Capital in insurance information

Home » Trend » Capital in insurance informationYour Capital in insurance images are ready in this website. Capital in insurance are a topic that is being searched for and liked by netizens today. You can Download the Capital in insurance files here. Find and Download all royalty-free images.

If you’re looking for capital in insurance images information linked to the capital in insurance keyword, you have pay a visit to the ideal blog. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

Capital In Insurance. In insurance, capital must be held to ensure that at period’s end the claim of the last policyholder will be met. For such firms, the principal providers of debt capital (insurance reserves) are also the firm’s principal customers. Insurance is not for the investor in you but the individual and family man in you. Capital expenditure and revenue expenditure.

Capital Insurance Group to Offer Premium Credits for From insurancejournal.com

Capital Insurance Group to Offer Premium Credits for From insurancejournal.com

And 2) the inherent riskiness of its financial assets and operations. Our solutions we collaborate with leading insurance businesses and management teams to unlock value and drive innovation across the industry. Although the occurrence of an insured event will always trigger cash outflows, payments are often spread out over an extended period. Based in lansing michigan, capital insurance services is proud to serve the insurance needs of individuals and businesses of all sizes. Pwc’s professionals also address risk management framework components, including strategy, governance and organization, measurement and. To both survive and thrive, carriers must accelerate their technology adoption and implement.

In insurance, capital must be held to ensure that at period’s end the claim of the last policyholder will be met.

As part of their business, insurers are exposed to different risks and therefore must be treated differently in terms of regulation and reporting. Capital�s role in spurring insurance transformation. Venture capital insurance claim settlement is a quick and easy process. Although the occurrence of an insured event will always trigger cash outflows, payments are often spread out over an extended period. Required documents are submitted at the insurance office. As part of their business, insurers are exposed to different risks and therefore must be treated differently in terms of regulation and reporting.

Source: vecteezy.com

Source: vecteezy.com

Find location, phone number, services, reviews and more. Although the occurrence of an insured event will always trigger cash outflows, payments are often spread out over an extended period. Capital is often referred to as the cornerstone of an institution’s financial strength. And 2) the inherent riskiness of its financial assets and operations. Rbc is intended to be a regulatory standard and not necessarily the full amount of.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

The permanent capital residing on insurance companies’ balance sheets has become a key growth driver for many pe firms. Required documents are submitted at the insurance office. View telephone numbers, contact information, addresses, reviews, prices and more for capital insurance in trinidad & tobago. Based in lansing michigan, capital insurance services is proud to serve the insurance needs of individuals and businesses of all sizes. Capital is often referred to as the cornerstone of an institution’s financial strength.

Source: insurancejournal.com

Source: insurancejournal.com

As used in this document, “deloitte” means deloitte consulting llp and its subsidiaries. Required documents are submitted at the insurance office. The pandemic has caused a massive amount of disruption in the insurance industry, encouraging a traditional sector of financial services to more rapidly embrace new technologies on a faster timeline. View telephone numbers, contact information, addresses, reviews, prices and more for capital insurance in trinidad & tobago. As used in this document, “deloitte” means deloitte consulting llp and its subsidiaries.

Source: paramountdirect.com

Source: paramountdirect.com

The amount of capital that is set aside to cover risks. This report examines capital and its. The claimant intimates the insurance company immediately about the issue. And 2) the inherent riskiness of its financial assets and operations. Rbc is intended to be a regulatory standard and not necessarily the full amount of.

Source: mywisefinances.com

Source: mywisefinances.com

These are braodly classified into two categories, i.e. Although the occurrence of an insured event will always trigger cash outflows, payments are often spread out over an extended period. Our solutions we collaborate with leading insurance businesses and management teams to unlock value and drive innovation across the industry. Capital allocation is perhaps of special interest to financial firms such as insurers. This report examines capital and its.

Source: medicarequotefinder.com

Source: medicarequotefinder.com

Also find other businesses in trinidad & tobago offering insurance, insurance consultants, insurance brokers, marine contractors, financial services, insurance agents, insurance claims consultants, project management, insurance claims. To both survive and thrive, carriers must accelerate their technology adoption and implement. Insurance and banking have very different business models. Find location, phone number, services, reviews and more. Let us help you find the right auto, home, and commercial insurance to meet your needs.

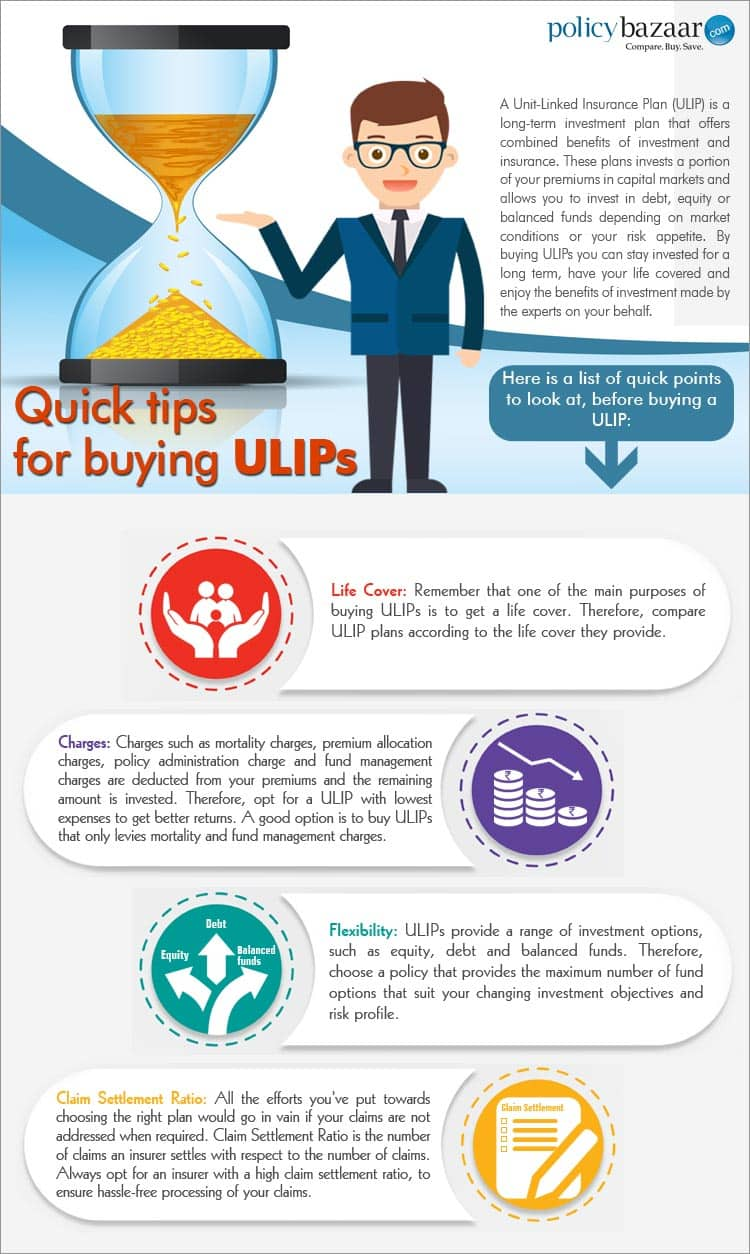

Source: policybazaar.com

Source: policybazaar.com

Insurance is not for the investor in you but the individual and family man in you. The rbc requirement is a statutory minimum level of capital that is based on two factors: Based in lansing michigan, capital insurance services is proud to serve the insurance needs of individuals and businesses of all sizes. Although the occurrence of an insured event will always trigger cash outflows, payments are often spread out over an extended period. To both survive and thrive, carriers must accelerate their technology adoption and implement.

Source: chaospost.com

Source: chaospost.com

The amount of money to be charged for a certain amount of insurance coverage is called the premium. Capital is often referred to as the cornerstone of an institution’s financial strength. Capital from an insurance company perspective robert e. One should be clear of the steps to make claims in order to avoid any rejection of the claims. In doing so, i will present two views on capital adequacy and capital allocation in the insurance industry.

Source: techicy.com

Source: techicy.com

Capital trends report—we will discuss 10 human capital trends that, although common across several industries, will contemplate and opine on the unique implications for the insurance industry. Insurance is not for the investor in you but the individual and family man in you. Pwc’s professionals also address risk management framework components, including strategy, governance and organization, measurement and. Venture capital insurance claim settlement is a quick and easy process. The claimant intimates the insurance company immediately about the issue.

Source: aegonlife.com

Source: aegonlife.com

Venture capital insurance claim settlement is a quick and easy process. Our solutions we collaborate with leading insurance businesses and management teams to unlock value and drive innovation across the industry. Capital allocation is perhaps of special interest to financial firms such as insurers. Capital insurance agency has the answers. Capital�s role in spurring insurance transformation.

Source: firstservicefinancial.com

Source: firstservicefinancial.com

The amount of money to be charged for a certain amount of insurance coverage is called the premium. Find location, phone number, services, reviews and more. Capital from an insurance company perspective robert e. The rbc requirement is a statutory minimum level of capital that is based on two factors: Although the occurrence of an insured event will always trigger cash outflows, payments are often spread out over an extended period.

Source: onlineaccountopen.in

Source: onlineaccountopen.in

The pandemic has caused a massive amount of disruption in the insurance industry, encouraging a traditional sector of financial services to more rapidly embrace new technologies on a faster timeline. For such firms, the principal providers of debt capital (insurance reserves) are also the firm’s principal customers. The rbc requirement is a statutory minimum level of capital that is based on two factors: In insurance, capital must be held to ensure that at period’s end the claim of the last policyholder will be met. The amount of money to be charged for a certain amount of insurance coverage is called the premium.

Source: bestplanner.ca

Source: bestplanner.ca

One should be clear of the steps to make claims in order to avoid any rejection of the claims. To both survive and thrive, carriers must accelerate their technology adoption and implement. Capital trends report—we will discuss 10 human capital trends that, although common across several industries, will contemplate and opine on the unique implications for the insurance industry. Private equity footprint in u.s life insurance has grown since the 2008 financial crisis, largely driven by systemic shifts in banking credit and capital standards. The steps of claim process are:

Source: youtube.com

Source: youtube.com

Our solutions we collaborate with leading insurance businesses and management teams to unlock value and drive innovation across the industry. One should be clear of the steps to make claims in order to avoid any rejection of the claims. That is, the company must hold capital in proportion to its risk. Required documents are submitted at the insurance office. If you have any questions about the benefits you have access to as a state of florida employee, please give us a call.

Source: pensionsweek.com

Source: pensionsweek.com

Capital trends report—we will discuss 10 human capital trends that, although common across several industries, will contemplate and opine on the unique implications for the insurance industry. And 2) the inherent riskiness of its financial assets and operations. Private equity footprint in u.s life insurance has grown since the 2008 financial crisis, largely driven by systemic shifts in banking credit and capital standards. The amount of money to be charged for a certain amount of insurance coverage is called the premium. View telephone numbers, contact information, addresses, reviews, prices and more for capital insurance in trinidad & tobago.

Source: backhouse.co.uk

Source: backhouse.co.uk

Capital insurance agency has the answers. For such firms, the principal providers of debt capital (insurance reserves) are also the firm’s principal customers. Capital from an insurance company perspective robert e. Insurance is not for the investor in you but the individual and family man in you. That is, the company must hold capital in proportion to its risk.

Source: wealthsecure.com

Source: wealthsecure.com

Also find other businesses in trinidad & tobago offering insurance, insurance consultants, insurance brokers, marine contractors, financial services, insurance agents, insurance claims consultants, project management, insurance claims. Required documents are submitted at the insurance office. Private equity footprint in u.s life insurance has grown since the 2008 financial crisis, largely driven by systemic shifts in banking credit and capital standards. To both survive and thrive, carriers must accelerate their technology adoption and implement. Our solutions we collaborate with leading insurance businesses and management teams to unlock value and drive innovation across the industry.

Source: surejob.in

Source: surejob.in

The amount of capital that is set aside to cover risks. Our licensed capital insurance agents are very knowledgable, and they are happy to assist you in any way they can. As part of their business, insurers are exposed to different risks and therefore must be treated differently in terms of regulation and reporting. 1) an insurance company’s size; One should be clear of the steps to make claims in order to avoid any rejection of the claims.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title capital in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information