Captive insurance tax implications information

Home » Trending » Captive insurance tax implications informationYour Captive insurance tax implications images are available in this site. Captive insurance tax implications are a topic that is being searched for and liked by netizens today. You can Find and Download the Captive insurance tax implications files here. Download all royalty-free photos.

If you’re searching for captive insurance tax implications pictures information connected with to the captive insurance tax implications interest, you have come to the ideal blog. Our website always gives you hints for downloading the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Captive Insurance Tax Implications. • there is diversification and pooling of risk in the captive insurance; While many taxpayers will find that the. A common misconception has been that captive insurance companies are only subject to the favorable Insurance premium tax (ipt) remains an area of focus for tax authorities, and can be impacted by pricing changes.

A Brief Introduction to Captive Insurance infinity insurance From infinityinsurances.blogspot.com

A Brief Introduction to Captive Insurance infinity insurance From infinityinsurances.blogspot.com

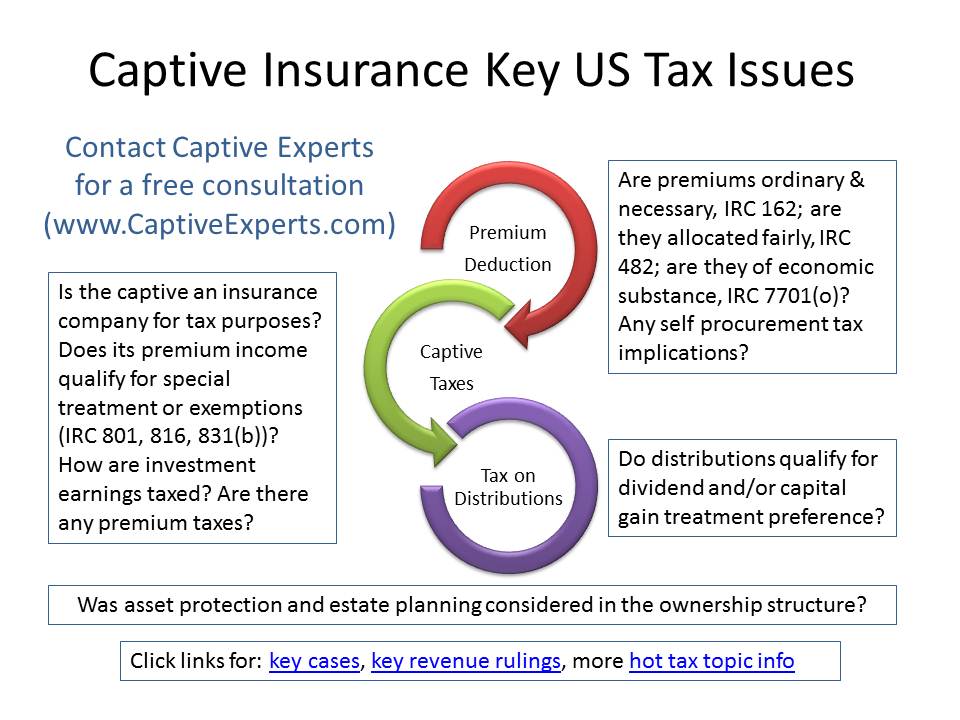

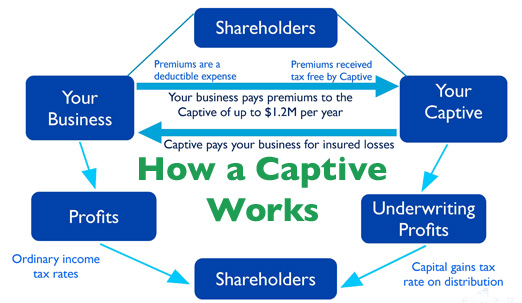

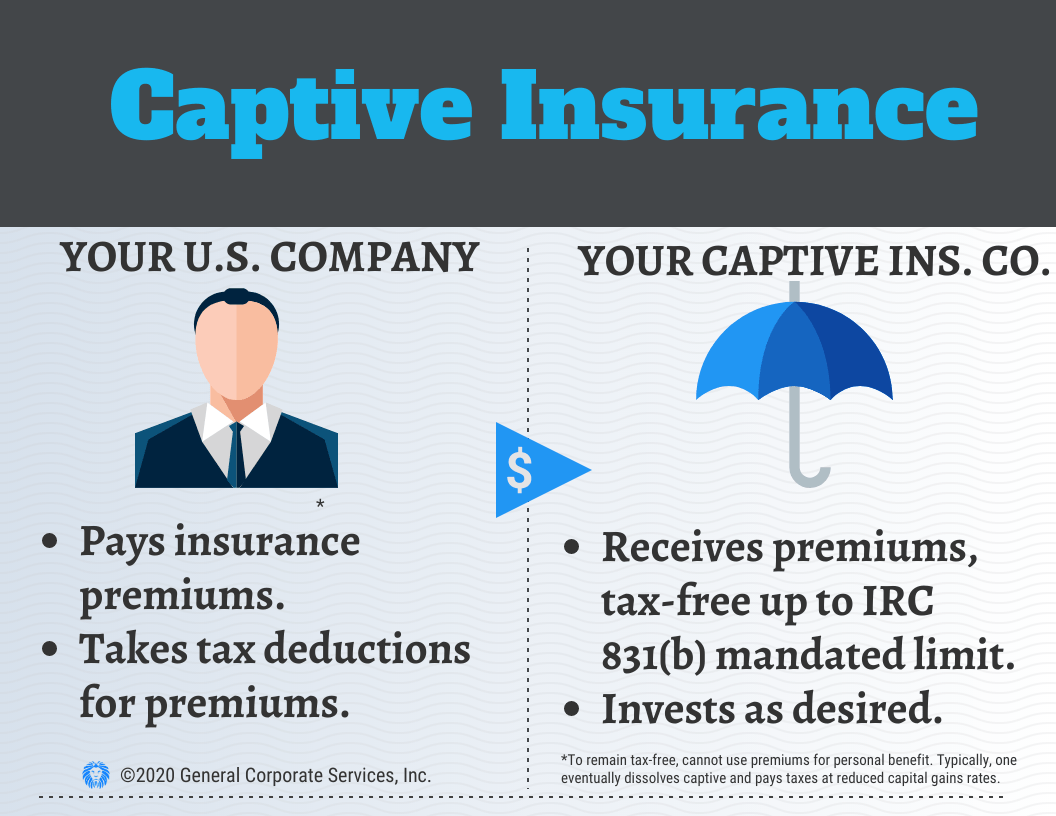

Premiums paid to a captive insurer can be tax deductible if the. As of 2018, small captive insurance companies that receive annual insurance benefits of less than $2.3 million are taxed at 0% on their underwriting profits. Use of captives opens numerous issues which have ramifications for federal income tax purposes. The captive then must meet the applicable legal and regulatory hurdles to receive its insurance license from that state, and the subsidiary must operate as a c corporation for. The owner of the captive will retain the profits generated. The main issue for captives is whether the captive insurance company is a valid insurance entity from an irs standpoint.

Over the years, profits and surplus may accumulate to sizable amounts and may be distributed to the owner(s) of the captive insurance company under favorable income tax rates.

Under the oecd 2020 tp guidance, captive insurance arrangements must This really should come as no surprise, given that many companies can secure tax deductions and savings opportunities only if they have a captive for their insurance purposes. Some professionals recommend captive insurance as the greatest thing since sliced bread. Although their implementation and legal structure are often poorly understood, their financial rewards can be very attractive. The corporate, regulatory, & tax structure of captive insurance companies. Ipt is an underlying cost and the uk rate has increased over recent years.

![]() Source: businessinsurance.com

Source: businessinsurance.com

Insurance captives taxation through the application of malta’s full imputation system, which completely eliminates economic double taxation, malta offers a flexible tax environment for captives. The captive then must meet the applicable legal and regulatory hurdles to receive its insurance license from that state, and the subsidiary must operate as a c corporation for. Premiums paid to a captive insurer can be tax deductible if the. Paragraph 95(2)(a.2) of the income tax act (canada) [1] was introduced as a measure to restrict the tax benefit associated with transferring income from the insurance of a risk in respect of a person resident in canada, property situated in canada or a business carried on in canada (each a canadian risk) to an offshore captive insurance entity. Captive insurance companies are usually taxed on underwriting income after required adjustments for tax purposes.

Source: getsmithinsurance.com

Source: getsmithinsurance.com

Additionally, while the internal revenue service has accepted the use and role of captive insurance arrangements as an integral part of a comprehensive risk management strategy, they continue to challenge captive insurance arrangements which fail to comply with the principles and guidelines established by the courts in defining insurance for us. The corporate, regulatory, & tax structure of captive insurance companies. Captives not deriving income from maltese immovable property are liable to tax on such income at 35%, subject to relief for any foreign tax suffered. Insurance premium tax (ipt) remains an area of focus for tax authorities, and can be impacted by pricing changes. In 2017, the threshold on the amount of premiums that qualify an insurance company to be eligible to elect under section 831 (b) increased from $1.2 million to $2.2 million (subject to future indexing for inflation).

Source: uscaptive.com

Source: uscaptive.com

The parent company pays insurance premiums to its captive insurance company and seeks to deduct these premiums in its home. • there is diversification and pooling of risk in the captive insurance; Benefits of a captive include the ability to tailor coverage for hard to insure or emerging risks, apply alternative strategies to deal with insurance market cycles, provide financial incentives for loss control, offer flexibility in managing risk, offer creative insurance solutions, allocate costs to business units, and consolidate risk management. The owner of the captive will retain the profits generated. Captive insurance companies are usually taxed on underwriting income after required adjustments for tax purposes.

Source: slideserve.com

Source: slideserve.com

Insurance captives taxation through the application of malta’s full imputation system, which completely eliminates economic double taxation, malta offers a flexible tax environment for captives. Benefits of a captive include the ability to tailor coverage for hard to insure or emerging risks, apply alternative strategies to deal with insurance market cycles, provide financial incentives for loss control, offer flexibility in managing risk, offer creative insurance solutions, allocate costs to business units, and consolidate risk management. Premiums paid to a captive insurer can be tax deductible if the. Under the oecd 2020 tp guidance, captive insurance arrangements must Also, the captive insurance company does not pay taxes on the insurance premiums that it collects up to $1.2 million annually, provided it is an 831 (b) captive.

Source: lobbplewe.com

Source: lobbplewe.com

As of 2018, small captive insurance companies that receive annual insurance benefits of less than $2.3 million are taxed at 0% on their underwriting profits. When a captive returns surplus to its owners, the tax rate will remain at 23.8 percent. Although their implementation and legal structure are often poorly understood, their financial rewards can be very attractive. To form a captive, the parent incorporates a new subsidiary corporation in a particular state. Insurance captives taxation through the application of malta’s full imputation system, which completely eliminates economic double taxation, malta offers a flexible tax environment for captives.

Source: forbes.com

Source: forbes.com

When a captive returns surplus to its owners, the tax rate will remain at 23.8 percent. While many taxpayers will find that the. The captive then must meet the applicable legal and regulatory hurdles to receive its insurance license from that state, and the subsidiary must operate as a c corporation for. Also, the captive insurance company does not pay taxes on the insurance premiums that it collects up to $1.2 million annually, provided it is an 831 (b) captive. Irrational’ with a specific captive insurance example.

.png?width=750&name=Inline Blog Images (77).png “Captive Insurance Tax Benefits Chandler & Knowles”) Source: blog.chandlerknowlescpa.com

• there is diversification and pooling of risk in the captive insurance; In recent years, the use of captives, both domestic and foreign, has increased dramatically. Over the years, profits and surplus may accumulate to sizable amounts and may be distributed to the owner(s) of the captive insurance company under favorable income tax rates. In 2017, the threshold on the amount of premiums that qualify an insurance company to be eligible to elect under section 831 (b) increased from $1.2 million to $2.2 million (subject to future indexing for inflation). [3] as a tradeoff for this election, the captive insurer may not deduct its underwriting losses.

Source: web-bugs.com

Source: web-bugs.com

The tax concept of a captive insurance company is relatively simple. Premiums paid to a captive insurer can be tax deductible if the. Paragraph 95(2)(a.2) of the income tax act (canada) [1] was introduced as a measure to restrict the tax benefit associated with transferring income from the insurance of a risk in respect of a person resident in canada, property situated in canada or a business carried on in canada (each a canadian risk) to an offshore captive insurance entity. The parent company pays insurance premiums to its captive insurance company and seeks to deduct these premiums in its home. Ipt is an underlying cost and the uk rate has increased over recent years.

Source: inspiralviral.com

Source: inspiralviral.com

Captive insurance companies are usually taxed on underwriting income after required adjustments for tax purposes. This is because the business logic behind most alternative risk structures involving a captive have as a foundation a company�s expectation that it can deduct against income premiums paid for insurance, and the involved captive will qualify for special accounting and tax treatment afforded insurance arrangements under us tax law, making it less expensive in most cases to build loss. Insurance captives taxation through the application of malta’s full imputation system, which completely eliminates economic double taxation, malta offers a flexible tax environment for captives. The main issue for captives is whether the captive insurance company is a valid insurance entity from an irs standpoint. Captives not deriving income from maltese immovable property are liable to tax on such income at 35%, subject to relief for any foreign tax suffered.

Source: catalystadvisorygroup.com

Source: catalystadvisorygroup.com

Paragraph 95(2)(a.2) of the income tax act (canada) [1] was introduced as a measure to restrict the tax benefit associated with transferring income from the insurance of a risk in respect of a person resident in canada, property situated in canada or a business carried on in canada (each a canadian risk) to an offshore captive insurance entity. Irrational’ with a specific captive insurance example. • the economic capital position of the entities within the mne group has improved as a result of diversification and there is therefore a real economic impact for the mne group as a whole; In recent years, the use of captives, both domestic and foreign, has increased dramatically. The corporate, regulatory, & tax structure of captive insurance companies.

Source: mtginsurance.com

Source: mtginsurance.com

The captive insurance company also experiences tax benefits. Some professionals recommend captive insurance as the greatest thing since sliced bread. The short answer is that the business owner can sell the operating business and keep the captive insurance company. The owner of the captive will retain the profits generated. Ipt is an underlying cost and the uk rate has increased over recent years.

Source: captiveinsurance.io

Source: captiveinsurance.io

• both the captive insurance and any reinsurer are Additionally, while the internal revenue service has accepted the use and role of captive insurance arrangements as an integral part of a comprehensive risk management strategy, they continue to challenge captive insurance arrangements which fail to comply with the principles and guidelines established by the courts in defining insurance for us. Ipt is an underlying cost and the uk rate has increased over recent years. The captive insurance company also experiences tax benefits. The corporate, regulatory, & tax structure of captive insurance companies.

Source: scamguards.org

Source: scamguards.org

As of 2018, small captive insurance companies that receive annual insurance benefits of less than $2.3 million are taxed at 0% on their underwriting profits. Use of captives opens numerous issues which have ramifications for federal income tax purposes. • there is diversification and pooling of risk in the captive insurance; Also, the captive insurance company does not pay taxes on the insurance premiums that it collects up to $1.2 million annually, provided it is an 831 (b) captive. The owner of the captive will retain the profits generated.

Source: captiveinsurancetaxforum.splashthat.com

Source: captiveinsurancetaxforum.splashthat.com

In 2017, the threshold on the amount of premiums that qualify an insurance company to be eligible to elect under section 831 (b) increased from $1.2 million to $2.2 million (subject to future indexing for inflation). Use of captives opens numerous issues which have ramifications for federal income tax purposes. In 2017, the threshold on the amount of premiums that qualify an insurance company to be eligible to elect under section 831 (b) increased from $1.2 million to $2.2 million (subject to future indexing for inflation). In recent years, the use of captives, both domestic and foreign, has increased dramatically. The captive then must meet the applicable legal and regulatory hurdles to receive its insurance license from that state, and the subsidiary must operate as a c corporation for.

Source: captivenation.com

Source: captivenation.com

Ipt is an underlying cost and the uk rate has increased over recent years. The main issue for captives is whether the captive insurance company is a valid insurance entity from an irs standpoint. The captive insurance company also experiences tax benefits. The parent company pays insurance premiums to its captive insurance company and seeks to deduct these premiums in its home. Over the years, profits and surplus may accumulate to sizable amounts and may be distributed to the owner(s) of the captive insurance company under favorable income tax rates.

Source: offshorecorporation.com

Source: offshorecorporation.com

Over the years, profits and surplus may accumulate to sizable amounts and may be distributed to the owner(s) of the captive insurance company under favorable income tax rates. Premiums paid to a captive insurer can be tax deductible if the. Insurance premium tax (ipt) remains an area of focus for tax authorities, and can be impacted by pricing changes. The main issue for captives is whether the captive insurance company is a valid insurance entity from an irs standpoint. While many taxpayers will find that the.

Source: infinityinsurances.blogspot.com

Source: infinityinsurances.blogspot.com

• both the captive insurance and any reinsurer are While many taxpayers will find that the. Over the years, profits and surplus may accumulate to sizable amounts and may be distributed to the owner(s) of the captive insurance company under favorable income tax rates. Benefits of a captive include the ability to tailor coverage for hard to insure or emerging risks, apply alternative strategies to deal with insurance market cycles, provide financial incentives for loss control, offer flexibility in managing risk, offer creative insurance solutions, allocate costs to business units, and consolidate risk management. The parent company pays insurance premiums to its captive insurance company and seeks to deduct these premiums in its home.

Source: sftaxcounsel.com

Source: sftaxcounsel.com

Use of captives opens numerous issues which have ramifications for federal income tax purposes. Some professionals recommend captive insurance as the greatest thing since sliced bread. The tax concept of a captive insurance company is relatively simple. When a captive returns surplus to its owners, the tax rate will remain at 23.8 percent. Captive insurance companies are usually taxed on underwriting income after required adjustments for tax purposes.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title captive insurance tax implications by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea