Cash surrender value of life insurance taxable in canada information

Home » Trending » Cash surrender value of life insurance taxable in canada informationYour Cash surrender value of life insurance taxable in canada images are ready. Cash surrender value of life insurance taxable in canada are a topic that is being searched for and liked by netizens today. You can Find and Download the Cash surrender value of life insurance taxable in canada files here. Find and Download all free photos and vectors.

If you’re looking for cash surrender value of life insurance taxable in canada pictures information linked to the cash surrender value of life insurance taxable in canada topic, you have pay a visit to the right site. Our website always gives you hints for viewing the maximum quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

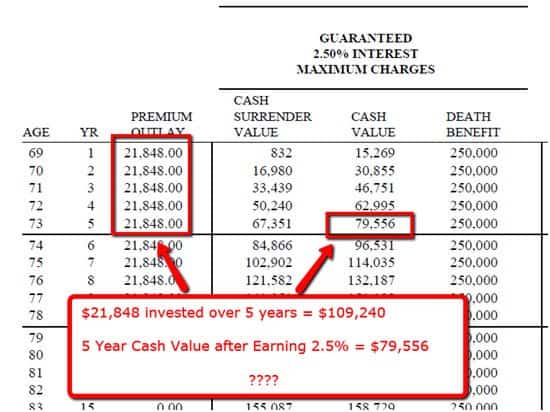

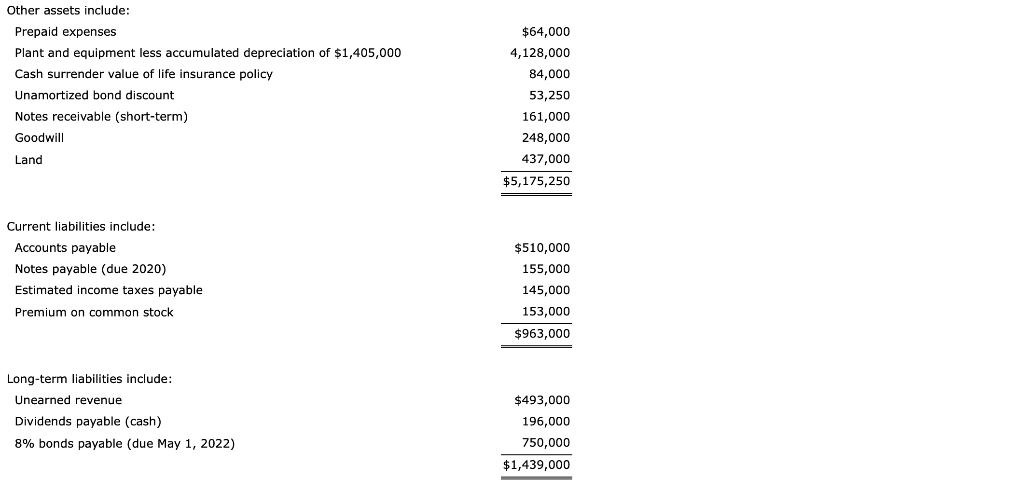

Cash Surrender Value Of Life Insurance Taxable In Canada. The other $10,000 is considered a. You will pay tax on $2,000 at a rate of 25%. In canada, the cash surrender value of a life insurance policy is taxable if the cash value received exceeds the adjusted cost base. “you might also have to.

What is Universal Life Insurance? Insurance Advantage From insuranceadvantage.ca

What is Universal Life Insurance? Insurance Advantage From insuranceadvantage.ca

This comes from the monthly or annual premiums you pay to prevent a policy lapse. The net cost is a rate using one year renewal term from a government table. The cash surrender value of life insurance is basically the same as the cash value of a life insurance policy. If your beneficiaries received any interest earnings from the policy, along with a death benefit, the interest would be taxable as income. If kate’s corporation owns and. “is my life insurance cash surrender value taxable?” isn�t the right question.

“you might also have to.

In canada, the cash surrender value can become taxable under a number of circumstances. The net cost is a rate using one year renewal term from a government table. This comes from the monthly or annual premiums you pay to prevent a policy lapse. Regardless of the size of the policy, your spouse, child or anyone else you’ve named as a beneficiary would not have to report life insurance proceeds as taxable income on their. In canada, the cash surrender value can become taxable under a number of circumstances. If your beneficiaries received any interest earnings from the policy, along with a death benefit, the interest would be taxable as income.

Source: clips-dkso.blogspot.com

Source: clips-dkso.blogspot.com

Regardless of the size of the policy, your spouse, child or anyone else you’ve named as a beneficiary would not have to report life insurance proceeds as taxable income on their. Is cash value of life insurance taxable in canada? It’s one of the perks of purchasing a life insurance policy. The answer is also no. If you choose to surrender the policy and receive its cash value in return, you will pay taxes based on the amount that your investments increased in value.

Source: lsminsurance.ca

Source: lsminsurance.ca

If you surrender your cash value life insurance policy, any gain on the policy will be subject to federal (and possibly state) income tax. In canada, the cash surrender value of a life insurance policy is taxable if the cash value received exceeds the adjusted cost base. In canada, the cash surrender value can become taxable under a number of circumstances. You pay $1,000 in surrender charges and receive a check from the insurance company for $12,000. In that case, the cash surrender value of your life insurancepolicy is considered taxable;

Source: sec.gov

Source: sec.gov

Any amount you receive over the amount of premiums you paid is taxable income. If your beneficiaries received any interest earnings from the policy, along with a death benefit, the interest would be taxable as income. When you surrender a permanent policy, you exchange your death benefit for a cash payout from your insurance company. The net cost is a rate using one year renewal term from a government table. In canada, the cash surrender value of a life insurance policy is taxable if the cash value received exceeds the adjusted cost base.

Source: foxbusiness.com

Source: foxbusiness.com

The net cost is a rate using one year renewal term from a government table. The cash value refers to the amount of money deposited in the life insurance policy. If the csv is more than the premiums and you surrender the policy (cancel it), the excess is earnings and taxable income. In general, whole life policies have two parts—a guaranteed cash value (that you need to cash in the policy to get, or alternatively, get a. If you choose to surrender the policy and receive its cash value in return, you will pay taxes based on the amount that your investments increased in value.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Permanent life insurance policies can accrue cash value, which you can get by cashing out your policy. Instead, you need to take the amount of premiums paid minus the value of insurance to determine your acb. Is life insurance taxable in canada? It’s one of the perks of purchasing a life insurance policy. For example, imagine you have taken a $150,000 distribution (sometimes referred to as a cash surrender value) from your whole life policy, and over the years, you have paid $50,000 in premiums.

Source: ascendantfinancial.ca

Source: ascendantfinancial.ca

You will pay tax on $2,000 at a rate of 25%. Is cash surrender value of life insurance taxable in canada? If the csv is more than the premiums and you surrender the policy (cancel it), the excess is earnings and taxable income. In canada, the cash surrender value of a life insurance policy is taxable if the cash value received exceeds the adjusted cost base. The cash value refers to the amount of money deposited in the life insurance policy.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

When you surrender a permanent policy, you exchange your death benefit for a cash payout from your insurance company. It’s one of the perks of purchasing a life insurance policy. Yes—if you surrender your life insurance policy and the cash value exceeds the adjusted cost base of the policy (acb). If the csv is more than the premiums and you surrender the policy (cancel it), the excess is earnings and taxable income. If you choose to surrender the policy and receive its cash value in return, you will pay taxes based on the amount that your investments increased in value.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Yes—if you surrender your life insurance policy and the cash value exceeds the adjusted cost base of the policy (acb). Yes—if you surrender your life insurance policy and the cash value exceeds the adjusted cost base of the policy (acb). If you choose to surrender the policy and receive its cash value in return, you will pay taxes based on the amount that your investments increased in value. In general, whole life policies have two parts—a guaranteed cash value (that you need to cash in the policy to get, or alternatively, get a. Partial surrender (withdrawal) of cash surrender value in the case of a partial surrender, the amount of the withdrawal that is taxable is proportional to the ratio at which the total cash surrender value would be taxable on surrender.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Generally, the cash surrender value is the cash built up portion of the insurance policy. The answer is also no. You will have to pay tax based on the increased value of. The truth is, asking simply: If you cash in a life insurance policy, you may need to pay tax on the cash surrender value.

Source: kitces.com

Source: kitces.com

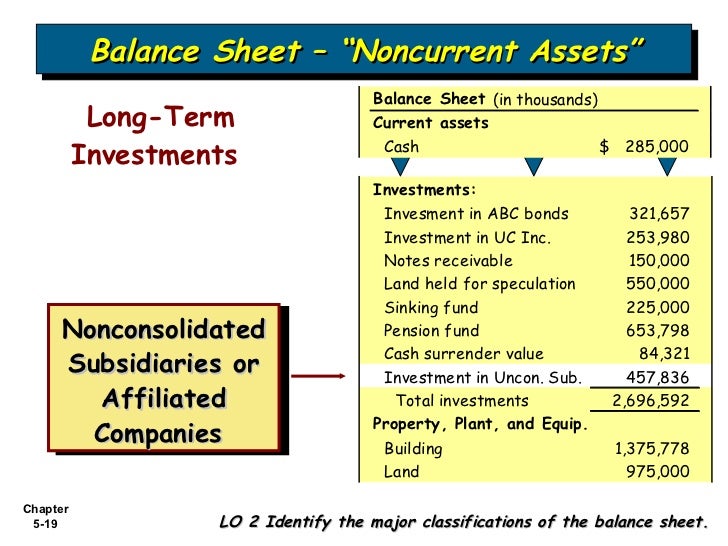

In that case, the cash surrender value of your life insurancepolicy is considered taxable; Tax reporting rules for life insurance payouts In general, any amount that is built up minus the insurance component of your premiums that you paid in is taxable. However, any dividends, interest or capital gains that were paid to the cash value will be counted as taxable income. The other $10,000 is considered a.

Source: franbeiler.blogspot.com

Source: franbeiler.blogspot.com

Regardless of the size of the policy, your spouse, child or anyone else you’ve named as a beneficiary would not have to report life insurance proceeds as taxable income on their. Cash value vs surrender value. You will pay tax on $2,000 at a rate of 25%. In simple terms the total premiums paid, less the cost of any riders and the net cost of pure insurance. “you might also have to.

Source: insuranceadvantage.ca

Source: insuranceadvantage.ca

On the other hand, the cash surrender value refers to the cash value minus how much you�ll pay in surrender fees. If you cash in a life insurance policy, you may need to pay tax on the cash surrender value. It’s one of the perks of purchasing a life insurance policy. When you surrender a permanent policy, you exchange your death benefit for a cash payout from your insurance company. If kate’s corporation owns and.

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Source: newyorklifeinsurancecompanyreviewswoy.blogspot.com

Is cash value of life insurance taxable in canada? So is your cash surrender value of life insurance taxable? Most amounts received from a life insurance policy are not subject to income tax. In simple terms the total premiums paid, less the cost of any riders and the net cost of pure insurance. “is my life insurance cash surrender value taxable?” isn�t the right question.

Source: lowcostlifeinsuranceketanru.blogspot.com

Source: lowcostlifeinsuranceketanru.blogspot.com

If you surrender your cash value life insurance policy, any gain on the policy will be subject to federal (and possibly state) income tax. It’s one of the perks of purchasing a life insurance policy. If you choose to surrender the policy and receive its cash value in return, you will pay taxes based on the amount that your investments increased in value. Most amounts received from a life insurance policy are not subject to income tax. “is my life insurance cash surrender value taxable?” isn�t the right question.

Source: waalsbeheading.blogspot.com

Source: waalsbeheading.blogspot.com

In canada, the cash surrender value of a life insurance policy is taxable if the cash value received exceeds the adjusted cost base. Yes—if you surrender your life insurance policy and the cash value exceeds the adjusted cost base of the policy (acb). When you surrender a permanent policy, you exchange your death benefit for a cash payout from your insurance company. If you cash in a life insurance policy, you may need to pay tax on the cash surrender value. Kate’s personal marginal tax rate is 48% and her corporate tax rate is 12%.

Source: britneyspearspictzzd.blogspot.com

Source: britneyspearspictzzd.blogspot.com

If the csv is more than the premiums and you surrender the policy (cancel it), the excess is earnings and taxable income. If your beneficiaries received any interest earnings from the policy, along with a death benefit, the interest would be taxable as income. In canada, the cash surrender value can become taxable under a number of circumstances. You will have to pay tax based on the increased value of. Tax can be payable on the full or partial surrender of permanent life insurance that has a cash value, says wouters.

Source: epsilonbef.blogspot.com

Source: epsilonbef.blogspot.com

Yes—if you surrender your life insurance policy and the cash value exceeds the adjusted cost base of the policy (acb). Is life insurance taxable in canada? For example, kate owns a ccpc and is considering buying life insurance with a monthly premium of $500. Regardless of the size of the policy, your spouse, child or anyone else you’ve named as a beneficiary would not have to report life insurance proceeds as taxable income on their. If you surrender your cash value life insurance policy, any gain on the policy will be subject to federal (and possibly state) income tax.

Source: lowcostlifeinsuranceketanru.blogspot.com

Source: lowcostlifeinsuranceketanru.blogspot.com

Your cash value is now worth $13,000, and you decide to surrender your policy. For example, kate owns a ccpc and is considering buying life insurance with a monthly premium of $500. If your beneficiaries received any interest earnings from the policy, along with a death benefit, the interest would be taxable as income. In general, any amount that is built up minus the insurance component of your premiums that you paid in is taxable. The answer is also no.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cash surrender value of life insurance taxable in canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea