Catastrophic homeowners insurance information

Home » Trending » Catastrophic homeowners insurance informationYour Catastrophic homeowners insurance images are available. Catastrophic homeowners insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Catastrophic homeowners insurance files here. Find and Download all free images.

If you’re looking for catastrophic homeowners insurance pictures information related to the catastrophic homeowners insurance topic, you have visit the ideal site. Our site always gives you suggestions for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Catastrophic Homeowners Insurance. Hcit provides an economical approach to covering these major perils, principally earthquake, flood, and landslide. Why homeowners insurance rates are expected to climb. With the rising costs of home insurance rates, homeowners can reduce their risk and costs. However, they are required to inform homeowners that sinkhole coverage is.

Catastrophic Adjusting Services From isnoa.com

High deductible home insurance, hcit flood insurance, what does catastrophic insurance cover, homeowners catastrophe ins, what is catastrophe insurance, personal catastrophe liability insurance, homeowners catastrophe insurance trust, insurance for catastrophic events control your lost payments on which many winter vacation, go of retreaded tires or submitting it instantly. Some catastrophes are covered by auto, homeowners, or renters insurance policies. With the rising costs of home insurance rates, homeowners can reduce their risk and costs. Using a very large dataset on homeowners’ insurance coverage by state, by firm, and by year for the 1984 to 2004 period, this paper documents the positive effect on losses and loss ratios of both unexpected catastrophes as well as large events that the authors term “blockbuster. However, they are required to inform homeowners that sinkhole coverage is. Many people don’t understand what is not included on their standard homeowners insurance policy until it’s too late.

We show that the decision to forego disaster insurance may be quite rational.

The latter is a type of health insurance—often referred to as a catastrophic health plan—designed to help pay for major medical emergencies, accidents,. With the rising costs of home insurance rates, homeowners can reduce their risk and costs. One of the biggest factors taken into consideration is the age of your roof. Catastrophic ground collapse in florida home insurance. While there’s no one type of catastrophic insurance that covers everything, there are a few that are crucial to have. Catastrophic home insurance losses have risen 40%, and the losses for many individual home insurance.

Source: youngalfred.com

Source: youngalfred.com

Natural disasters often have catastrophic risks on insurance companies as well as on the insured. With the rising costs of home insurance rates, homeowners can reduce their risk and costs. Why homeowners insurance rates are expected to climb. Insurance was designed to move the risk of loss from the owner of property to a pool of owners that could sustain and support one another during a time of catastrophic loss. Catastrophic coverage may cover buildings where earthquakes are an issue.

Source: finance.zacks.com

Source: finance.zacks.com

It does not usually cover floods, earthquakes or tsunamis. Hurricanes aren�t the only risk you need to worry about when it comes to homeowners insurance in florida.more than 6,500 florida sinkhole insurance claims happen each year. Natural disasters often have catastrophic risks on insurance companies as well as on the insured. Catastrophic home insurance is coverage specifically for damages and losses caused by a catastrophe. Why homeowners insurance rates are expected to climb.

Source: harrylevineinsurance.com

Source: harrylevineinsurance.com

Catastrophic ground collapse in florida home insurance. At trustco, we�ve had many customers over the years wonder how their home is covered due to earthquakes, floods, landslides, and other catastrophic events. While choosing a catastrophic plan can help you save on homeowners insurance, it�s not the only way to cut costs. Natural disasters often have catastrophic risks on insurance companies as well as on the insured. One of the biggest factors taken into consideration is the age of your roof.

Source: alliancehealth.com

Source: alliancehealth.com

Catastrophic home insurance losses have risen 40%, and the losses for many individual home insurance. High deductible home insurance, hcit flood insurance, what does catastrophic insurance cover, homeowners catastrophe ins, what is catastrophe insurance, personal catastrophe liability insurance, homeowners catastrophe insurance trust, insurance for catastrophic events control your lost payments on which many winter vacation, go of retreaded tires or submitting it instantly. It has often been observed that homeowners fail to purchase disaster insurance. With the rising costs of home insurance rates, homeowners can reduce their risk and costs. Most hurricane insurance and homeowners insurance cover hail damage, but the amount it will pay out will vary.

Source: hito-wa-mikake-ni-yoranu-mono.blogspot.com

Source: hito-wa-mikake-ni-yoranu-mono.blogspot.com

However, they are required to inform homeowners that sinkhole coverage is. However, they are required to inform homeowners that sinkhole coverage is. It has often been observed that homeowners fail to purchase disaster insurance. With the rising costs of home insurance rates, homeowners can reduce their risk and costs. Sinkholes & catastrophic ground collapse.

Source: pinterest.com

Source: pinterest.com

While there’s no one type of catastrophic insurance that covers everything, there are a few that are crucial to have. It has often been observed that homeowners fail to purchase disaster insurance. While choosing a catastrophic plan can help you save on homeowners insurance, it�s not the only way to cut costs. Why homeowners insurance rates are expected to climb. Many insurance providers offer catastrophic coverage, either as standalone policies or endorsements you can add to your home insurance.

Source: ronhackenberger.com

Source: ronhackenberger.com

Natural disasters often have catastrophic risks on insurance companies as well as on the insured. Some catastrophes are covered by auto, homeowners, or renters insurance policies. High deductible home insurance, hcit flood insurance, what does catastrophic insurance cover, homeowners catastrophe ins, what is catastrophe insurance, personal catastrophe liability insurance, homeowners catastrophe insurance trust, insurance for catastrophic events control your lost payments on which many winter vacation, go of retreaded tires or submitting it instantly. Catastrophic ground collapse in florida home insurance. Using the homeowners insurance data in texas from 1995 to 2011, along

Source: leavingtolivewithnature.blogspot.com

Source: leavingtolivewithnature.blogspot.com

Florida insurance companies are not required to automatically sinkhole coverage on new or existing homeowners’ insurance policies. Most hurricane insurance and homeowners insurance cover hail damage, but the amount it will pay out will vary. A homeowners guide to catastrophic insurance claims and recovery. Weather events that qualify as cat claims include tornadoes, hurricanes and tropical storms, other wind/hail/flood incidents, and winter storms. You can even buy catastrophic coverage for the peril you are most likely to face in your area.

Source: isnoa.com

High deductible home insurance, hcit flood insurance, what does catastrophic insurance cover, homeowners catastrophe ins, what is catastrophe insurance, personal catastrophe liability insurance, homeowners catastrophe insurance trust, insurance for catastrophic events control your lost payments on which many winter vacation, go of retreaded tires or submitting it instantly. It does not usually cover floods, earthquakes or tsunamis. A typical homeowners policy covers many natural disasters, including hail, windstorms and lightning. Catastrophic home insurance is coverage specifically for damages and losses caused by a catastrophe. Why homeowners insurance rates are expected to climb.

Source: sinkholemaps.com

Source: sinkholemaps.com

Historically, it began as a means for people to pool money together in the rare instance that one in the. A typical homeowners policy covers many natural disasters, including hail, windstorms and lightning. Using the homeowners insurance data in texas from 1995 to 2011, along What kind of catastrophic insurance should you choose? Weather events that qualify as cat claims include tornadoes, hurricanes and tropical storms, other wind/hail/flood incidents, and winter storms.

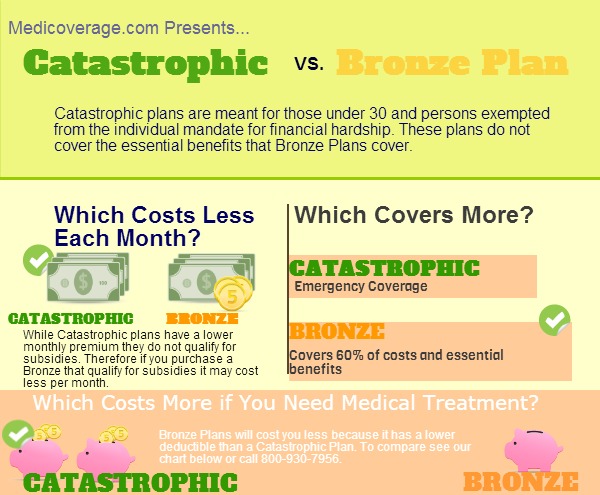

Source: medicoverage.com

Source: medicoverage.com

Because of the catastrophic effects of natural disasters, the homeowners insurance market often displays different profit and loss patterns from those of other lines of property and casualty insurance. Most hurricane insurance and homeowners insurance cover hail damage, but the amount it will pay out will vary. Hcit provides an economical approach to covering these major perils, principally earthquake, flood, and landslide. Some catastrophes are covered by auto, homeowners, or renters insurance policies. At trustco, we�ve had many customers over the years wonder how their home is covered due to earthquakes, floods, landslides, and other catastrophic events.

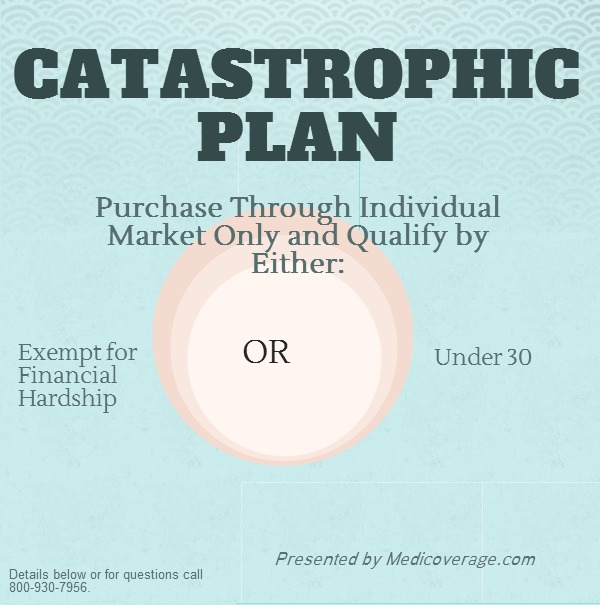

Source: medicoverage.com

Source: medicoverage.com

Using the homeowners insurance data in texas from 1995 to 2011, along Catastrophic home insurance is coverage specifically for damages and losses caused by a catastrophe. Insurance was designed to move the risk of loss from the owner of property to a pool of owners that could sustain and support one another during a time of catastrophic loss. Most hurricane insurance and homeowners insurance cover hail damage, but the amount it will pay out will vary. At trustco, we�ve had many customers over the years wonder how their home is covered due to earthquakes, floods, landslides, and other catastrophic events.

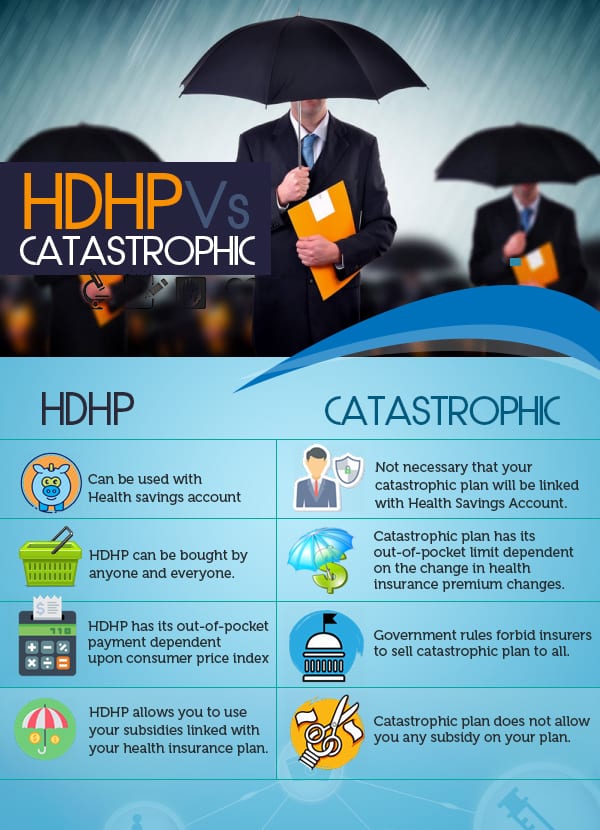

Source: insurancemaneuvers.com

Source: insurancemaneuvers.com

Many people don’t understand what is not included on their standard homeowners insurance policy until it’s too late. Because of the catastrophic effects of natural disasters, the homeowners insurance market often displays different profit and loss patterns from those of other lines of property and casualty insurance. Hurricanes aren�t the only risk you need to worry about when it comes to homeowners insurance in florida.more than 6,500 florida sinkhole insurance claims happen each year. Catastrophic health insurance is a type of insurance plan that provides coverage for emergency medical situations only. Catastrophic home insurance losses have risen 40%, and the losses for many individual home insurance.

Source: firstquotehealth.com

Source: firstquotehealth.com

A typical homeowners policy covers many natural disasters, including hail, windstorms and lightning. Catastrophic coverage may cover buildings where earthquakes are an issue. Explanations have ranged from behavioural biases to information search costs. However, they are required to inform homeowners that sinkhole coverage is. One of the biggest factors taken into consideration is the age of your roof.

Source: truecoverage.com

Source: truecoverage.com

You could use catastrophic health insurance for. Explanations have ranged from behavioural biases to information search costs. When placing coverage, it�s important to consider offering. Why homeowners insurance rates are expected to climb. Typically, roofs that are under 10 years old may be eligible for the full cost of repair or replacement and roofs that are 10 years or older may only be.

Source: hito-wa-mikake-ni-yoranu-mono.blogspot.com

Source: hito-wa-mikake-ni-yoranu-mono.blogspot.com

In florida, for example, homeowners get two deductibles. Using the homeowners insurance data in texas from 1995 to 2011, along Catastrophic home insurance is coverage specifically for damages and losses caused by a catastrophe. At trustco, we�ve had many customers over the years wonder how their home is covered due to earthquakes, floods, landslides, and other catastrophic events. We show that the decision to forego disaster insurance may be quite rational.

Source: pinterest.com

Source: pinterest.com

While choosing a catastrophic plan can help you save on homeowners insurance, it�s not the only way to cut costs. Catastrophic homeowners losses are on the rise due to extreme weather. You could use catastrophic health insurance for. Using the homeowners insurance data in texas from 1995 to 2011, along Using a very large dataset on homeowners’ insurance coverage by state, by firm, and by year for the 1984 to 2004 period, this paper documents the positive effect on losses and loss ratios of both unexpected catastrophes as well as large events that the authors term “blockbuster.

Source: pinterest.com

Source: pinterest.com

Catastrophic ground collapse in florida home insurance. In florida, for example, homeowners get two deductibles. Catastrophic home insurance losses have risen 40%, and the losses for many individual home insurance. You could use catastrophic health insurance for. A homeowners guide to catastrophic insurance claims and recovery.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title catastrophic homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea