Car insurance is tax deductible Idea

Home » Trending » Car insurance is tax deductible IdeaYour Car insurance is tax deductible images are available. Car insurance is tax deductible are a topic that is being searched for and liked by netizens now. You can Get the Car insurance is tax deductible files here. Find and Download all royalty-free photos.

If you’re looking for car insurance is tax deductible pictures information related to the car insurance is tax deductible keyword, you have come to the right blog. Our website always provides you with suggestions for seeing the highest quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

Car Insurance Is Tax Deductible. You�ll be happy to hear that, under certain circumstances, writing. Only certain situations allow you to deduct your car insurance from taxes. Your car insurance and deductible may be exempted from tax if you use your vehicle primarily for business purposes. With tax day just a few months away, we thought we would help you out by providing some tips that should help you to determine whether or not you are eligible to claim your auto insurance as a tax deduction.

Learn if Auto Insurance Could Be Tax Deductible For you From rowaninsurance.com

Learn if Auto Insurance Could Be Tax Deductible For you From rowaninsurance.com

Tax incentives are financial perks and discounts that encourage canadians to be transparent about their spending habits. Most drivers pay a deductible when they’re not at fault, but there are some exceptions. Your car insurance premium may be tax deductible if you meet certain criteria. Your car’s use will determine whether or not it falls under this category. Most people won’t be able to deduct their car insurance from their taxes. For cars that are exclusively used as business vehicles, the answer is generally yes.

Car insurance is tax deductible as part of a list of expenses for certain individuals.

For cars that are exclusively used as business vehicles, the answer is generally yes. This included commuting to and from work, running personal errands, or driving for lunch during your lunch break. Most drivers pay a deductible when they’re not at fault, but there are some exceptions. Only certain situations allow you to deduct your car insurance from taxes. The average car insurance deductible is $500. If you use cash basis accounting and buy a car for your business, claim this as a capital allowance as long as you’re not using simplified expenses.

Source: rowaninsurance.com

Source: rowaninsurance.com

However, car insurance for a vehicle used for business can be taken as a tax deduction if you deduct actual expenses on your vehicles (gas, depreciation, garaging, parking, maintenance, etc.) but not if you deduct the standard rate for. Car insurance tax deductions you cannot deduct insurance premiums you pay for your personal car insurance. Tax incentives are financial perks and discounts that encourage canadians to be transparent about their spending habits. In this scenario, 50% of your auto insurance premium is tax deductible. If you use your car for business purposes, you can deduct a portion of the total cost of running and maintaining the vehicle, including the.

Source: einsure.com

Source: einsure.com

For starters, a tax deductible (not to be confused with your car insurance deductible) is a type of incentive offered by the canadian government. The insurance costs for business vehicles fall under business expenses and is deductible on your taxes as such. If you use your car for business purposes, you can deduct a portion of the total cost of running and maintaining the vehicle, including the. Yes, tax deductions on your car insurance are possible to obtain, if you’re: Most people won’t be able to deduct their car insurance from their taxes.

Source: insureye.com

Source: insureye.com

Using your vehicle for personal use does not usually allow you to deduct your car insurance for tax reasons. Tax incentives are financial perks and discounts that encourage canadians to be transparent about their spending habits. Is car insurance tax deductible? Is car insurance tax deductible? For starters, a tax deductible (not to be confused with your car insurance deductible) is a type of incentive offered by the canadian government.

Source: bankrate.com

Source: bankrate.com

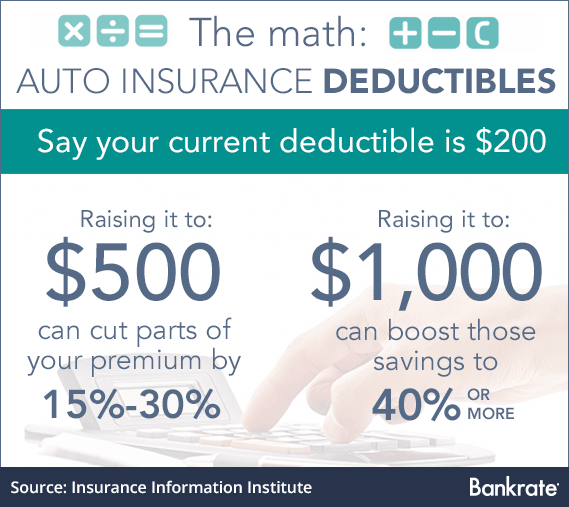

In general, if you do not pay taxes when purchasing or acquiring something, auto insurance in this instance, there is likely nothing in. Writing off your car insurance deductible starting in the 2018 tax year, you are generally unable to deduct personal losses due to casualty or theft, regardless of whether or not the loss is covered by an insurance policy. If you use your car for business purposes, you can deduct a portion of the total cost of running and maintaining the vehicle, including the. Most drivers pay a deductible when they’re not at fault, but there are some exceptions. The higher your car insurance deductible is, the lower your car insurance premium will be.

Source: metromile.com

Source: metromile.com

Only certain situations allow you to deduct your car insurance from taxes. The average car insurance deductible is $500. The insurance costs for business vehicles fall under business expenses and is deductible on your taxes as such. Is car insurance tax deductible? Is car insurance tax deductible?

Source: autoinsurance.org

Source: autoinsurance.org

Thus the car insurance premium is also slightly higher for commercial/business cars. Not every type of car insurance uses a deductible. So if your monthly car insurance premium is $120, you can deduct $72 per month or $864 per year. Is car insurance tax deductible for personal use? Your car’s use will determine whether or not it falls under this category.

Source: moneygeek.com

Source: moneygeek.com

Your car insurance premium may be tax deductible if you meet certain criteria. In this scenario, 50% of your auto insurance premium is tax deductible. The higher your car insurance deductible is, the lower your car insurance premium will be. However, car insurance for a vehicle used for business can be taken as a tax deduction if you deduct actual expenses on your vehicles (gas, depreciation, garaging, parking, maintenance, etc.) but not if you deduct the standard rate for. Thus, 60% of your auto insurance premium payments will be tax deductible.

Source: budgetdirect.com.au

Source: budgetdirect.com.au

If you use cash basis accounting and buy a car for your business, claim this as a capital allowance as long as you’re not using simplified expenses. Thus the car insurance premium is also slightly higher for commercial/business cars. Not every type of car insurance uses a deductible. Your car insurance premium may be tax deductible if you meet certain criteria. In this case, a tax deductible allows you to reduce your taxable income by including expenses that are related.

Source: pinterest.com

Source: pinterest.com

The insurance costs for business vehicles fall under business expenses and is deductible on your taxes as such. Thus, 60% of your auto insurance premium payments will be tax deductible. Not every type of car insurance uses a deductible. Car insurance is tax deductible as part of a list of expenses for certain individuals. Your car insurance and deductible may be exempted from tax if you use your vehicle primarily for business purposes.

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

The average car insurance deductible is $500. Is car insurance tax deductible? The average car insurance deductible is $500. Thus, 60% of your auto insurance premium payments will be tax deductible. Your car insurance premium may be tax deductible if you meet certain criteria.

Source: amistadinsuranceservices.com

Source: amistadinsuranceservices.com

In this scenario, 50% of your auto insurance premium is tax deductible. Thus the car insurance premium is also slightly higher for commercial/business cars. Thus, 60% of your auto insurance premium payments will be tax deductible. Only certain situations allow you to deduct your car insurance from taxes. Not every type of car insurance uses a deductible.

Source: backfires.caranddriver.com

Source: backfires.caranddriver.com

For cars that are exclusively used as business vehicles, the answer is generally yes. Is car insurance tax deductible? Regardless of whether you work for yourself or someone else, you can deduct the cost of your car insurance if you used your vehicle for work purposes. Thus, 60% of your auto insurance premium payments will be tax deductible. Using your vehicle for personal use does not usually allow you to deduct your car insurance for tax reasons.

Source: smartfinancial.com

Source: smartfinancial.com

As compared to a car used for personal needs, a car used for commercial purposes can be at a higher risk of accidents and damage. Tax incentives are financial perks and discounts that encourage canadians to be transparent about their spending habits. Most people won’t be able to deduct their car insurance from their taxes. Using your vehicle for personal use does not usually allow you to deduct your car insurance for tax reasons. For starters, a tax deductible (not to be confused with your car insurance deductible) is a type of incentive offered by the canadian government.

Source: ray11sportboy.blogspot.com

Source: ray11sportboy.blogspot.com

Tax incentives are financial perks and discounts that encourage canadians to be transparent about their spending habits. Generally, car insurance is classified as a ‘running cost’ of your vehicle, along with other car expenses. Writing off your car insurance deductible starting in the 2018 tax year, you are generally unable to deduct personal losses due to casualty or theft, regardless of whether or not the loss is covered by an insurance policy. Most drivers pay a deductible when they’re not at fault, but there are some exceptions. Most people won’t be able to deduct their car insurance from their taxes.

Source: americaninsurance.com

Source: americaninsurance.com

Tax incentives are financial perks and discounts that encourage canadians to be transparent about their spending habits. Tax incentives are financial perks and discounts that encourage canadians to be transparent about their spending habits. Is car insurance tax deductible? If you use your car for business purposes, you can deduct a portion of the total cost of running and maintaining the vehicle, including the. Most people won’t be able to deduct their car insurance from their taxes.

Source: wallinside.com

Source: wallinside.com

In general, if you do not pay taxes when purchasing or acquiring something, auto insurance in this instance, there is likely nothing in. As compared to a car used for personal needs, a car used for commercial purposes can be at a higher risk of accidents and damage. Thus the car insurance premium is also slightly higher for commercial/business cars. Your car insurance premium may be tax deductible if you meet certain criteria. In general, if you do not pay taxes when purchasing or acquiring something, auto insurance in this instance, there is likely nothing in.

Source: insuredasap.com

Source: insuredasap.com

However, car insurance for a vehicle used for business can be taken as a tax deduction if you deduct actual expenses on your vehicles (gas, depreciation, garaging, parking, maintenance, etc.) but not if you deduct the standard rate for. For cars that are exclusively used as business vehicles, the answer is generally yes. Generally, car insurance is classified as a ‘running cost’ of your vehicle, along with other car expenses. You�ll be happy to hear that, under certain circumstances, writing. So if your monthly car insurance premium is $120, you can deduct $72 per month or $864 per year.

Source: insurify.com

Source: insurify.com

The insurance costs for business vehicles fall under business expenses and is deductible on your taxes as such. In general, if you do not pay taxes when purchasing or acquiring something, auto insurance in this instance, there is likely nothing in. Thus, 60% of your auto insurance premium payments will be tax deductible. This included commuting to and from work, running personal errands, or driving for lunch during your lunch break. Not every type of car insurance uses a deductible.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title car insurance is tax deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea