Car insurance premium increase after address change Idea

Home » Trend » Car insurance premium increase after address change IdeaYour Car insurance premium increase after address change images are available. Car insurance premium increase after address change are a topic that is being searched for and liked by netizens now. You can Find and Download the Car insurance premium increase after address change files here. Get all royalty-free photos and vectors.

If you’re looking for car insurance premium increase after address change pictures information linked to the car insurance premium increase after address change interest, you have visit the right blog. Our site frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

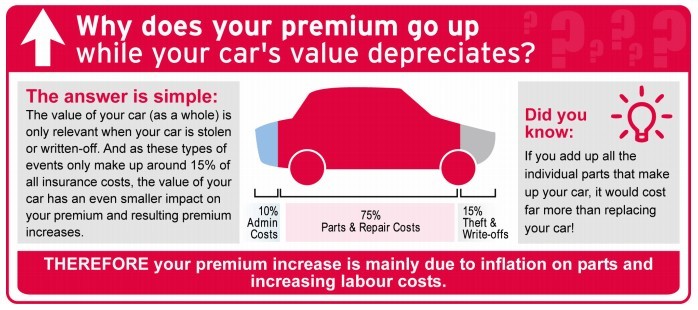

Car Insurance Premium Increase After Address Change. With our great car insurance rate change calculator, you can see by how much your current car insurance rate will spike (or plummet) depending upon just where you are relocating to. In recent years, medical and auto body repair costs have increased at a rate much faster than inflation. Some rate increases can be attributed to things outside of your control as a consumer. Lowering your annual mileage estimate can help to cut costs.

Car Insurance Premium Increase After Claim flipsdesigns From flipsdesigns.blogspot.com

If you�re moving a short distance, your rate may stay the same, but even if you�re only moving across town, your rate could change by a little or a lot. Is car insurance impacted when moving? You can receive senior discounts or pay a higher premium as an elderly driver. Minor changes shouldn�t impact on your insurance premium. Prices paid for home and motor insurance are changing due to new rules coming into effect on 1 january to protect loyal and vulnerable. Marriages, newly licensed drivers, or birthdays can all change your rates;

Whether you are moving out of state or in state, your car insurance policy may see changes because the location of your vehicle is one of the most important factors for rates and coverage options.

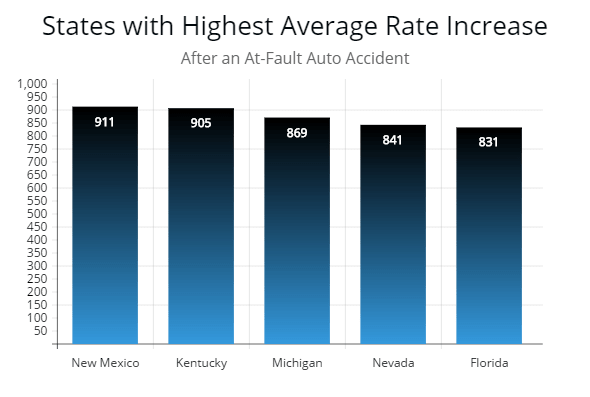

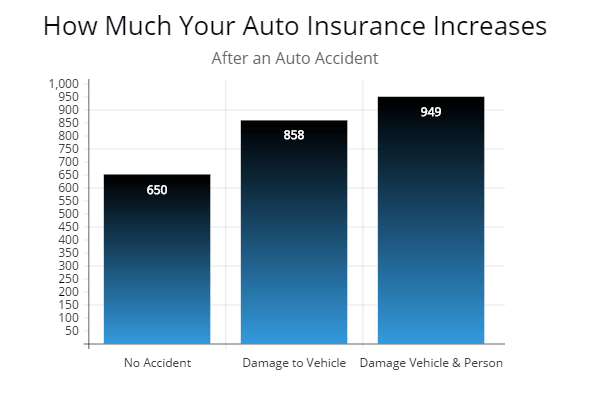

Maria riddle, 46, who lives in a small village near colchester, contacted the rac ahead of her house move in november to log a change of address. Yes, progressive does raise rates after 6 months in some cases. If you move, your premium could increase or decrease; Can i change insurer instead? For example, the number of drivers filing auto insurance claims has risen sharply over the past few years. Minor changes shouldn�t impact on your insurance premium.

Source: nerdwallet.com

Source: nerdwallet.com

If you�re moving a short distance, your rate may stay the same, but even if you�re only moving across town, your rate could change by a little or a lot. Key takeaways car insurance rates are affected by your zip code. If your insurance company does raise your premium, you can still lower the amount by increasing your deductible (the amount you’ll pay after you file a claim and your insurance kicks in). Traffic violations, such as driving under the influence and speeding, may prompt your insurer to increase your auto insurance premium. Retirement can lower your premiums if you now drive for pleasure rather than for work.

Source: miway.co.za

Source: miway.co.za

If you�re moving a short distance, your rate may stay the same, but even if you�re only moving across town, your rate could change by a little or a lot. Auto accidents and traffic violations are common explanations for an insurance rate increasing, but there are other reasons why car insurance premiums go up including an address change, new vehicle, and claims in your zip code. Different makes and models have different repair costs; If you move, your premium could increase or decrease; For example, according to the i.i.i., increasing your deductible from $200 to $500 could reduce your car insurance coverage cost by 15% to 30%.

Source: salinastriallaw.com

Source: salinastriallaw.com

If the change you need to make is significant, you might find your insurer does not like the risk and wants to charge you a huge amount. Auto accidents and traffic violations are common explanations for an insurance rate increasing, but there are other reasons why car insurance premiums go up including an address change, new vehicle, and claims in your zip code. With our great car insurance rate change calculator, you can see by how much your current car insurance rate will spike (or plummet) depending upon just where you are relocating to. Maria riddle, 46, who lives in a small village near colchester, contacted the rac ahead of her house move in november to log a change of address. Minor changes shouldn�t impact on your insurance premium.

Source: archwayinsurance.ca

Source: archwayinsurance.ca

If the change you need to make is significant, you might find your insurer does not like the risk and wants to charge you a huge amount. Carinsurance.com�s moving tool calculates the change in your premium for your new address. If you�re moving a short distance, your rate may stay the same, but even if you�re only moving across town, your rate could change by a little or a lot. The answer is yes, because your rate may go up or down based on your new address. It also covers the cost of injured crash victims’ medical care and lost wages as well as the repairs and/or replacement of vehicles and any property damaged in a crash.

Source: chambersmedical.com

Source: chambersmedical.com

When the world around us changes, those changes can have a significant effect on car insurance rates. Traffic violations, such as driving under the influence and speeding, may prompt your insurer to increase your auto insurance premium. Yes, progressive does raise rates after 6 months in some cases. You can receive senior discounts or pay a higher premium as an elderly driver. Some rate increases can be attributed to things outside of your control as a consumer.

Source: autoinsuresavings.org

Source: autoinsuresavings.org

If you move out of state, different car insurance requirements may also impact your coverages and premiums. You can receive senior discounts or pay a higher premium as an elderly driver. If your insurance company does raise your premium, you can still lower the amount by increasing your deductible (the amount you’ll pay after you file a claim and your insurance kicks in). Whether you are moving out of state or in state, your car insurance policy may see changes because the location of your vehicle is one of the most important factors for rates and coverage options. If the change you need to make is significant, you might find your insurer does not like the risk and wants to charge you a huge amount.

Source: mymoneyblog.com

Source: mymoneyblog.com

Newer cars may have enhanced safety and security features; Age can affect insurance rates in several ways; The latest cpi showed the auto insurance prices up 16.9% in may, following a 6.4% increase in april. When geico sets your premium, we also consider our overall group of insured drivers. If you move, your premium could increase or decrease;

Source: autoinsuresavings.org

Source: autoinsuresavings.org

Insurance providers like this because it means your car is less likely to be stolen or exposed to accidental damage from passing traffic. Prices paid for home and motor insurance are changing due to new rules coming into effect on 1 january to protect loyal and vulnerable. When the world around us changes, those changes can have a significant effect on car insurance rates. There are larger factors that impact the auto insurance industry overall. If you move out of state, different car insurance requirements may also impact your coverages and premiums.

Source: salesstaffapp.co.uk

Source: salesstaffapp.co.uk

Carinsurance.com�s moving tool calculates the change in your premium for your new address. Following a crash, the provider may also raise your rate if you were 50% or more responsible for the accident. It also covers the cost of injured crash victims’ medical care and lost wages as well as the repairs and/or replacement of vehicles and any property damaged in a crash. If you�re moving a short distance, your rate may stay the same, but even if you�re only moving across town, your rate could change by a little or a lot. Insurance providers like this because it means your car is less likely to be stolen or exposed to accidental damage from passing traffic.

Source: knowyourinsurance.net

Source: knowyourinsurance.net

If you move, your premium could increase or decrease; If you move out of state, different car insurance requirements may also impact your coverages and premiums. How to update your driving documents when your circumstances change Maria riddle, 46, who lives in a small village near colchester, contacted the rac ahead of her house move in november to log a change of address. The amount of accidents around you goes up or down.

Source: autoinsuranceape.com

Source: autoinsuranceape.com

If you move, your premium could increase or decrease; But if the change fundamentally increases the risk of you claiming your premium might rise. Is car insurance impacted when moving? When the world around us changes, those changes can have a significant effect on car insurance rates. Following a crash, the provider may also raise your rate if you were 50% or more responsible for the accident.

Source: flipsdesigns.blogspot.com

There are larger factors that impact the auto insurance industry overall. There are larger factors that impact the auto insurance industry overall. When the world around us changes, those changes can have a significant effect on car insurance rates. Is car insurance impacted when moving? Traffic violations, such as driving under the influence and speeding, may prompt your insurer to increase your auto insurance premium.

Source: immajamalcollections.blogspot.com

Source: immajamalcollections.blogspot.com

Retirement can be a major change in life. Is car insurance impacted when moving? It also covers the cost of injured crash victims’ medical care and lost wages as well as the repairs and/or replacement of vehicles and any property damaged in a crash. Following a crash, the provider may also raise your rate if you were 50% or more responsible for the accident. You can receive senior discounts or pay a higher premium as an elderly driver.

![]() Source: mybanktracker.com

Source: mybanktracker.com

When geico sets your premium, we also consider our overall group of insured drivers. How to update your driving documents when your circumstances change Age can affect insurance rates in several ways; Prices paid for home and motor insurance are changing due to new rules coming into effect on 1 january to protect loyal and vulnerable. Following a crash, the provider may also raise your rate if you were 50% or more responsible for the accident.

Source: immajamalcollections.blogspot.com

Source: immajamalcollections.blogspot.com

With our great car insurance rate change calculator, you can see by how much your current car insurance rate will spike (or plummet) depending upon just where you are relocating to. When the world around us changes, those changes can have a significant effect on car insurance rates. The insurer may also apply a price increase for a history of late payments. If the change you need to make is significant, you might find your insurer does not like the risk and wants to charge you a huge amount. The answer is yes, because your rate may go up or down based on your new address.

Source: compareukquotes.com

Source: compareukquotes.com

Maria riddle, 46, who lives in a small village near colchester, contacted the rac ahead of her house move in november to log a change of address. But know that insurance premiums aren�t raised on a whim, and the reason for a rate increase is almost always tied to insurance risk. Auto accidents and traffic violations are common explanations for an insurance rate increasing, but there are other reasons why car insurance premiums go up including an address change, new vehicle, and claims in your zip code. If the change you need to make is significant, you might find your insurer does not like the risk and wants to charge you a huge amount. Carinsurance.com�s moving tool calculates the change in your premium for your new address.

Source: insurancefouryou.com

Source: insurancefouryou.com

Prices paid for home and motor insurance are changing due to new rules coming into effect on 1 january to protect loyal and vulnerable. For example, the number of drivers filing auto insurance claims has risen sharply over the past few years. Maria riddle, 46, who lives in a small village near colchester, contacted the rac ahead of her house move in november to log a change of address. Can i change insurer instead? Following a crash, the provider may also raise your rate if you were 50% or more responsible for the accident.

Cars are put into insurance groups and switching from a can in a low group to a car in a higher group, even if the price of the car is lower, might see your premium rise. Key takeaways car insurance rates are affected by your zip code. Prices paid for home and motor insurance are changing due to new rules coming into effect on 1 january to protect loyal and vulnerable. If you�re moving a short distance, your rate may stay the same, but even if you�re only moving across town, your rate could change by a little or a lot. The financial conduct authority will ban, from january, the practice of charging existing customers a higher premium when renewing their insurance than they would charge someone taking out a new.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title car insurance premium increase after address change by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information