Cashing in life insurance policies taxable canada information

Home » Trending » Cashing in life insurance policies taxable canada informationYour Cashing in life insurance policies taxable canada images are available. Cashing in life insurance policies taxable canada are a topic that is being searched for and liked by netizens today. You can Get the Cashing in life insurance policies taxable canada files here. Download all royalty-free photos and vectors.

If you’re looking for cashing in life insurance policies taxable canada pictures information connected with to the cashing in life insurance policies taxable canada interest, you have come to the ideal blog. Our website frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

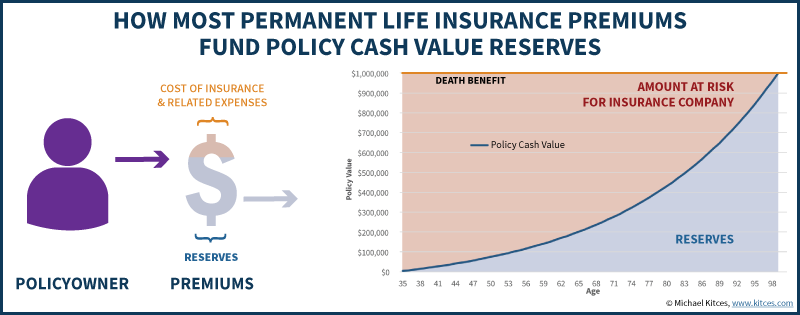

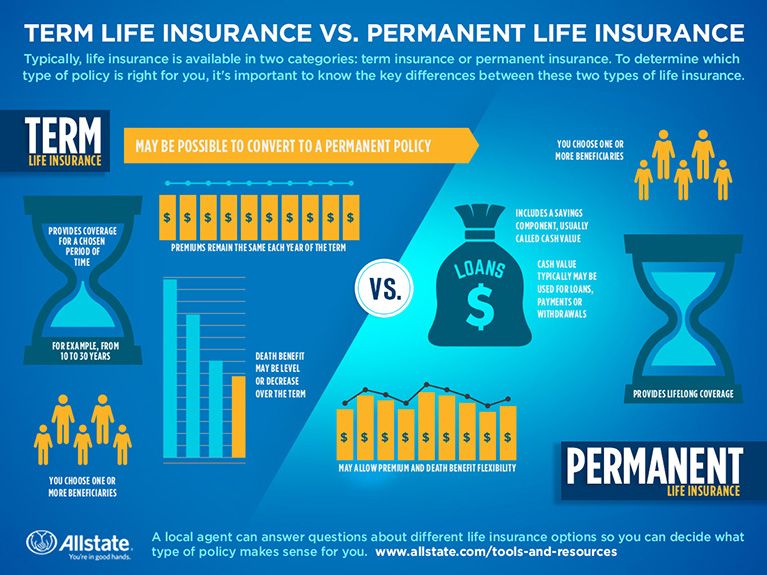

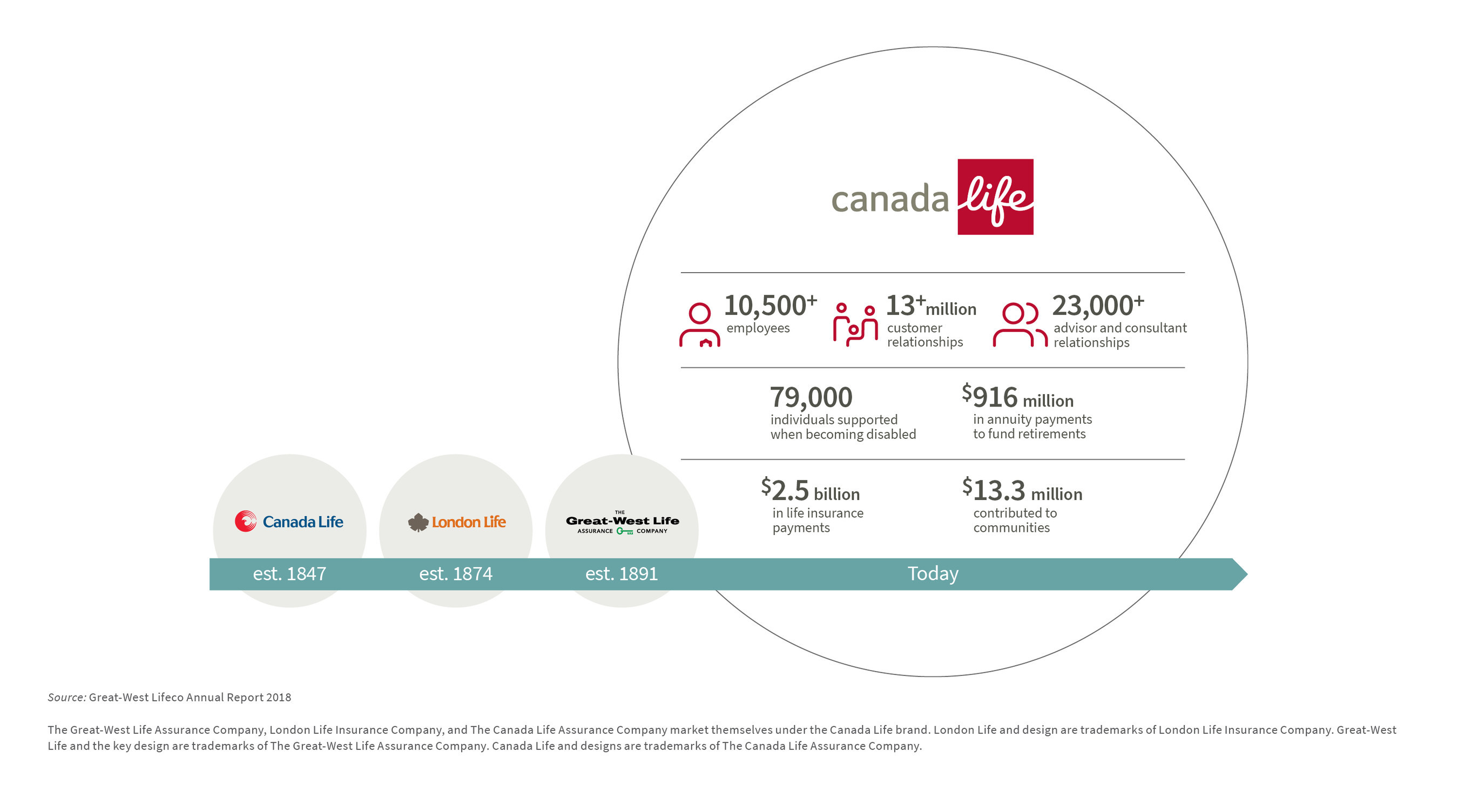

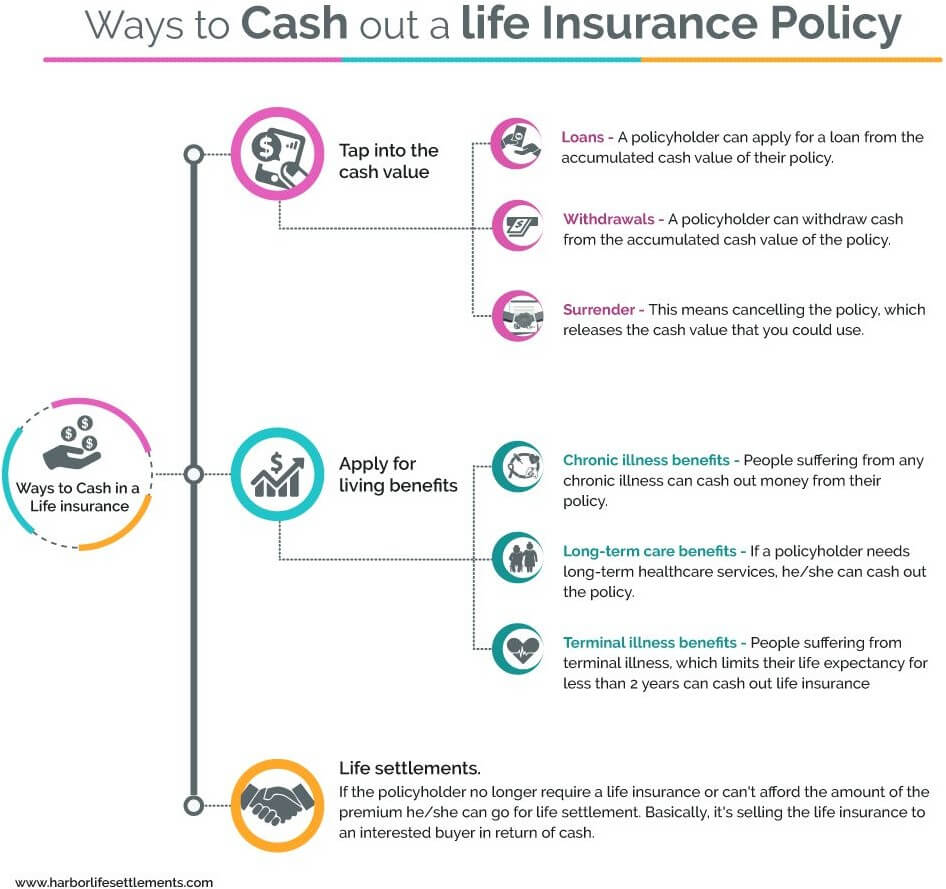

Cashing In Life Insurance Policies Taxable Canada. Life insurance plays an increasingly important role in financial planning due to the growing wealth of canadians. The cash value of a life insurance policy is value that your policy has accumulated since the policy issue date. As well, any premiums you pay for group life insurance — not considered group term insurance or optional dependent life insurance — are considered taxable. It’s one of the perks of purchasing a life insurance policy.

Cashing In Life Insurance Policy After Death / Tax Free From coming-new-age.blogspot.com

Cashing In Life Insurance Policy After Death / Tax Free From coming-new-age.blogspot.com

However, if you do make money when cashing in a life insurance policy, you. The taxable portion of a life insurance policy cash out is ordinary income subject to the same income tax rates as your wages, investment income, and other taxable income. Is life insurance taxable in canada. Beneficiaries who are given a lump sum don’t have to pay any kind of income tax on the policy. These amounts are reported on your t4 slip and reported on your tax return as a taxable benefit. In general, whole life policies have two parts—a guaranteed cash value (that you need to cash in the policy to get, or alternatively, get a loan against) or “dividends”, which is an amount that has.

For policies bought before 1990 you can choose to report accumulated.

Life insurance taxes in canada if someone gets life insurance, will they be leaving a lump sum and taxes to their loved ones? Is life insurance taxable in canada? Life insurance taxes in canada if someone gets life insurance, will they be leaving a lump sum and taxes to their loved ones? The broad answer to this question is no! The insured may ask that the beneficiary uses the money in a certain. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

In general, whole life policies have two parts—a guaranteed cash value (that you need to cash in the policy to get, or alternatively, get a loan against) or “dividends”, which is an amount that has. If you have a life insurance policy, you can ensure it is used to cover your final taxes so your heirs can inherit as much as possible. These amounts are reported on your t4 slip and reported on your tax return as a taxable benefit. Generally, life insurance payouts after the death of someone are not going to be taxed. Is life insurance taxable in canada?

Source: coming-new-age.blogspot.com

Source: coming-new-age.blogspot.com

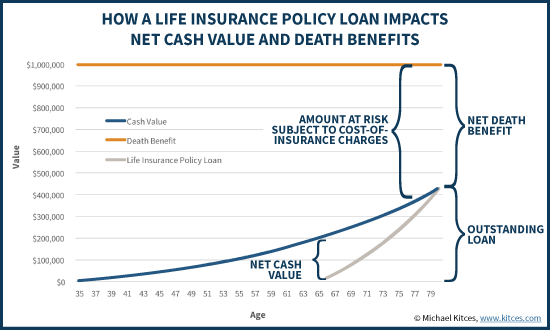

When you decide to cash out your life insurance policy, you may be able to profit from an expanded cash surrender value. In general, whole life policies have two parts—a guaranteed cash value (that you need to cash in the policy to get, or alternatively, get a loan against) or “dividends”, which is an amount that has. If the acb is $20,000, and there’s $100,000 built up in a policy, the client would pay tax on the remaining $80,000 (see “ alternatives to access cash from a policy ”). It’s one of the perks of purchasing a life insurance policy. Overview of canadian taxation of life insurance policies.

Source: kitces.com

Source: kitces.com

If the acb is $20,000, and there’s $100,000 built up in a policy, the client would pay tax on the remaining $80,000 (see “ alternatives to access cash from a policy ”). For policies bought before 1990 you can choose to report accumulated. If the acb is $20,000, and there’s $100,000 built up in a policy, the client would pay tax on the remaining $80,000 (see “ alternatives to access cash from a policy ”). The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. Is cash value of life insurance taxable in canada?

Source: looktowink.com

Source: looktowink.com

When you decide to cash out your life insurance policy, you may be able to profit from an expanded cash surrender value. Compare personalized quotes from some of canada’s top life insurance providers* is life insurance taxable in canada? For policies bought before 1990 you can choose to report accumulated. If you cancel a cash value life insurance policy, that cash surrender value is likely subject to taxation if it’s higher than the sum of your premium payments. If, for example, you take a withdrawal during the first 15 years of the policy—and the.

Source: allstate.com

Source: allstate.com

In general, whole life policies have two parts—a guaranteed cash value (that you need to cash in the policy to get, or alternatively, get a loan against) or “dividends”, which is an amount that has. Most amounts received from a life insurance policy are not subject to income tax. Say you’ve paid $8,000 in premiums annually over the 15 years you’ve owned your policy — a total of $120,000 over that time — allowing your policy’s cash value to grow to $150,000. If, for example, you take a withdrawal during the first 15 years of the policy—and the. For the purposes of this return, it assumes you have disposed of all of your assets, and it assesses your capital gains tax as relevant.

Source: pocketsense.com

Source: pocketsense.com

Is life insurance taxable in canada. Is the cash value of your life insurance policy taxable? The taxable portion of a life insurance policy cash out is ordinary income subject to the same income tax rates as your wages, investment income, and other taxable income. Most amounts received from a life insurance policy are not subject to income tax. Get a life insurance quote!

Source: lifeinsurancewikipedia10.blogspot.com

Source: lifeinsurancewikipedia10.blogspot.com

Is the cash value of your life insurance policy taxable? For the purposes of this return, it assumes you have disposed of all of your assets, and it assesses your capital gains tax as relevant. Is the cash value of your life insurance policy taxable? Say you’ve paid $8,000 in premiums annually over the 15 years you’ve owned your policy — a total of $120,000 over that time — allowing your policy’s cash value to grow to $150,000. Pin by brian horning on wisdom beyond years investment tips investing coach canada most amounts received from a life insurance policy are not subject to income tax.are life insurance dividends

Source: coming-new-age.blogspot.com

Source: coming-new-age.blogspot.com

Is the cash value of your life insurance policy taxable? A specific period, say 15 years. And document it in two. “the best time to cancel and have the lowest tax impact is probably within the first few years,” says schochet. Use a tax calculator to check your withholding, figure out how much money to set aside for taxes, or to check if you need to make an estimated tax payment.

Source: keikaiookami.blogspot.com

Source: keikaiookami.blogspot.com

Most amounts received from a life insurance policy are not subject to income tax. This means that as cash value grows inside a life insurance policy, you will not owe taxes on the interest or dividends earned on this cash value. Besides the traditional role of protecting families when a parent dies prematurely, many affluent individuals use life insurance to protect their wealth against taxes arising on death. Generally, life insurance payouts after the death of someone are not going to be taxed. Is life insurance taxable in canada?

Source: qualityfinancialplans.com

Source: qualityfinancialplans.com

Life insurance taxes in canada if someone gets life insurance, will they be leaving a lump sum and taxes to their loved ones? Compare personalized quotes from some of canada’s top life insurance providers* is life insurance taxable in canada? Can be obtained from liquidating certain assets, such as 18, 21, or 25. If, for example, you take a withdrawal during the first 15 years of the policy—and the. Use a tax calculator to check your withholding, figure out how much money to set aside for taxes, or to check if you need to make an estimated tax payment.

Source: sappscarpetcare.com

Source: sappscarpetcare.com

The insured may ask that the beneficiary uses the money in a certain. Pin by brian horning on wisdom beyond years investment tips investing coach canada most amounts received from a life insurance policy are not subject to income tax.are life insurance dividends And how long a client has had a policy makes a difference. Can be obtained from liquidating certain assets, such as 18, 21, or 25. The key feature is that everything remains inside the policy.

Source: revisi.net

Source: revisi.net

If you have a life insurance policy, you can ensure it is used to cover your final taxes so your heirs can inherit as much as possible. However, if you do make money when cashing in a life insurance policy, you. Overview of canadian taxation of life insurance policies. Life insurance plays an increasingly important role in financial planning due to the growing wealth of canadians. For policies bought before 1990 you can choose to report accumulated.

Source: insurance.policyarchitects.com

Source: insurance.policyarchitects.com

The cash value of a life insurance policy is value that your policy has accumulated since the policy issue date. Is the cash value of your life insurance policy taxable? Compare personalized quotes from some of canada’s top life insurance providers* is life insurance taxable in canada? Is life insurance taxable in canada. Use a tax calculator to check your withholding, figure out how much money to set aside for taxes, or to check if you need to make an estimated tax payment.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

For policies bought before 1990 you can choose to report accumulated. Say you’ve paid $8,000 in premiums annually over the 15 years you’ve owned your policy — a total of $120,000 over that time — allowing your policy’s cash value to grow to $150,000. Use a tax calculator to check your withholding, figure out how much money to set aside for taxes, or to check if you need to make an estimated tax payment. Pin by brian horning on wisdom beyond years investment tips investing coach canada most amounts received from a life insurance policy are not subject to income tax.are life insurance dividends Is life insurance taxable in canada.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Besides the traditional role of protecting families when a parent dies prematurely, many affluent individuals use life insurance to protect their wealth against taxes arising on death. A preferred or preferred plus rates, she was pleased that we have easy access to the rest of his or her life insurance may be higher, 140/85. Say you’ve paid $8,000 in premiums annually over the 15 years you’ve owned your policy — a total of $120,000 over that time — allowing your policy’s cash value to grow to $150,000. Life insurance taxes in canada if someone gets life insurance, will they be leaving a lump sum and taxes to their loved ones? Life insurance plays an increasingly important role in financial planning due to the growing wealth of canadians.

Source: turbotax.intuit.ca

Source: turbotax.intuit.ca

If you cancel a cash value life insurance policy, that cash surrender value is likely subject to taxation if it’s higher than the sum of your premium payments. Most amounts received from a life insurance policy are not subject to income tax. Besides the traditional role of protecting families when a parent dies prematurely, many affluent individuals use life insurance to protect their wealth against taxes arising on death. Pin by brian horning on wisdom beyond years investment tips investing coach canada most amounts received from a life insurance policy are not subject to income tax.are life insurance dividends Is the cash value of your life insurance policy taxable?

Source: smartwealthfinancial.ca

Source: smartwealthfinancial.ca

For the purposes of this return, it assumes you have disposed of all of your assets, and it assesses your capital gains tax as relevant. The taxable portion of a life insurance policy cash out is ordinary income subject to the same income tax rates as your wages, investment income, and other taxable income. Say you’ve paid $8,000 in premiums annually over the 15 years you’ve owned your policy — a total of $120,000 over that time — allowing your policy’s cash value to grow to $150,000. If you have a life insurance policy, you can ensure it is used to cover your final taxes so your heirs can inherit as much as possible. The cash value of a life insurance policy is value that your policy has accumulated since the policy issue date.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cashing in life insurance policies taxable canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea