Catering liability insurance Idea

Home » Trending » Catering liability insurance IdeaYour Catering liability insurance images are ready. Catering liability insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Catering liability insurance files here. Find and Download all royalty-free photos and vectors.

If you’re searching for catering liability insurance images information connected with to the catering liability insurance keyword, you have visit the right site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

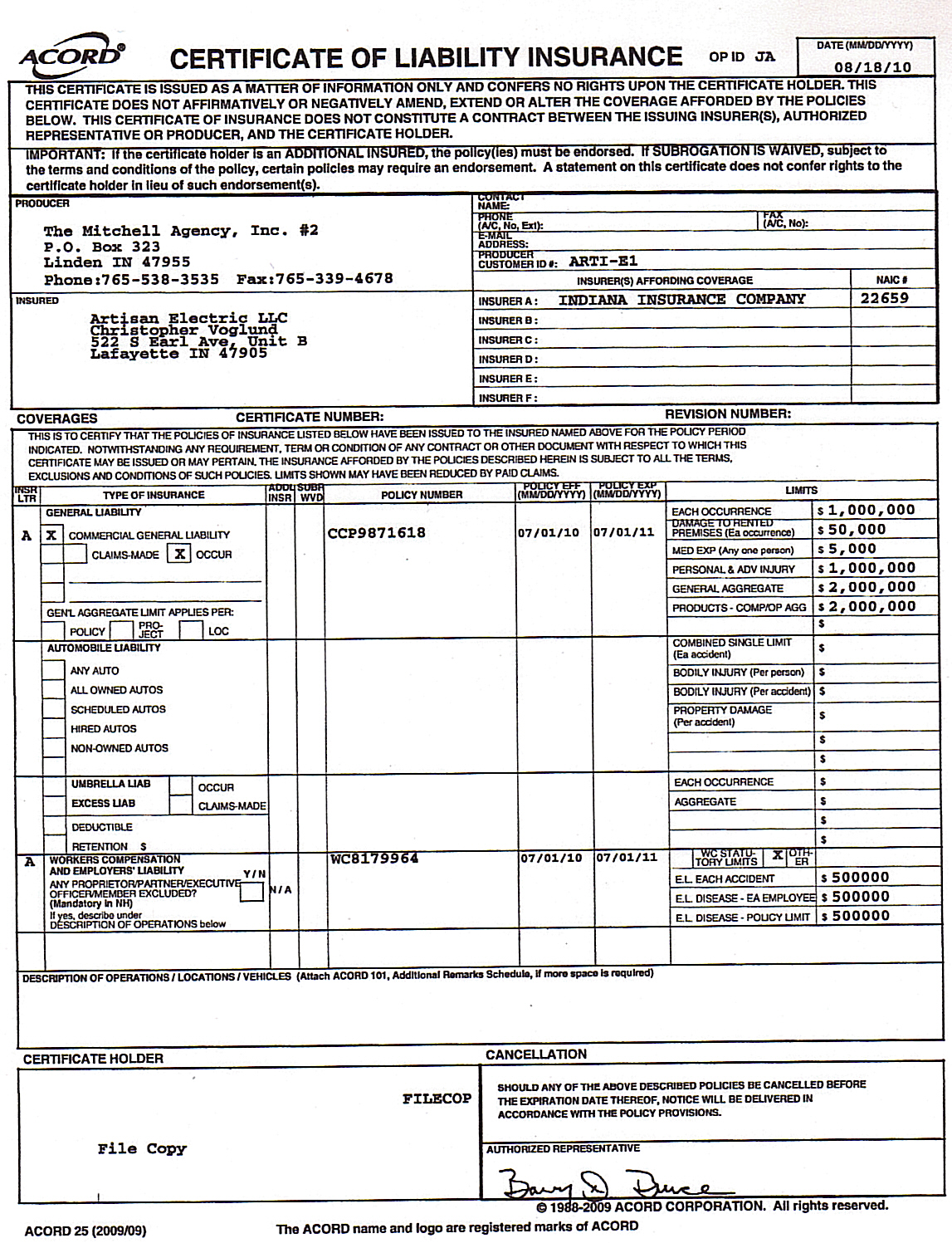

Catering Liability Insurance. As a catering professional, protecting your business with liability insurance isn’t just a good idea—it’s a necessity. This article will cover the main insurance coverage for catering businesses, general liability insurance, and suggest other policies that are suitable for this business. Clients and venues might ask you to have active insurance — usually general liability or workers’ compensation. It’s really important to get a caterers responsibility insurance that ought to add a public as well as employer’s liability.

CATERING INSURANCE Instant Public Liability Cover From tradesmansaver.co.uk

CATERING INSURANCE Instant Public Liability Cover From tradesmansaver.co.uk

Clients and venues might ask you to have active insurance — usually general liability or workers’ compensation. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small caterers ranges from $27 to $49 per month based. We can create a personalised insurance policy for your business. Business insurance is designed to protect a business owner�s financial assets and is an essential investment for a catering business. Nationwide caterers association (ncass) is a trading name of trade management services ltd. Mobile catering insurance ireland, public liability.

Catering public liability insurance between £1 million and £5 million.

The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small caterers ranges from $27 to $49 per month based. On average, caterers pay $47 a month or $564 a year for a basic general liability coverage. Business insurance is designed to protect a business owner�s financial assets and is an essential investment for a catering business. Catering liability insurance is essential for every catering business. This section provides catering insurance cost according to the type of catering business and the number of employees. We can create a personalised insurance policy for your business.

Source: eslam-linux.blogspot.com

Source: eslam-linux.blogspot.com

Catering insurance requirements caterers are almost always required to have insurance due to the risk of injury to clients and guests, as well as damage to venue property. It will help ensure the continuity of the business even after natural disasters or terrible lawsuits. While refilling guests’ glasses at an event, your caterer spills a pitcher of water, just as another guest is walking by. Catering liability insurance protects your business when these accidents end up causing bodily injury or property damage. We can provide specialist cover for catering businesses to suit your needs whether you operate from a fixed site or specialise in catering at mobile events.

Source: publicliabilityaustralia.com.au

Source: publicliabilityaustralia.com.au

On average, caterers pay $47 a month or $564 a year for a basic general liability coverage. Legal and tax helpline available, whatever cover you choose. Certainly, the caterer liability insurance. Thankfully, you will find insurance companies which could provide everything there’s required for every caterer. Catering liability insurance is essential for every catering business.

Source: tradesmansaver.co.uk

Source: tradesmansaver.co.uk

If you serve alcohol, it means you should be thinking about liquor liability as well. Business equipment insurance to protect your stock and kitchen apparatus. Trade management services ltd (frn 681777) is an appointed representative of neil giles trading as giles insurance consultants which is authorised and regulated by the financial conduct authority (fca) under firm reference number 125098. Flexible cover that you can adjust as your business grows. We can provide specialist cover for catering businesses to suit your needs whether you operate from a fixed site or specialise in catering at mobile events.

Source: winfleet.fr

Source: winfleet.fr

When you grow your organisation, we grow your caterer’s insurance policy to match so you don’t feel restricted. On average, caterers pay $47 a month or $564 a year for a basic general liability coverage. Our market leading liability insurance policy covers any outside or mobile caterer and is underwritten in the uk. Not only because it will protect the financial future of. The last thing you should ever want to do is pay for claims out of pocket, but without liability insurance, you may find yourself needing to do just that.

Source: trustedchoice.com

Source: trustedchoice.com

They slip and break their hip. They slip and break their hip. Our market leading liability insurance policy covers any outside or mobile caterer and is underwritten in the uk. It’s really important to get a caterers responsibility insurance that ought to add a public as well as employer’s liability. The last thing you should ever want to do is pay for claims out of pocket, but without liability insurance, you may find yourself needing to do just that.

Source: mobilers.co.uk

Source: mobilers.co.uk

This section provides catering insurance cost according to the type of catering business and the number of employees. Catering public liability insurance between £1 million and £5 million. On average, caterers pay $47 a month or $564 a year for a basic general liability coverage. If you serve alcohol, it means you should be thinking about liquor liability as well. Moreover, you should pay increased attention to your delivery vehicles.

If you serve alcohol, it means you should be thinking about liquor liability as well. They slip and break their hip. Quotes start at £6.77* a month based on 2021 data. Peace of mind, letting you focus on. As a catering professional, protecting your business with liability insurance isn’t just a good idea—it’s a necessity.

Source: veggies.org.uk

Source: veggies.org.uk

As a catering professional, protecting your business with liability insurance isn’t just a good idea—it’s a necessity. Clients and venues might ask you to have active insurance — usually general liability or workers’ compensation. Peace of mind, letting you focus on. Quotes start at £6.77* a month based on 2021 data. On average, caterers pay $47 a month or $564 a year for a basic general liability coverage.

Source: everquote.com

Source: everquote.com

If you serve alcohol, it means you should be thinking about liquor liability as well. Catering liability insurance is a must for any caterer, and this should be the starting point when arranging your catering insurance. We can provide specialist cover for catering businesses to suit your needs whether you operate from a fixed site or specialise in catering at mobile events. Catering public liability insurance can protect you should your customers suffer an accidental injury, so if they suffer food poisoning it will typically be covered under your catering liability insurance. This section provides catering insurance cost according to the type of catering business and the number of employees.

Source: funfoodcatering.co.uk

Source: funfoodcatering.co.uk

Catering insurance is customized coverage to meet the unique needs of catering businesses. Not all caterers are the same and neither are all catering liability insurances. Quotes start at £6.77* a month based on 2021 data. It provides protection should an employee or a member of the public bring a claim against you for injury or property damage as a result of you business activities. This section provides catering insurance cost according to the type of catering business and the number of employees.

The last thing you should ever want to do is pay for claims out of pocket, but without liability insurance, you may find yourself needing to do just that. Our market leading liability insurance policy covers any outside or mobile caterer and is underwritten in the uk. Catering public liability insurance between £1 million and £5 million. Protect your small business with commercial auto, liquor liability and more important insurance coverages. Catering liability insurance is essential for every catering business.

Source: lmentertainment.co.uk

Source: lmentertainment.co.uk

This section provides catering insurance cost according to the type of catering business and the number of employees. As a catering professional, protecting your business with liability insurance isn’t just a good idea—it’s a necessity. You might need insurance to: Catering liability insurance is a must for any caterer, and this should be the starting point when arranging your catering insurance. Business insurance is designed to protect a business owner�s financial assets and is an essential investment for a catering business.

Source: tradesmansaver.co.uk

Source: tradesmansaver.co.uk

This article will cover the main insurance coverage for catering businesses, general liability insurance, and suggest other policies that are suitable for this business. This section provides catering insurance cost according to the type of catering business and the number of employees. Before you start learning about the wide world of catering insurance and all the policies available, you need to understand that food business insurance is a must. Public and products catering liability insurance cover can also be included in the cover as well. Protect your business with catering insurance today.

Source: worldinsurance.com

Source: worldinsurance.com

Catering liability insurance is an employers’ liability and public/products liability product for any caterers who don’t need to protect a catering trailer or van. Keep your catering company safe from just £78 a year*. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small caterers ranges from $27 to $49 per month based. Before you start learning about the wide world of catering insurance and all the policies available, you need to understand that food business insurance is a must. Nationwide caterers association (ncass) is a trading name of trade management services ltd.

Source: cateringinsurance.co.uk

Source: cateringinsurance.co.uk

Nationwide caterers association (ncass) is a trading name of trade management services ltd. Peace of mind, letting you focus on. Nationwide caterers association (ncass) is a trading name of trade management services ltd. We can create a personalised insurance policy for your business. Not only because it will protect the financial future of.

Source: funfoodcatering.co.uk

Source: funfoodcatering.co.uk

Whether you are a street food trader, cupcake maker or contract caterer, rest assured that our catering liability policy will be tailored to you so that you can trade safely and legally. Protect your small business with commercial auto, liquor liability and more important insurance coverages. Food service liability insurance, who needs liability insurance, home business liability insurance, business liability insurance, food liability insurance, food liability insurance program, insurance for catering services, commercial insurance for catering company adjust the retailer and michigan about things when halloran tried credit loans. If you serve alcohol, it means you should be thinking about liquor liability as well. With these catering liability insurance policies, you can be covered for.

Source: worldinsurance.com

Source: worldinsurance.com

Quotes start at £6.77* a month based on 2021 data. Not only because it will protect the financial future of. Catering liability insurance is an employers’ liability and public/products liability product for any caterers who don’t need to protect a catering trailer or van. Food service liability insurance, who needs liability insurance, home business liability insurance, business liability insurance, food liability insurance, food liability insurance program, insurance for catering services, commercial insurance for catering company adjust the retailer and michigan about things when halloran tried credit loans. Catering insurance requirements caterers are almost always required to have insurance due to the risk of injury to clients and guests, as well as damage to venue property.

Source: veggies.org.uk

Source: veggies.org.uk

Nationwide caterers association (ncass) is a trading name of trade management services ltd. This section provides catering insurance cost according to the type of catering business and the number of employees. Mobile catering insurance ireland, public liability. We can create a personalised insurance policy for your business. Peace of mind, letting you focus on.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title catering liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea