Captive insurance vs self insurance Idea

Home » Trending » Captive insurance vs self insurance IdeaYour Captive insurance vs self insurance images are ready in this website. Captive insurance vs self insurance are a topic that is being searched for and liked by netizens today. You can Get the Captive insurance vs self insurance files here. Get all free vectors.

If you’re looking for captive insurance vs self insurance images information related to the captive insurance vs self insurance interest, you have visit the right site. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly search and find more informative video articles and images that match your interests.

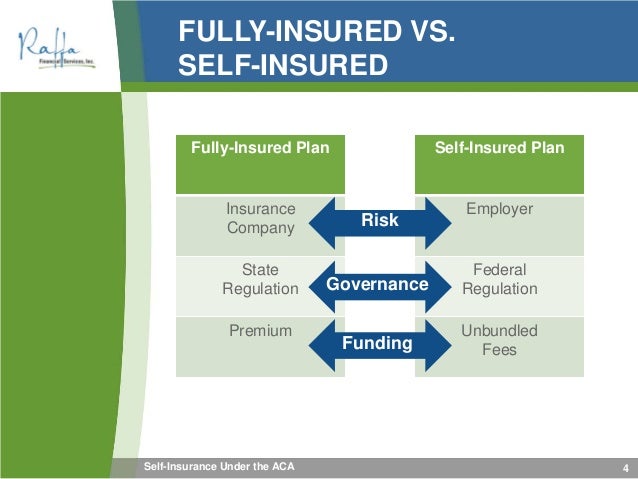

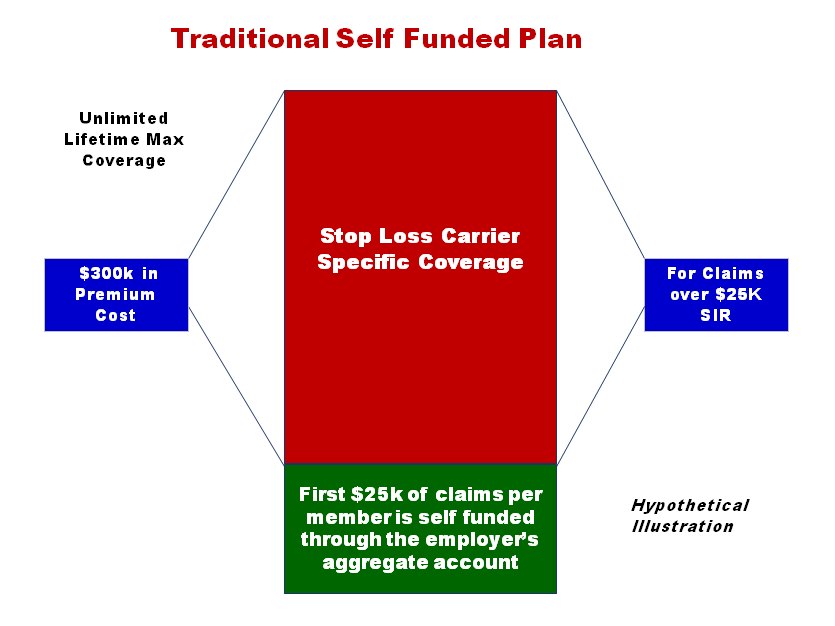

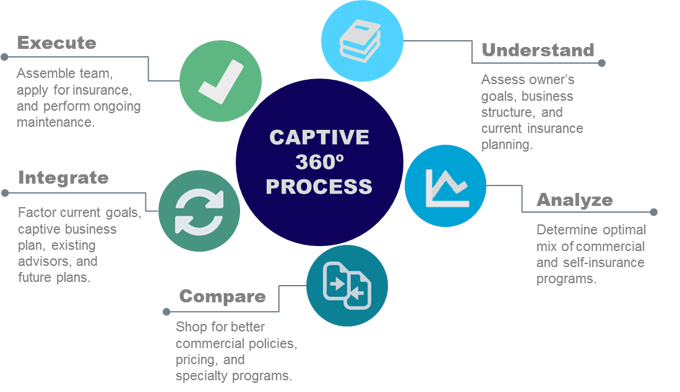

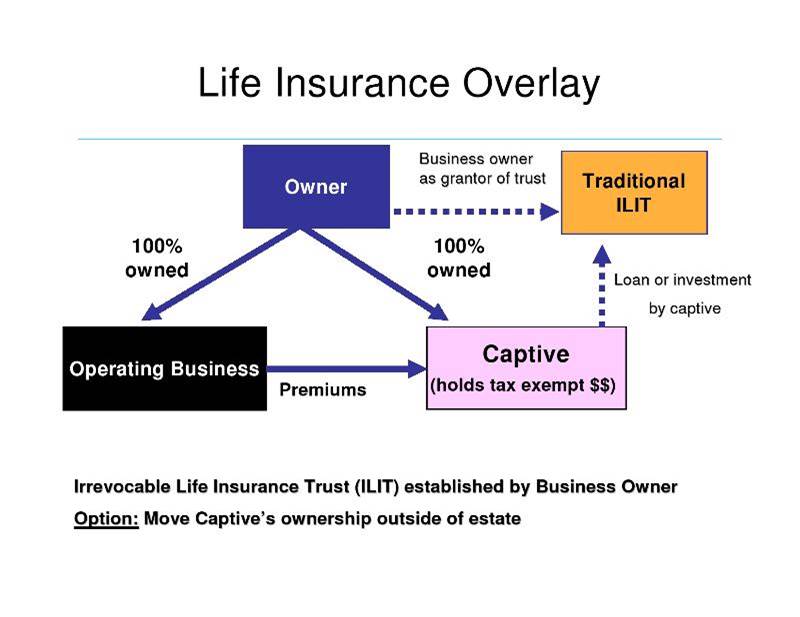

Captive Insurance Vs Self Insurance. Instead of paying to use a commercial insurer’s money, the owner invests their own capital and resources, assuming a portion of the risk. A captive insurance company is a self insurance model that allows a company to create it�s own insurance company which insures the risk to the company. Therefore, it’s up to you to choose. Financial control are the key words here.

Pitfalls of Captive Insurance for Health Benefits From pinterest.com

Pitfalls of Captive Insurance for Health Benefits From pinterest.com

What’s the difference between captive insurance and being self insured? Financial control are the key words here. Which is the best cover for you. It instead spends that money on an insurance company. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; Instead of paying to use a commercial insurer’s money, the owner invests their own capital and resources, assuming a portion of the risk.

In this post, we will focus on two of them:

Which is the best cover for you. Which is the best cover for you. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; Last week, we defined what an insurance captive is and the 3 most common types of captives. The balance is assumed by another insurance company known as a “reinsurance. A captive insurance company is a self insurance model that allows a company to create it�s own insurance company which insures the risk to the company.

Source: slideshare.net

Source: slideshare.net

Healthcare captives can be streamlined to meet your company’s needs: These losses are caused by realized business risk. Which is the best cover for you. In this post, we will focus on two of them: Captive insurance, on the other hand, is more formal because it is a small insurance company.

Source: slideshare.net

Source: slideshare.net

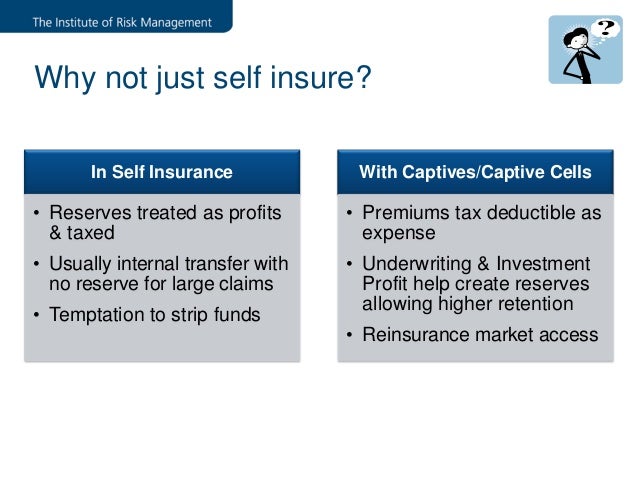

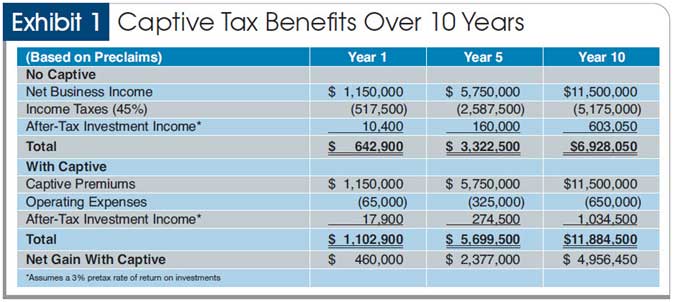

Captives typically will fund anticipated losses upfront in the form of premiums. A captive insurance company is a subsidiary of a business owner(s) company that writes the insurance policies for the business owner’s company. The company pays into its captive a premium that is invested and grows in the markets, creating even more available funds to satisfy the claims made to the captive from the company. But there are also significant differences. Captive insurance operates according to principles similar to self insurance, but captive insurance is a bit more complicated and costly to maintain.

Source: frontfin.wordpress.com

Source: frontfin.wordpress.com

In a captive insurance arrangement, however, the insured creates a more formal arrangement for insuring against its unique business risks via the creation of its own. The principal benefit of captive insurance over self insurance is that depending on the policy limits that a company purchases, captive insurance can often cover a much larger percentage of. Therefore, it’s up to you to choose. A captive insurance company is a self insurance model that allows a company to create it�s own insurance company which insures the risk to the company. These losses are caused by realized business risk.

Source: researchgate.net

Source: researchgate.net

Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. In short, captive health insurance resides in a subsidiary company of the parent company that is set up for one purpose only: It is, however, the better choice if you like the idea of general instance but want the ability. Financial control are the key words here. The balance is assumed by another insurance company known as a “reinsurance.

Source: captivenation.com

Source: captivenation.com

Captives typically will fund anticipated losses upfront in the form of premiums. The balance is assumed by another insurance company known as a “reinsurance. However, if this risk is not realized, all the premium payments go to waste. Which is the best cover for you. Last week, we defined what an insurance captive is and the 3 most common types of captives.

Source: captivenation.com

Source: captivenation.com

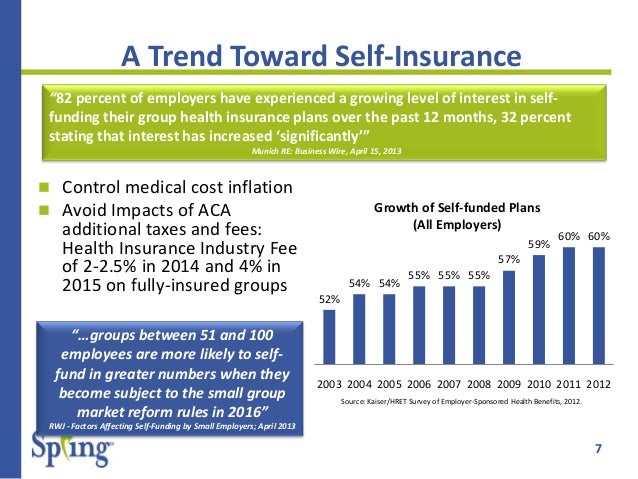

Health insurance costs are on the rise. But there are also significant differences. Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. Health insurance costs are on the rise. It is, however, the better choice if you like the idea of general instance but want the ability.

Source: captiveinternational.com

Source: captiveinternational.com

Captives typically will fund anticipated losses upfront in the form of premiums. Captive insurance, on the other hand, is more formal because it is a small insurance company. When employer claims are extensive, a group captive absorbs the shock. The principal benefit of captive insurance over self insurance is that depending on the policy limits that a company purchases, captive insurance can often cover a much larger percentage of. In this post, we will focus on two of them:

Source: benefitcorp.com

Source: benefitcorp.com

This can lower costs of monthly premiums for a company but, initially, may require more overhead. What’s the difference between captive insurance and being self insured? Healthcare captives can be streamlined to meet your company’s needs: These losses are caused by realized business risk. It is, however, the better choice if you like the idea of general instance but want the ability.

Source: pinterest.com

Source: pinterest.com

Captive owners typically earn investment income on premium and any cash collateral during the period whereby losses are paid. The company pays into its captive a premium that is invested and grows in the markets, creating even more available funds to satisfy the claims made to the captive from the company. Health insurance costs are on the rise. In short, captive health insurance resides in a subsidiary company of the parent company that is set up for one purpose only: It is, however, the better choice if you like the idea of general instance but want the ability.

Source: captivenation.us

Source: captivenation.us

It instead spends that money on an insurance company. Captive owners typically earn investment income on premium and any cash collateral during the period whereby losses are paid. Healthcare captives can be streamlined to meet your company’s needs: Health insurance costs are on the rise. A captive insurance company is a self insurance model that allows a company to create it�s own insurance company which insures the risk to the company.

Source: slideshare.net

Source: slideshare.net

Health insurance costs are on the rise. Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. A captive insurance company is a self insurance model that allows a company to create it�s own insurance company which insures the risk to the company. In a captive insurance arrangement, however, the insured creates a more formal arrangement for insuring against its unique business risks via the creation of its own. A captive insurance company is a subsidiary of a business owner(s) company that writes the insurance policies for the business owner’s company.

Source: capstoneassociated.com

Source: capstoneassociated.com

This does not mean captive insurance is the solution to your problems. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; The principal benefit of captive insurance over self insurance is that depending on the policy limits that a company purchases, captive insurance can often cover a much larger percentage of. These points do not clearly distinguish the captive insurer from a mutual insurance company. Therefore, it’s up to you to choose.

Source: slideserve.com

Source: slideserve.com

It is, however, the better choice if you like the idea of general instance but want the ability. The principal benefit of captive insurance over self insurance is that depending on the policy limits that a company purchases, captive insurance can often cover a much larger percentage of. These losses are caused by realized business risk. In short, captive health insurance resides in a subsidiary company of the parent company that is set up for one purpose only: When employer claims are extensive, a group captive absorbs the shock.

Source: sawgrassbenefits.com

Source: sawgrassbenefits.com

A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; The principal benefit of captive insurance over self insurance is that depending on the policy limits that a company purchases, captive insurance can often cover a much larger percentage of. These losses are caused by realized business risk. The company pays into its captive a premium that is invested and grows in the markets, creating even more available funds to satisfy the claims made to the captive from the company.

Source: everlongcaptive.com

Source: everlongcaptive.com

To provide health insurance to the parent company’s employees. He’s subjected to the same rules as any other insurance company but he can ‘customize’ his coverage as he sees fit. A captive insurance company is a self insurance model that allows a company to create it�s own insurance company which insures the risk to the company. In a captive insurance arrangement, however, the insured creates a more formal arrangement for insuring against its unique business risks via the creation of its own. It is, however, the better choice if you like the idea of general instance but want the ability.

Source: unityfinancial.net

Source: unityfinancial.net

This does not mean captive insurance is the solution to your problems. This does not mean captive insurance is the solution to your problems. Captive insurance, on the other hand, is more formal because it is a small insurance company. Captives typically will fund anticipated losses upfront in the form of premiums. What’s the difference between captive insurance and being self insured?

Source: capstoneassociated.com

Source: capstoneassociated.com

In a captive insurance arrangement, however, the insured creates a more formal arrangement for insuring against its unique business risks via the creation of its own. A captive insurance company is a subsidiary of a business owner(s) company that writes the insurance policies for the business owner’s company. Which is the best cover for you. Healthcare captives can be streamlined to meet your company’s needs: However, if this risk is not realized, all the premium payments go to waste.

Financial control are the key words here. Instead of paying to use a commercial insurer’s money, the owner invests their own capital and resources, assuming a portion of the risk. It is, however, the better choice if you like the idea of general instance but want the ability. He’s subjected to the same rules as any other insurance company but he can ‘customize’ his coverage as he sees fit. The principal benefit of captive insurance over self insurance is that depending on the policy limits that a company purchases, captive insurance can often cover a much larger percentage of.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title captive insurance vs self insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea