Car insurance settlement taxable information

Home » Trending » Car insurance settlement taxable informationYour Car insurance settlement taxable images are available in this site. Car insurance settlement taxable are a topic that is being searched for and liked by netizens now. You can Find and Download the Car insurance settlement taxable files here. Find and Download all free photos.

If you’re looking for car insurance settlement taxable images information related to the car insurance settlement taxable topic, you have pay a visit to the right blog. Our site frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

Car Insurance Settlement Taxable. Car accident settlement depending on the type of loss from your car accident, the settlement you receive may or may not be taxable. It also provides brief explanations as to the rationale behind the guidelines. Generally, proceeds from your car insurance settlement are used to repair your car or pay for your medical bills and aren’t considered taxable income by the irs. If you received a settlement after being injured in a car accident, you may be wondering whether or not you have to pay taxes on it.

Auto Insurance 101 Choosing Your Car Insurance Policy From thebalance.com

Auto Insurance 101 Choosing Your Car Insurance Policy From thebalance.com

Any kind of medical claim you make to insurance, whether it�s part of a settlement you make after an accident or simply a claim for a medical appointment, won�t be taxed. Generally, proceeds from your car insurance settlement are used to repair your car or pay for your medical bills and aren’t considered taxable income by the irs. The internal revenue service (irs) has a tax law in place ( 26 c.f.r. Since an insurance payout is directly compensating you for a lost or damaged asset that you already own, it wouldn’t make sense to pay tax on something that’s already taxed at the point of sale. For example, if you buy a new car for £20,000, £4,000 of that purchase cost is vat. Certain damages included in a car accident settlement are taxable, namely those that are not compensatory.

Is an insurance settlement taxable?

Certain damages included in a car accident settlement are taxable, namely those that are not compensatory. For example, if you buy a new car for £20,000, £4,000 of that purchase cost is vat. Things that will be taxed include: The good news is, most car accident compensation is not taxable. If you received a settlement after being injured in a car accident, you may be wondering whether or not you have to pay taxes on it. Generally, proceeds from your car insurance settlement are used to repair your car or pay for your medical bills and aren’t considered taxable income by the irs.

Source: thebalance.com

Source: thebalance.com

The payments you receive to repair your vehicle and other property also won’t be taxed. 1) that protects accident victims from owing taxes on the majority of their injury settlements. The good news is, most car accident compensation is not taxable. Any portion of a car insurance settlement that is awarded for emotional distress suffered by the plaintiff due to the car accident is considered taxable income. Insurers award insurance settlements to compensate an injured party for her damages and losses.

Source: einsurance.com

Source: einsurance.com

Before you sign any documents for an insurance company or accept a settlement, consult with an experienced car accident lawyer. 1 you can get your car repaired or replaced and don’t have to worry about the tax bill. Whether car insurance settlements are taxable depends on the type of settlement and what damages the insurer. If you received a settlement after being injured in a car accident, you may be wondering whether or not you have to pay taxes on it. Is an insurance settlement taxable?

Source: askadamskutner.com

Source: askadamskutner.com

Car accident insurance settlements are generally not taxable, although there are certain exceptions, according to the (irs). According to h&r block, this may be taxable. Generally, proceeds from your car insurance settlement are used to repair your car or pay for your medical bills and aren’t considered taxable income by the irs. The payments you receive to repair your vehicle and other property also won’t be taxed. If you received a settlement after being injured in a car accident, you may be wondering whether or not you have to pay taxes on it.

Source: insurancepanda.com

Source: insurancepanda.com

If you split that into ten annual payments of $50,000, you’ll stay in a middle tax bracket unless your other income is. Car accident settlement depending on the type of loss from your car accident, the settlement you receive may or may not be taxable. Any portion of a car insurance settlement that is awarded for emotional distress suffered by the plaintiff due to the car accident is considered taxable income. Car accident settlements that are taxed. Are car accident settlements taxable?

Source: insurance.com

If you split that into ten annual payments of $50,000, you’ll stay in a middle tax bracket unless your other income is. Most insurance settlements are not taxable. We can help you figure out if your car accident insurance settlement is taxable, how much money you may be able to recover, and more. The good news is, most car accident compensation is not taxable. For example, if you�re in a car accident and incur $500 in medical expenses, your personal injury protection (pip) coverage will reimburse you.

Source: askadamskutner.com

Source: askadamskutner.com

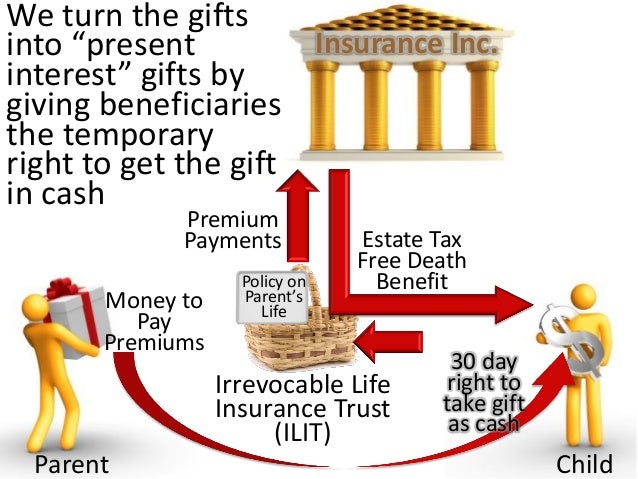

The government cannot tax you for any gross income you receive from an injury settlement for physical sickness or personal injuries according to federal regulations. Posted on july 16, 2021 july 13, 2021 whether you have already received compensation for injuries sustained in an accident or you have filed a claim but do not yet know how much you will receive, you may worry about the impact, or potential impact, of that claim on your taxes. Car accident settlement depending on the type of loss from your car accident, the settlement you receive may or may not be taxable. However, there are a variety of factors that can impact if you will need to pay taxes on some or all of your settlement. Is an insurance settlement taxable?

Source: thebalance.com

Source: thebalance.com

7 rows car insurance settlement for pain and suffering taxable: H&r block explains that this does not have to be included in your income if you are compensated for an injury, personal pain, or suffering. Since an insurance payout is directly compensating you for a lost or damaged asset that you already own, it wouldn’t make sense to pay tax on something that’s already taxed at the point of sale. According to h&r block, this may be taxable. The payments you receive to repair your vehicle and other property also won’t be taxed.

Source: insuredbypearson.com

Source: insuredbypearson.com

If you received a settlement after being injured in a car accident, you may be wondering whether or not you have to pay taxes on it. The internal revenue service (irs) has a tax law in place ( 26 c.f.r. Are car accident settlements taxable? According to h&r block, this may be taxable. 1) that protects accident victims from owing taxes on the majority of their injury settlements.

Source: yahoo.com

Source: yahoo.com

However, if you recover for lost income or emotional distress, the car accident insurance settlement is taxable. If you receive an auto insurance settlement, part of it may be taxable. It also provides brief explanations as to the rationale behind the guidelines. The good news is, most car accident compensation is not taxable. Therefore, they are considered income.

Source: gutierrezinjury.attorney

Source: gutierrezinjury.attorney

1 you can get your car repaired or replaced and don’t have to worry about the tax bill. Posted on july 16, 2021 july 13, 2021 whether you have already received compensation for injuries sustained in an accident or you have filed a claim but do not yet know how much you will receive, you may worry about the impact, or potential impact, of that claim on your taxes. It must be reported to the irs and you must pay income taxes on that amount. Generally, proceeds from your car insurance settlement are used to repair your car or pay for your medical bills and aren’t considered taxable income by the irs. For example, if you buy a new car for £20,000, £4,000 of that purchase cost is vat.

Source: dnsassociates.co.uk

Source: dnsassociates.co.uk

Since an insurance payout is directly compensating you for a lost or damaged asset that you already own, it wouldn’t make sense to pay tax on something that’s already taxed at the point of sale. If you received a settlement after being injured in a car accident, you may be wondering whether or not you have to pay taxes on it. Taxes on car accident settlements some car accident insurance settlements are taxable. It must be reported to the irs and you must pay income taxes on that amount. The payments you receive to repair your vehicle and other property also won’t be taxed.

Source: pinterest.com

Source: pinterest.com

The payments you receive to compensate you for medical bills will not be taxed. Car accident settlement depending on the type of loss from your car accident, the settlement you receive may or may not be taxable. The internal revenue service (irs) has a tax law in place ( 26 c.f.r. 7 rows car insurance settlement for pain and suffering taxable: However, the portion of the settlement that compensates you for medical bills, pain and suffering and property damages is not taxable.

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Are car accident settlements taxable? Therefore, they are considered income. Our car accident lawyer los angeles will clearly explain that the irs taxes any money classified as an income, but car insurance settlements don’t align under this category. If your vehicle is damaged in an accident, the settlement to repair or replace it will not be taxable as long as it doesn’t exceed your adjusted basis in the car, which is generally how much you paid for it and the cost of any improvements you made. If you split that into ten annual payments of $50,000, you’ll stay in a middle tax bracket unless your other income is.

Source: bernsteinslaw.com

Source: bernsteinslaw.com

While an auto accident insurance settlement will not be taxable in general, some parts of it may be subject to taxation. You earned interest on the settlement amount. Things that will be taxed include: If you received a settlement after being injured in a car accident, you may be wondering whether or not you have to pay taxes on it. However, there are a variety of factors that can impact if you will need to pay taxes on some or all of your settlement.

Source: bressmanlaw.com

Source: bressmanlaw.com

If you split that into ten annual payments of $50,000, you’ll stay in a middle tax bracket unless your other income is. It also provides brief explanations as to the rationale behind the guidelines. As mentioned above, anything that the irs considers income is taxable. You aren�t required to include the $2,000 you received as a car insurance settlement under your comprehensive coverage for your stolen vehicle as gross income on your taxes. You earned interest on the settlement amount.

Source: askadamskutner.com

Source: askadamskutner.com

Car accident insurance settlements are generally not taxable, although there are certain exceptions, according to the (irs). The payments you receive to compensate you for medical bills will not be taxed. For example, if you�re in a car accident and incur $500 in medical expenses, your personal injury protection (pip) coverage will reimburse you. 7 rows car insurance settlement for pain and suffering taxable: According to h&r block, this may be taxable.

Source: insuredasap.com

Source: insuredasap.com

It must be reported to the irs and you must pay income taxes on that amount. If you split that into ten annual payments of $50,000, you’ll stay in a middle tax bracket unless your other income is. Things that will be taxed include: The payments you receive to repair your vehicle and other property also won’t be taxed. Fortunately, the majority of car accident insurance settlements are not taxable in california.

Source: carinsurancecompanies.net

Source: carinsurancecompanies.net

The government cannot tax you for any gross income you receive from an injury settlement for physical sickness or personal injuries according to federal regulations. You aren�t required to include the $2,000 you received as a car insurance settlement under your comprehensive coverage for your stolen vehicle as gross income on your taxes. If you received a settlement after being injured in a car accident, you may be wondering whether or not you have to pay taxes on it. Car accident settlement depending on the type of loss from your car accident, the settlement you receive may or may not be taxable. If you receive an auto insurance settlement, part of it may be taxable.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title car insurance settlement taxable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea