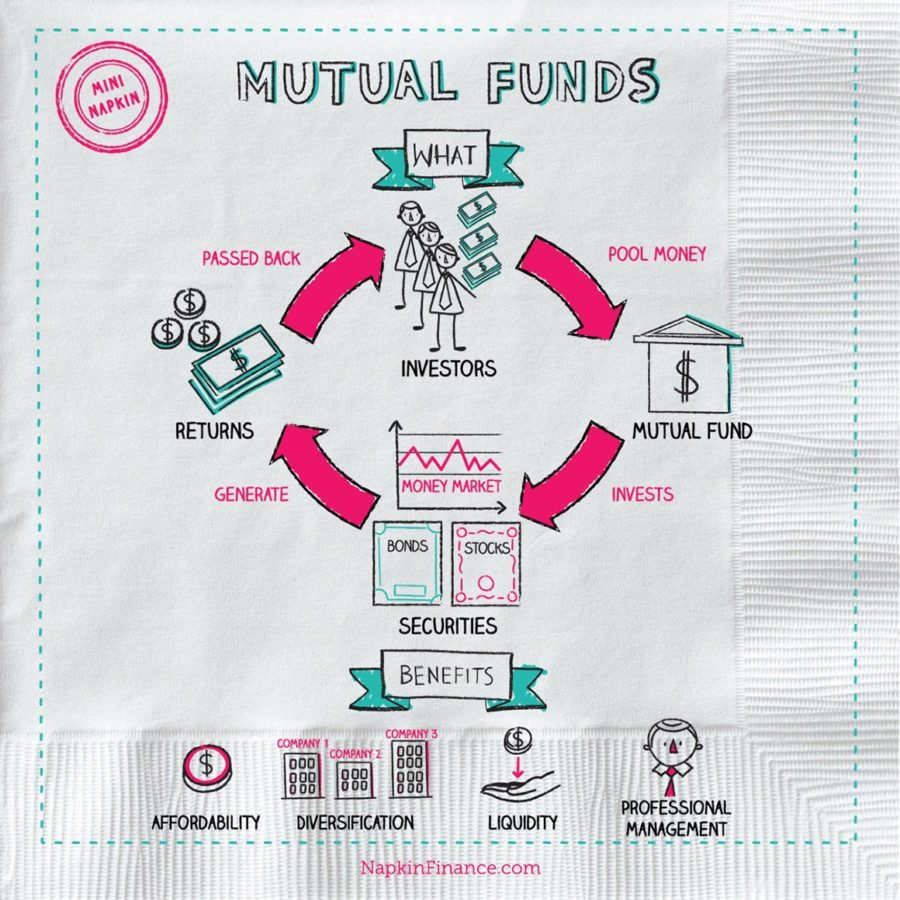

Source: napkinfinance.com

Source: napkinfinance.com

Covered benefits and excluded services are defined in the health insurance plan�s coverage documents. Invested capital is the investment made by both shareholders. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; Or the sum of these two plus accumulated surplus. Capital investment is the money used by a business to purchase fixed assets, such as land, machinery, or buildings.

Source: capital.com

Source: capital.com

Our capital disability and impairment benefit is designed to provide financial security for members and their loved ones, as it pays a cash. Covered benefits and excluded services are defined in the health insurance plan�s coverage documents. Or the sum of these two plus accumulated surplus. Insurance company is solvent enough to do their regular insurance business. Lump sum if a member becomes physically disabled or impaired due to an accident or illness.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title capital benefit insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information