Captive vs independent insurance agent information

Home » Trending » Captive vs independent insurance agent informationYour Captive vs independent insurance agent images are available in this site. Captive vs independent insurance agent are a topic that is being searched for and liked by netizens now. You can Get the Captive vs independent insurance agent files here. Find and Download all royalty-free photos and vectors.

If you’re searching for captive vs independent insurance agent pictures information related to the captive vs independent insurance agent topic, you have pay a visit to the ideal blog. Our site always gives you hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Captive Vs Independent Insurance Agent. If given a choice to invest time, effort, and money into myself or someone else’s company, i would choose myself. Independent agents can quote multiple companies to find the best policy and price. As an independent agent, you�ll be paid only on commission, so you�re always out to close. What is an independent agent?

Captive Insurance Agent PROS and CONS Jeremy Smith Academy From jeremysmithacademy.com

Captive Insurance Agent PROS and CONS Jeremy Smith Academy From jeremysmithacademy.com

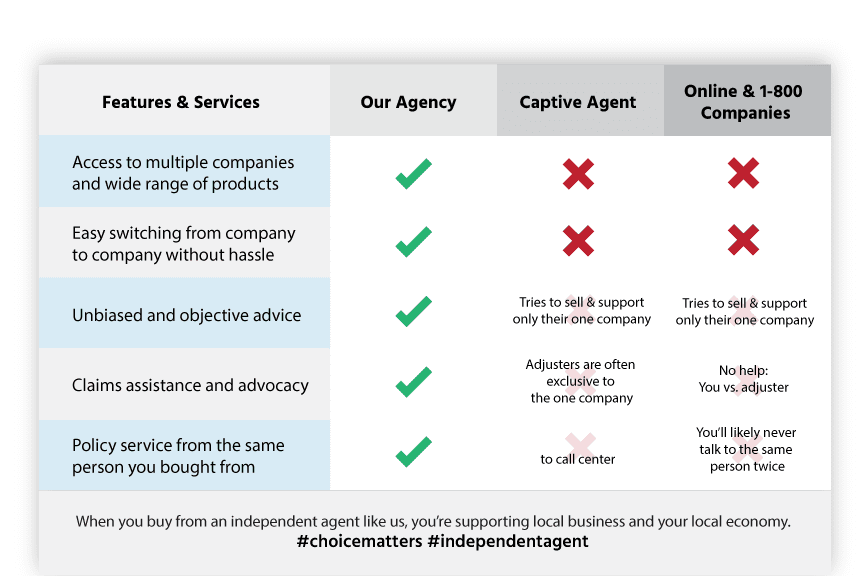

There is a big difference between a captive and an independent life insurance agent. They may also have different types of agents with a range of licenses and specialties in commercial or personal. A captive agent can offer you products from one insurer, while independent agents can provide you with 100 or more products from which to choose. Contrary to a captive agent, an independent agent is an insurance agent that sells insurance policies from many different insurance companies. They only have specific knowledge about the few policies and products available through their company. That’s essentially the biggest distinction, but like anything, the devil is in the details.

Captive and independent insurance agents also have some major differences.

The underwriters, claims team, and. As part of the relationship between the captive carrier and the captive agent, agents in these positions can typically only sell the carrier�s product lines and cannot offer additional options to their clients. Captive and independent insurance agents also have some major differences. If given a choice to invest time, effort, and money into myself or someone else’s company, i would choose myself. Knowing the differences between the two can save you time and money. In some cases, independent agents can even make 50 percent more than captive agents on each sale.

Source: youtube.com

Source: youtube.com

If given a choice to invest time, effort, and money into myself or someone else’s company, i would choose myself. They may also have different types of agents with a range of licenses and specialties in commercial or personal. That is another advantage that an independent insurance agent has over a captive agent. Captive agents are only allowed to sell policies through one insurance company. A captive agent can offer you products from one insurer, while independent agents can provide you with 100 or more products from which to choose.

Source: pinterest.com

Source: pinterest.com

They only have specific knowledge about the few policies and products available through their company. Those details include how agents are paid, how they market, how they get leads, and more. They only have specific knowledge about the few policies and products available through their company. They do not have any target to meet. Many new agents are attracted to this option, either because of the training programs or the compensation structures they offer.

Source: priorityrisk.com

Source: priorityrisk.com

The biggest difference between captive and independent insurance agents is in compensation. An independent insurance agent either works for an independent agency or as their own boss. Captive agencies are more like traditional employers. Working with an independent agent versus a captive agent. So what is an independent insurance agent vs.

Source: insurancesplash.com

Source: insurancesplash.com

A captive agent sells insurance from one company and can. A captive agent can only show you quotes from one company, the company he or she represents. Captive insurance agents can find that retaining a customer in the books of their company is quite challenging. Ultimately, you will buy a policy from an agent. The underwriters, claims team, and.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

As an independent agent, i have more control over how i live and organize my work. In some cases, independent agents can even make 50 percent more than captive agents on each sale. Captive agencies are more like traditional employers. They do this because their carrier either does not write commercial insurance at all or it is a sideline for them. In this post, i will go over some of the questions you need to ask your agent to see if he/she is a.

Source: nkyinsurance.com

Source: nkyinsurance.com

They do this because their carrier either does not write commercial insurance at all or it is a sideline for them. Knowing the differences between the two can save you time and money. Going captive can be a great starting point as you embark on your insurance career, since it can be difficult to get up and running without the support you. Independent agents represent, in some cases, over 100 insurance companies. As an independent agent, i have more control over how i live and organize my work.

Source: lsminsurance.ca

Source: lsminsurance.ca

On the other hand, independent agents are contracted to work with a variety of insurance companies and can sell policies from multiple providers. An independent agent represents more than one insurance company and is free to recommend the insurance company they feel is best to serve their policyholders’ needs.; Captive and independent insurance agents can enjoy lucrative careers and can be recognized as respected members of their communities and enjoy the benefits of being licensed agents. This will benefit you, as you will be given proper time, guidance and support. Independent agents can quote multiple companies to find the best policy and price.

Source: agencyrevolution.com

Source: agencyrevolution.com

Generally, a captive agent represents one insurance company exclusively while an independent agent represents multiple insurance companies. They do this because their carrier either does not write commercial insurance at all or it is a sideline for them. They do not have any target to meet. However, the differences really begin to show up when a closer look is taken at who each agent works for and how they conduct business. If you plan to buy life insurance , or if you have a friend or loved one who wants to purchase life insurance, it is important to know the differences between captive life insurance agents and independent life.

Source: getsafeharbor.com

Source: getsafeharbor.com

There is a big difference between a captive and an independent life insurance agent. Ultimately, you will buy a policy from an agent. In this post, i will go over some of the questions you need to ask your agent to see if he/she is a. Captive agencies are more like traditional employers. Independent agents tend to make more on each sale they make.

Source: pinterest.com

Source: pinterest.com

However, the differences really begin to show up when a closer look is taken at who each agent works for and how they conduct business. As part of the relationship between the captive carrier and the captive agent, agents in these positions can typically only sell the carrier�s product lines and cannot offer additional options to their clients. Imagine the limitations of that position. Captive and independent insurance agents can enjoy lucrative careers and can be recognized as respected members of their communities and enjoy the benefits of being licensed agents. #1 independent agents have access to many insurance companies.

Source: valueinsuranceinc.com

Source: valueinsuranceinc.com

Working with an independent agent versus a captive agent. If given a choice to invest time, effort, and money into myself or someone else’s company, i would choose myself. Captive insurance agents can find that retaining a customer in the books of their company is quite challenging. Working with an independent agent versus a captive agent. Those details include how agents are paid, how they market, how they get leads, and more.

Source: jblbinsurance.com

Source: jblbinsurance.com

A captive agent is one who works for a company, either an agency or an insurance carrier. Major insurance carriers like farmers, geico and state farm, to only name a few, use captive insurance agents to sell their products. Typically, independent insurance agents take home a higher percentage of the sales they make, sometimes earning commissions as much as 50% higher than their exclusive agent counterparts. A captive agent can offer you products from one insurer, while independent agents can provide you with 100 or more products from which to choose. If given a choice to invest time, effort, and money into myself or someone else’s company, i would choose myself.

Source: westernpacig.com

Source: westernpacig.com

Those details include how agents are paid, how they market, how they get leads, and more. A captive agent can only show you quotes from one company, the company he or she represents. While these differences are significant, perhaps the most important difference is in what each type of agent can expect to make. A captive agent is one who works for a company, either an agency or an insurance carrier. Independent agents can quote multiple companies to find the best policy and price.

Source: thebrokerageinc.com

Source: thebrokerageinc.com

Independent agents represent, in some cases, over 100 insurance companies. The biggest difference between captive agents and independent agents is the amount of choice they can offer their clients. Many new agents are attracted to this option, either because of the training programs or the compensation structures they offer. Going captive can be a great starting point as you embark on your insurance career, since it can be difficult to get up and running without the support you. As an independent agent, you�ll be paid only on commission, so you�re always out to close.

Source: getsafeharbor.com

Source: getsafeharbor.com

A captive agent sells insurance from one company and can. Independent agents are not considered employees of a single company. Going captive can be a great starting point as you embark on your insurance career, since it can be difficult to get up and running without the support you. Captive agencies (state farm, allstate, farmers, and more) a captive agency is a type of insurance company that operates in a closed environment. Generally, a captive agent represents one insurance company exclusively while an independent agent represents multiple insurance companies.

Source: knoxvilleinsurancegroup.com

Source: knoxvilleinsurancegroup.com

They may also have different types of agents with a range of licenses and specialties in commercial or personal. Captive and independent insurance agents also have some major differences. Typically, independent insurance agents take home a higher percentage of the sales they make, sometimes earning commissions as much as 50% higher than their exclusive agent counterparts. A captive agent sells insurance from one company and can. So what is an independent insurance agent vs.

Source: pinterest.com

Source: pinterest.com

As an independent agent, i have more control over how i live and organize my work. They may also have different types of agents with a range of licenses and specialties in commercial or personal. The biggest difference between captive and independent insurance agents is in compensation. You can spot the difference between these two once you work with an independent agent to shop for life insurance. Another significant difference between the typical captive insurance company, and the typical independent insurance agency, is that that most captive insurance agents focus almost exclusively on personal insurance.

Source: jeremysmithacademy.com

Source: jeremysmithacademy.com

Another significant difference between the typical captive insurance company, and the typical independent insurance agency, is that that most captive insurance agents focus almost exclusively on personal insurance. Captive insurance agents can find that retaining a customer in the books of their company is quite challenging. What is an independent agent? Many new agents are attracted to this option, either because of the training programs or the compensation structures they offer. Captive and independent insurance agents also have some major differences.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title captive vs independent insurance agent by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea