Cash surrender value of life insurance information

Home » Trend » Cash surrender value of life insurance informationYour Cash surrender value of life insurance images are ready in this website. Cash surrender value of life insurance are a topic that is being searched for and liked by netizens now. You can Get the Cash surrender value of life insurance files here. Get all royalty-free photos and vectors.

If you’re searching for cash surrender value of life insurance images information connected with to the cash surrender value of life insurance topic, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

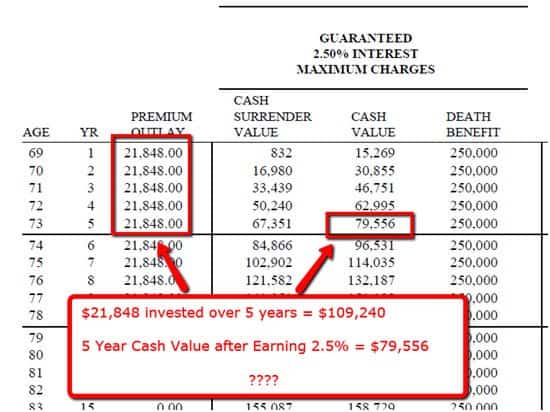

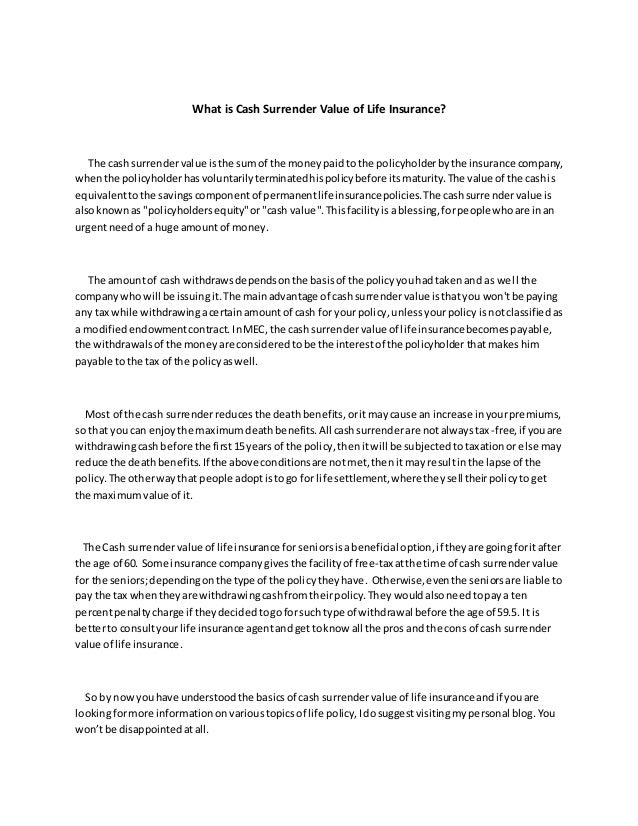

Cash Surrender Value Of Life Insurance. What does cash surrender value mean? A major part of a whole life insurance policy is the cash value. So is your cash surrender value of life insurance taxable? Then your insurance company adjusts for their surrender charge of 20 percent, for example.

How To Surrender Life Insurance Policy From thismyshiatsxz.blogspot.com

How To Surrender Life Insurance Policy From thismyshiatsxz.blogspot.com

Term life insurance doesn’t have an investment component, so there isn’t any cash value tied to the policy. Cash value vs surrender value. This comes from the monthly or annual premiums you pay to prevent a policy lapse. It is an amount that an insurance company pays when you decide to “surrender” your insurance policy back to the insurance company. What is cash surrender value? Sometimes the cash surrender value is equal to the cash value of your insurance policy, but there are instances where it may.

The surrender value of your policy depends on how much cash value you have and what if any surrender penalty exists when you want to cancel it.

This is called the cash surrender value. A cash surrender value is the original cash value, minus any applicable charges and fees. You will be able to take the money that is available in your cash surrender value as long as you are not already covered by another life insurance policy. The surrender value in life insurance plans refers to the amount of money an insurance company owes you if you cancel or withdraw your policy before the maturity date. The cash surrender value in your life insurance policy is essentially the amount of cash that you can withdraw if you surrender your policy to your insurance company and allow it to lapse. The cash surrender value represents the total payout that an insurance company will pay you as a policyholder if you decide to cash in your life insurance policy.

Source: accounting-services.net

Source: accounting-services.net

Cash surrender value is the accumulated fraction of a permanent life insurance policy’s cash value available to the owner upon retiring from the policy before their death. What is cash surrender value? Cash surrender value life insurance refers to a policy where you pay the insurance premium plus fees and a cash value. How long the surrender period lasts and how surrender charges are calculated is listed in your policy; This amount can vary according to a variety of factors.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Cash surrender value means the policyholder gets the cash that has built up in the account (minus surrender fees and taxes) in return for. This value is at times, lower than the maturity value, depending upon the time passed from the date of initiation of the policy till the date of surrendering it. The cash surrender value in your life insurance policy is essentially the amount of cash that you can withdraw if you surrender your policy to your insurance company and allow it to lapse. Cash value vs surrender value. Cash surrender value applies to whole life, universal life, or variable universal life policies.

Source: thismyshiatsxz.blogspot.com

Source: thismyshiatsxz.blogspot.com

The taxability of life insurance cash surrender value causes much confusion. This is separate from the value of the death benefit, and it encompasses different aspects such as the premiums paid, the interest earned, and any dividend cash values. A major part of a whole life insurance policy is the cash value. You can access a policy’s cash surrender value after cancellation or while keeping the policy in force, depending on the terms and conditions of your policy. The cash surrender value is the amount that would be paid out if the policy were.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

Depending on the age of the policy, this number can be less than what was originally invested in it. The surrender value of your policy depends on how much cash value you have and what if any surrender penalty exists when you want to cancel it. You will be able to take the money that is available in your cash surrender value as long as you are not already covered by another life insurance policy. What does cash surrender value mean? Depending on the age of the policy, this number can be less than what was originally invested in it.

Source: prefactvision.com

Source: prefactvision.com

This is separate from the value of the death benefit, and it encompasses different aspects such as the premiums paid, the interest earned, and any dividend cash values. This amount is payable to you after deducting the applicable surrender charges. The cash surrender value calculation is a way to figure out how much money you will receive if you choose to surrender your life insurance at a certain point in time. Subsequently, you will receive $5,600, and the company will earn $1,400 in fees. The surrender value in life insurance plans refers to the amount of money an insurance company owes you if you cancel or withdraw your policy before the maturity date.

Source: slideshare.net

Source: slideshare.net

What is cash surrender value? This is separate from the value of the death benefit, and it encompasses different aspects such as the premiums paid, the interest earned, and any dividend cash values. Cash value vs surrender value. They’re based on your age, gender, rating class, and the amount of coverage you have. Cash surrender value is not applicable with term policies, which only provide.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

The cash surrender value of life insurance is basically the same as the cash value of a life insurance policy. Does term life insurance have a cash surrender value? Then your insurance company adjusts for their surrender charge of 20 percent, for example. This comes from the monthly or annual premiums you pay to prevent a policy lapse. A cash surrender value is the original cash value, minus any applicable charges and fees.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Your cash surrender value is the money the insurance company will pay you if you terminate the policy or cash in a portion of your cash value. It is an amount that an insurance company pays when you decide to “surrender” your insurance policy back to the insurance company. In this context, “surrender” is another word for terminate or return. You can access a policy’s cash surrender value after cancellation or while keeping the policy in force, depending on the terms and conditions of your policy. This amount is payable to you after deducting the applicable surrender charges.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

Does term life insurance have a cash surrender value? Then your insurance company adjusts for their surrender charge of 20 percent, for example. Subsequently, you will receive $5,600, and the company will earn $1,400 in fees. Your cash surrender value is the money the insurance company will pay you if you terminate the policy or cash in a portion of your cash value. You can cancel your term life insurance policy whenever you want, but you won’t receive any money — and neither will your beneficiaries when you die.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Permanent life insurance policies accumulate a cash value. Cash surrender value life insurance refers to a policy where you pay the insurance premium plus fees and a cash value. Typically, the amount of cash surrender value increases as the policy’s cash value increases and. The cash surrender value in your life insurance policy is essentially the amount of cash that you can withdraw if you surrender your policy to your insurance company and allow it to lapse. Cash value vs surrender value.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The answer is also no. They’re based on your age, gender, rating class, and the amount of coverage you have. The taxability of life insurance cash surrender value causes much confusion. Your cash surrender value is the money the insurance company will pay you if you terminate the policy or cash in a portion of your cash value. Cash surrender value life insurance refers to a policy where you pay the insurance premium plus fees and a cash value.

Source: personal-accounting.org

Source: personal-accounting.org

They’re based on your age, gender, rating class, and the amount of coverage you have. The cash surrender value is the amount of money an insurer will pay you if you surrender a permanent life insurance policy that has a cash value. This amount is payable to you after deducting the applicable surrender charges. Cash value vs surrender value. Many insurance companies will need policies to be active for a certain duration before the cash value surrender can be given.

Source: slideshare.net

Source: slideshare.net

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. If you decide you no longer want your permanent life insurance policy, your insurance company will pay you a lump sum when the policy voluntarily terminates. Cash surrender value is not applicable with term policies, which only provide. Does term life insurance have a cash surrender value? Typically, the amount of cash surrender value increases as the policy’s cash value increases and.

Source: britneyspearspictzzd.blogspot.com

Source: britneyspearspictzzd.blogspot.com

They’re based on your age, gender, rating class, and the amount of coverage you have. Cash surrender value is the amount that you will be able to withdraw from your life insurance policy if you decide to cancel the policy. Cash surrender value is the sum of money an insurance company pays to the policyholder or account owner upon the surrender of a policy/account. Cash surrender value applies to whole life, universal life, or variable universal life policies. This amount is payable to you after deducting the applicable surrender charges.

Source: insuranceadvantage.ca

Source: insuranceadvantage.ca

Cash surrender value means the policyholder gets the cash that has built up in the account (minus surrender fees and taxes) in return for. You can access a policy’s cash surrender value after cancellation or while keeping the policy in force, depending on the terms and conditions of your policy. What is a surrender period? This amount is payable to you after deducting the applicable surrender charges. Cash surrender value is the money that the life insurance policyholder will receive if they actually withdraw before the completion of policy or his death;

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Your cash surrender value is the money the insurance company will pay you if you terminate the policy or cash in a portion of your cash value. The cash surrender value is the amount that would be paid out if the policy were. So is your cash surrender value of life insurance taxable? You will be able to take the money that is available in your cash surrender value as long as you are not already covered by another life insurance policy. Cash value vs surrender value.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Does term life insurance have a cash surrender value? But the marketing brochures often have numerous footnotes on the tax subject. In this context, “surrender” is another word for terminate or return. The cash surrender value of life insurance is basically the same as the cash value of a life insurance policy. They’re based on your age, gender, rating class, and the amount of coverage you have.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

The surrender value in life insurance plans refers to the amount of money an insurance company owes you if you cancel or withdraw your policy before the maturity date. Sometimes the cash surrender value is equal to the cash value of your insurance policy, but there are instances where it may. Depending on the age of the policy, this number can be less than what was originally invested in it. You want to surrender the policy to access the cash value in it. Cash surrender value life insurance refers to a policy where you pay the insurance premium plus fees and a cash value.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cash surrender value of life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information