Car insurance for lease vs buy information

Home » Trending » Car insurance for lease vs buy informationYour Car insurance for lease vs buy images are ready in this website. Car insurance for lease vs buy are a topic that is being searched for and liked by netizens now. You can Find and Download the Car insurance for lease vs buy files here. Get all royalty-free images.

If you’re searching for car insurance for lease vs buy pictures information linked to the car insurance for lease vs buy interest, you have visit the right blog. Our site always provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

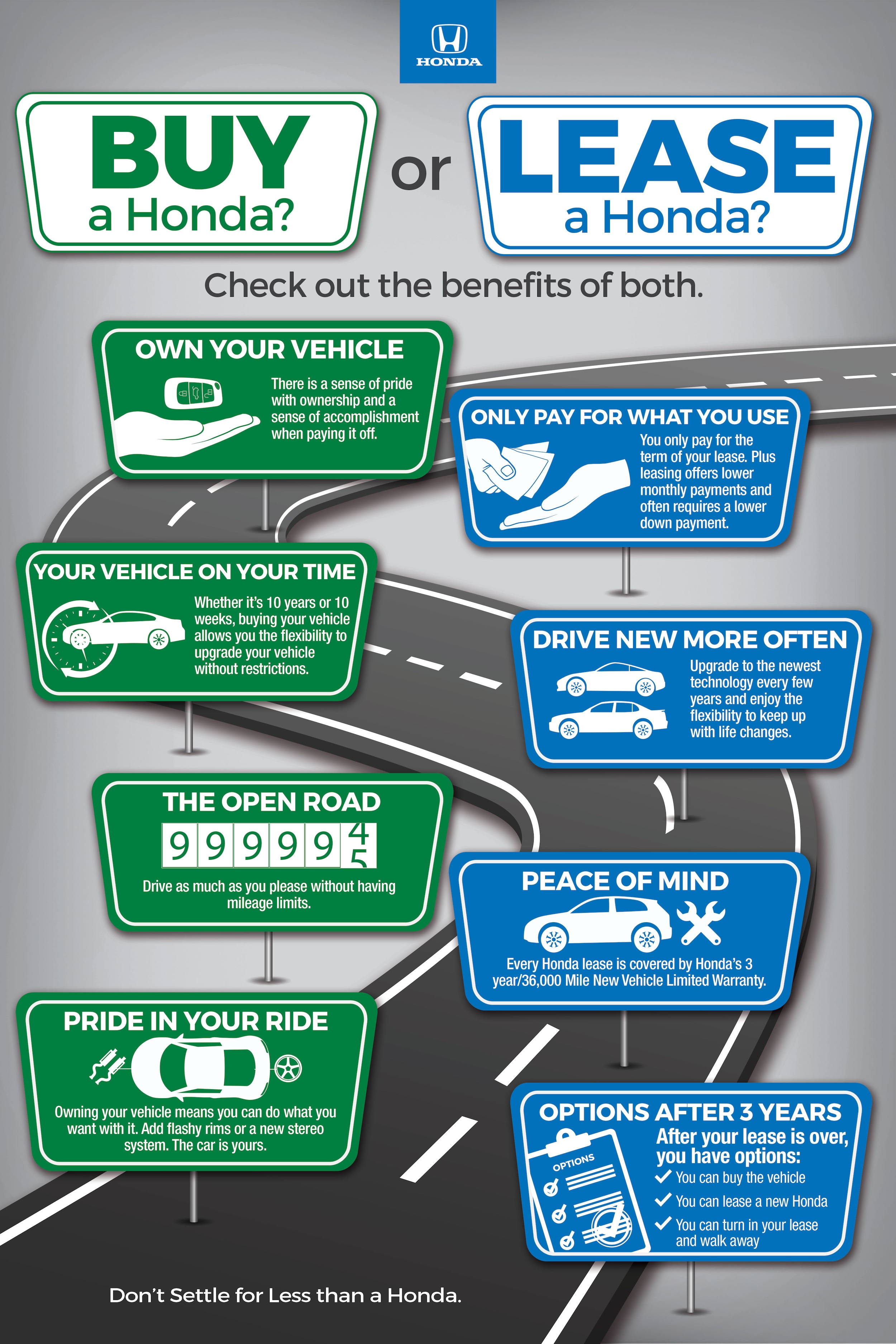

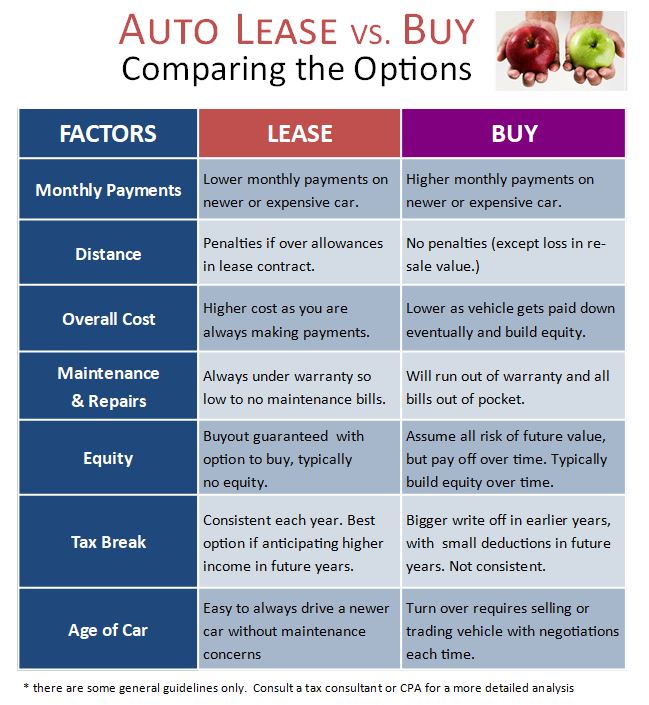

Car Insurance For Lease Vs Buy. At the end of a financing agreement, you will own the vehicle. Both lease vs buy are popular choices in the market; Leasing allows you to pay less and get all the benefits of buying (most of). When you buy a car, you can choose to pay less for less coverage.

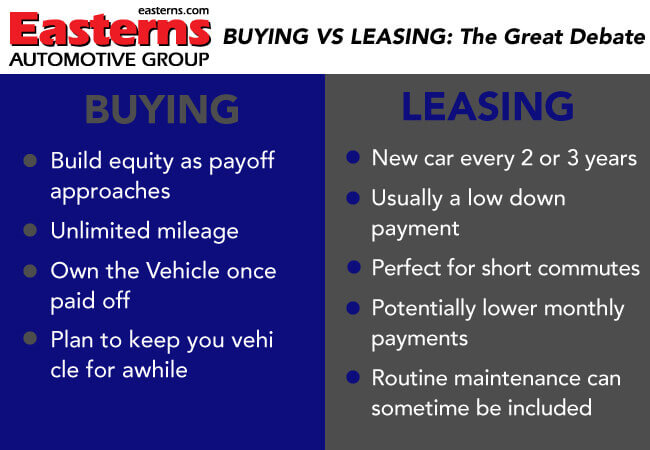

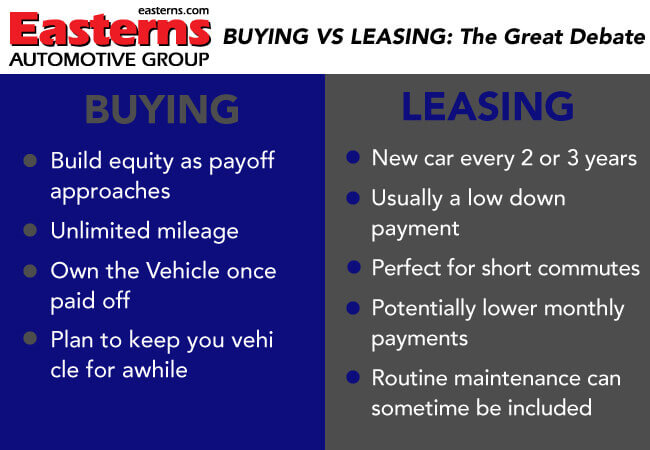

Used Car Leasing in MD and VA at Easterns Automotive Can From easterns.com

Used Car Leasing in MD and VA at Easterns Automotive Can From easterns.com

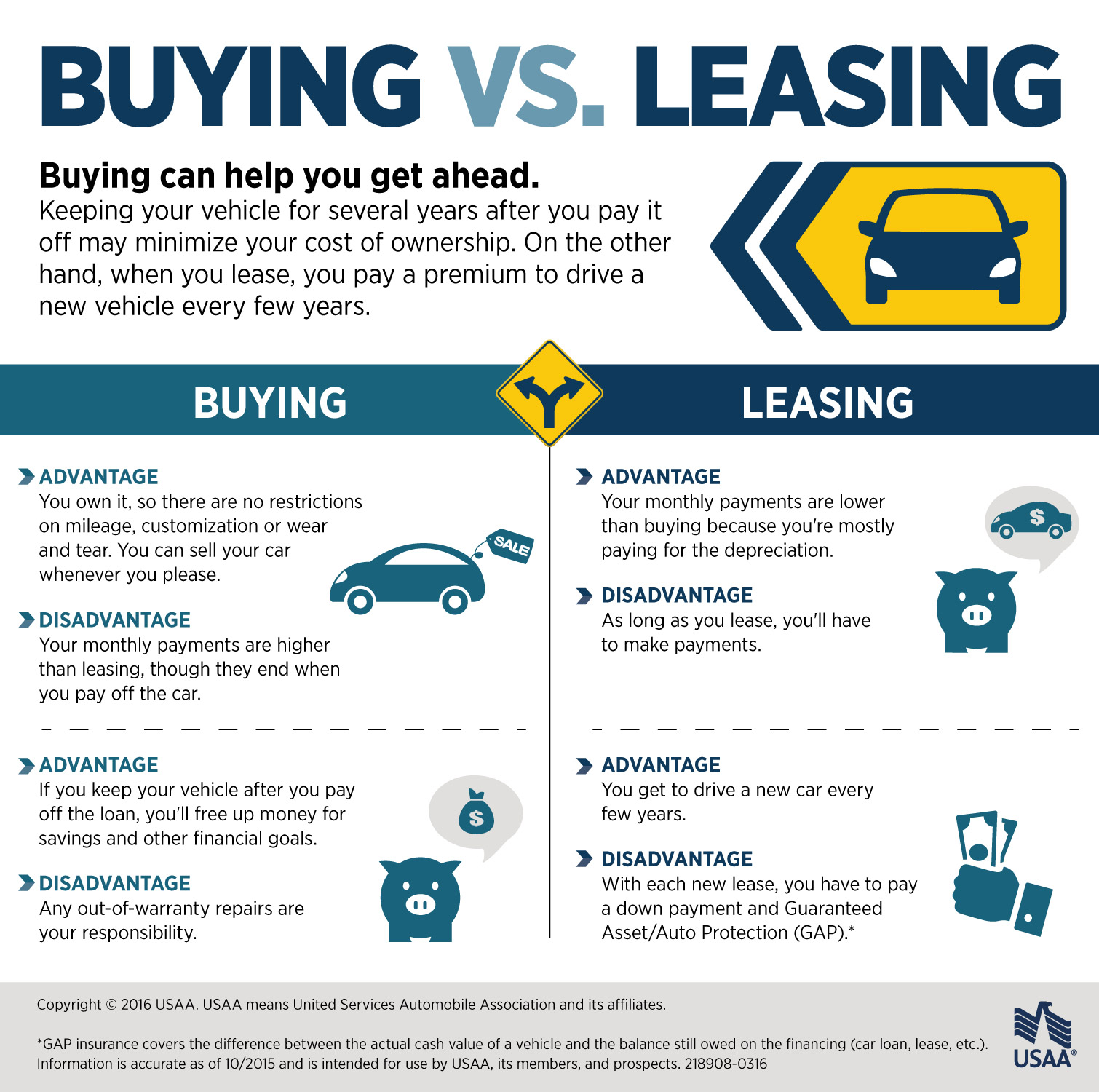

The obvious downside to leasing a car is that you don�t own the car at the end of the lease. Some coverages may be required by law or by your lender, while other types of insurance may be optional for a financed or leased car. Your normal car insurance covers the current value of the car, while the gap insurance covers you for the remaining payment costs on your lease contract. Just like the buying vs leasing conundrum, it can also be difficult to decide on the right insurer for you. Contract hire gap insurance is specifically designed for leased cars. On the other hand, buying a car generally means higher monthly payments, but those payments end once your loan is paid off, leaving you with a car that�s wholly your own.

Two factors included in the calculation are.

Contract hire gap insurance is specifically designed for leased cars. There are lots of factors that go into deciding whether to lease or buy a car: In simplest terms, the price of car insurance depends heavily on what level of coverage you buy. Carsdirect also notes that insurance companies don�t tend to change your rate depending on whether you purchase or lease your vehicle. You will never own the asset and will make the monthly payments continuously instead of. The potential to trade in every two to three years;

Source: easterns.com

Source: easterns.com

While loan payments are based on how much you owe on the price of a vehicle, lease payments are based not on the car’s retail value, but on the amount of the car’s value that will depreciate during the lease. When you lease a car, you’ll be required to pay more for more coverage. This means that as long as you drive a lease. Insurance options for bought vs. Quality auto coverage starts here.

Source: usedcars-cars.com

Source: usedcars-cars.com

With financing, every payment you make goes toward paying off your loan. On the other hand, buying a car generally means higher monthly payments, but those payments end once your loan is paid off, leaving you with a car that�s wholly your own. Weighing the advantages and disadvantages of leasing vs. While loan payments are based on how much you owe on the price of a vehicle, lease payments are based not on the car’s retail value, but on the amount of the car’s value that will depreciate during the lease. The ability to drive a better (and perhaps newer) make and model;

Source: pinterest.com

Source: pinterest.com

Is it better to lease or finance my new car? Contract hire gap insurance is specifically designed for leased cars. Just like the buying vs leasing conundrum, it can also be difficult to decide on the right insurer for you. If the leased car is totaled, there may be a gap between the amount of coverage you have and the amount you owe on the lease. The potential to trade in every two to three years;

Source: araglegal.com

You will never own the asset and will make the monthly payments continuously instead of. On the other hand, buying a car generally means higher monthly payments, but those payments end once your loan is paid off, leaving you with a car that�s wholly your own. Either way, you will have to pay for a full coverage policy. Buying a car often find their monthly payments are lower. The obvious downside to leasing a car is that you don�t own the car at the end of the lease.

Source: usedcars-cars.com

Source: usedcars-cars.com

Weighing the advantages and disadvantages of leasing vs. Is it better to lease or finance my new car? If you�re deciding whether to buy or lease your next car, it�s important to understand what insurance coverages may be required in either situation. In simplest terms, the price of car insurance depends heavily on what level of coverage you buy. Insurance options for bought vs.

Source: pinterest.com

Source: pinterest.com

This means that as long as you drive a lease. Some coverages may be required by law or by your lender, while other types of insurance may be optional for a financed or leased car. It assumes you will not exercise the purchase option at the end of a lease. This calculator helps you decide whether it is better for you to buy or lease a car. At the end of a financing agreement, you will own the vehicle.

Source: pinterest.com

Source: pinterest.com

This means that as long as you drive a lease. At the end of a financing agreement, you will own the vehicle. If you�re deciding whether to buy or lease your next car, it�s important to understand what insurance coverages may be required in either situation. Is it better to lease or finance my new car? It gives you full protection against theft or damage;

Source: valleychevy.com

Source: valleychevy.com

To cover the gap between the car’s current value and the amount you owe, you may be able to choose between buying gap coverage through a dealership waiver or buying a gap insurance policy. Either way, you will have to pay for a full coverage policy. Two factors included in the calculation are. However, at the end of a vehicle loan, you will own the car. If you�re deciding whether to buy or lease your next car, it�s important to understand what insurance coverages may be required in either situation.

Source: buyyourproduct.com

Source: buyyourproduct.com

One of the biggest differences between the insurance of a lease and a buy, according to allstate is that a lease requires ongoing monthly payments. At the end of a financing agreement, you will own the vehicle. On the other hand, buying a car generally means higher monthly payments, but those payments end once your loan is paid off, leaving you with a car that�s wholly your own. Your normal car insurance covers the current value of the car, while the gap insurance covers you for the remaining payment costs on your lease contract. While monthly payments on the lease of a car can be less expensive than the ones when buying a car, it is usually more costly to lease in the long run.

Source: eastcoastcars.net

Source: eastcoastcars.net

When you buy a car, you can choose to pay less for less coverage. The ability to drive a better (and perhaps newer) make and model; Lease payments lease payments are generally lower than the monthly loan payments for a new vehicle. Insurance options for bought vs. Two factors included in the calculation are.

Source: pinterest.com

Source: pinterest.com

Let us discuss some of the major differences between lease vs buy : The potential to trade in every two to three years; How often you plan on using it, what kind of car you want to drive, how long you want to have it, and what you can afford. If you�re deciding whether to buy or lease your next car, it�s important to understand what insurance coverages may be required in either situation. Key differences between lease vs buy.

Source: visual.ly

Source: visual.ly

Quality auto coverage starts here. The obvious downside to leasing a car is that you don�t own the car at the end of the lease. Some coverages may be required by law or by your lender, while other types of insurance may be optional for a financed or leased car. With a lease, you will not own the car. While monthly payments on the lease of a car can be less expensive than the ones when buying a car, it is usually more costly to lease in the long run.

Source: classiccarwalls.blogspot.com

Source: classiccarwalls.blogspot.com

But whatever decision you make may also affect how much car insurance coverage you’ll need for your. While monthly payments on the lease of a car can be less expensive than the ones when buying a car, it is usually more costly to lease in the long run. This means that as long as you drive a lease. How often you plan on using it, what kind of car you want to drive, how long you want to have it, and what you can afford. Quality auto coverage starts here.

Source: carlease.com

Source: carlease.com

There are lots of factors that go into deciding whether to lease or buy a car: If the car you’re leasing is less than three years old and/or you’re getting a pricier luxury model, gap insurance may be worth your while. If the leased car is totaled, there may be a gap between the amount of coverage you have and the amount you owe on the lease. One of the biggest differences between the insurance of a lease and a buy, according to allstate is that a lease requires ongoing monthly payments. The key difference between leasing and financing is vehicle ownership.

Source: capitalmotorcars.com

Source: capitalmotorcars.com

The obvious downside to leasing a car is that you don�t own the car at the end of the lease. Let us discuss some of the major differences between lease vs buy : Buying allows you to take ownership but at a hefty cost. But whatever decision you make may also affect how much car insurance coverage you’ll need for your. While loan payments are based on how much you owe on the price of a vehicle, lease payments are based not on the car’s retail value, but on the amount of the car’s value that will depreciate during the lease.

Source: ellsworthcpa.com

Source: ellsworthcpa.com

While monthly payments on the lease of a car can be less expensive than the ones when buying a car, it is usually more costly to lease in the long run. This type of insurance, which usually runs from $350 to $800 1, basically covers the “gap between what your vehicle is worth and how much you owe on your lease. At the end of a financing agreement, you will own the vehicle. Insurance options for bought vs. But whatever decision you make may also affect how much car insurance coverage you’ll need for your.

Source: thebalance.com

Source: thebalance.com

Buying a car often find their monthly payments are lower. But whatever decision you make may also affect how much car insurance coverage you’ll need for your. Leasing allows you to pay less and get all the benefits of buying (most of). You will never own the asset and will make the monthly payments continuously instead of. Whether you decide to buy, lease or finance, getting your new car fully insured is just as important.

Source: pro-ledgers.com

Source: pro-ledgers.com

The obvious downside to leasing a car is that you don�t own the car at the end of the lease. There are lots of factors that go into deciding whether to lease or buy a car: Just like the buying vs leasing conundrum, it can also be difficult to decide on the right insurer for you. Quality auto coverage starts here. Whether you decide to buy, lease or finance, getting your new car fully insured is just as important.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title car insurance for lease vs buy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea