Car insurance tax deductible australia information

Home » Trending » Car insurance tax deductible australia informationYour Car insurance tax deductible australia images are ready. Car insurance tax deductible australia are a topic that is being searched for and liked by netizens today. You can Get the Car insurance tax deductible australia files here. Find and Download all royalty-free images.

If you’re searching for car insurance tax deductible australia images information related to the car insurance tax deductible australia topic, you have come to the ideal blog. Our site frequently provides you with hints for seeing the highest quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

Car Insurance Tax Deductible Australia. There are a number of methods you can use to claim the car expenses. Car insurance home insurance travel insurance business insurance funeral insurance health insurance. This taxable amount is your total income minus the deduction: This will make life a lot easier for you come tax time.

Are Car Insurance Deductibles Tax Deductible Traditional From whitewedingscity.blogspot.com

Are Car Insurance Deductibles Tax Deductible Traditional From whitewedingscity.blogspot.com

What car expenses are tax deductible? You can make claims at the australian tax office for motoring expenses. However, if the damage to your car exceeds your policy limits, you can deduct the difference. If you make $50,000 a year and qualify for a $1,080 car insurance deduction, you should fall under the 25% tax bracket. If you use your car for both private and work purposes, you can only claim the work portion of your car expenses as a tax deduction. Insurance premiums are included in the ato’s definition of operating expenses.

Read more learn more about income protection back to aami search page products car insurance home & property

However, be sure to seek independent tax advice related to your individual circumstances. According to the australian taxation office (ato), you may be able to claim deductions for most operating expenses in the same income year you incur them. This taxable amount is your total income minus the deduction: This means that if you’ve bought life, tpd or trauma cover policies outside of super they’re not tax deductible. Australian tax car expenses can be worked out by calculating all car expenses relating to work purposes. If you use your car for work you are entitled to claim the work related travel expenses that relate to the business costs of using your car to do your job.

Source: everquote.com

Source: everquote.com

Read more about these methods. Insurance premiums, including accident or disability, fire, burglary, professional indemnity, public risk, motor vehicle, loss of profits insurance, or workers’. This taxable amount is your total income minus the deduction: Your costs must be greater than $100 and more than 10% of your agi. You must own the car to claim under any of these methods and the record.

Source: imbillionaire.net

Source: imbillionaire.net

This will make life a lot easier for you come tax time. This means that you can’t request a reimbursement of your premiums when lodging a tax return. Insurance premiums, including accident or disability, fire, burglary, professional indemnity, public risk, motor vehicle, loss of profits insurance, or workers’. This means that if you’ve bought life, tpd or trauma cover policies outside of super they’re not tax deductible. That means at tax time you may be able to claim your premium as a deduction and potentially save money.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Are car insurance premiums tax deductible? Income protection insurance premiums are generally income tax deductible in australia under the tax law provisions which allow deductions for expenses incurred in earning assessable income. If you use your car for both private and work purposes, you can only claim the work portion of your car expenses as a tax deduction. But if you pay $300 a month and your employer pays $300, you’d only be able to deduct $3,600 for the year. Are insurance premiums tax deductible in australia?

Source: ray11sportboy.blogspot.com

Source: ray11sportboy.blogspot.com

You may be able to claim your car insurance if you use your vehicle in performing your job or in running your business. This means that if you’ve bought life, tpd or trauma cover policies outside of super they’re not tax deductible. For cars that are exclusively used as business vehicles, the answer is generally yes. Read more about these methods. Company car petrol expenses or diesel expenses registration fees car lease deductible as business expense car insurance

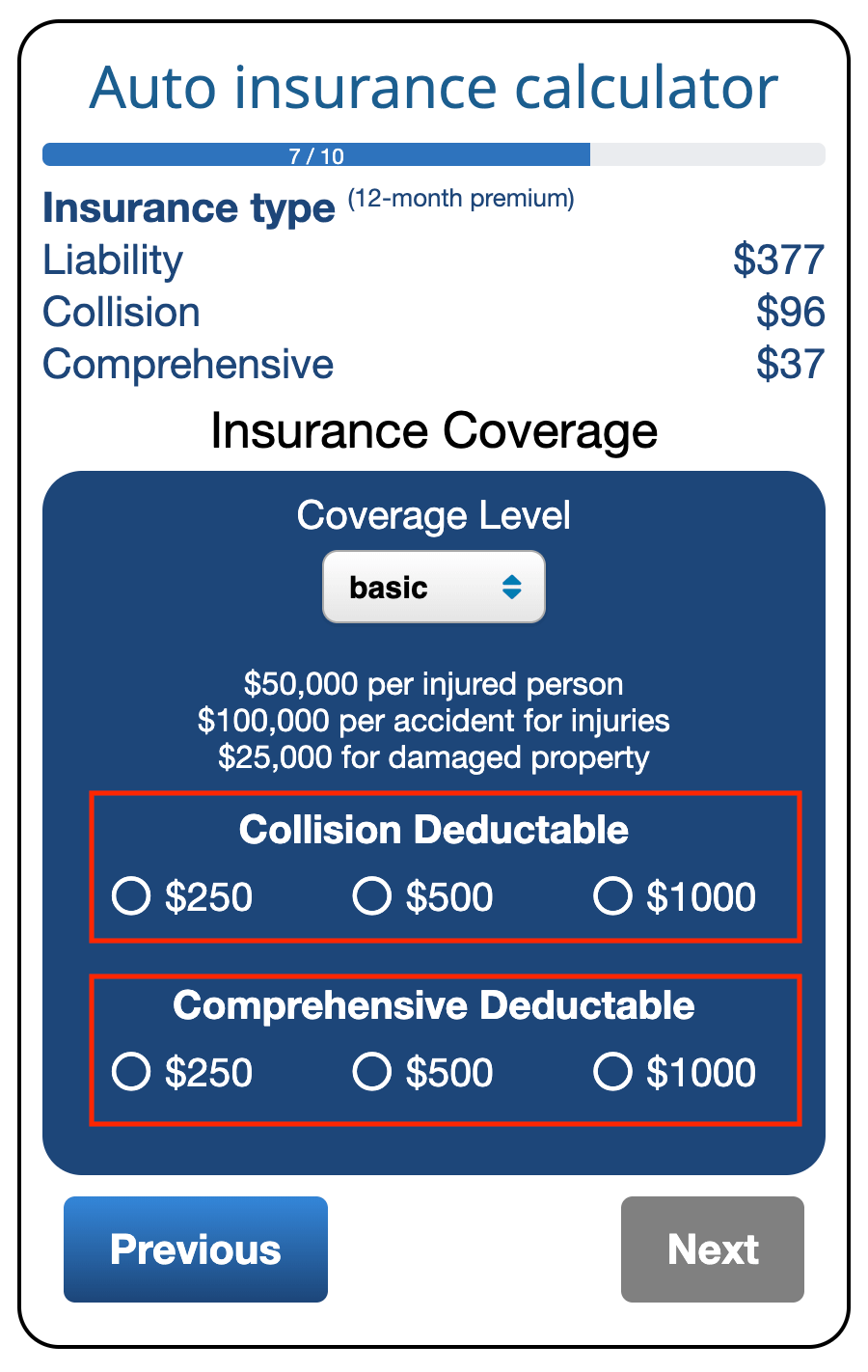

Source: valuepenguin.com

Source: valuepenguin.com

Australian tax car expenses can be worked out by calculating all car expenses relating to work purposes. Is car insurance tax deductible? According to the australian taxation office (ato), you may be able to claim deductions for most operating expenses in the same income year you incur them. That means at tax time you may be able to claim your premium as a deduction and potentially save money. Are car insurance premiums tax deductible?

For example, if you use your car to earn an income (e.g. You may be able to claim your car insurance if you use your vehicle in performing your job or in running your business. Insurance premiums, including accident or disability, fire, burglary, professional indemnity, public risk, motor vehicle, loss of profits insurance, or workers’. What car expenses are tax deductible? Company car petrol expenses or diesel expenses registration fees car lease deductible as business expense car insurance

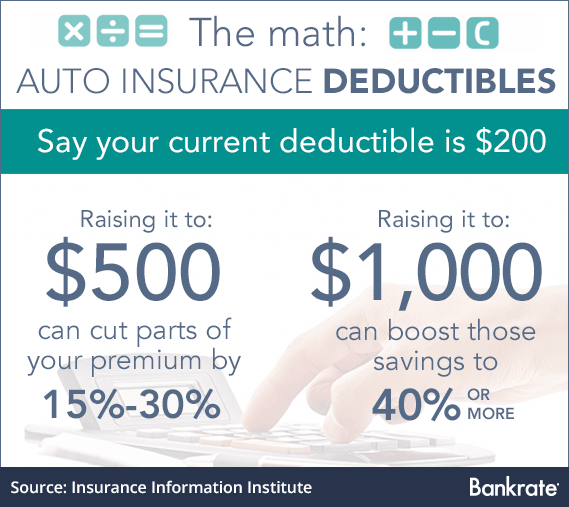

Source: bankrate.com

Source: bankrate.com

There are a number of methods you can use to claim the car expenses. This will make life a lot easier for you come tax time. Are car insurance premiums tax deductible? This taxable amount is your total income minus the deduction: What car expenses are tax deductible?

Source: whitewedingscity.blogspot.com

Source: whitewedingscity.blogspot.com

Are insurance premiums tax deductible in australia? If your activities fall under the umbrella of those that are eligible, you can claim them on vehicles that. Car insurance home insurance travel insurance business insurance funeral insurance health insurance. You will need to seek independent tax advice relating to your individual situation, however according to the ato, ‘you can generally claim a deduction for most operating expenses in the same income year you incur them. Tax deductions the general principal is that if the proceeds of the income protection policy would be assessable (because the proceeds are designed to replace lost.

For example, if you use your car to earn an income (e.g. If you use your car for both private and work purposes, you can only claim the work portion of your car expenses as a tax deduction. If you use your car for work you are entitled to claim the work related travel expenses that relate to the business costs of using your car to do your job. For example, if you use your car to earn an income (e.g. For a summary of this content in poster format, see motor vehicle expenses (pdf, 761kb) this link will download a file.

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

You must own the car to claim under any of these methods and the record. The $1,080 car insurance deduction means that you’ll pay taxes on $48,920 instead of the total income you made. If you use your car for work you are entitled to claim the work related travel expenses that relate to the business costs of using your car to do your job. Are car insurance premiums tax deductible? You may also be able to deduct your car insurance deductible cost.

Source: budgetdirect.com.au

Source: budgetdirect.com.au

However, be sure to seek independent tax advice related to your individual circumstances. You will need to seek independent tax advice relating to your individual situation, however according to the ato, ‘you can generally claim a deduction for most operating expenses in the same income year you incur them. Insurance premiums are included in the ato’s definition of operating expenses. To calculate your deduction you multiply the number of business kilometres the car travelled in the income year by the appropriate rate per kilometre for that income year. However, be sure to seek independent tax advice related to your individual circumstances.

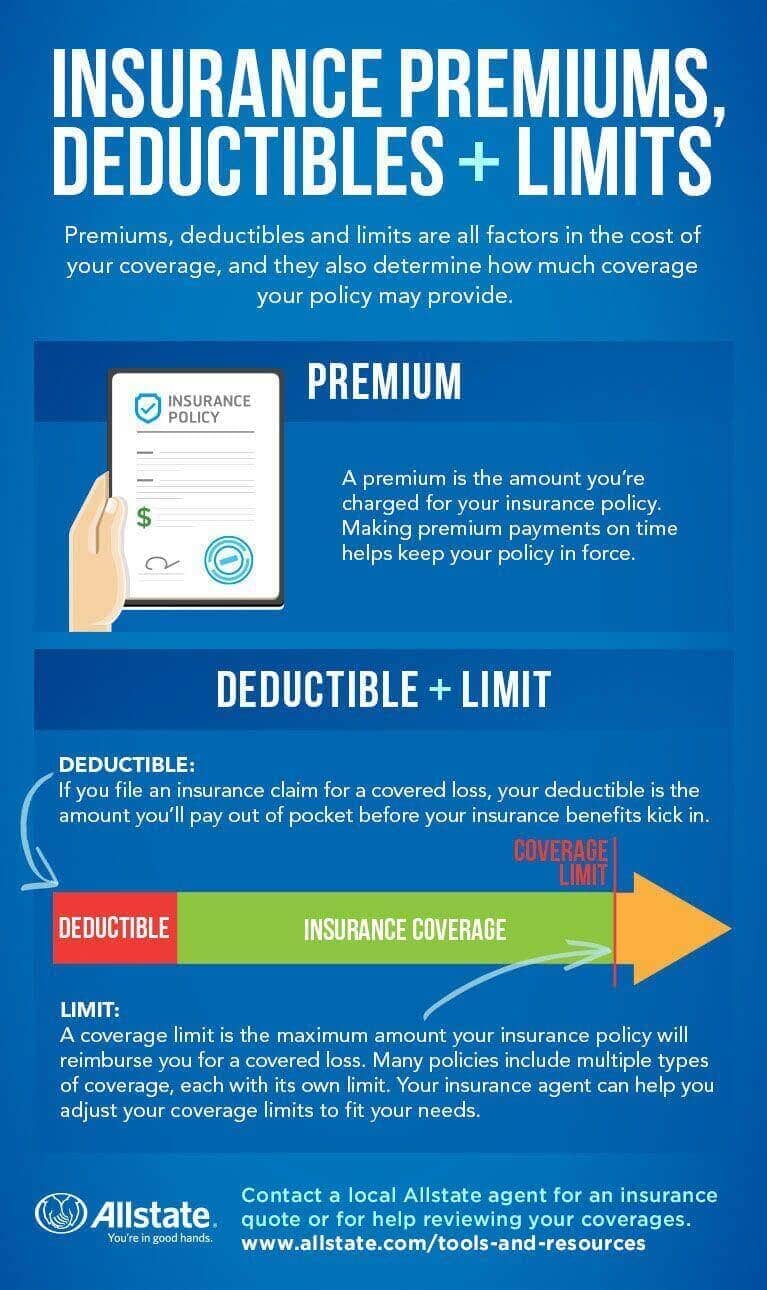

Source: pinterest.com

Source: pinterest.com

This means that if you’ve bought life, tpd or trauma cover policies outside of super they’re not tax deductible. However, if the damage to your car exceeds your policy limits, you can deduct the difference. To calculate your deduction you multiply the number of business kilometres the car travelled in the income year by the appropriate rate per kilometre for that income year. If you make $50,000 a year and qualify for a $1,080 car insurance deduction, you should fall under the 25% tax bracket. Are car insurance premiums tax deductible?

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

Insurance premiums are included in the ato’s definition of operating expenses. Your costs must be greater than $100 and more than 10% of your agi. You may also be able to deduct your car insurance deductible cost. Is car insurance tax deductible? Car insurance home insurance travel insurance business insurance funeral insurance health insurance.

Source: valchoice.com

Source: valchoice.com

You must own the car to claim under any of these methods and the record. A deductible expenditure in order to protect your income consists solely of your premiums. To calculate your deduction you multiply the number of business kilometres the car travelled in the income year by the appropriate rate per kilometre for that income year. But if you pay $300 a month and your employer pays $300, you’d only be able to deduct $3,600 for the year. Income protection insurance premiums are generally income tax deductible in australia under the tax law provisions which allow deductions for expenses incurred in earning assessable income.

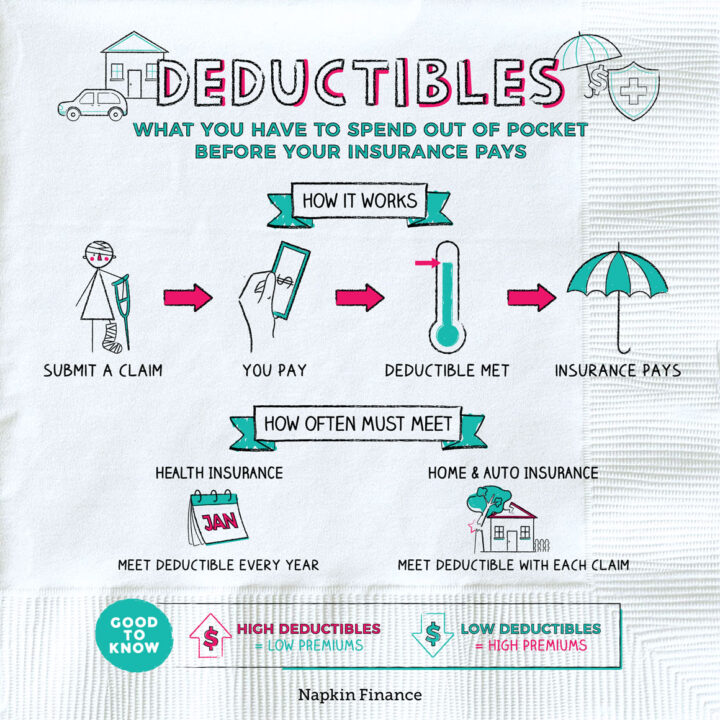

Source: napkinfinance.com

Source: napkinfinance.com

Read more about these methods. This means that if you’ve bought life, tpd or trauma cover policies outside of super they’re not tax deductible. If you use your own car for business or work, you may be able to claim your car insurance premiums as a tax deduction. Are insurance premiums tax deductible in australia? Tax deductions the general principal is that if the proceeds of the income protection policy would be assessable (because the proceeds are designed to replace lost.

Source: general.com

Source: general.com

You may be able to claim your car insurance if you use your vehicle in performing your job or in running your business. For cars that are exclusively used as business vehicles, the answer is generally yes. A premium can be discounted as much as 33% in this case. This taxable amount is your total income minus the deduction: If you use your own car for business or work, you may be able to claim your car insurance premiums as a tax deduction.

Source: moneygeek.com

Source: moneygeek.com

For cars that are exclusively used as business vehicles, the answer is generally yes. This means that you can’t request a reimbursement of your premiums when lodging a tax return. Company car petrol expenses or diesel expenses registration fees car lease deductible as business expense car insurance This can be done using either the cents per kilometre method or the logbook method. Most of the time, income protection premiums are tax deductible if you’re working (depending on a few individual circumstances).

Source: iselect.com.au

Source: iselect.com.au

A deductible expenditure in order to protect your income consists solely of your premiums. If you use your car for work you are entitled to claim the work related travel expenses that relate to the business costs of using your car to do your job. Read more learn more about income protection back to aami search page products car insurance home & property Insurance premiums, including accident or disability, fire, burglary, professional indemnity, public risk, motor vehicle, loss of profits insurance, or workers’. A premium can be discounted as much as 33% in this case.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title car insurance tax deductible australia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea