Car insurance rating territory ontario information

Home » Trend » Car insurance rating territory ontario informationYour Car insurance rating territory ontario images are ready in this website. Car insurance rating territory ontario are a topic that is being searched for and liked by netizens today. You can Get the Car insurance rating territory ontario files here. Download all royalty-free photos.

If you’re searching for car insurance rating territory ontario images information linked to the car insurance rating territory ontario interest, you have pay a visit to the right blog. Our site frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Car Insurance Rating Territory Ontario. And, as if that isn�t convenient enough, then wait for it: Liability opcf 44r accident benefits The information comes entirely from actual insurance claims data, collected from most of the car insurance companies in canada. Yeah, thats a pretty huge win.

State Auto Home Insurance Review From homeownersinsurancecover.net

State Auto Home Insurance Review From homeownersinsurancecover.net

Their offices are open from monday to friday between 8:00am and 5:00pm. The most expensive areas for car insurance Yeah, thats a pretty huge win. For example, there is generally more risk of a crash in more populated, urban areas, while rural locations may be more likely to have other risks, such as damage due to road conditions or weather. Where your vehicle is located is a factor in your premiums because traffic and other driving risks vary around the province. Use as per apcf 21n attached.

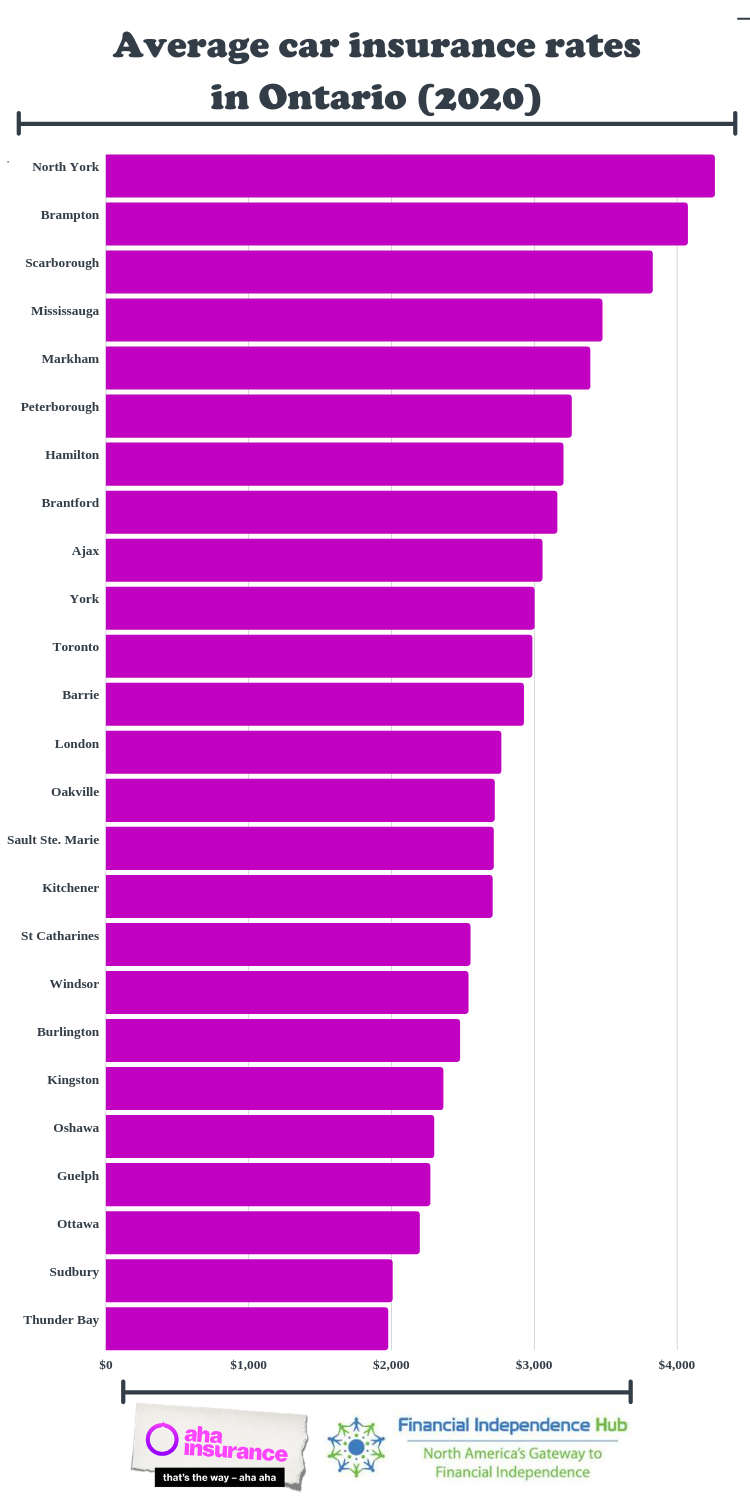

The most expensive areas for car insurance

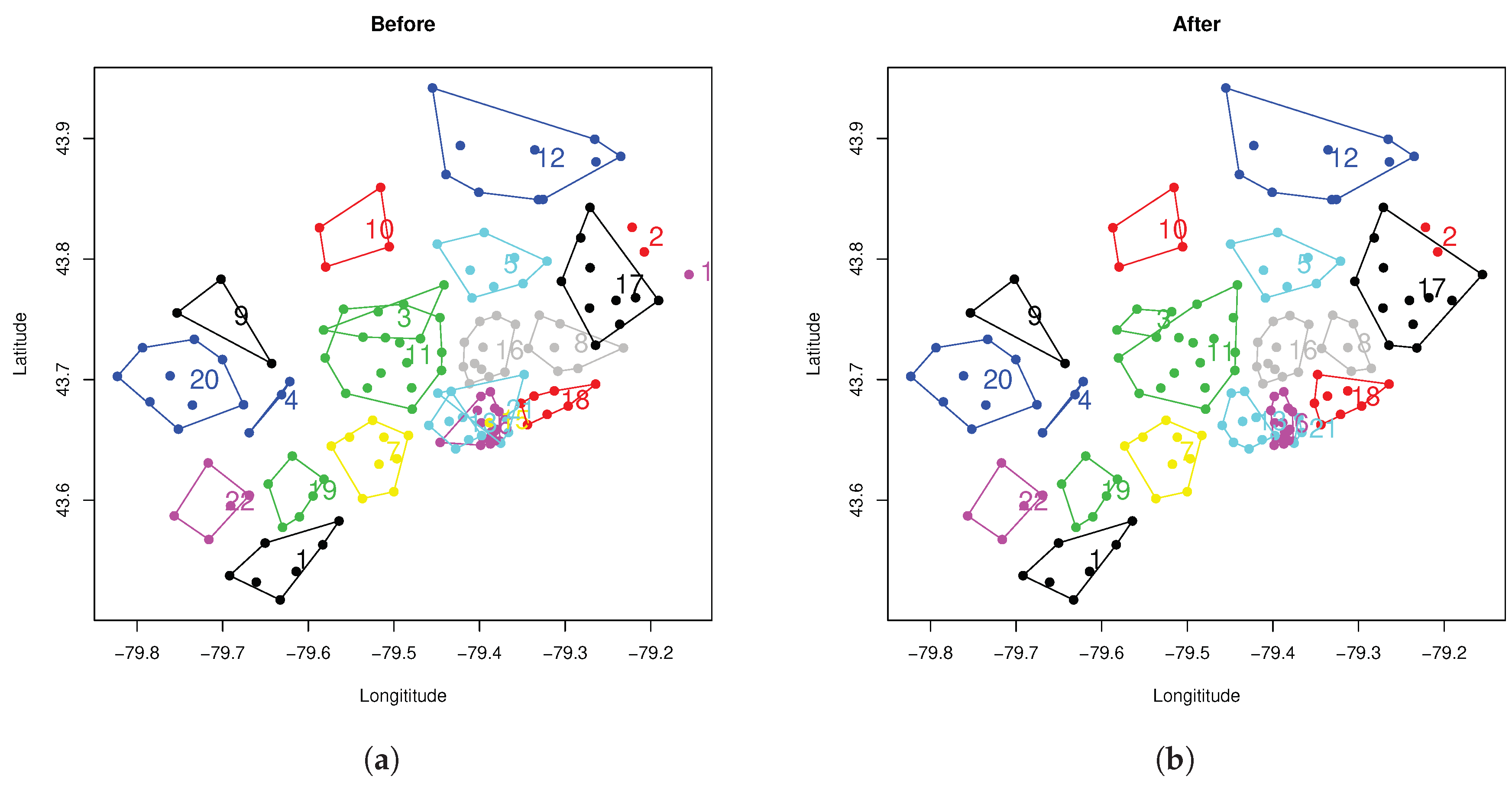

Now the average annual insurance rate is $1,718. Over the last 5 years, auto insurance rates in ontario have averaged $1501 per year, with only 3 statistical regions in the province paying a higher premium than that, all of which are in the gta or close to the gta. Statistical territory urban / description territory group rural saint john/moncton 402 1 u carleton/kent 401 2 r gloucester/madawaska 404 3 r northumberland/victoria 405 4 r nova scotia statistical territory urban / description territory group rural halifax/dartmouth 501 1 u sydney 502 2 r rest of province 500 3 r cape breton 503 4 r newfoundland There are only 55 rating territories allowed in ontario. While the number is mandated by fsco, the distribution of them can be different for every company. Revised guidelines for territorial rating minimum number of vehicles in new territory and credibility all newly formed territories should be based on a minimum of three years of company data and at least 2,500 annualized average vehicles over the three year period where a unique territory definition is proposed.

Source: california-dmv-9783.blogspot.com

Source: california-dmv-9783.blogspot.com

The factors that determine the cost of your ontario car insurance Now the average annual insurance rate is $1,718. While the number is mandated by fsco, the distribution of them can be different for every company. The information comes entirely from actual insurance claims data, collected from most of the car insurance companies in canada. One rationale for using postal codes as a rating factor is that a.

In q2 2021 (april, may, and june), ontario auto insurance rate changes amounted to a weighted average of 0.0%, but three insurance companies did lower their rates a bit. Gair insurance is located at 28 colborne street north in simcoe, ontario. Rating information auto no class driving record vehicle code rate group territory at fault claims/convictions surcharge bi pd/ ab coll/ dcpd ap acc. The financial services commission of ontario (fsco) has received automobile insurance rate and risk classification applications proposing the establishment of a large number of territories in urban areas. Yeah, thats a pretty huge win.

Source: pinterest.com

Source: pinterest.com

So, it does not come as a surprise that there are few cities where car insurance rates are cheap. Now the average annual insurance rate is $1,718. Connecticut has 18 auto insurance rating territories. The cheapest regions in toronto are still expensive when compared with the best rates in the province. The information comes entirely from actual insurance claims data, collected from most of the car insurance companies in canada.

Source: carinsuranceonswa.blogspot.com

The cheapest regions in toronto are still expensive when compared with the best rates in the province. Rating a territory or terr is an important aspect of auto insurance and its regulation of pricing. Jan 19th, 2017 6:27 pm. Low claims can add up to premium savings On average, ontario drivers can save 30% on car insurance using kanetix.ca.

Source: bankovia.com

Source: bankovia.com

Rates ranged from $1,479 to $1,503, roughly equal to the 2015 average for all of ontario. Jan 19th, 2017 6:27 pm. Their offices are open from monday to friday between 8:00am and 5:00pm. The clear system is built upon insurance claims data. Using this process, insurance companies are required to demonstrate that the pricing methodologies used by them are appropriate.

Source: findependencehub.com

Source: findependencehub.com

Yeah, thats a pretty huge win. Connecticut has 18 auto insurance rating territories. Their offices are open from monday to friday between 8:00am and 5:00pm. And, as if that isn�t convenient enough, then wait for it: While the number is mandated by fsco, the distribution of them can be different for every company.

Source: nocleginaplus.net

Source: nocleginaplus.net

The information comes entirely from actual insurance claims data, collected from most of the car insurance companies in canada. Rating information auto no class driving record vehicle code rate group territory at fault claims/convictions surcharge bi pd/ ab coll/ dcpd ap acc. Over the last 5 years, auto insurance rates in ontario have averaged $1501 per year, with only 3 statistical regions in the province paying a higher premium than that, all of which are in the gta or close to the gta. Territory codes don�t mean anything. Those top 10 cities, their premiums and the difference with the provincial average are as follows:

Source: statelocalgov.net

Source: statelocalgov.net

And, as if that isn�t convenient enough, then wait for it: For example, there is generally more risk of a crash in more populated, urban areas, while rural locations may be more likely to have other risks, such as damage due to road conditions or weather. The purpose of this bulletin is to advise insurers that fsco will be developing guidelines for territorial rating to ensure that consumers are. In q2 2021 (april, may, and june), ontario auto insurance rate changes amounted to a weighted average of 0.0%, but three insurance companies did lower their rates a bit. The cheapest regions in toronto are still expensive when compared with the best rates in the province.

Source: insurify.com

Source: insurify.com

Rates vary between urban and suburban areas and by other various factors, including a driver�s age, gender, marital status, vehicle, driving history, and credit score. The clear system is built upon insurance claims data. Ontario has the 2nd highest auto insurance premium in canada. Insurers use clear to assess how likely it is that a specific. Yeah, thats a pretty huge win.

Source: ratelab.ca

Source: ratelab.ca

The factors that determine the cost of your ontario car insurance The cheapest regions in toronto are still expensive when compared with the best rates in the province. There are only 55 rating territories allowed in ontario. Our ratesdotca auto insuramap data from december 2021 shows the average ontario car insurance premium is $1,555. Its purpose is to ensure that the premiums offered by the insurance companies are justified and precise.

Source: mdpi.com

Source: mdpi.com

Yeah, thats a pretty huge win. Rating information auto no class driving record vehicle code rate group territory at fault claims/convictions surcharge bi pd/ ab coll/ dcpd ap acc. Use as per apcf 21n attached. Which postal codes have the cheapest car insurance in ontario. Based on fsra, the average ontario car insurance premium was $1,651 as of march 2021.

Source: bankovia.com

Source: bankovia.com

Low claims can add up to premium savings Areas near kingston, belleville and napanee hovered around $1,000 in 2015. The financial services commission of ontario (fsco) has received automobile insurance rate and risk classification applications proposing the establishment of a large number of territories in urban areas. There are small villages and towns in ontario that have low insurance rates. Based on fsra, the average ontario car insurance premium was $1,651 as of march 2021.

Source: mychoice.ca

Source: mychoice.ca

The information comes entirely from actual insurance claims data, collected from most of the car insurance companies in canada. Statistical territory urban / description territory group rural saint john/moncton 402 1 u carleton/kent 401 2 r gloucester/madawaska 404 3 r northumberland/victoria 405 4 r nova scotia statistical territory urban / description territory group rural halifax/dartmouth 501 1 u sydney 502 2 r rest of province 500 3 r cape breton 503 4 r newfoundland Automobile statistical plan manual including underwriting information tracking january, 2013 v2.3 version 2.3 of the automobile statistical plan manual incorporates a number of changes as a result of data rationalization automobile insurance initiative: In 2015, ontarians had the highest auto insurance premium in the country — an average of $1,458 per vehicle, according to a report in. There are small villages and towns in ontario that have low insurance rates.

Source: hubbardinsurance.com

Source: hubbardinsurance.com

In q2 2021 (april, may, and june), ontario auto insurance rate changes amounted to a weighted average of 0.0%, but three insurance companies did lower their rates a bit. The clear system is built upon insurance claims data. Which postal codes have the cheapest car insurance in ontario. The purpose of this bulletin is to advise insurers that fsco will be developing guidelines for territorial rating to ensure that consumers are. Connecticut has 18 auto insurance rating territories.

Source: bloghpdownloads.blogspot.com

Source: bloghpdownloads.blogspot.com

Use as per apcf 21n attached. Rates ranged from $1,479 to $1,503, roughly equal to the 2015 average for all of ontario. Its purpose is to ensure that the premiums offered by the insurance companies are justified and precise. This year�s edition of how cars measure up presents the results for 2001 through 2019 models where at least 1,500 of each of the models were insured between 2014 and 2019. The most expensive areas for car insurance

Source: homeownersinsurancecover.net

Source: homeownersinsurancecover.net

Rates vary between urban and suburban areas and by other various factors, including a driver�s age, gender, marital status, vehicle, driving history, and credit score. One rationale for using postal codes as a rating factor is that a. Now the average annual insurance rate is $1,718. Added codes to signify the presence of: So, it does not come as a surprise that there are few cities where car insurance rates are cheap.

Source: allinsurancesforyou.blogspot.com

Source: allinsurancesforyou.blogspot.com

Their offices are open from monday to friday between 8:00am and 5:00pm. Insurers use clear to assess how likely it is that a specific. Added codes to signify the presence of: Which postal codes have the cheapest car insurance in ontario. So, it does not come as a surprise that there are few cities where car insurance rates are cheap.

Source: insurancekarma.com

Source: insurancekarma.com

The financial services commission of ontario (fsco) has received automobile insurance rate and risk classification applications proposing the establishment of a large number of territories in urban areas. This year�s edition of how cars measure up presents the results for 2001 through 2019 models where at least 1,500 of each of the models were insured between 2014 and 2019. Over the last 5 years, auto insurance rates in ontario have averaged $1501 per year, with only 3 statistical regions in the province paying a higher premium than that, all of which are in the gta or close to the gta. Dcpd coll/ comp/ ben ap sp com. Rating information auto no class driving record vehicle code rate group territory at fault claims/convictions surcharge bi pd/ ab coll/ dcpd ap acc.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title car insurance rating territory ontario by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information