Car insurance continuous coverage information

Home » Trending » Car insurance continuous coverage informationYour Car insurance continuous coverage images are available in this site. Car insurance continuous coverage are a topic that is being searched for and liked by netizens now. You can Find and Download the Car insurance continuous coverage files here. Download all free images.

If you’re searching for car insurance continuous coverage images information connected with to the car insurance continuous coverage topic, you have pay a visit to the ideal site. Our site frequently gives you hints for refferencing the highest quality video and image content, please kindly search and locate more informative video articles and graphics that fit your interests.

Car Insurance Continuous Coverage. Car insurance provides protection from losses resulting from owning and operating a car or vehicle. As i mentioned, i went without a car until i bought a new one in 2005. Newly licensed youth drivers may have a difficult time finding coverage with a preferred carrier on their own, so it�s best to start by being listed on a parent�s insurance policy. While you have and drive your vehicle, you must maintain minimum, continuous, insurance liability coverage.

Progressive Auto Insurance Reviews Policy Advice From policyadvice.net

Progressive Auto Insurance Reviews Policy Advice From policyadvice.net

Another thing to keep in mind is eligibility. Get all the details here. You can save up to 15 percent with a continuous coverage car insurance discount not all car insurance companies offer this type of discount You want to maintain continuous auto insurance coverage. Save up to 15% for not allowing your car insurance to lapse. Continuous insurance enforcement came into force in 2011.

Drivers maintaining continuous motorcycle insurance service members can obtain insurance without prior coverage due to deployment or training on base.

Certain companies will not sell a policy to drivers who haven�t maintained continuous coverage for a certain duration. Catastrophe a disaster affecting a specific geographic area. A break in your coverage—even if you didn�t own a car during that period—can make it harder to get auto insurance later on or make it more expensive. Drivers maintaining continuous motorcycle insurance service members can obtain insurance without prior coverage due to deployment or training on base. Carrier the insurance company or insurer. Get all the details here.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

Find out about insurance discounts for continuous coverage and what you’ll need to qualify. Get all the details here. Another thing to keep in mind is eligibility. A break in your coverage—even if you didn�t own a car during that period—can make it harder to get auto insurance later on or make it more expensive. Other car insurance companies offer no discounts whatsoever.

Source: motor1.com

Source: motor1.com

Some insurers offer continuous coverage car insurance discounts of 5% to 10%. As i mentioned, i went without a car until i bought a new one in 2005. That £30 goes to fund payments to victims of uninsured drivers made by the motor insurance bureau (mib). Looking for the best deals on a continuous coverage discount? Get all the details here.

Source: policyadvice.net

Source: policyadvice.net

Certain companies will not sell a policy to drivers who haven�t maintained continuous coverage for a certain duration. (a) under california law, the state department ofinsurance regulates insurance rates and determines what discounts auto insurance companies can give drivers. This is a little more complicated, but a key difference is that there is no direct fine for going uninsured. Other car insurance companies offer no discounts whatsoever. Continuous insurance coverage means not allowing your auto insurance to lapse or cancel without other coverage in place.

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

The people ofthe state of california find and declare that: The people ofthe state of california find and declare that: For example, the continuous insurance discount from progressive car insurance is determined by how long you’ve had. Continuous insurance coverage means not allowing your auto insurance to lapse or cancel without other coverage in place. While you have and drive your vehicle, you must maintain minimum, continuous, insurance liability coverage.

Source: inspiredluv.com

Source: inspiredluv.com

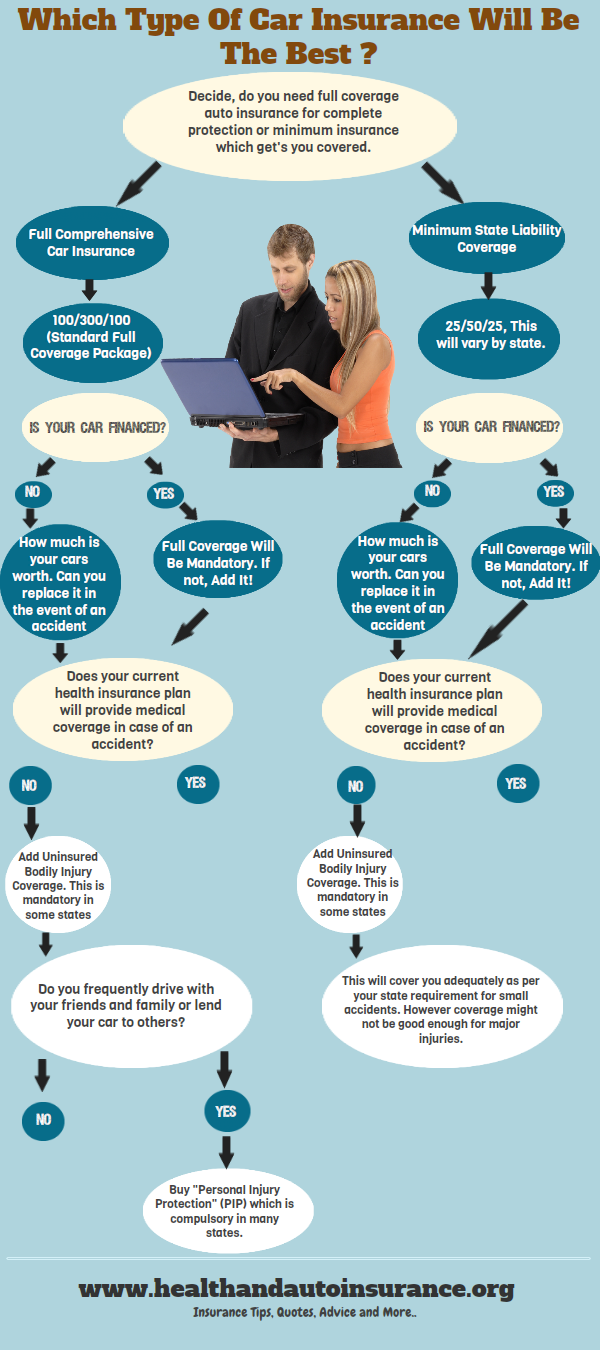

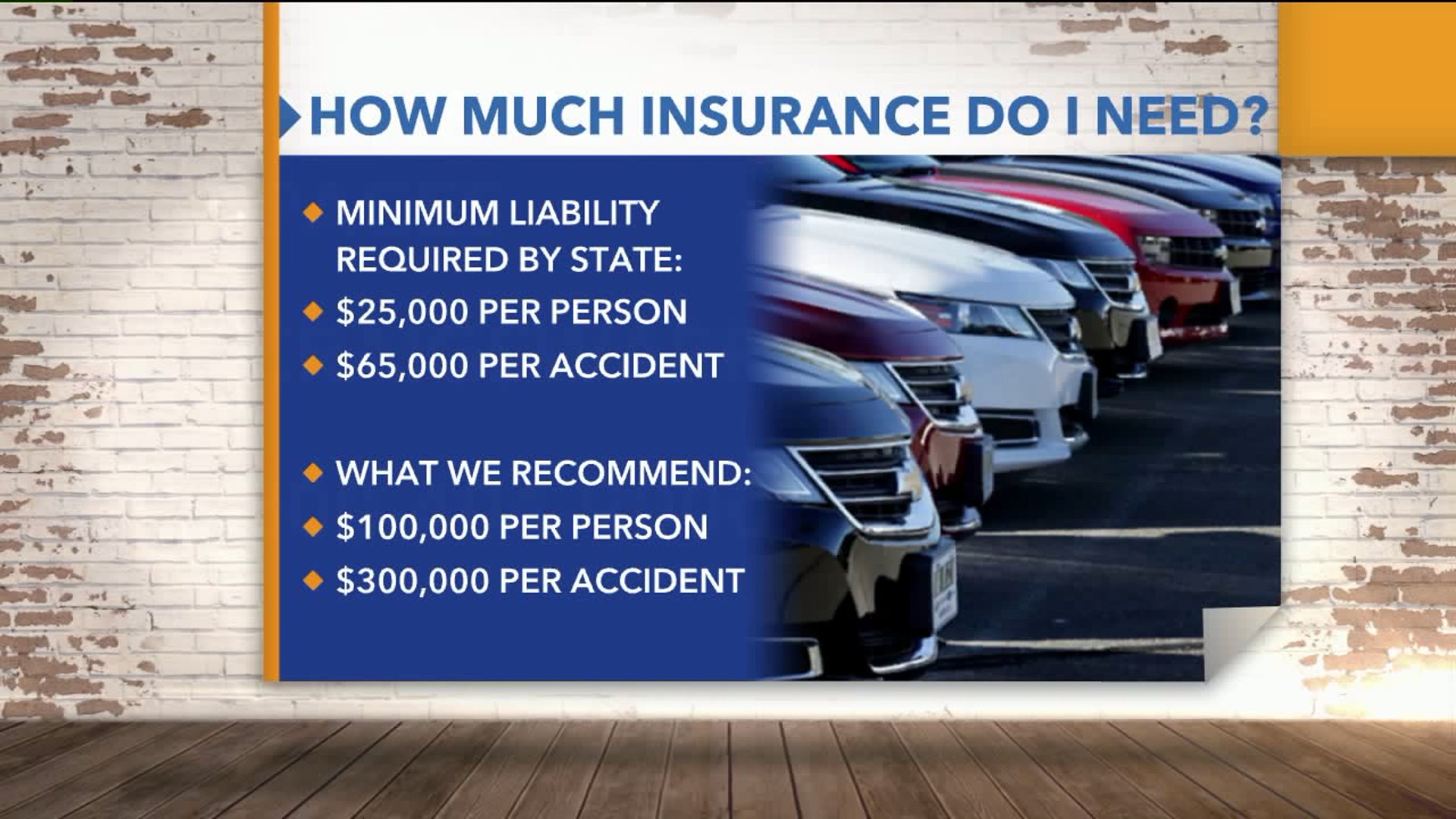

Some insurers offer continuous coverage car insurance discounts of 5% to 10%. The required minimums are shown in the table below: In a case where you had insurance coverage under a company car insurance policy, this information may not appear on a driving record search. Instead, you can be charged more by insurance companies if you have had a gap in your coverage. Drivers maintaining continuous motorcycle insurance service members can obtain insurance without prior coverage due to deployment or training on base.

Source: fox13now.com

Source: fox13now.com

This is a little more complicated, but a key difference is that there is no direct fine for going uninsured. Continuous insurance enforcement came into force in 2011. The continuous coverage auto insurance discount act is gaining some leverage in california as a host of consumer groups have gotten behind the bill. Save up to 15% for not allowing your car insurance to lapse. Companies will handle the discount differently.

Source: allstate.com

Source: allstate.com

Carrier the insurance company or insurer. It is important in the context of both auto and health insurance, as it may have legal ramifications, leave the person susceptible to financial hardship due to an unexpected event, and affect premium rates and eligibility. To be charged the standard rate, you have to keep “continuous coverage.” here’s how it would work. The only prior car insurance history which counts is the continuous auto insurance coverage you have had going back from today. This is a little more complicated, but a key difference is that there is no direct fine for going uninsured.

Source: pinterest.com

Source: pinterest.com

The continuous coverage auto insurance discount act is gaining some leverage in california as a host of consumer groups have gotten behind the bill. For example, the continuous insurance discount from progressive car insurance is determined by how long you’ve had. Continuous insurance coverage means not allowing your auto insurance to lapse or cancel without other coverage in place. Car insurance provides protection from losses resulting from owning and operating a car or vehicle. Instead, you can be charged more by insurance companies if you have had a gap in your coverage.

Source: pinterest.co.uk

Source: pinterest.co.uk

Carrier the insurance company or insurer. That £30 goes to fund payments to victims of uninsured drivers made by the motor insurance bureau (mib). Get all the details here. Another thing to keep in mind is eligibility. The required minimums are shown in the table below:

Source: 4mccutcheon.com

Source: 4mccutcheon.com

The required minimums are shown in the table below: Continuous coverage refers having insurance coverage without any lapses. Continuous coverage car insurance discounts reward drivers who have kept insurance for five or six years without pausing, canceling, or lapsing. You can save up to 15 percent with a continuous coverage car insurance discount not all car insurance companies offer this type of discount Catastrophe a disaster affecting a specific geographic area.

Source: quora.com

Another thing to keep in mind is eligibility. I blogged previously explaining why your current insurance history is the history which is important to your car insurance company. $25,000 per person and $50,000 per accident. The people ofthe state of california find and declare that: Continuous insurance enforcement came into force in 2011.

Source: greatoutdoorsabq.com

Continuous coverage discounts are for drivers who don’t pause or cancel their car insurance for a certain amount of. You can save up to 15 percent with a continuous coverage car insurance discount not all car insurance companies offer this type of discount Carrier the insurance company or insurer. Continuous insurance coverage means not allowing your auto insurance to lapse or cancel without other coverage in place. In a case where you had insurance coverage under a company car insurance policy, this information may not appear on a driving record search.

Source: fullcreate3d.blogspot.com

Source: fullcreate3d.blogspot.com

Another thing to keep in mind is eligibility. You can save up to 15 percent with a continuous coverage car insurance discount not all car insurance companies offer this type of discount When you want to arrange for coverage under your own name, producing a car insurance letter will confirm the fact that you had previously been insured. Some offer the same discount and others base it on certain factors. As i mentioned, i went without a car until i bought a new one in 2005.

Source: insurance.com

Source: insurance.com

Want to save money on your car insurance premiums? When you want to arrange for coverage under your own name, producing a car insurance letter will confirm the fact that you had previously been insured. This measure shall be known as the continuous coverage auto insurance discount act. Insurers like to see a record of uninterrupted care insurance coverage. That £30 goes to fund payments to victims of uninsured drivers made by the motor insurance bureau (mib).

Source: bankeditor.com

Source: bankeditor.com

Save up to 15% for not allowing your car insurance to lapse. As i mentioned, i went without a car until i bought a new one in 2005. This is a little more complicated, but a key difference is that there is no direct fine for going uninsured. Continuous insurance coverage means not allowing your auto insurance to lapse or cancel without other coverage in place. Drivers maintaining continuous motorcycle insurance service members can obtain insurance without prior coverage due to deployment or training on base.

Source: autoinsuranceape.com

Source: autoinsuranceape.com

This measure shall be known as the continuous coverage auto insurance discount act. Injuries to other drivers in accidents that you cause. Instead, you can be charged more by insurance companies if you have had a gap in your coverage. Get all the details here. A break in your coverage—even if you didn�t own a car during that period—can make it harder to get auto insurance later on or make it more expensive.

Source: pinterest.com

Source: pinterest.com

To be charged the standard rate, you have to keep “continuous coverage.” here’s how it would work. Save up to 15% for not allowing your car insurance to lapse. $25,000 per person and $50,000 per accident. The insurance covers losses to the insured�s property and losses for which the insured is liable as a result of owning or operating a car. Drivers maintaining continuous motorcycle insurance service members can obtain insurance without prior coverage due to deployment or training on base.

Source: creditdonkey.com

Source: creditdonkey.com

The people ofthe state of california find and declare that: The insurance covers losses to the insured�s property and losses for which the insured is liable as a result of owning or operating a car. The people ofthe state of california find and declare that: (a) under california law, the state department ofinsurance regulates insurance rates and determines what discounts auto insurance companies can give drivers. For example, the continuous insurance discount from progressive car insurance is determined by how long you’ve had.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title car insurance continuous coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea