Cause of loss insurance Idea

Home » Trend » Cause of loss insurance IdeaYour Cause of loss insurance images are ready. Cause of loss insurance are a topic that is being searched for and liked by netizens now. You can Download the Cause of loss insurance files here. Get all free photos.

If you’re looking for cause of loss insurance images information connected with to the cause of loss insurance topic, you have come to the right blog. Our site always provides you with hints for seeing the highest quality video and image content, please kindly surf and find more informative video content and images that match your interests.

Cause Of Loss Insurance. Your homeowner policy causes of loss form the foundation of the protection on your property insurance policy and are the terms of coverage under. Results in a covered cause of loss, we will pay for the loss or damage caused by that covered cause of loss. A causes of loss form is combined with one or more coverage forms, the commercial property conditions form, the common policy conditions form, and the declarations to make up an iso. For instance, in a fire loss, the origin may be behind a stove or in a fireplace or in the middle of a room.

Opengear Presents IT Resilience at ITExpo in Miami, FL From opengear.com

Opengear Presents IT Resilience at ITExpo in Miami, FL From opengear.com

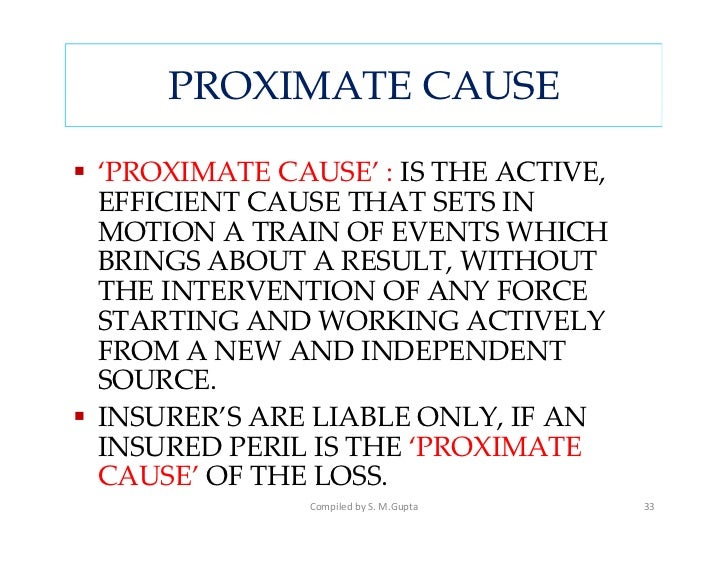

The doctrine of proximate cause is one of the six principles of insurance. Cause of loss means the dangers that can cause or trigger loss or damage. Insurance policies only provide cover for loss or damage if it is as a result of one of the perils listed in the policy. Top causes of loss in the united states. The loss be caused by a covered cause of loss or peril, in order for coverage to exist. As its name implies, a cause and origin investigation is designed to determine both the cause and the origin of the property damage.

Top causes of loss in the united states.

- “observations of commercial property losses by limit of insurance indicate that average property losses sustained by policies written at higher limits are generally a smaller percentage of the limit than those losses sustained by policies written at. And (b)with the intent to cause a loss. We discuss how this type of policy fits into the family of business insurance policies and when you may need it. Many policy forms provide substantially as follows: As its name implies, a cause and origin investigation is designed to determine both the cause and the origin of the property damage. * “observations of commercial property losses by limit of insurance indicate that average property losses sustained by policies written at higher limits are generally a smaller percentage of the limit than those losses sustained by policies written at.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

Cause of loss forms are part of an insurance bundle. (by value of the claim) fire and explosion 22%. Risks that can be insured against are called “insurable” risks. Insurance companies will not insure against all risks. Cause of loss forms are part of an insurance bundle.

Source: oldelibertyins.com

Source: oldelibertyins.com

It is an insured peril or not. Your homeowner policy causes of loss form the foundation of the protection on your property insurance policy and are the terms of coverage under. The insurance company will find the nearest cause of loss to the property. Results in a covered cause of loss, we will pay for the loss or damage caused by that covered cause of loss. For an act or event to be considered a proximate cause, it does not necessarily have to directly precede a loss or begin a chain of occurrences leading to the same.

Source: etiqaslink.blogspot.ca

Source: etiqaslink.blogspot.ca

Explosion of steam boilers, steam pipes, steam engines or steam turbines owned or Many policy forms provide substantially as follows: Proximate cause is a key principle of insurance and is concerned with how the loss or (a)by or at the direction of any insured; Cause of loss forms are part of an insurance bundle.

Source: help.vertafore.com

Source: help.vertafore.com

Aviation collision & crash 10%. The special form is also referred to as open peril or all risks. The loss be caused by a covered cause of loss or peril, in order for coverage to exist. Many policy forms provide substantially as follows: Proximate cause is concerned with how the actual loss or damage happened to the insured party and whether it resulted from an insured peril.

Source: emcins.com

Source: emcins.com

Explosion of steam boilers, steam pipes, steam engines or steam turbines owned or It looks for is the reason behind the loss; Each covered cause of loss is subject to restrictions or conditions stated in the section which amplifies each. Many policy forms provide substantially as follows: Can be direct (the action immediately before the loss) or indirect (part of an uninterrupted chain of events leading to the loss).

Source: cannabishempinsurance.com

Source: cannabishempinsurance.com

Proximate cause is concerned with how the actual loss or damage happened to the insured party and whether it resulted from an insured peril. Insurance companies will not insure against all risks. For instance, in a fire loss, the origin may be behind a stove or in a fireplace or in the middle of a room. ‘‘we will pay for direct physical loss of or damage to covered property at the premises described in the declarations caused by or resulting from any covered cause of loss’’ 2. If it is not a cause the property is insured against, then no payment will be made by the insured.

Source: slideshare.net

Source: slideshare.net

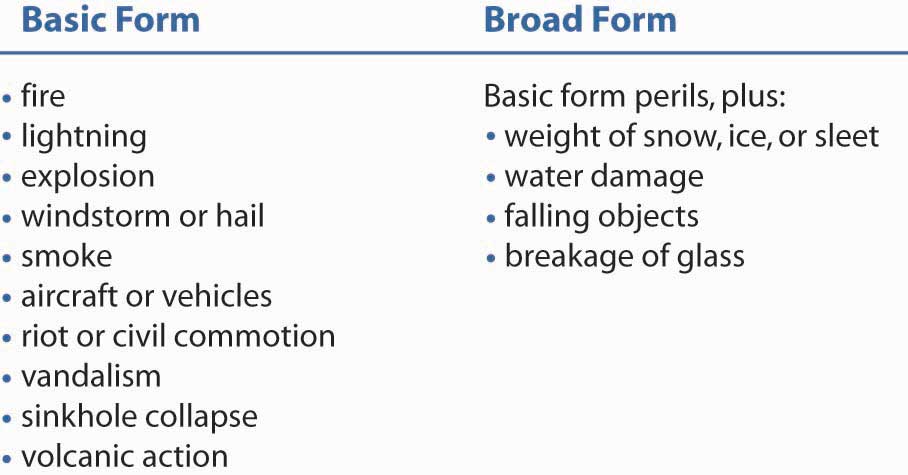

There are three commercial property forms (basic, broad and special) that identify the causes of loss (or perils) for which coverage is provided. And (b)with the intent to cause a loss. L.(1) we will not pay for loss or damage arising out of any act committed: A “peril” is a cause of loss to property. A causes of loss form is combined with one or more coverage forms, the commercial property conditions form, the common policy conditions form, and the declarations to make up an iso.

Source: safeguardme.com

Source: safeguardme.com

(iso), commercial property insurance forms that establish and define the causes of loss (or perils) for which coverage is provided. A “peril” is a cause of loss to property. Students of insurance need to understand the concept of peril because insurance policies nearly always limit. The report identifies five major causes of insurance loss in the united states in terms of the value and the frequency of claims, as listed below. Faulty workmanship and maintenance 6%.

Source: liabilityinsurancetoday.blogspot.fr

Source: liabilityinsurancetoday.blogspot.fr

Each covered cause of loss is subject to restrictions or conditions stated in the section which amplifies each. Top causes of loss in the united states. It looks for is the reason behind the loss; Can be direct (the action immediately before the loss) or indirect (part of an uninterrupted chain of events leading to the loss). Your homeowner policy causes of loss form the foundation of the protection on your property insurance policy and are the terms of coverage under.

Source: opengear.com

Source: opengear.com

A causes of loss form is combined with one or more coverage forms, the commercial property conditions form, the common policy conditions form, and the declarations to make up an iso. We discuss how this type of policy fits into the family of business insurance policies and when you may need it. The insurance company will find the nearest cause of loss to the property. Proximate cause is a key principle of insurance and is concerned with how the loss or For instance, in a fire loss, the origin may be behind a stove or in a fireplace or in the middle of a room.

Source: insurancedodo.com

Source: insurancedodo.com

The doctrine of proximate cause is one of the six principles of insurance. Find the complete cause of loss — basic form rule (rule 70) in division five of the clm. Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles, vandalism, sprinkler leakage, sinkhole collapse, and volcanic action. We discuss how this type of policy fits into the family of business insurance policies and when you may need it. Can be direct (the action immediately before the loss) or indirect (part of an uninterrupted chain of events leading to the loss).

Source: help.vertafore.com

Source: help.vertafore.com

Find the complete cause of loss — basic form rule (rule 70) in division five of the clm. Therefore, it is a highly relevant principle in the insurance industry. An insurable risk must meet certain requirements before an insurance company will cover the risk: It looks for is the reason behind the loss; But if loss or damage by a covered cause of loss results at the described premises, we will pay for that resulting loss or damage.

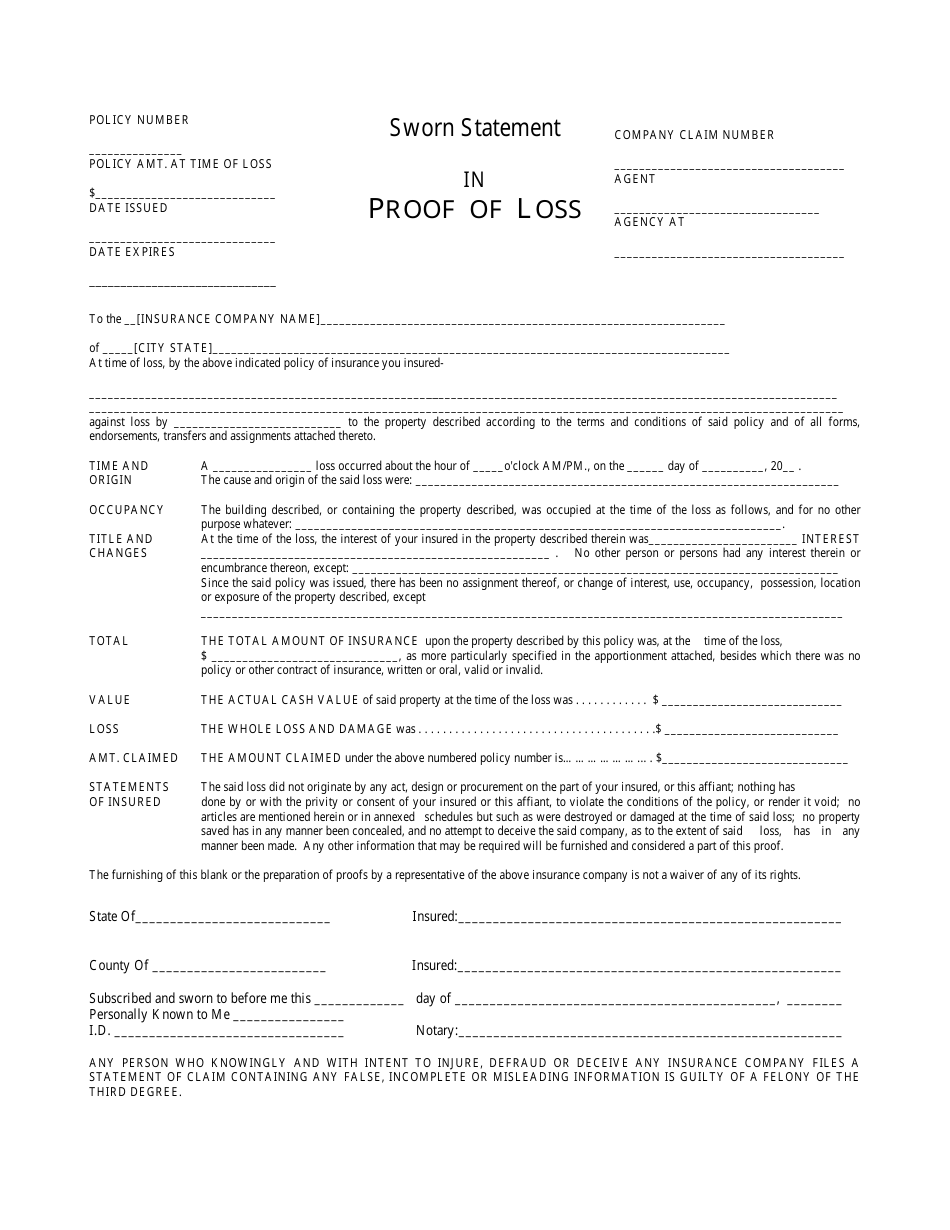

Source: templateroller.com

Source: templateroller.com

Cause of loss means the dangers that can cause or trigger loss or damage. We discuss how this type of policy fits into the family of business insurance policies and when you may need it. The doctrine of proximate cause is one of the six principles of insurance. Causes of loss covered or not covered under basic, broad and special forms note: The loss or damage caused by that specified cause of loss.

Source: slideshare.net

Source: slideshare.net

Risks that can be insured against are called “insurable” risks. Can be direct (the action immediately before the loss) or indirect (part of an uninterrupted chain of events leading to the loss). Results in a covered cause of loss, we will pay for the loss or damage caused by that covered cause of loss. The report identifies five major causes of insurance loss in the united states in terms of the value and the frequency of claims, as listed below. Find the complete cause of loss — basic form rule (rule 70) in division five of the clm.

Source: slideshare.net

Source: slideshare.net

Results in a covered cause of loss, we will pay for the loss or damage caused by that covered cause of loss. Proximate cause is concerned with how the actual loss or damage happened to the insured party and whether it resulted from an insured peril. Businesses use cause of loss forms to ensure that the insurance will reimburse every possible issue. Your homeowner policy causes of loss form the foundation of the protection on your property insurance policy and are the terms of coverage under. The loss or damage caused by that specified cause of loss.

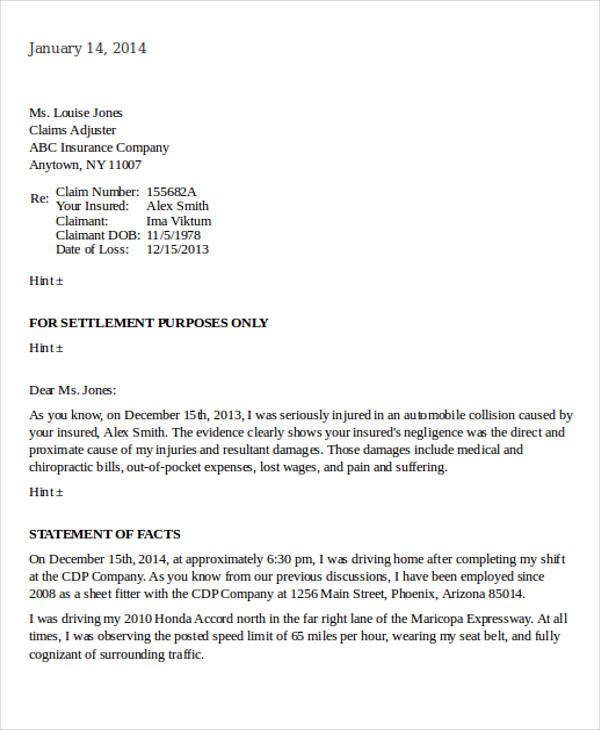

Source: sampletemplates.com

Source: sampletemplates.com

Proximate cause is concerned with how the actual loss or damage happened to the insured party and whether it resulted from an insured peril. Businesses use cause of loss forms to ensure that the insurance will reimburse every possible issue. For an act or event to be considered a proximate cause, it does not necessarily have to directly precede a loss or begin a chain of occurrences leading to the same. The report identifies five major causes of insurance loss in the united states in terms of the value and the frequency of claims, as listed below. As its name implies, a cause and origin investigation is designed to determine both the cause and the origin of the property damage.

Source: safeguardme.com

Source: safeguardme.com

If it is not a cause the property is insured against, then no payment will be made by the insured. Determining the actual cause of loss or damage is therefore a fundamental step in the consideration of any claim. We will not pay for loss or damage caused by or resulting from any of the following, 3.a. Cause of loss forms are part of an insurance bundle. Correctly, the risk is the uncertainty about the happening of an event that can create a loss, whereas peril is the cause of the loss.

Source: slideserve.com

Source: slideserve.com

There are property forms that define the cause of loss, or perils, for which coverage is provided. Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles, vandalism, sprinkler leakage, sinkhole collapse, and volcanic action. Proximate cause is concerned with how the actual loss or damage happened to the insured party and whether it resulted from an insured peril. Also known as peril forms, they specifically list what the insurance will cover. (a)by or at the direction of any insured;

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cause of loss insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information