Cash loss in insurance Idea

Home » Trending » Cash loss in insurance IdeaYour Cash loss in insurance images are available. Cash loss in insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Cash loss in insurance files here. Find and Download all royalty-free photos and vectors.

If you’re looking for cash loss in insurance pictures information related to the cash loss in insurance keyword, you have come to the ideal blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Cash Loss In Insurance. This type of settlement does not allow you to replace what you�ve lost, at least not without some of the money to replace it coming out of your own pocket. The process is split into three stages as follows: The money can be used for meeting additional expenses that are not covered by health insurance or for even compensating the loss of income during the period of hospitalization. Total loss claims and actual cash value.

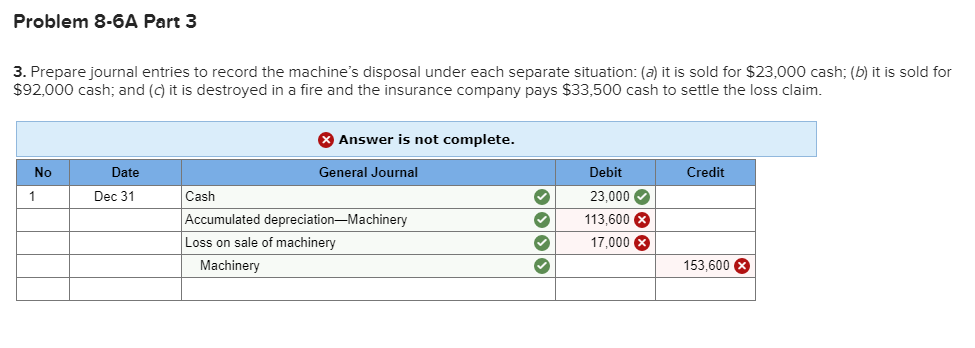

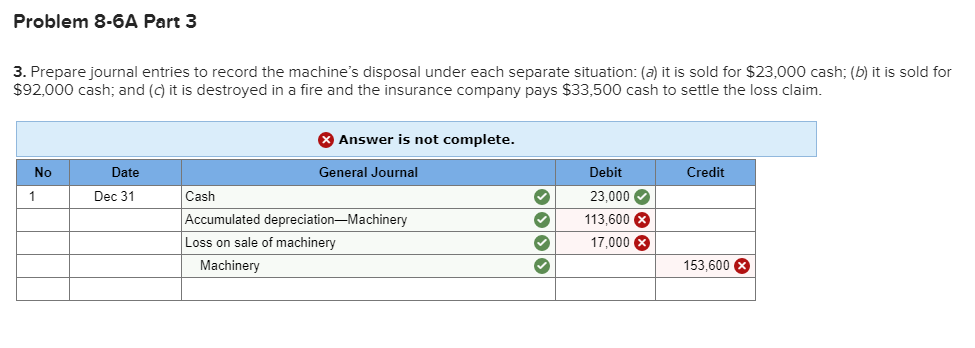

Solved Required Information Problem 86A Disposal Of Plan From chegg.com

Solved Required Information Problem 86A Disposal Of Plan From chegg.com

Any insurance claim receipts must be accounted for separately rather than being adjusted in the carrying amount of the asset. Today, we’re explaining everything you need to know about a total loss insurance claim for a home or business and what happens if your business or house is a total loss. The short answer, you better check your insurance policy. The insured person may receive $20,000, but after all of the amounts associated with the claim are tallied, the actual loss might be $63,300. The limit beyond which immediate payments is required from reinsurers. The term “total loss” is used by insurance companies to describe damage to property where the cost to repair (insurance company payout) exceeds the insurance policy coverage.

The actual loss is often only known once.

The term “total loss” is used by insurance companies to describe damage to property where the cost to repair (insurance company payout) exceeds the insurance policy coverage. Unless you want to take a photo of your register and send it to your insurance company on an hourly basis, it�s hard to prove how much cash was actually stolen in a theft or robbery. Actual cash value and replacement cost. How to cash in a life insurance policy yes, cashing out life insurance is possible. The insured person may receive $20,000, but after all of the amounts associated with the claim are tallied, the actual loss might be $63,300. In this case in event of major loss the settlement is on total loss basis and salvage is also retained by the insured.

Source: dreamstime.com

Source: dreamstime.com

The insured person may receive $20,000, but after all of the amounts associated with the claim are tallied, the actual loss might be $63,300. Cash in lieu in the vehicle insurance industry parlance refers to where a company exercises the option of giving one cash for repairs instead of repairing it for the client. The process is split into three stages as follows: In this case in event of major loss the settlement is on total loss basis and salvage is also retained by the insured. In the case of homeowner�s insurance, homeowners are.

Source: gadgets.ndtv.com

Source: gadgets.ndtv.com

The actual loss is often only known once. The loss settlement amount is the funds that an insurance company pays out to the homeowner in the event of a homeowner�s insurance claim. Theft of cash is a tricky subject for homeowners insurance. What is a total loss insurance claim? The money can be used for meeting additional expenses that are not covered by health insurance or for even compensating the loss of income during the period of hospitalization.

![]() Source: dreamstime.com

Source: dreamstime.com

The cash can get lumped in together with other pieces of currency or value (think gold coins, silver bars, etc). A cash loss is a provision, common in proportional reinsurance, which allows the ceding party to claim and receive immediate payment for a large loss without waiting for the usual periodic payment to occur. The term “total loss” is used by insurance companies to describe damage to property where the cost to repair (insurance company payout) exceeds the insurance policy coverage. The actual loss is often only known once. When you have a total loss vehicle, iaa has the tools you need to get from fnol to claim resolution efficiently.

![]() Source: iconfinder.com

Source: iconfinder.com

Typically, the amount of money covered is relatively small, say a few hundred dollars. Pd is mandatory in every state, but the only way to receive a payout from it is to file a claim against another driver’s pd. Actual cash value and replacement cost. The loss settlement amount is the funds that an insurance company pays out to the homeowner in the event of a homeowner�s insurance claim. The insured person may receive $20,000, but after all of the amounts associated with the claim are tallied, the actual loss might be $63,300.

Source: insurancemantra2018.blogspot.com

Source: insurancemantra2018.blogspot.com

Cash in lieu in the vehicle insurance industry parlance refers to where a company exercises the option of giving one cash for repairs instead of repairing it for the client. The journal entries below act as a quick reference for accounting for insurance proceeds. What is a total loss insurance claim? Theft of cash is a tricky subject for homeowners insurance. Typically, the amount of money covered is relatively small, say a few hundred dollars.

Source: dreamstime.com

Source: dreamstime.com

Homeowner�s insurance also covers the loss of your personal property. A daily hospital cash benefit provides a lump sum amount daily in case of hospitalization and this amount can be used per the insured’s need. The cash loss limit is a specified amount of loss if a claim exceeds then the ceding company shall have the option to call for an immediate payment from the reinsurers rather than just waiting till the end of the accounting period. Cash call — provision whereby large losses can be collected from reinsurers, rather thanpaid by the insurer on an account or from funds withheld or a loss escrowaccount. The process is split into three stages as follows:

Source: sanantoniolatest.blogspot.com

Source: sanantoniolatest.blogspot.com

The best ways to cash out a life insurance policy are to leverage cash value withdrawals , take out a loan against your policy, surrender your policy, or sell your policy in. Cash is difficult to document. If the amount of loss is material, it may be necessary to present the loss separately in the income statement. The short answer, you better check your insurance policy. This type of settlement does not allow you to replace what you�ve lost, at least not without some of the money to replace it coming out of your own pocket.

Source: insuranceclaimlawyerblog.com

Source: insuranceclaimlawyerblog.com

Iaa also deploys its catastrophe response plan when a weather disaster strikes. A home can also be considered a total loss by the insurance company when the cost to rebuild the home is higher than the value of the home. Any insurance claim receipts must be accounted for separately rather than being adjusted in the carrying amount of the asset. What is a total loss insurance claim? The journal entries below act as a quick reference for accounting for insurance proceeds.

Source: pinterest.com

Source: pinterest.com

A home can also be considered a total loss by the insurance company when the cost to rebuild the home is higher than the value of the home. Write off the damaged inventory to the impairment of inventory account. The term “total loss” is used by insurance companies to describe damage to property where the cost to repair (insurance company payout) exceeds the insurance policy coverage. Cash in lieu in the vehicle insurance industry parlance refers to where a company exercises the option of giving one cash for repairs instead of repairing it for the client. Homeowner�s insurance also covers the loss of your personal property.

Source: nairametrics.com

Source: nairametrics.com

As such, a cash call is interesting; When working with total loss vehicles, iaa uses integrated technology that makes the process as smooth as possible. The insured person may receive $20,000, but after all of the amounts associated with the claim are tallied, the actual loss might be $63,300. The actual loss is often only known once. A home can also be considered a total loss by the insurance company when the cost to rebuild the home is higher than the value of the home.

Source: tawasulinsurance.ae

Source: tawasulinsurance.ae

As such, a cash call is interesting; Theft of cash is a tricky subject for homeowners insurance. Apart from that, cash loss is a term used in insurance to mean that they will offer you a particular sum of money to get out of their obligations under the policy. In the case of homeowner�s insurance, homeowners are. Typically, the amount of money covered is relatively small, say a few hundred dollars.

Source: tellermate.com

Source: tellermate.com

A total loss fire claim. Actual cash value (acv) is the depreciated value of an item of property at the time of the loss. The short answer, you better check your insurance policy. The best ways to cash out a life insurance policy are to leverage cash value withdrawals , take out a loan against your policy, surrender your policy, or sell your policy in. Cash call — provision whereby large losses can be collected from reinsurers, rather thanpaid by the insurer on an account or from funds withheld or a loss escrowaccount.

Source: sanantoniolatest.blogspot.com

Any insurance claim receipts must be accounted for separately rather than being adjusted in the carrying amount of the asset. Any insurance claim receipts must be accounted for separately rather than being adjusted in the carrying amount of the asset. A cash loss is a provision, common in proportional reinsurance, which allows the ceding party to claim and receive immediate payment for a large loss without waiting for the usual periodic payment to occur. A total loss fire claim. Total loss claims and actual cash value.

Source: chegg.com

Source: chegg.com

The loss settlement amount is the funds that an insurance company pays out to the homeowner in the event of a homeowner�s insurance claim. This type of settlement does not allow you to replace what you�ve lost, at least not without some of the money to replace it coming out of your own pocket. Cash is difficult to document. Actual cash value (acv) is the depreciated value of an item of property at the time of the loss. A cash loss is a provision, common in proportional reinsurance, which allows the ceding party to claim and receive immediate payment for a large loss without waiting for the usual periodic payment to occur.

Source: pinterest.com

Source: pinterest.com

Cash call — provision whereby large losses can be collected from reinsurers, rather thanpaid by the insurer on an account or from funds withheld or a loss escrowaccount. It may contribute to reducing the primary insurer’s treasury needs. The journal entries below act as a quick reference for accounting for insurance proceeds. In the case of homeowner�s insurance, homeowners are. The insured person may receive $20,000, but after all of the amounts associated with the claim are tallied, the actual loss might be $63,300.

Source: prepaidexpensestoday.blogspot.com

Source: prepaidexpensestoday.blogspot.com

A daily hospital cash benefit provides a lump sum amount daily in case of hospitalization and this amount can be used per the insured’s need. When inventory is destroyed by fire, a business makes an insurance claim for the replacement cost of the damaged inventory. Cash in lieu in the vehicle insurance industry parlance refers to where a company exercises the option of giving one cash for repairs instead of repairing it for the client. Pd is mandatory in every state, but the only way to receive a payout from it is to file a claim against another driver’s pd. Homeowner�s insurance also covers the loss of your personal property.

Source: paychex.com

Source: paychex.com

The cash can get lumped in together with other pieces of currency or value (think gold coins, silver bars, etc). The short answer, you better check your insurance policy. The actual loss is often only known once. When you have a total loss vehicle, iaa has the tools you need to get from fnol to claim resolution efficiently. It may contribute to reducing the primary insurer’s treasury needs.

Source: justinsomjen.blogspot.com

A home can also be considered a total loss by the insurance company when the cost to rebuild the home is higher than the value of the home. In the case of homeowner�s insurance, homeowners are. For you to get compensation from pd, the other. The loss settlement amount is the funds that an insurance company pays out to the homeowner in the event of a homeowner�s insurance claim. How to cash in a life insurance policy yes, cashing out life insurance is possible.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cash loss in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea