Captive insurance tax benefits information

Home » Trend » Captive insurance tax benefits informationYour Captive insurance tax benefits images are ready. Captive insurance tax benefits are a topic that is being searched for and liked by netizens now. You can Get the Captive insurance tax benefits files here. Download all free photos.

If you’re searching for captive insurance tax benefits images information linked to the captive insurance tax benefits topic, you have come to the ideal site. Our website always provides you with hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

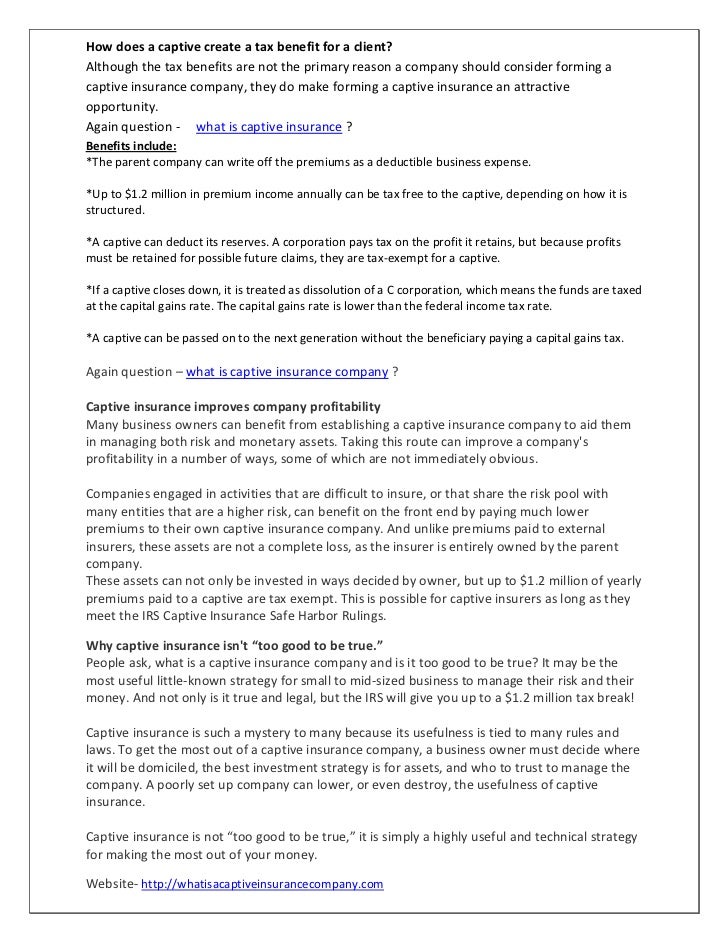

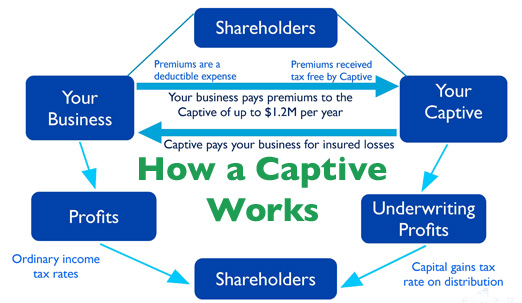

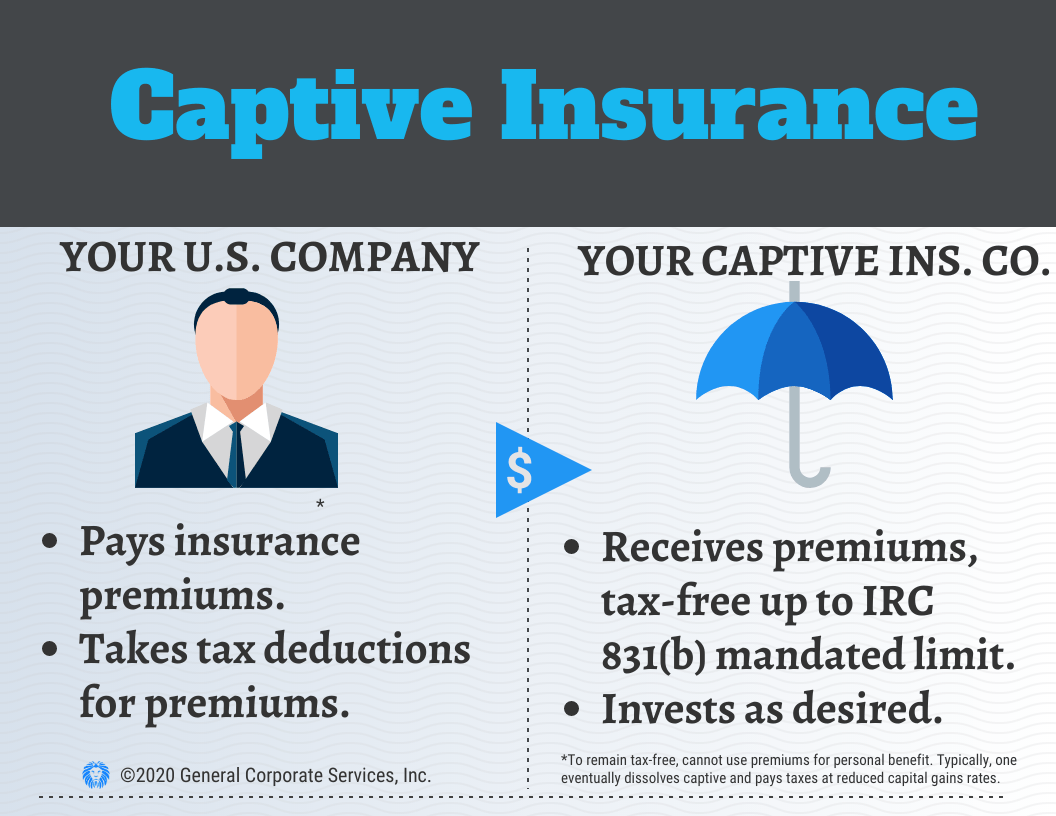

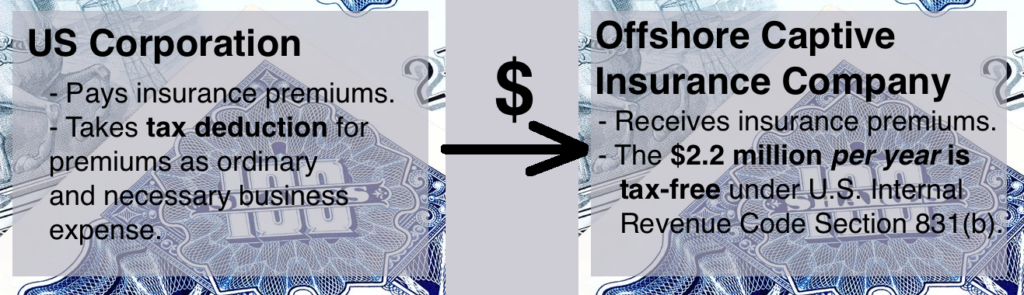

Captive Insurance Tax Benefits. The statutory captive insurance company will elect to be classified as a domestic insurance company as indicated under irc section 953(d). Using a captive insurance company can insure risks that are (9). Captive versus self funding why is “insurance” treatment important? Although their implementation and legal structure are often poorly understood, their financial rewards can be very attractive.

Captive Insurance Management Company Captive Nation From captivenation.com

Captive Insurance Management Company Captive Nation From captivenation.com

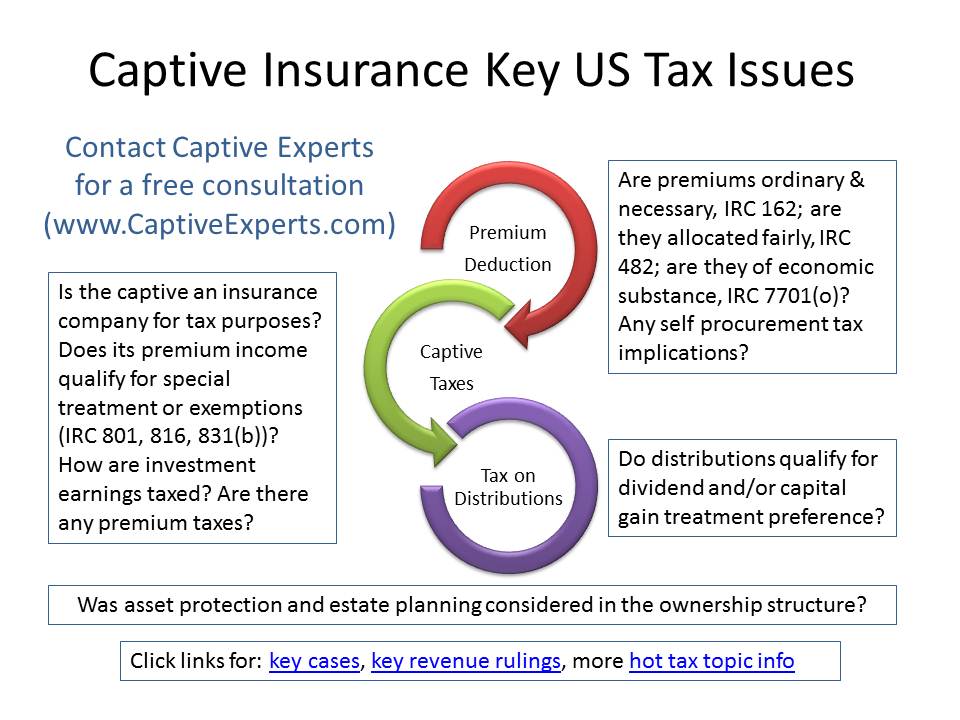

Although their implementation and legal structure are often poorly understood, their financial rewards can be very attractive. Using a captive insurance company can insure risks that are (7). Qualifying as insurance for tax purposes. Tax credit on the insurance payment paid to a captive by the parent company; Captive versus self funding why is “insurance” treatment important? “large” captive insurance companies are taxed under irc code section 831(a).

Some professionals recommend captive insurance as the greatest thing since sliced bread.

Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive). First, their tax on underwriting profits is reduced from as high as 35% to only 21%. Captives can play a significant role in a company’s tax strategy. The statutory captive insurance company will elect to be classified as a domestic insurance company as indicated under irc section 953(d). Although their implementation and legal structure are often poorly understood, their financial rewards can be very attractive. Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive).

Source: youtube.com

Source: youtube.com

A properly structured and managed captive insurance company could provide the following tax and nontax benefits: Some professionals recommend captive insurance as the greatest thing since sliced bread. It will, therefore, file us tax returns annually. Amounts paid to the captive are deductible as insurance premiums), it must be considered an insurance company. A properly structured and managed captive insurance company could provide the following tax and nontax benefits:

Source: slideshare.net

Source: slideshare.net

Tax deduction for the parent company for the insurance premium paid to the captive; Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive). Insurance premiums paid by a company to the captive are tax deductible. It has allowed business owners in the middle market to play on a more level playing field with large insurers. Using a captive insurance company can insure risks that are (7).

Source: catalystadvisorygroup.com

Source: catalystadvisorygroup.com

Insurance premiums paid by a company to the captive are tax deductible. Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive). “large” captive insurance companies are taxed under irc code section 831(a). A properly structured and managed captive insurance company could provide the following tax and nontax benefits: The premiums paid to your captive insurance company you’ve created are tax deductible.

Source: captivenation.com

Source: captivenation.com

Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive). Insurance premiums paid by a company to the captive are tax deductible. The statutory captive insurance company will elect to be classified as a domestic insurance company as indicated under irc section 953(d). Although their implementation and legal structure are often poorly understood, their financial rewards can be very attractive. A properly structured and managed captive insurance company could provide the following tax and nontax benefits:

Source: captivatingthinking.com

Source: captivatingthinking.com

This reduces the taxable income for the business owner. A properly structured and managed captive insurance company could provide the following tax and nontax benefits: Although their implementation and legal structure are often poorly understood, their financial rewards can be very attractive. This reduces the taxable income for the business owner. The statutory captive insurance company will elect to be classified as a domestic insurance company as indicated under irc section 953(d).

Source: captiveinsurance.io

Source: captiveinsurance.io

Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive). Tax deductions for the parent company for the insurance premium paid to the captive; Since insurance companies are subject to special tax rules, captives can take deductions for loss reserves. It will, therefore, file us tax returns annually. • the captive retains the risk, or a proportion of the risk and seeks external reinsurance with a third / unrelated party for certain layers or proportions of the risks.

Source: offshorecompany.com

Source: offshorecompany.com

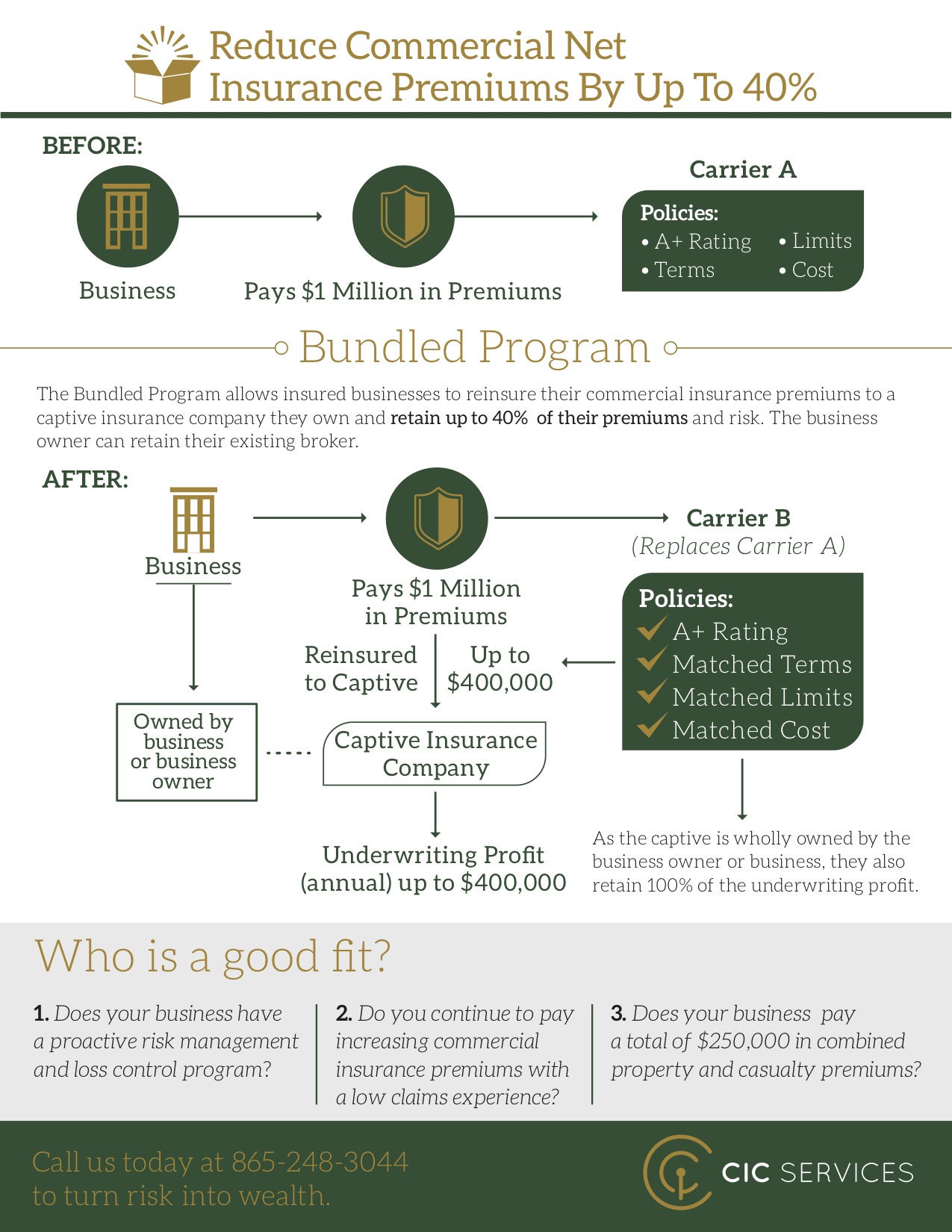

Captive insurance is a risk management tool with tax benefit and increased company cash flow. For a captive to obtain the tax benefits of a captive (e.g. First, their tax on underwriting profits is reduced from as high as 35% to only 21%. Premiums received by the captive insurance company are tax exempt up to $2.3mm per year. Using a captive insurance company can insure risks that are (9).

.png?width=750&name=Inline Blog Images (77).png “Captive Insurance Tax Benefits Chandler & Knowles”) Source: blog.chandlerknowlescpa.com

Using a captive insurance company can insure risks that are (7). This reduces the taxable income for the business owner. Insurance premiums paid by a company to the captive are tax deductible. Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive). Although their implementation and legal structure are often poorly understood, their financial rewards can be very attractive.

Source: captivenation.com

Source: captivenation.com

It will, therefore, file us tax returns annually. Captive insurance is a risk management tool with tax benefit and increased company cash flow. Tax deductions for the parent company for the insurance premium paid to the captive; Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive). Insurance premiums paid by a company to the captive are tax deductible.

Source: captivenation.com

Source: captivenation.com

It has allowed business owners in the middle market to play on a more level playing field with large insurers. • the captive retains the risk, or a proportion of the risk and seeks external reinsurance with a third / unrelated party for certain layers or proportions of the risks. The statutory captive insurance company will elect to be classified as a domestic insurance company as indicated under irc section 953(d). Some professionals recommend captive insurance as the greatest thing since sliced bread. The tax benefits that may be available should never be the driving focus for forming a captive insurance company and are often small in comparison to the risk management benefits obtained.

Source: offshorecorporation.com

Source: offshorecorporation.com

Insurance premiums paid by a company to the captive are tax deductible. Captive versus self funding why is “insurance” treatment important? Premiums paid to a captive insurer can be tax deductible if the. Although captive insurance offered a number of tax benefits in the united states in the past, the benefits have been going away over time. Captive insurance company tax benefits.

Source: uscaptive.com

Source: uscaptive.com

Multiple other tax savings measures, including savings on gifts and property taxes for lenders savings on payroll taxes for both. Premiums received by the captive insurance company are tax exempt up to $2.3mm per year. Captive versus self funding why is “insurance” treatment important? The tax benefits that may be available should never be the driving focus for forming a captive insurance company and are often small in comparison to the risk management benefits obtained. Some professionals recommend captive insurance as the greatest thing since sliced bread.

Source: captivatingthinking.com

Source: captivatingthinking.com

The statutory captive insurance company will elect to be classified as a domestic insurance company as indicated under irc section 953(d). “large” captive insurance companies are taxed under irc code section 831(a). Amounts paid to the captive are deductible as insurance premiums), it must be considered an insurance company. A pure captive insurance company is established by parent organization to provide insurance to itself or subsidiaries. A “captive” is a licensed insurance company utilized to insure a wide range of risks depending on business needs.

Source: slideshare.net

Source: slideshare.net

Second, their tax on investment income is also reduced to 21%. The statutory captive insurance company will elect to be classified as a domestic insurance company as indicated under irc section 953(d). Various other tax savings opportunities, including gift and estate tax savings for the shareholders and income tax savings for both the captive and the parent; Insurance premiums paid by a company to the captive are tax deductible. Group captive insurance formed by a group of companies to take insurance for their collective risk.

Source: sdgyoungleaders.org

Source: sdgyoungleaders.org

Captive insurance company tax benefits. Insurance premiums paid by a company to the captive are tax deductible. Using a captive insurance company can insure risks that are (9). Captive insurance offers no tax benefits. Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive).

Source: offshorecorporation.com

Source: offshorecorporation.com

Tax deduction for the parent company for the insurance premium paid to the captive; However, there are key tax benefits that can be derived from a captive insurance arrangement. Using a captive insurance company can insure risks that are (7). Some professionals recommend captive insurance as the greatest thing since sliced bread. The statutory captive insurance company will elect to be classified as a domestic insurance company as indicated under irc section 953(d).

Source: captivenation.us

Source: captivenation.us

Tax deductions for the parent company for the insurance premium paid to the captive; Amounts paid to the captive are deductible as insurance premiums), it must be considered an insurance company. Oct 6, 2020 — tax benefits in relation to section 831 include a 0% federal income tax on the captive’s underwriting profits (premium income to the captive). The premiums paid to your captive insurance company you’ve created are tax deductible. Premiums paid to a captive insurer can be tax deductible if the.

Source: uscaptive.com

Source: uscaptive.com

The tax benefits that may be available should never be the driving focus for forming a captive insurance company and are often small in comparison to the risk management benefits obtained. Qualifying as insurance for tax purposes. A “captive” is a licensed insurance company utilized to insure a wide range of risks depending on business needs. Captive versus self funding why is “insurance” treatment important? It has allowed business owners in the middle market to play on a more level playing field with large insurers.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title captive insurance tax benefits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information