Car finance payment protection insurance information

Home » Trend » Car finance payment protection insurance informationYour Car finance payment protection insurance images are available. Car finance payment protection insurance are a topic that is being searched for and liked by netizens now. You can Get the Car finance payment protection insurance files here. Get all free vectors.

If you’re searching for car finance payment protection insurance images information linked to the car finance payment protection insurance interest, you have pay a visit to the right blog. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Car Finance Payment Protection Insurance. A car loan protection insurance policy will cover the debt on your vehicle in the event of your death, disability, development of a dread disease or retrenchment. This may be as a result of illness, accident, death or unemployment and will be covered on your policy. However some mortgage payment protection policies are targeted towards homeowners, so they’ll payout enough to cover your mortgage payments as well as a certain extra. Loan protection insurance is designed to help policyholders by providing financial support in times of need.

How Payment Protection Insurance Can Best Serve You From bizadvisors.net

How Payment Protection Insurance Can Best Serve You From bizadvisors.net

23/07/2020 | estimated reading time: Payment protection insurance (ppi) was usually sold with products that you need to make repayments on, like a loan,. Vehicle and the finance contract you’ve arranged. Loan protection insurance is a type of income protection insurance designed to cover your. When you are applying for your auto loan, you may be asked if you want to buy credit insurance. Payment protection insurance (ppi), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt.

The policy cover options are specific to the policyholder�s source of income at the time of entering into a credit contract.

You simply can�t predict the future, although you can prepare for it. Credit insurance is optional insurance that make your auto payments to your lender in certain situations, such as if you die or become disabled. Payment protection insurance is a policy which covers the policyholder for the monthly instalments on their credit contract in the event that they suffer an insured event below. Yes i am now at the address when agreement was taken out.i have the letter from direct auto financial services and says that i didnt owe anything for the car as i paid more the 50% but insurance amount required was 1300 less rebate 280. Whether the need is due to disability or unemployment, this insurance can help cover. For peace of mind alongside your motor finance, guaranteed asset protection (gap) insurance could protect you against losses that can occur in the event of your vehicle being written off or stolen.

Source: johnlewisfinance.com

Source: johnlewisfinance.com

Typically, you can protect up to 70% of your annual income and a ppi policy will provide payouts for up to 12 months if your claim is successful. We will assist by helping you to meet your finance contract repayments in accordance with the cover offered under this policy. Loan protection insurance is a type of life insurance that protects your loan payments in the event of an accident or death. 23/07/2020 | estimated reading time: Autosure payment protection insurance (ppi) protects you for the repayment of your loan obligations to the financier if you suffer an insured event.

Source: in.pinterest.com

Source: in.pinterest.com

Payment protection insurance (ppi) was usually sold with products that you need to make repayments on, like a loan,. Payment protection insurance is a policy which covers the policyholder for the monthly instalments on their credit contract in the event that they suffer an insured event below. Before deciding to buy credit insurance, think about your choices and about the cost of this insurance. When you are applying for your auto loan, you may be asked if you want to buy credit insurance. Car finance payment protection insurance.

Source: firstprioritycu.com

Source: firstprioritycu.com

Your motor insurance will pay out what the vehicle is worth at the time of a claim, but doesn’t cover what you may still owe on your car finance. Payment protection insurance is a policy which covers the policyholder for the monthly instalments on their credit contract in the event that they suffer an insured event below. This may be as a result of illness, accident, death or unemployment and will be covered on your policy. Loan protection insurance is a type of income protection insurance designed to cover your. Loan protection insurance is a type of income protection insurance designed to cover your loan repayments if you lose your job or find yourself unable to work due to an accident or illness.

Source: cuone.org

Source: cuone.org

Payment protection insurance (ppi) was usually sold with products that you need to make repayments on, like a loan,. My partner bought a car years ago through advantage car finance and after a few years had it repossessed, well he has already paid £4,800 back through his detachment of earnings. Autosure payment protection insurance (ppi) protects you for the repayment of your loan obligations to the financier if you suffer an insured event. Loan protection insurance is designed to help policyholders by providing financial support in times of need. A car loan protection insurance policy will cover the debt on your vehicle in the event of your death, disability, development of a dread disease or retrenchment.

Source: carsdirect.com

Source: carsdirect.com

It can cover various types of debt, including car finance, credit cards, mortgages and more. Your finance protection insurance policy provides you with assistance by helping you to meet your finance contract repayments if you are made redundant or unable to work due to illness or injury. Your policy will help assist in covering your finance repayments for up to 180. You simply can�t predict the future, although you can prepare for it. Mortgage payment protection insurance (mppi) and payment protection insurance are both types of income protection, and they’re each intended to help you repay certain debts.

Source: carfinance2u.co.nz

Source: carfinance2u.co.nz

For peace of mind alongside your motor finance, guaranteed asset protection (gap) insurance could protect you against losses that can occur in the event of your vehicle being written off or stolen. This could be due to sickness, an accident or involuntary unemployment. Payment protection insurance (ppi) yes car credit/ direct auto finance. Whether the need is due to disability or unemployment, this insurance can help cover. Your finance protection insurance policy provides you with assistance by helping you to meet your finance contract repayments if you are made redundant or unable to work due to illness or injury.

Source: onlinecarloans.co.nz

Source: onlinecarloans.co.nz

This means that if you are unable to make your loan payments due to injury or death, it can cover those payments for you. Loan protection insurance is a type of life insurance that protects your loan payments in the event of an accident or death. Your finance protection insurance policy provides you with assistance by helping you to meet your finance contract repayments if you are made redundant or unable to work due to illness or injury. Typically, you can protect up to 70% of your annual income and a ppi policy will provide payouts for up to 12 months if your claim is successful. Protect yourself from failing to make payments by choosing payment protection insurance.

Source: pinterest.com

Source: pinterest.com

Whether the need is due to disability or unemployment, this insurance can help cover. Vehicle and the finance contract you’ve arranged. Payment protection insurance is a policy which covers the policyholder for the monthly instalments on their credit contract in the event that they suffer an insured event below. Loan protection insurance is a type of income protection insurance designed to cover your loan repayments if you lose your job or find yourself unable to work due to an accident or illness. Autosure payment protection insurance (ppi) protects you for the repayment of your loan obligations to the financier if you suffer an insured event.

Source: pinterest.com

Source: pinterest.com

Payment protection insurance (ppi) is a form of income protection that covers monthly debt repayments if you’re unable to work. For peace of mind alongside your motor finance, guaranteed asset protection (gap) insurance could protect you against losses that can occur in the event of your vehicle being written off or stolen. Payment protection insurance (ppi) is insurance that will pay out a sum of money to help you cover your monthly repayments on mortgages, loans, credit/store cards or catalogue payments if you are unable to work. However some mortgage payment protection policies are targeted towards homeowners, so they’ll payout enough to cover your mortgage payments as well as a certain extra. You�ve just bought a home or car, taken out a personal loan or received a new credit card.

Source: bizadvisors.net

Source: bizadvisors.net

You simply can�t predict the future, although you can prepare for it. Should you become disabled as a result of an injury, contract a serious illness, or even pass away, your loved ones may find themselves unable to continue paying your outstanding debt. Payment protection insurance (ppi) is a form of income protection that covers monthly debt repayments if you’re unable to work. Autosure payment protection insurance (ppi) protects you for the repayment of your loan obligations to the financier if you suffer an insured event. Typically, you can protect up to 70% of your annual income and a ppi policy will provide payouts for up to 12 months if your claim is successful.

Source: bannerfcu.org

Source: bannerfcu.org

Payment protection insurance is available with some finance companies that bundle it with loans or offer it to those paying off a lease or loan that could help you with car payments if you lose your job. Helps you with your car loan repayments, should the unexpected happen. Payment protection insurance is available with some finance companies that bundle it with loans or offer it to those paying off a lease or loan that could help you with car payments if you lose your job. Payment protection insurance (ppi) was usually sold with products that you need to make repayments on, like a loan,. Payment protection insurance (ppi) yes car credit/ direct auto finance.

Source: pinterest.com

Source: pinterest.com

It can cover various types of debt, including car finance, credit cards, mortgages and more. This toyota insurance finance protection policy has been designed to provide a choice of two levels of protection for your vehicle finance. Protect yourself from failing to make payments by choosing payment protection insurance. This means that if you are unable to make your loan payments due to injury or death, it can cover those payments for you. This could be due to sickness, an accident or involuntary unemployment.

Source: pinterest.com

Source: pinterest.com

Typically, you can protect up to 70% of your annual income and a ppi policy will provide payouts for up to 12 months if your claim is successful. Car finance payment protection insurance. Helps you with your car loan repayments, should the unexpected happen. Payment protection insurance will normally pay your monthly payments on any motor vehicle finance agreement, mortgage, or any type of loan if. Credit insurance is optional insurance that make your auto payments to your lender in certain situations, such as if you die or become disabled.

Source: pinterest.com

Source: pinterest.com

You�ve just bought a home or car, taken out a personal loan or received a new credit card. This means that if you are unable to make your loan payments due to injury or death, it can cover those payments for you. Mortgage payment protection insurance (mppi) and payment protection insurance are both types of income protection, and they’re each intended to help you repay certain debts. The benefits are payable directly to the financier and the policy cover options are specific to your source of income at the time of entering into a credit contract. However some mortgage payment protection policies are targeted towards homeowners, so they’ll payout enough to cover your mortgage payments as well as a certain extra.

Source: pgafcu.org

Source: pgafcu.org

23/07/2020 | estimated reading time: The policy cover options are specific to the policyholder�s source of income at the time of entering into a credit contract. Payment protection insurance is a policy which covers the policyholder for the monthly instalments on their credit contract in the event that they suffer an insured event below. Your motor insurance will pay out what the vehicle is worth at the time of a claim, but doesn’t cover what you may still owe on your car finance. Your policy will help assist in covering your finance repayments for up to 180.

Source: cfsfinance.co.nz

Source: cfsfinance.co.nz

This may be as a result of illness, accident, death or unemployment and will be covered on your policy. 23/07/2020 | estimated reading time: You simply can�t predict the future, although you can prepare for it. Payment protection insurance is available with some finance companies that bundle it with loans or offer it to those paying off a lease or loan that could help you with car payments if you lose your job. Before deciding to buy credit insurance, think about your choices and about the cost of this insurance.

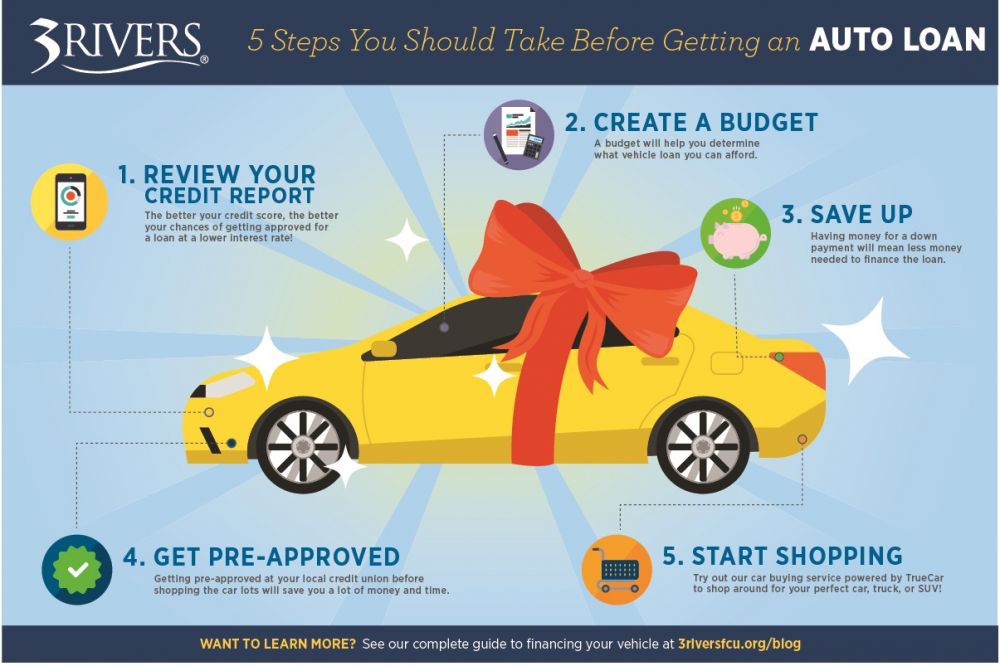

Source: 3riversfcu.org

Source: 3riversfcu.org

Whether the need is due to disability or unemployment, this insurance can help cover. The policy cover options are specific to the policyholder�s source of income at the time of entering into a credit contract. Loan protection insurance is a type of income protection insurance designed to cover your loan repayments if you lose your job or find yourself unable to work due to an accident or illness. Payment protection insurance (ppi) was usually sold with products that you need to make repayments on, like a loan,. Autosure payment protection insurance (ppi) protects you for the repayment of your loan obligations to the financier if you suffer an insured event.

Source: cfsfinance.co.nz

Source: cfsfinance.co.nz

Car finance payment protection insurance. Payment protection insurance (ppi) was usually sold with products that you need to make repayments on, like a loan,. Car finance payment protection insurance. Loan protection insurance is a type of life insurance that protects your loan payments in the event of an accident or death. This means that if you are unable to make your loan payments due to injury or death, it can cover those payments for you.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title car finance payment protection insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information