Cargo and liability insurance information

Home » Trending » Cargo and liability insurance informationYour Cargo and liability insurance images are ready in this website. Cargo and liability insurance are a topic that is being searched for and liked by netizens today. You can Download the Cargo and liability insurance files here. Get all royalty-free photos.

If you’re looking for cargo and liability insurance pictures information linked to the cargo and liability insurance interest, you have visit the ideal blog. Our site always gives you suggestions for seeking the maximum quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

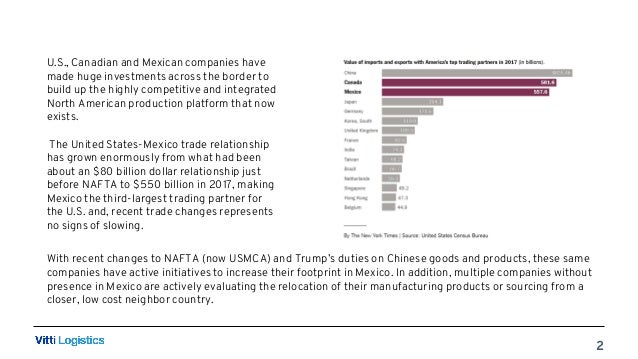

Cargo And Liability Insurance. Liability insurance is mandatory for all commercial trucks. Although they both involve certain coverage of freight, they have some key differences that are important to understand. One of the biggest liabilities commercial truck drivers and carriers face is damage done to other people. Cargo insurance is mainly categorized into land and marine cargo insurance (which also covers air cargo).

Cargo Insurance Carrier�s Liability From blog.crowley.com

Liability insurance is mandatory for all commercial trucks. Motor truck cargo liability insurance provides coverage for liability against the risks of direct physical loss to covered motor truck cargo while in transit and during loading or unloading. It covers theft, collusion damages, and other risks involved in land freight shipping. Although they both involve certain coverage of freight, they have some key differences that are important to understand. Cargo liability insurance is insurance policy purchased by the owner operator of a truck, train, or ship who is in the business of transporting goods from one point to another through a contract of carriage. Damaged and lost items are unfortunately a common problem when shipping freight.

Motor truck cargo liability insurance provides coverage for liability.

Driving without liability insurance results in large fines & penalties. Rare or precious cargo unless agreed by underwriter; The type of commodity being transported. Once you know that, it can be easier to pick specialized policies geared toward your industry with a little more confidence. Considering that your carrier or freight forwarder’s liability is limited to just a set dollar amount. Business auto life home health renter disability commercial auto long term care annuity.

Source: slideshare.net

Source: slideshare.net

An example of cargo liability insurance is what would protect a shipment of cars on a semitrailer truck against theft or damage while en route to a dealership. Carrier insurance a certificate of insurance (coi) displays coverage limits for primary liability policies. With carrier liability, the coverage is limited. One of the biggest liabilities commercial truck drivers and carriers face is damage done to other people. An example of cargo liability insurance is what would protect a shipment of cars on a semitrailer truck against theft or damage while en route to a dealership.

Source: slideshare.net

Source: slideshare.net

Frequently enough in order to reduce the insurance cost the additional limits are imposed within the total limit of liability under the insurance policy. Frequently enough in order to reduce the insurance cost the additional limits are imposed within the total limit of liability under the insurance policy. It usually depends on the maximum value of one shipment. Make sure your insurance coverage thoroughly protects you and your business, and make. Legal precedent has been set holding the logistics service provider liable in these cases.

Source: nvcargologistics.com

Source: nvcargologistics.com

Examples of cargo liabilities could be shortage, physical loss or damage to cargo by reason of for example bad stowage, wrong handling etc. It pays for bodily injury and property damages that carriers may cause to other people or property. It usually depends on the maximum value of one shipment. Make sure your insurance coverage thoroughly protects you and your business, and make. One of the biggest liabilities commercial truck drivers and carriers face is damage done to other people.

Source: uscustomsclearing.com

Source: uscustomsclearing.com

The definition of cargo liability insurance is insurance that protects products that are in transit by ship, train, semitrailer truck or delivery vehicle. Business auto life home health renter disability commercial auto long term care annuity. Cargo insurance also offers far more coverage than carrier liability. One of the biggest liabilities commercial truck drivers and carriers face is damage done to other people. Insuranceopedia explains cargo liability insurance.

Source: riskinsurancetedy.blogspot.com

Source: riskinsurancetedy.blogspot.com

Charterers liability insurance means that cover is provided for, among others, cargo claims, which come via the shipowner to the charterer under the charter party. Cargo and liability insurance is an insurance policy that will cover the transporter from the costs of these products should they get damaged or lost at any point from the start to the final destination, whether it is traveling by air, sea, or land. Driving without liability insurance results in large fines & penalties. It usually depends on the maximum value of one shipment. Subject to the limit of liability, terms and conditions of this policy, we will pay all sums which you are liable to pay following an occurrence happening during the period of insurance and arising out of your insured operations for:

Source: slideshare.net

Source: slideshare.net

Although they both involve certain coverage of freight, they have some key differences that are important to understand. Cargo liability insurance covers damages and losses that can occur but it will even cover additional losses that happen after the cargo is damaged. It covers property while at a terminal or dock awaiting final distribution. It usually depends on the maximum value of one shipment. Liability insurance is mandatory for all commercial trucks.

Source: botsoninsurancegroup.com

Source: botsoninsurancegroup.com

Cargo insurance from db schenker protects the full invoice value of your cargo, shipping costs, insurance costs, plus an additional 10%. Once you know that, it can be easier to pick specialized policies geared toward your industry with a little more confidence. M | +65 91 70 89 85. Carrier liability and cargo insurance (also known as shippers’ interest) are often thought to be the same thing. Considering that your carrier or freight forwarder’s liability is limited to just a set dollar amount.

Source: genextrans.com

Source: genextrans.com

With carrier liability, the coverage is limited. It is also typically used for domestic cargo. Subject to the limit of liability, terms and conditions of this policy, we will pay all sums which you are liable to pay following an occurrence happening during the period of insurance and arising out of your insured operations for: Although they both involve certain coverage of freight, they have some key differences that are important to understand. Frequently enough in order to reduce the insurance cost the additional limits are imposed within the total limit of liability under the insurance policy.

Source: worldinsuranceagency.com

Source: worldinsuranceagency.com

Whether it’s through a collision, unsafe driving, or unsecured cargo, truckers can be held liable for a lot of damage done to third parties. Subject to the limit of liability, terms and conditions of this policy, we will pay all sums which you are liable to pay following an occurrence happening during the period of insurance and arising out of your insured operations for: Primary liability and cargo insurance 🟩 dec 2021. Cargo liability insurance covers damages and losses that can occur but it will even cover additional losses that happen after the cargo is damaged. It’s called cif +10% insurance, and it’s the only kind of freight insurance we offer.

Source: ts.dbschenker.com

Source: ts.dbschenker.com

The definition of cargo liability insurance is insurance that protects products that are in transit by ship, train, semitrailer truck or delivery vehicle. One of the biggest liabilities commercial truck drivers and carriers face is damage done to other people. M | +65 91 70 89 85. Business auto life home health renter disability commercial auto long term care annuity. Make sure your insurance coverage thoroughly protects you and your business, and make.

Source: luxurialogistics.com

Source: luxurialogistics.com

Cargo and liability insurance is an insurance policy that will cover the transporter from the costs of these products should they get damaged or lost at any point from the start to the final destination, whether it is traveling by air, sea, or land. Cargo insurance from db schenker protects the full invoice value of your cargo, shipping costs, insurance costs, plus an additional 10%. Steel products unless surveyed by surveyor; It is also typically used for domestic cargo. It usually depends on the maximum value of one shipment.

Source: slideshare.net

Source: slideshare.net

Make sure your insurance coverage thoroughly protects you and your business, and make. So if the cargo is lost you will have to pay for the cargo, but then the company who hired you may sue for loss of income because their shipment did not arrive. One of the biggest liabilities commercial truck drivers and carriers face is damage done to other people. Carrier insurance a certificate of insurance (coi) displays coverage limits for primary liability policies. The definition of cargo liability insurance is insurance that protects products that are in transit by ship, train, semitrailer truck or delivery vehicle.

Source: fba.help

Source: fba.help

The definition of cargo liability insurance is insurance that protects products that are in transit by ship, train, semitrailer truck or delivery vehicle. Motor truck cargo liability insurance provides coverage for liability against the risks of direct physical loss to covered motor truck cargo while in transit and during loading or unloading. Considering that your carrier or freight forwarder’s liability is limited to just a set dollar amount. There are different types of cargo insurance policies, some going by names such as “all risks,” “broad form,” “legal liability,” and “motor truck freight.” regardless of what the name might imply, none of these policies provide complete protection against carmack amendment and common law liability. The definition of cargo liability insurance is insurance that protects products that are in transit by ship, train, semitrailer truck or delivery vehicle.

Source: blog.crowley.com

Legal precedent has been set holding the logistics service provider liable in these cases. It usually depends on the maximum value of one shipment. Liability insurance is mandatory for all commercial trucks. Motor truck cargo liability insurance provides coverage for liability against the risks of direct physical loss to covered motor truck cargo while in transit and during loading or unloading. With carrier liability, the coverage is limited.

Source: truckinsurancehq.com.au

Source: truckinsurancehq.com.au

Primary liability and cargo insurance 🟩 dec 2021. Legal precedent has been set holding the logistics service provider liable in these cases. Frequently enough in order to reduce the insurance cost the additional limits are imposed within the total limit of liability under the insurance policy. Make sure your insurance coverage thoroughly protects you and your business, and make. Carrier liability and cargo insurance (also known as shippers’ interest) are often thought to be the same thing.

Source: slideshare.net

Source: slideshare.net

With carrier liability, the coverage is limited. Rare or precious cargo unless agreed by underwriter; Once you know that, it can be easier to pick specialized policies geared toward your industry with a little more confidence. It is also typically used for domestic cargo. Liability insurance is mandatory for all commercial trucks.

Source: cannonball-express.com

Source: cannonball-express.com

Motor truck cargo liability insurance provides coverage for liability against the risks of direct physical loss to covered motor truck cargo while in transit and during loading or unloading. Examples of cargo liabilities could be shortage, physical loss or damage to cargo by reason of for example bad stowage, wrong handling etc. The 3 biggest factors in determining how much your cargo insurance premium will cost are: Damaged and lost items are unfortunately a common problem when shipping freight. Cargo insurance also offers far more coverage than carrier liability.

Source: slideshare.net

Source: slideshare.net

The definition of cargo liability insurance is insurance that protects products that are in transit by ship, train, semitrailer truck or delivery vehicle. M | +65 91 70 89 85. Cargo liability insurance is insurance policy purchased by the owner operator of a truck, train, or ship who is in the business of transporting goods from one point to another through a contract of carriage. It’s called cif +10% insurance, and it’s the only kind of freight insurance we offer. Driving without liability insurance results in large fines & penalties.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cargo and liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea