Car insurance increase ontario Idea

Home » Trend » Car insurance increase ontario IdeaYour Car insurance increase ontario images are ready. Car insurance increase ontario are a topic that is being searched for and liked by netizens now. You can Download the Car insurance increase ontario files here. Download all royalty-free images.

If you’re looking for car insurance increase ontario pictures information connected with to the car insurance increase ontario keyword, you have visit the right site. Our website frequently gives you hints for seeking the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

Car Insurance Increase Ontario. According to lowestrates.ca data, an ontario driver would see a 15% increase in their car insurance premium after their first conviction. The big question is always how much with the insurance premiums increase. Auto rates continue to climb in ontario but the increase in frequency and severity of claims plays a big role, insurance bureau of canada suggests. On the other hand, once you reach your elderly years, the cost of your car insurance could start increasing again.

Average Car Insurance Rates By Age Ontario blog From blog.pricespin.net

Average Car Insurance Rates By Age Ontario blog From blog.pricespin.net

(tony smyth/cbc) auto insurance rates. The same thing applies when a conviction falls. Here are the rate changes approved by fsra in july 2021: The answer will depend on a lot of factors. Canada post has changed postal codes over the years and that has led some insurance companies to increase their insurance premiums, but if you don�t physically move, they�re not supposed to. According to lowestrates.ca data, an ontario driver would see a 15% increase in their car insurance premium after their first conviction.

For may, there were a total of three approved rate changes.

Ad customised motor insurance solutions. An insurance company may look at these specific demerit points. After the second conviction, an ontario driver would see a 27% increase in their insurance premium. Here are the rate changes approved by fsra in july 2021: Ontario�s consumer regulatory agency has given the green light to increases in automobile insurance premiums for some 20 insurance companies in the province. This is because of the statistical risk factors that come with driving at an older age.

Source: newswire.ca

Source: newswire.ca

Auto rates continue to climb in ontario but the increase in frequency and severity of claims plays a big role, insurance bureau of canada suggests. For may, there were a total of three approved rate changes. On average there has been a +52.35% increase in cost of car insurance in ontario. In june, there were no rate changes to mention. On the other hand, once you reach your elderly years, the cost of your car insurance could start increasing again.

Source: autowinnipegcreditsolutions.com

Source: autowinnipegcreditsolutions.com

In june, there were no rate changes to mention. The same thing applies when a conviction falls. If the conviction impacts a driver’s insurance the increased rates will be reflected upon policy renewal for 3 years. On average there has been a +52.35% increase in cost of car insurance in ontario. Basically, if you have an accident that qualifies as minor, and is your first accident in 3 years, your insurance premium cannot be increased.

Source: borrowell.com

Source: borrowell.com

The same thing applies when a conviction falls. Convictions stay on your driving record for 3 years starting from the conviction date. The big question is always how much with the insurance premiums increase. According to hellosafe.ca, car insurance rates in canada skyrocketed by 19.1% on average between 2017 and 2019. Canada post has changed postal codes over the years and that has led some insurance companies to increase their insurance premiums, but if you don�t physically move, they�re not supposed to.

The last few years have seen the rates level out a bit more, with subtle increases and decreases, but in the early 2000 there were significant price swings on both sides of the equation. How much will my insurance go up after a parking lot accident? Car insurance fraud is affecting the entire industry. Ontario�s consumer regulatory agency has given the green light to increases in automobile insurance premiums for some 20 insurance companies in the province. Ad customised motor insurance solutions.

Source: lowestrates.ca

Source: lowestrates.ca

How much will my insurance go up after a parking lot accident? According to ratesdotca’s data, the average ontario auto insurance premium in december 2020 is estimated at $1,616, a 9.7 per cent increase from december 2018. Rates are higher or lower depending on your location, the type of vehicle you drive, driving history and many other factors. In ontario, the insurance bureau of canada reports that fraud costs an estimated $1.6 billion per year ($236 per driver). Most insurance providers can offer additional discounts if you bundle your car insurance policy with other insurance policies.

Source: thestar.com

Source: thestar.com

Most drivers pay in the range of $1,300 to $1,800 annually. Of course, the primary one being who was at fault. According to ratesdotca’s data, the average ontario auto insurance premium in december 2020 is estimated at $1,616, a 9.7 per cent increase from december 2018. Convictions stay on your driving record for 3 years starting from the conviction date. The region has seen the average price of auto insurance increase.

Source: blog.pricespin.net

Source: blog.pricespin.net

On a national level, rates only increased by 1.8% from 2018 to 2019 — a $27 increase in yearly auto insurance premiums. Convictions stay on your driving record for 3 years starting from the conviction date. The average cost of car insurance in ontario by age, month, and year. The same thing applies when a conviction falls. In june, there were no rate changes to mention.

Source: rates.ca

Source: rates.ca

Distracted driving is on the rise. They are going to look at many different factors. An insurance company may look at these specific demerit points. Ad customised motor insurance solutions. In ontario, the insurance rate on average was $1,463 in march of 2017 and $1,634 in.

Source: abiteofculture.com

Source: abiteofculture.com

We conducted our own analysis and found that an ontario driver would see a 15% increase in their car insurance premium after their first conviction. Canada post has changed postal codes over the years and that has led some insurance companies to increase their insurance premiums, but if you don�t physically move, they�re not supposed to. To see what driving infractions they pertain to. Ad customised motor insurance solutions. Distracted driving is on the rise.

Source: insurance-canada.ca

Source: insurance-canada.ca

An insurance company may look at these specific demerit points. In june, there were no rate changes to mention. The gta is officially the most expensive place to be a driver in ontario, new data shows, at least when it comes to car insurance. The average auto insurance cost in ontario is $1,634 per year. An insurance company may look at these specific demerit points.

Source: newswire.ca

Source: newswire.ca

On the other hand, once you reach your elderly years, the cost of your car insurance could start increasing again. Most drivers pay in the range of $1,300 to $1,800 annually. The last few years have seen the rates level out a bit more, with subtle increases and decreases, but in the early 2000 there were significant price swings on both sides of the equation. So how much is car insurance in ontario? On average there has been a +52.35% increase in cost of car insurance in ontario.

Source: surex.com

Source: surex.com

The region has seen the average price of auto insurance increase. A premium of $191 a month would go up to $226. After the second conviction, an ontario driver would see a 27% increase in their insurance premium. None of the 21 ontario auto insurers who filed. Here are the rate changes approved by fsra in july 2021:

Source: insurancehotline.com

Source: insurancehotline.com

An insurance company may look at these specific demerit points. On the other hand, once you reach your elderly years, the cost of your car insurance could start increasing again. Distracted driving is on the rise. Also, every insurance company will make their determinations. Car insurance fraud is affecting the entire industry.

Source: sooke.pocketnews.ca

Source: sooke.pocketnews.ca

According to hellosafe.ca, car insurance rates in canada skyrocketed by 19.1% on average between 2017 and 2019. Some states — 18 of them — enjoyed rate decreases from 2018 to 2019. Convictions stay on your driving record for 3 years starting from the conviction date. The region has seen the average price of auto insurance increase. 5, 2021 2 mins the financial services regulatory authority (fsra), ontario’s car insurance regulator, approved rate changes for only one insurer in july 2021.

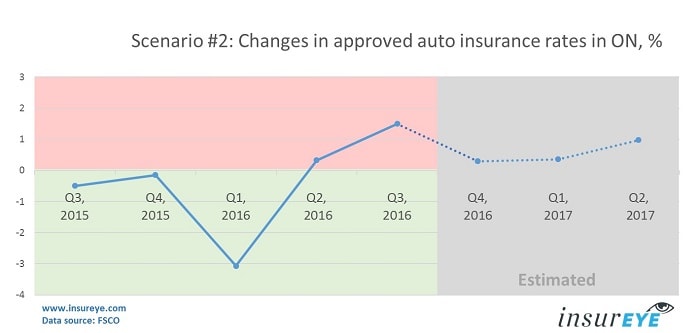

Source: insureye.com

Source: insureye.com

Looking at three demerit points. Here are the rate changes approved by fsra in july 2021: According to ratesdotca’s data, the average ontario auto insurance premium in december 2020 is estimated at $1,616, a 9.7 per cent increase from december 2018. In ontario, the insurance bureau of canada reports that fraud costs an estimated $1.6 billion per year ($236 per driver). Free quotation and instant application.

Source: lowestrates.ca

Source: lowestrates.ca

According to ratesdotca’s data, the average ontario auto insurance premium in december 2020 is estimated at $1,616, a 9.7 per cent increase from december 2018. The big question is always how much with the insurance premiums increase. The answer will depend on a lot of factors. Basically, if you have an accident that qualifies as minor, and is your first accident in 3 years, your insurance premium cannot be increased. So how much is car insurance in ontario?

Source: ratingwalls.blogspot.com

Source: ratingwalls.blogspot.com

Rates are higher or lower depending on your location, the type of vehicle you drive, driving history and many other factors. On a national level, rates only increased by 1.8% from 2018 to 2019 — a $27 increase in yearly auto insurance premiums. In ontario, the insurance bureau of canada reports that fraud costs an estimated $1.6 billion per year ($236 per driver). The same thing applies when a conviction falls. After the second conviction, an ontario driver would see a 27% increase in their insurance premium.

In ontario, the insurance bureau of canada reports that fraud costs an estimated $1.6 billion per year ($236 per driver). How much will my insurance go up after a parking lot accident? The gta is officially the most expensive place to be a driver in ontario, new data shows, at least when it comes to car insurance. In ontario, the insurance rate on average was $1,463 in march of 2017 and $1,634 in. This is fairly new, so don’t expect every driver on the road to fully understand this.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title car insurance increase ontario by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information