Care custody and control insurance cost Idea

Home » Trending » Care custody and control insurance cost IdeaYour Care custody and control insurance cost images are ready in this website. Care custody and control insurance cost are a topic that is being searched for and liked by netizens now. You can Get the Care custody and control insurance cost files here. Find and Download all royalty-free photos and vectors.

If you’re searching for care custody and control insurance cost images information related to the care custody and control insurance cost keyword, you have visit the right blog. Our site frequently gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Care Custody And Control Insurance Cost. Your policy will cover up to the chosen policy limits for injury, theft or death of the horses in your care, custody or control. Coverage for this exposure is available under other, more specific forms of insurance, such as motor truck cargo and garagekeepers insurance. For those that have large exposures; Policy limits are available up to $500,000 per horse and $2,000,000 maximum loss per policy year.

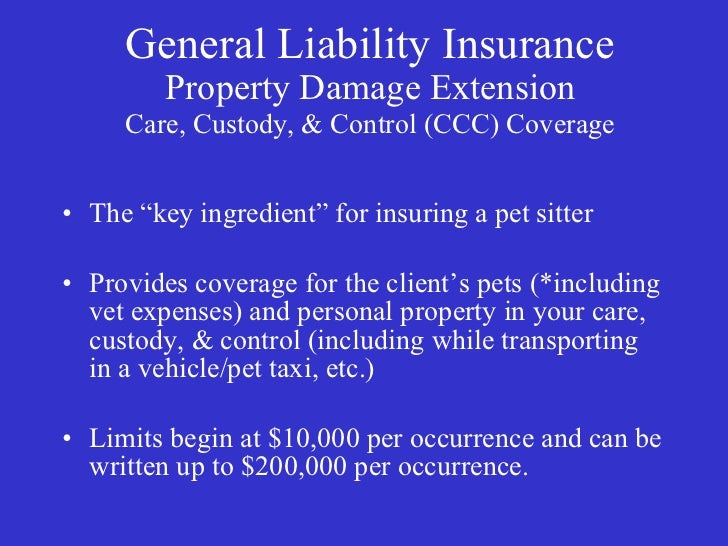

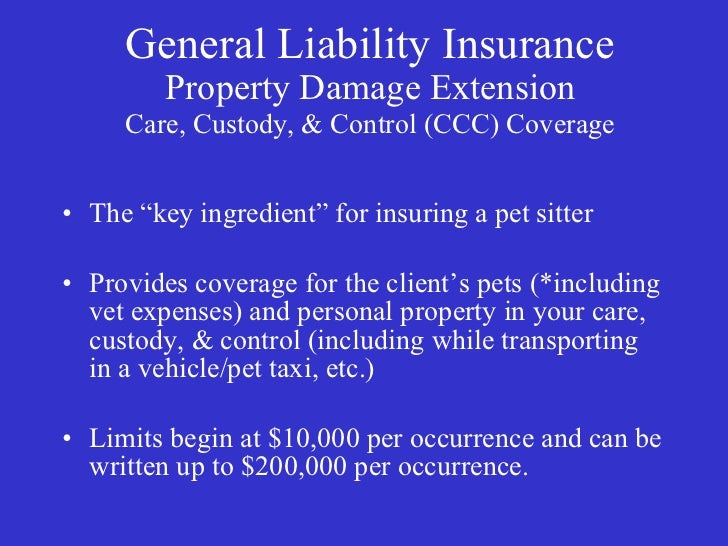

Petsitter insurance for the professional pet sitter From slideshare.net

Petsitter insurance for the professional pet sitter From slideshare.net

It provides for veterinary care or the horse�s value up to the policy limit. Policy limits are available up to $500,000 per horse and $2,000,000 maximum loss per policy year. It can also refer to you damaging real estate (like a wall in a client’s house) or personal property (like a television) while you are working on a client’s premises, but here we’ll focus on what you need to know when you have others’ property in your. A leading insurance industry trade group, the international risk management institute, notes that the definition of care, custody or control is dependent upon the jurisdiction and court giving the definition: Several limit options are available, up to a maximum amount of $200,000 per horse, $500,000 per policy period. Contact an agent for details.

Coverage for this exposure is available under other, more specific forms of insurance, such as motor truck cargo and garagekeepers insurance.

Defense costs are also covered. Your policy will cover up to the chosen policy limits for injury, theft or death of the horses in your care, custody or control. Care, custody and control (ccc) insurance coverage is to protect you in the event you or an employee of your operation is found legally liable for the death, injury, or theft of a horse that is in your care, custody, or control. Care, custody and control covers the owner�s liability if a horse dies or is injured under their care. These endorsements typically have a $5,000 limit on the care, custody and control coverage. That case involved musicians who left their musical instruments in.

Source: insurehorses.com

Source: insurehorses.com

The care, custody, and control liability insurance coverage protects you should the owner blame you for damages done to their animal while in your care, and demand you pay for surgeries, medicine, or expenses covering their death. Coverage for this exposure is available under other, more specific forms of insurance, such as motor truck cargo and garagekeepers insurance. There is an excess of £50 on each policy for any care, custody and control claims made, but having the cover in place could save you a huge amount of money were something to happen to a client’s pet. This insurance will cover up to the chosen policy limits for the injury, theft or death of the horses in your care, custody or control. Click for a care, custody & control quote if you are interested in information regarding insuring your horses or helping your clients find coverage for their horses for mortality and related coverages, visit our.

Source: lakestatecleaning.com

Source: lakestatecleaning.com

Incidental transit coverage within the continental u.s. As both prongs of the test were met, the care, custody, or control exclusion applied, and warehouse operator�s liability insurer had no further duty to their insured for this incident. It can also refer to you damaging real estate (like a wall in a client’s house) or personal property (like a television) while you are working on a client’s premises, but here we’ll focus on what you need to know when you have others’ property in your. Care, custody, or control is an exclusion found in liability insurance policies that removes compensation for the insured when a property that is placed in their care is damaged. The average cost for up to 10 horses at $100,000 each for veterinary care or mortality if the stable owner is deemed negligent is $1,500 annually.

Source: insureon.com

Source: insureon.com

And canada is included in ccc coverage. That case involved musicians who left their musical instruments in. The care, custody, and control liability insurance coverage protects you should the owner blame you for damages done to their animal while in your care, and demand you pay for surgeries, medicine, or expenses covering their death. Coverage for this exposure is available under other, more specific forms of insurance, such as motor truck cargo and garagekeepers insurance. This endorsement modifies insurance provided under the following:

Source: psfinc.com

Source: psfinc.com

For these insurers, the cgl�s care, custody and control exclusion(s) would still apply to all losses larger than $5,000. The exclusion applies to property damage and pollution cleanup costs. You are driving a truck you borrowed from a friend to use in your business. Consider this coverage if you board, train or breed horses for others. You may need items like bailee coverage or warehouseman’s liability or garage keeper’s coverage.

Source: sciroccogroup.com

Source: sciroccogroup.com

Get the coverage you need through ark agency animal insurance services, and contact them today. An example of cost for the above mentioned $5k/$25k would be about $275 per year. In others, any party with a legal obligation to exercise care with. The care, custody or control exclusion eliminates coverage for damage to property (including vehicles) in your care, custody or control. Incidental transit coverage within the continental u.s.

Source: psfinc.com

Source: psfinc.com

For example, if you are in the freight industry or operate an auto repair shop, you can purchase dedicated motor truck cargo insurance or garage keepers’ insurance that will protect you in case you damage a customer’s. You are driving a truck you borrowed from a friend to use in your business. If one of those horses is injured or dies while in your care and you are found negligent, this policy will provide for medical care or replacement of the horse up to. The care, custody, and control liability insurance coverage protects you should the owner blame you for damages done to their animal while in your care, and demand you pay for surgeries, medicine, or expenses covering their death. Here are examples of excluded claims.

Source: propertycasualty360.com

Source: propertycasualty360.com

Your policy will cover up to the chosen policy limits for injury, theft or death of the horses in your care, custody or control. For example, if you are in the freight industry or operate an auto repair shop, you can purchase dedicated motor truck cargo insurance or garage keepers’ insurance that will protect you in case you damage a customer’s. Care generally means to have “temporary charge of”, custody means “to keep or guard” and control means that it is “within your power to manage, or oversee”. Policy limits are available up to $500,000 per horse and $2,000,000 maximum loss per policy year. This insurance will cover up to the chosen policy limits for the injury, theft or death of the horses in your care, custody or control.

Source: propertycasualty360.com

Source: propertycasualty360.com

It provides for veterinary care or the horse�s value up to the policy limit. For example, if you are in the freight industry or operate an auto repair shop, you can purchase dedicated motor truck cargo insurance or garage keepers’ insurance that will protect you in case you damage a customer’s. There is an excess of £50 on each policy for any care, custody and control claims made, but having the cover in place could save you a huge amount of money were something to happen to a client’s pet. It can also refer to you damaging real estate (like a wall in a client’s house) or personal property (like a television) while you are working on a client’s premises, but here we’ll focus on what you need to know when you have others’ property in your. A leading insurance industry trade group, the international risk management institute, notes that the definition of care, custody or control is dependent upon the jurisdiction and court giving the definition:

Source: markelinsurance.com

Source: markelinsurance.com

Incidental transit coverage within the continental u.s. It can also refer to you damaging real estate (like a wall in a client’s house) or personal property (like a television) while you are working on a client’s premises, but here we’ll focus on what you need to know when you have others’ property in your. Yes, the intent of care, custody and control insurance is to provide coverage for people who board, train, breed, or are legally responsible for horses they do not own. Here are examples of excluded claims. “in some cases, ccc has been determined to entail physical possession of the property;

Source: st8wide.com

Source: st8wide.com

Several regional insurers have developed their own care, custody and control coverage endorsement that is attached to the cgl. Care, custody and control covers the owner�s liability if a horse dies or is injured under their care. Defense costs are also covered. An example of cost for the above mentioned $5k/$25k would be about $275 per year. The care, custody, and control policy will provide for the medical care or replacement cost of the horse up to the policy limits.

Source: propertycasualty360.com

Source: propertycasualty360.com

Coverage for this exposure is available under other, more specific forms of insurance, such as motor truck cargo and garagekeepers insurance. This insurance will cover up to the chosen policy limits for the injury, theft or death of the horses in your care, custody or control. Yes, the intent of care, custody and control insurance is to provide coverage for people who board, train, breed, or are legally responsible for horses they do not own. Policy limits are available up to $500,000 per horse and $2,000,000 maximum loss per policy year. Other coverage such as care, custody and control liability, stud farm property insurance/liability etc is available for quotation on an individual basis.

Source: simply-easier-acord-forms.blogspot.com

Source: simply-easier-acord-forms.blogspot.com

This endorsement modifies insurance provided under the following: There is an excess of £50 on each policy for any care, custody and control claims made, but having the cover in place could save you a huge amount of money were something to happen to a client’s pet. Care, custody and control covers the owner�s liability if a horse dies or is injured under their care. Incidental transit coverage within the continental u.s. You may need items like bailee coverage or warehouseman’s liability or garage keeper’s coverage.

Source: thebalancesmb.com

Source: thebalancesmb.com

Care, custody, or control (ccc) — an exclusion common to several forms of liability insurance, which eliminates coverage with respect to damage to property in the insured�s care, custody, or control. Several regional insurers have developed their own care, custody and control coverage endorsement that is attached to the cgl. You are driving a truck you borrowed from a friend to use in your business. It can also refer to you damaging real estate (like a wall in a client’s house) or personal property (like a television) while you are working on a client’s premises, but here we’ll focus on what you need to know when you have others’ property in your. For example, if you are in the freight industry or operate an auto repair shop, you can purchase dedicated motor truck cargo insurance or garage keepers’ insurance that will protect you in case you damage a customer’s.

Source: leasetrack.ai

Source: leasetrack.ai

Coverage for this exposure is available under other, more specific forms of insurance, such as motor truck cargo and garagekeepers insurance. Here are examples of excluded claims. The exclusion applies to property damage and pollution cleanup costs. As both prongs of the test were met, the care, custody, or control exclusion applied, and warehouse operator�s liability insurer had no further duty to their insured for this incident. Contact an agent for details.

Source: slideshare.net

Source: slideshare.net

Coverage includes defense costs for lawsuits including the cost of bail bonds, interest on judgments against you and expenses you incur at our request to assist in the defense, including loss of earnings, up to $100 per day. Incidental transit coverage within the continental u.s. And canada is included in ccc coverage. Your policy will cover up to the chosen policy limits for the injury, theft or death of the horses in your care, custody, or control. The average cost for up to 10 horses at $100,000 each for veterinary care or mortality if the stable owner is deemed negligent is $1,500 annually.

Source: simply-easier-acord-forms.blogspot.com

Source: simply-easier-acord-forms.blogspot.com

Several limit options are available, up to a maximum amount of $200,000 per horse, $500,000 per policy period. Fortunately, there are specialized insurance policies designed to cover property damages that could be impacted by the care, custody, and control exclusion. A leading insurance industry trade group, the international risk management institute, notes that the definition of care, custody or control is dependent upon the jurisdiction and court giving the definition: Yes, the intent of care, custody and control insurance is to provide coverage for people who board, train, breed, or are legally responsible for horses they do not own. Several regional insurers have developed their own care, custody and control coverage endorsement that is attached to the cgl.

Source: thebalancesmb.com

Source: thebalancesmb.com

Several regional insurers have developed their own care, custody and control coverage endorsement that is attached to the cgl. Contact an agent for details. Coverage includes defense costs for lawsuits including the cost of bail bonds, interest on judgments against you and expenses you incur at our request to assist in the defense, including loss of earnings, up to $100 per day. This insurance will cover up to the chosen policy limits for the injury, theft or death of the horses in your care, custody or control. “in some cases, ccc has been determined to entail physical possession of the property;

Source: investopedia.com

Source: investopedia.com

Fortunately, there are specialized insurance policies designed to cover property damages that could be impacted by the care, custody, and control exclusion. The average cost for up to 10 horses at $100,000 each for veterinary care or mortality if the stable owner is deemed negligent is $1,500 annually. Coverage includes defense costs for lawsuits including the cost of bail bonds, interest on judgments against you and expenses you incur at our request to assist in the defense and can include loss of earnings. Several regional insurers have developed their own care, custody and control coverage endorsement that is attached to the cgl. You are driving a truck you borrowed from a friend to use in your business.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title care custody and control insurance cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea