Car insurance increase alberta information

Home » Trending » Car insurance increase alberta informationYour Car insurance increase alberta images are available. Car insurance increase alberta are a topic that is being searched for and liked by netizens today. You can Find and Download the Car insurance increase alberta files here. Download all free images.

If you’re looking for car insurance increase alberta pictures information connected with to the car insurance increase alberta topic, you have pay a visit to the ideal site. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

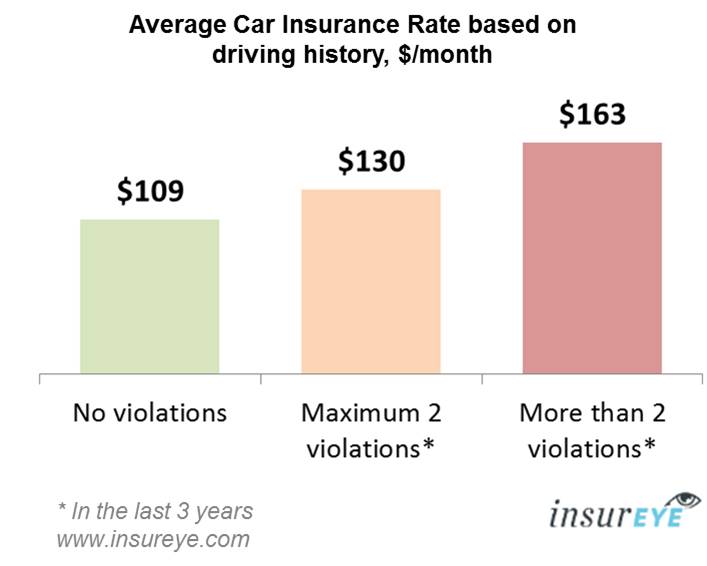

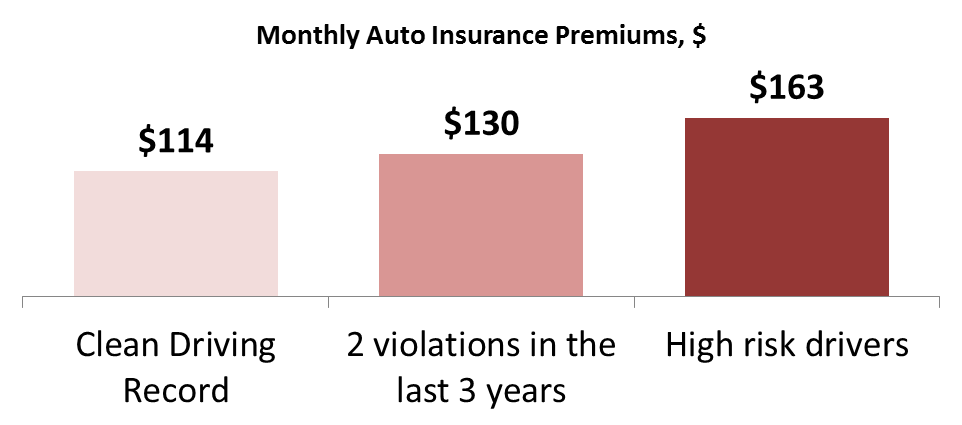

Car Insurance Increase Alberta. In alberta, mandatory car insurance coverages include if you lease, finance, or own a car in alberta, types of auto insurance you need to have by law are liability and accident benefit coverages. When you have albertans across the board paying substantially higher premiums for automobile insurance, while at the same time claims costs have stabilized and, in fact, decreased significantly in. According to the alberta automobile insurance rate board, the shift to dcpd means 42 per cent of policyholders will see a reduction in premiums, while 15 per cent will see no change, and 43 per. Car insurance companies in alberta must apply to airb for permission to raise rates.

Alberta auto insurance rates up 24 since beginning of From everythinggp.com

Alberta auto insurance rates up 24 since beginning of From everythinggp.com

To ensure you are ready for alberta’s automobile insurance changes call cmb at 780.424.2727, click here to get a quote, or download the dcpd insurance faq sheet. 10 ways to lower your automobile insurance premiums. Facts and statistics about auto insurance in alberta average auto insurance premiums by province. On december 9, 2020, bill 41 received royal assent to update the insurance act and all changes to the act will come into effect by early 2022. Alberta’s drivers pay the third highest car insurance premiums in canada. 43% will see an increase in premium.

15% will see no change in premium.

Power’s 2019 canada auto insurance satisfaction study says that the national average increase for auto insurance rates currently sits at $298. The automobile insurance rate board (airb) regulates car insurance rates in alberta by approving or denying rate increases. Liability coverage if you injure someone or damage property, payments are made on your behalf. Many alberta drivers will soon pay more to insure their vehicles — in some cases, much more. Car insurance companies in alberta must apply to airb for permission to raise rates. The weighted average of approved rate changes as of june 30, 2021, for private passenger vehicles, over the last 12 months is an increase of 2.79%.

Source: exclusivelyinjurylaw.com

Source: exclusivelyinjurylaw.com

This legislation made changes designed to improve the auto insurance system for alberta’s 3 million drivers. There are several factors that insurance companies use to determine your premiums: Peace hills general insurance company applied for the highest potential increase at 27.9 per cent for basic insurance, followed by certas home and auto insurance company at. (manuel carrillos/cbc) some alberta drivers are facing increases in car insurance premiums next year, following the provincial. To ensure you are ready for alberta’s automobile insurance changes call cmb at 780.424.2727, click here to get a quote, or download the dcpd insurance faq sheet.

Source: thestar.com

Source: thestar.com

The cap removal saw over 92% of private insurers apply for rate changes. Alberta has had the highest spike in costs at. With the average price of $146 a month, lethbridge car insurance is the least expensive in alberta. If you’re caught speeding 1 to 49 km over the limit, the potential fines and demerits you face vary based on how fast you were going. 10 ways to lower your automobile insurance premiums (posted january 31, 2020).

Source: beyondinsurance.ca

Source: beyondinsurance.ca

Car insurance premiums in alberta had been on the rise for quite a few years, and the 2019 decision to remove caps on rate increases affected affordability. 3 demerits, $140 to $239. The automobile insurance rate board (airb) regulates car insurance rates in alberta by approving or denying rate increases. Other worthy options include td insurance, intact, and sonnet. Top 10 reasons why premiums increase.

Source: insureye.com

Source: insureye.com

According to the alberta automobile insurance rate board , the shift to dcpd means 42 per cent of policyholders will see a reduction in premiums, while 15 per cent will see no change, and 43 per cent will have higher premiums. There are several factors that insurance companies use to determine your premiums: Top 10 reasons why premiums increase. Just like every other canadian province, car insurance is mandatory in order to be able to drive in alberta. Alberta drivers may face increased vehicle insurance premiums in 2020.

Source: newswire.ca

Source: newswire.ca

The cap removal saw over 92% of private insurers apply for rate changes. Alberta drivers may face increased vehicle insurance premiums in 2020. The latest figure represents a 5.2% increase, year over year. 10 ways to lower your automobile insurance premiums (posted january 31, 2020). Just like every other canadian province, car insurance is mandatory in order to be able to drive in alberta.

Source: insureye.com

Source: insureye.com

4 demerits, $253 to $474. Car insurance companies in alberta must apply to airb for permission to raise rates. 10 ways to lower your automobile insurance premiums (posted january 31, 2020). (manuel carrillos/cbc) some alberta drivers are facing increases in car insurance premiums next year, following the provincial. 4 demerits, $253 to $474.

Source: sooke.pocketnews.ca

Source: sooke.pocketnews.ca

The weighted average of approved rate changes as of june 30, 2021, for private passenger vehicles, over the last 12 months is an increase of 2.79%. In alberta, the minimum liability coverage you�ll require for auto insurance must cover third party liability coverage, accident benefits coverage. 16 to 30 km over limit: On december 9, 2020, bill 41 received royal assent to update the insurance act and all changes to the act will come into effect by early 2022. Facts and statistics about auto insurance in alberta average auto insurance premiums by province.

Source: bvinsurance.ca

Source: bvinsurance.ca

In alberta, the minimum liability coverage you�ll require for auto insurance must cover third party liability coverage, accident benefits coverage. Peace hills general insurance company applied for the highest potential increase at 27.9 per cent for basic insurance, followed by certas home and auto insurance company at. Changes to alberta’s auto insurance system are designed to reduce red tape, increase medical care, expand options for drivers, and stabilize costs. Just like every other canadian province, car insurance is mandatory in order to be able to drive in alberta. The latest figure represents a 5.2% increase, year over year.

Source: ratehub.ca

Source: ratehub.ca

In alberta, the minimum liability coverage you�ll require for auto insurance must cover third party liability coverage, accident benefits coverage. 4 demerits, $253 to $474. Top 10 reasons why premiums increase (posted october 4, 2019). An insurance policy ensures that all parties are covered in the event of an incident that causes property damage or personal injury. Since 2007 there has been a +16.95% increase in average cost of car insurance in alberta.

Source: ratehub.ca

Source: ratehub.ca

How car insurance premiums are calculated; The weighted average of approved rate changes as of june 30, 2021, for private passenger vehicles, over the last 12 months is an increase of 2.79%. 43% will see an increase in premium. Liability coverage if you injure someone or damage property, payments are made on your behalf. In alberta, mandatory car insurance coverages include if you lease, finance, or own a car in alberta, types of auto insurance you need to have by law are liability and accident benefit coverages.

Source: globalnews.ca

Source: globalnews.ca

When you have albertans across the board paying substantially higher premiums for automobile insurance, while at the same time claims costs have stabilized and, in fact, decreased significantly in. Since 2007 there has been a +16.95% increase in average cost of car insurance in alberta. With the average price of $146 a month, lethbridge car insurance is the least expensive in alberta. 1 to 15 km over limit: 10 ways to lower your automobile insurance premiums.

Source: globalnews.ca

Source: globalnews.ca

All standard automobile insurance forms are also commercially. 10 ways to lower your automobile insurance premiums. Top 10 reasons why premiums increase (posted october 4, 2019). Power’s 2019 canada auto insurance satisfaction study says that the national average increase for auto insurance rates currently sits at $298. 15% will see no change in premium.

Source: insureye.com

Source: insureye.com

31 to 49 km over limit: With the average price of $146 a month, lethbridge car insurance is the least expensive in alberta. On december 9, 2020, bill 41 received royal assent to update the insurance act and all changes to the act will come into effect by early 2022. 1 to 15 km over limit: If you’re caught speeding 1 to 49 km over the limit, the potential fines and demerits you face vary based on how fast you were going.

Source: awinins.ca

Source: awinins.ca

10 ways to lower your automobile insurance premiums. Alberta has had the highest spike in costs at. With the average price of $146 a month, lethbridge car insurance is the least expensive in alberta. An insurance policy ensures that all parties are covered in the event of an incident that causes property damage or personal injury. Just like every other canadian province, car insurance is mandatory in order to be able to drive in alberta.

Source: insurancebusinessmag.com

Source: insurancebusinessmag.com

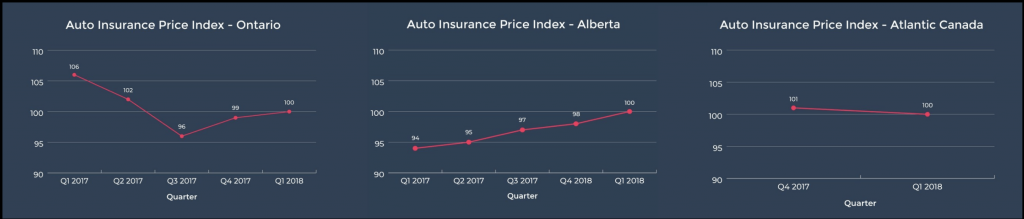

Auto insurance rates in alberta are on the move. Auto insurance rates in alberta are on the move. 10 ways to lower your automobile insurance premiums. Other worthy options include td insurance, intact, and sonnet. In late 2019, the conservative government removed a 5% cap on any rate increases.

Source: hubsmartcoverage.ca

Source: hubsmartcoverage.ca

3 demerits, $140 to $239. Alberta’s drivers pay the third highest car insurance premiums in canada. Liability coverage if you injure someone or damage property, payments are made on your behalf. If you’re caught speeding 1 to 49 km over the limit, the potential fines and demerits you face vary based on how fast you were going. In late 2019, the conservative government removed a 5% cap on any rate increases.

Source: lowestrates.ca

Source: lowestrates.ca

Since 2007 there has been a +16.95% increase in average cost of car insurance in alberta. The cap removal saw over 92% of private insurers apply for rate changes. See which alberta auto insurance providers changed their rates. All standard automobile insurance forms are also commercially. (manuel carrillos/cbc) some alberta drivers are facing increases in car insurance premiums next year, following the provincial.

Source: insurance-canada.ca

Source: insurance-canada.ca

Many alberta drivers will soon pay more to insure their vehicles — in some cases, much more. It�s the bare minimum to protect you and your loved ones. Other worthy options include td insurance, intact, and sonnet. Auto insurance rates in alberta are on the move. Alberta drivers may face increased vehicle insurance premiums in 2020.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title car insurance increase alberta by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea