Captive insurance specialist Idea

Home » Trending » Captive insurance specialist IdeaYour Captive insurance specialist images are available. Captive insurance specialist are a topic that is being searched for and liked by netizens today. You can Get the Captive insurance specialist files here. Find and Download all free photos and vectors.

If you’re looking for captive insurance specialist pictures information related to the captive insurance specialist topic, you have visit the ideal site. Our website always gives you hints for seeing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Captive Insurance Specialist. Where the conventional insurance marketplace has not responded to the needs of businesses requiring innovative solutions for large or complex risks, organisations that venture into this area have much to gain. Free and open company data on missouri (us) company captive insurance specialist llc (company number lc001559911), 5801 buck run, ozark, mo, 65721 Cyber risk, credit risk, wind risk etc…) resulting in increased control and cost reductions. + proven ability to work effectively both in a team environment and independently in an office with other professionals in order to meet deadlines and satisfy the needs of the client and service team managers

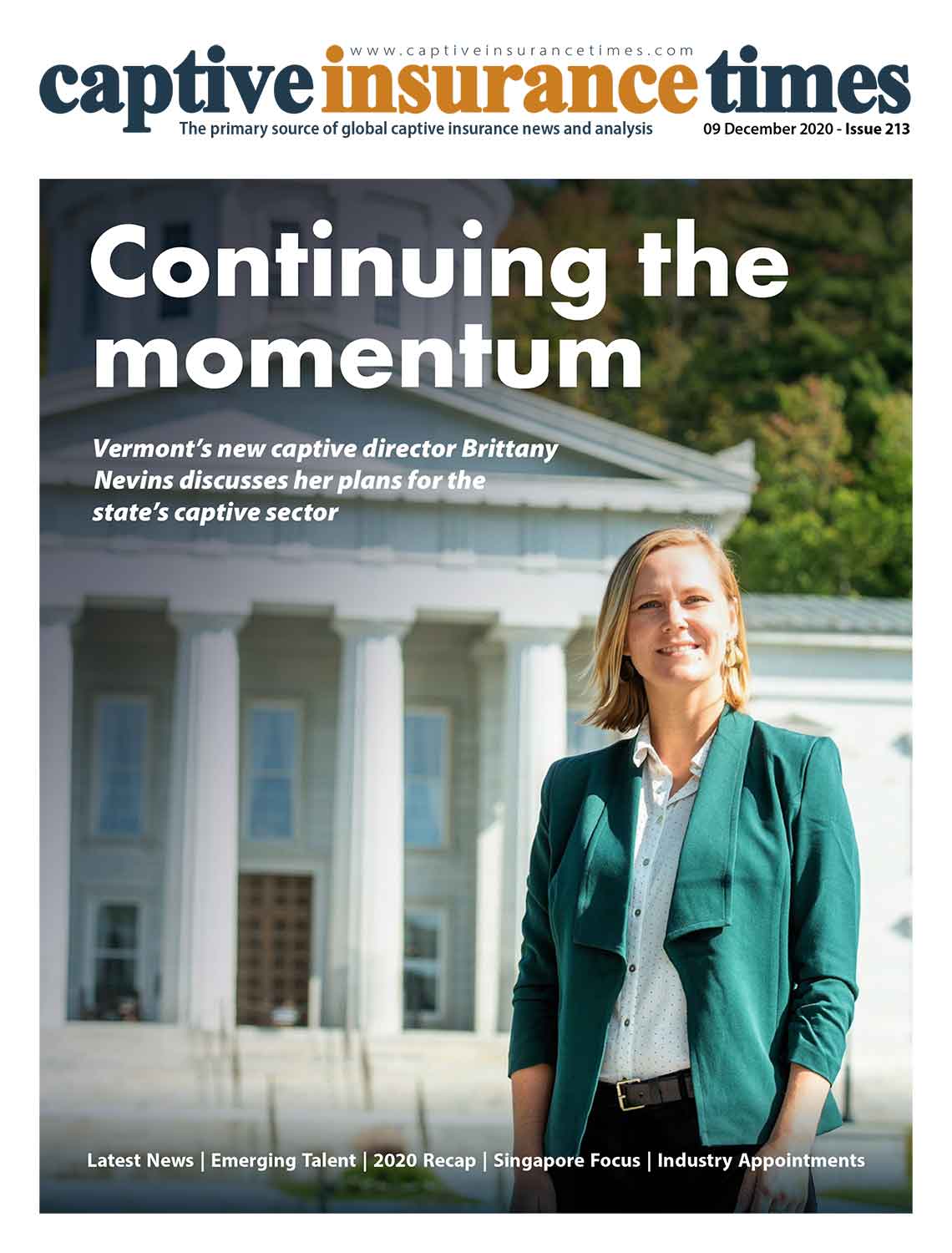

Captive insurance latest news APCAA endorses Alabama’s From captiveinsurancetimes.com

Captive insurance latest news APCAA endorses Alabama’s From captiveinsurancetimes.com

And performs related work as required. Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. What is a captive insurance company? A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; About 90% of the fortune 500 companies1 own one or more captive insurance companies and many captives house more than one Free and open company data on missouri (us) company captive insurance specialist llc (company number lc001559911), 5801 buck run, ozark, mo, 65721

In 2014, there are roughly 6,300 captives globally, up from 5,525 in 2009.

Together the vfo hub team was able to reduce the taxable income from $17m to $0, saving the client over $6m in taxes. Put another way, captives are an. If your organization has a great safety record, stellar loss control measures and solid financials, you could be a good fit for a captive program. A captive insurance company may be formed if the parent company cannot find a suitable outside firm to insure them against particular business risks, if the premiums paid to the captive insurer. Vivian koelsch is an underwriting specialist who has been with arch since 2016, having also worked at travelers and the hartford. These points do not clearly distinguish the captive insurer from a mutual insurance company.

Source: captiveinsurancetimes.com

Source: captiveinsurancetimes.com

About 90% of the fortune 500 companies1 own one or more captive insurance companies and many captives house more than one The commercial insurance veteran will serve as vice president, where he will provide targeted risk management and insurance solutions to alliant�s diverse portfolio of clients throughout the eastern united states. Together the vfo hub team was able to reduce the taxable income from $17m to $0, saving the client over $6m in taxes. After careful consideration of many possible combinations of solutions, vfo hub decided to bring in their top captive insurance specialist, a leading tax attorney to design the charitable strategy and their tax credit specialist. Captive insurance program captive management the missouri department of insurance is a fully accredited insurance department, recognized as being among the best insurance regulators in the country.

Source: voippacket.com

Source: voippacket.com

A captive is an insurance company set up by its owners primarily to insure its own specific risks. Where the conventional insurance marketplace has not responded to the needs of businesses requiring innovative solutions for large or complex risks, organisations that venture into this area have much to gain. Captive insurance program captive management the missouri department of insurance is a fully accredited insurance department, recognized as being among the best insurance regulators in the country. Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. A captive insurance company may be formed if the parent company cannot find a suitable outside firm to insure them against particular business risks, if the premiums paid to the captive insurer.

Source: programbusiness.com

Source: programbusiness.com

Companies of all sizes with annual insurance premiums totaling at least $500,000 among workers’ compensation, general liability, medical malpractice, automobile, property, warranty. These points do not clearly distinguish the captive insurer from a mutual insurance company. The commercial insurance veteran will serve as vice president, where he will provide targeted risk management and insurance solutions to alliant�s diverse portfolio of clients throughout the eastern united states. Together the vfo hub team was able to reduce the taxable income from $17m to $0, saving the client over $6m in taxes. About 90% of the fortune 500 companies1 own one or more captive insurance companies and many captives house more than one

Source: captiveinsurancetimes.com

Source: captiveinsurancetimes.com

We act for corporate entities and private individuals, providing great solutions to a wide range of insurance needs. This entry was last updated on march 15, 2021. He specialises in leading and developing underwriting teams, management, underwriting, marketing and design of sophisticated us and international captive insurance and specialty programmes. If your organization has a great safety record, stellar loss control measures and solid financials, you could be. A captive is an insurance company set up by its owners primarily to insure its own specific risks.

Source: captive.im

Source: captive.im

And performs related work as required. To be very clear, the purpose of an insurance company and, therefore, a captive is to pay losses (your own losses) and to afford you (the owner) more control over your risk and any losses that do occur. Adjure global limited has experience of assisting a wide range of entities to form their own insurer , captive insurer or protected cell insurer solutions. The commercial insurance veteran will serve as vice president, where he will provide targeted risk management and insurance solutions to alliant�s diverse portfolio of clients throughout the eastern united states. Exploring captives structuring techniques within the framework of recent cases brought to tax court, this cle course will introduce corporate attorneys to how captive insurance companies operate on the basis of the profitability that captives provide to their affiliate groups.

Source: captiveinsurancetimes.com

Source: captiveinsurancetimes.com

Vivian koelsch is an underwriting specialist who has been with arch since 2016, having also worked at travelers and the hartford. Cyber risk, credit risk, wind risk etc…) resulting in increased control and cost reductions. What is a captive insurance company? Vivian koelsch is an underwriting specialist who has been with arch since 2016, having also worked at travelers and the hartford. + proven ability to work effectively both in a team environment and independently in an office with other professionals in order to meet deadlines and satisfy the needs of the client and service team managers

Source: captiveinsurancetimes.com

Source: captiveinsurancetimes.com

In 2014, there are roughly 6,300 captives globally, up from 5,525 in 2009. What is a captive insurance company? Adjure global limited has experience of assisting a wide range of entities to form their own insurer , captive insurer or protected cell insurer solutions. These points do not clearly distinguish the captive insurer from a mutual insurance company. Captive insurance specialist at the state of tennessee white house, tennessee, united states 81 connections.

![]() Source: businessinsurance.com

Source: businessinsurance.com

Adjure global limited has experience of assisting a wide range of entities to form their own insurer , captive insurer or protected cell insurer solutions. These points do not clearly distinguish the captive insurer from a mutual insurance company. A captive insurance company may be formed if the parent company cannot find a suitable outside firm to insure them against particular business risks, if the premiums paid to the captive insurer. Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. Free and open company data on missouri (us) company captive insurance specialist llc (company number lc001559911), 5801 buck run, ozark, mo, 65721

Source: insurancejournal.com

Source: insurancejournal.com

A captive is an insurance company set up by its owners primarily to insure its own specific risks. Cyber risk, credit risk, wind risk etc…) resulting in increased control and cost reductions. He specialises in leading and developing underwriting teams, management, underwriting, marketing and design of sophisticated us and international captive insurance and specialty programmes. If your organization has a great safety record, stellar loss control measures and solid financials, you could be a good fit for a captive program. This entry was last updated on march 15, 2021.

Source: workerscompensationshop.com

Source: workerscompensationshop.com

As a captive insurance accounting specialist your skills and qualifications will ideally include; Free and open company data on missouri (us) company captive insurance specialist llc (company number lc001559911), 5801 buck run, ozark, mo, 65721 Captive insurance companies grew from 100 in the 1960s to 1,000 in the 1980s. About 90% of the fortune 500 companies1 own one or more captive insurance companies and many captives house more than one If your organization has a great safety record, stellar loss control measures and solid financials, you could be a good fit for a captive program.

Source: ferma.eu

Source: ferma.eu

Vivian koelsch is an underwriting specialist who has been with arch since 2016, having also worked at travelers and the hartford. Where the conventional insurance marketplace has not responded to the needs of businesses requiring innovative solutions for large or complex risks, organisations that venture into this area have much to gain. He specialises in leading and developing underwriting teams, management, underwriting, marketing and design of sophisticated us and international captive insurance and specialty programmes. Forming a captive insurance company has become a mainstream tool for mitigating traditional risks (e.g. If a company simply increases its retention, the funds held in.

Source: captiveinsurancetimes.com

Source: captiveinsurancetimes.com

In 2014, there are roughly 6,300 captives globally, up from 5,525 in 2009. These points do not clearly distinguish the captive insurer from a mutual insurance company. Cyber risk, credit risk, wind risk etc…) resulting in increased control and cost reductions. We act for corporate entities and private individuals, providing great solutions to a wide range of insurance needs. Free and open company data on missouri (us) company captive insurance specialist llc (company number lc001559911), 5801 buck run, ozark, mo, 65721

Source: captiveinsurancetimes.com

Source: captiveinsurancetimes.com

What is a captive insurance company? Vivian koelsch is an underwriting specialist who has been with arch since 2016, having also worked at travelers and the hartford. In 2014, there are roughly 6,300 captives globally, up from 5,525 in 2009. He specialises in leading and developing underwriting teams, management, underwriting, marketing and design of sophisticated us and international captive insurance and specialty programmes. If a company simply increases its retention, the funds held in.

Source: captiveinsurancetimes.com

Source: captiveinsurancetimes.com

The course will also examine the ways in which captive insurance can be used to minimize costs for. Vivian koelsch is an underwriting specialist who has been with arch since 2016, having also worked at travelers and the hartford. These points do not clearly distinguish the captive insurer from a mutual insurance company. Cyber risk, credit risk, wind risk etc…) resulting in increased control and cost reductions. And performs related work as required.

Source: captiveinsurancetimes.com

Source: captiveinsurancetimes.com

Vivian koelsch is an underwriting specialist who has been with arch since 2016, having also worked at travelers and the hartford. Adjure global limited has experience of assisting a wide range of entities to form their own insurer , captive insurer or protected cell insurer solutions. The commercial insurance veteran will serve as vice president, where he will provide targeted risk management and insurance solutions to alliant�s diverse portfolio of clients throughout the eastern united states. A captive insurance company may be formed if the parent company cannot find a suitable outside firm to insure them against particular business risks, if the premiums paid to the captive insurer. If a company simply increases its retention, the funds held in.

Source: bvi.gov.vg

Source: bvi.gov.vg

If your organization has a great safety record, stellar loss control measures and solid financials, you could be a good fit for a captive program. Companies of all sizes with annual insurance premiums totaling at least $500,000 among workers’ compensation, general liability, medical malpractice, automobile, property, warranty. These points do not clearly distinguish the captive insurer from a mutual insurance company. Captive insurance program captive management the missouri department of insurance is a fully accredited insurance department, recognized as being among the best insurance regulators in the country. Forming a captive insurance company has become a mainstream tool for mitigating traditional risks (e.g.

Source: ey.com

Source: ey.com

Under close supervision, is responsible for captive insurance analysis and examination work of routine difficulty; In 2014, there are roughly 6,300 captives globally, up from 5,525 in 2009. This entry was last updated on march 15, 2021. To see how much your company might benefit from a captive, schedule an appointment with a comerica captive specialist today. If your organization has a great safety record, stellar loss control measures and solid financials, you could be a good fit for a captive program.

Source: mylittledream-oficial.blogspot.com

Source: mylittledream-oficial.blogspot.com

Exploring captives structuring techniques within the framework of recent cases brought to tax court, this cle course will introduce corporate attorneys to how captive insurance companies operate on the basis of the profitability that captives provide to their affiliate groups. Cyber risk, credit risk, wind risk etc…) resulting in increased control and cost reductions. Forming a captive insurance company has become a mainstream tool for mitigating traditional risks (e.g. Companies of all sizes with annual insurance premiums totaling at least $500,000 among workers’ compensation, general liability, medical malpractice, automobile, property, warranty. And performs related work as required.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title captive insurance specialist by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea