Car insurance exemption in income tax Idea

Home » Trend » Car insurance exemption in income tax IdeaYour Car insurance exemption in income tax images are ready in this website. Car insurance exemption in income tax are a topic that is being searched for and liked by netizens today. You can Download the Car insurance exemption in income tax files here. Find and Download all free photos and vectors.

If you’re searching for car insurance exemption in income tax pictures information linked to the car insurance exemption in income tax interest, you have pay a visit to the right site. Our website frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Car Insurance Exemption In Income Tax. If the amount exceeds rm6,000, further deductions can be made in respect of amount spent for official duties. The sum received as death benefit under an insurance policy is fully exempt from tax under section 10 (10d) of the income tax act. The question raised “is car allowance income tax liability”. Using the example of the standard deduction, you would pay tax on only $47,450 if your overall gross income was $60,000 in 2021—that is, $60,000 less the $12,550 standard deduction.

Are insurance payments tax deductible? (Infographics From budgetdirect.com.au

Are insurance payments tax deductible? (Infographics From budgetdirect.com.au

Well, customers can claim tax exemption for premium paid on motor insurance as well. For a list of insurance products that are not subject to the tax, see. For multiple premium policies, you have to pay at least 2 years’ premium to avail the tax exemption. In this case, the lta exemption would be allowed for inr 40,000 which is the actual cost of the journey. (15/26) x last drawn salary* x. There are some of the facts or points you must understand regarding tax exemption on car allowances or fuel reimbursement policy.

There are some of the facts or points you must understand regarding tax exemption on car allowances or fuel reimbursement policy.

The question raised “is car allowance income tax liability”. Using the example of the standard deduction, you would pay tax on only $47,450 if your overall gross income was $60,000 in 2021—that is, $60,000 less the $12,550 standard deduction. The remaining inr 10,000 would be taxed in the hands of the employee Your insurance covers property located in québec. Insurance policies have always been a popular tool to save income tax. There are some of the facts or points you must understand regarding tax exemption on car allowances or fuel reimbursement policy.

Source: quoteinspector.com

Source: quoteinspector.com

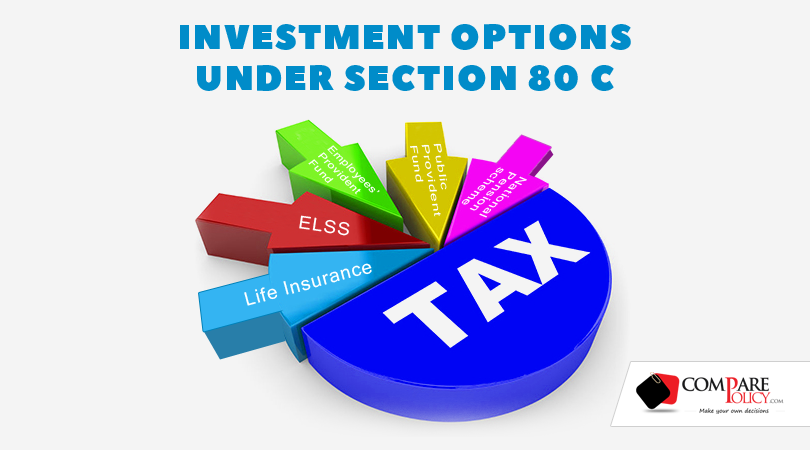

The policy should be one that benefits the policy holder in the long term while enabling him to incur savings on tax payment at the same time. The premium paid in unit linked life insurance policies (ulips) is also eligible for tax exemption under section 80c. The remaining inr 10,000 would be taxed in the hands of the employee Total income from all the heads of income is called as “gross total income” (gti). Using the example of the standard deduction, you would pay tax on only $47,450 if your overall gross income was $60,000 in 2021—that is, $60,000 less the $12,550 standard deduction.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

The remaining inr 10,000 would be taxed in the hands of the employee 28 rows additional exemption of rm8,000 disable child age 18 years old and. Tax exemption limit (per year) petrol, travel, toll allowances. If you qualify for a tax exemption, that income does not need to be claimed on your taxes. However, there are instances where the employees also contribute to the premium payment.

Source: comparepolicy.com

Source: comparepolicy.com

(15/26) x last drawn salary* x. Tax exemption limit (per year) petrol, travel, toll allowances. Insurance policies have always been a popular tool to save income tax. If you use your car strictly for personal use, you likely cannot deduct your car insurance costs on your tax return. To arrive at taxable income, one has to deduct from gti, the deductions allowable under chapter via (i.e., under section 80c to 80u).

Source: noclutter.cloud

Source: noclutter.cloud

However, if the travel tickets amounted to inr 60,000, the exemption would have been available only for inr 50,000 which is the maximum lta paid by the employer. Who qualifies for a tax exemption? Well, customers can claim tax exemption for premium paid on motor insurance as well. However, there are instances where the employees also contribute to the premium payment. Car allowance exemption u/s 10.

Source: noclutter.cloud

Source: noclutter.cloud

The premium paid in unit linked life insurance policies (ulips) is also eligible for tax exemption under section 80c. For multiple premium policies, you have to pay at least 2 years’ premium to avail the tax exemption. Tax exemption limit (per year) petrol, travel, toll allowances. Auto insurance settlement for medical bills: Exemption shall only after total income.car insurance is not a part of total income.

Source: noclutter.cloud

Source: noclutter.cloud

The policy should be one that benefits the policy holder in the long term while enabling him to incur savings on tax payment at the same time. Auto insurance settlement for medical bills: If you use your car strictly for personal use, you likely cannot deduct your car insurance costs on your tax return. Insurance premium, payment of health insurance premium and expenditure on medical treatment. However, there are instances where the employees also contribute to the premium payment.

Source: apnaplan.com

Source: apnaplan.com

The premium paid in unit linked life insurance policies (ulips) is also eligible for tax exemption under section 80c. As the premium for a group health policy for employees is usually paid by the employer, the employees do not have the opportunity to avail tax benefits. However, there is a small catch. For example, buying an electric car can potentially earn you a tax credit of up to $7,500. Car insurance is an allowable expenditure so not include it in business income.

Source: planmoneytax.com

Source: planmoneytax.com

Car allowance exemption u/s 10. If you qualify for a tax exemption, that income does not need to be claimed on your taxes. (15/26) x last drawn salary* x. Insurance policies have always been a popular tool to save income tax. The exemption available is the least of the following amounts:

Source: apnaplan.com

Source: apnaplan.com

To arrive at taxable income, one has to deduct from gti, the deductions allowable under chapter via (i.e., under section 80c to 80u). However, if the travel tickets amounted to inr 60,000, the exemption would have been available only for inr 50,000 which is the maximum lta paid by the employer. There are some of the facts or points you must understand regarding tax exemption on car allowances or fuel reimbursement policy. Well, customers can claim tax exemption for premium paid on motor insurance as well. For a list of insurance products that are not subject to the tax, see.

Source: budgetdirect.com.au

Source: budgetdirect.com.au

The remaining inr 10,000 would be taxed in the hands of the employee The remaining inr 10,000 would be taxed in the hands of the employee The policy should be one that benefits the policy holder in the long term while enabling him to incur savings on tax payment at the same time. Car allowance exemption u/s 10. The sum received as death benefit under an insurance policy is fully exempt from tax under section 10 (10d) of the income tax act.

Source: noclutter.cloud

Source: noclutter.cloud

Who qualifies for a tax exemption? However, if the travel tickets amounted to inr 60,000, the exemption would have been available only for inr 50,000 which is the maximum lta paid by the employer. When it comes to medical bills and auto insurance, the insurance company will usually pay the hospital directly or simply reimburse you for medical bills you have already paid, which would not be considered income. Exemption shall only after total income.car insurance is not a part of total income. For example, buying an electric car can potentially earn you a tax credit of up to $7,500.

Source: myinsuranceclub.com

Source: myinsuranceclub.com

95 rows least of following amount is exempt from tax: Car insurance is an allowable expenditure so not include it in business income. 28 rows additional exemption of rm8,000 disable child age 18 years old and. Who qualifies for a tax exemption? Auto insurance settlement for medical bills:

Source: thebalance.com

Source: thebalance.com

Group insurance scheme exemption under income tax for employees: For a list of insurance products that are not subject to the tax, see. Group insurance scheme exemption under income tax for employees: Using the example of the standard deduction, you would pay tax on only $47,450 if your overall gross income was $60,000 in 2021—that is, $60,000 less the $12,550 standard deduction. In this case, the lta exemption would be allowed for inr 40,000 which is the actual cost of the journey.

Source: policybazaar.com

Source: policybazaar.com

In this case, the lta exemption would be allowed for inr 40,000 which is the actual cost of the journey. Exemption shall only after total income.car insurance is not a part of total income. Group insurance scheme exemption under income tax for employees: If you use your car strictly for personal use, you likely cannot deduct your car insurance costs on your tax return. The sum received as death benefit under an insurance policy is fully exempt from tax under section 10 (10d) of the income tax act.

Source: pinterest.com

Source: pinterest.com

(15/26) x last drawn salary* x. Using the example of the standard deduction, you would pay tax on only $47,450 if your overall gross income was $60,000 in 2021—that is, $60,000 less the $12,550 standard deduction. Tax deductions and adjustments to income are used together to arrive at the total amount of your exempt income. When it comes to medical bills and auto insurance, the insurance company will usually pay the hospital directly or simply reimburse you for medical bills you have already paid, which would not be considered income. Exemption shall only after total income.car insurance is not a part of total income.

Source: thebalance.com

Source: thebalance.com

If the amount exceeds rm6,000, further deductions can be made in respect of amount spent for official duties. When it comes to medical bills and auto insurance, the insurance company will usually pay the hospital directly or simply reimburse you for medical bills you have already paid, which would not be considered income. For example, buying an electric car can potentially earn you a tax credit of up to $7,500. In this case, the lta exemption would be allowed for inr 40,000 which is the actual cost of the journey. Your insurance covers property located in québec.

Source: pinterest.com

Source: pinterest.com

*increased to rm20,000 for individuals who ceased employment during the period from 1 january 2020 to 31 december 2021. Tax exemption limit (per year) petrol, travel, toll allowances. However, there are instances where the employees also contribute to the premium payment. When it comes to medical bills and auto insurance, the insurance company will usually pay the hospital directly or simply reimburse you for medical bills you have already paid, which would not be considered income. To arrive at taxable income, one has to deduct from gti, the deductions allowable under chapter via (i.e., under section 80c to 80u).

Source: coverfox.com

Source: coverfox.com

Exemption shall only after total income.car insurance is not a part of total income. Many of the corporate provide car allowance to their staff which was incurred for official use. If you use your car strictly for personal use, you likely cannot deduct your car insurance costs on your tax return. Insurance policies have always been a popular tool to save income tax. To arrive at taxable income, one has to deduct from gti, the deductions allowable under chapter via (i.e., under section 80c to 80u).

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title car insurance exemption in income tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information