Ceding insurer Idea

Home » Trending » Ceding insurer IdeaYour Ceding insurer images are ready in this website. Ceding insurer are a topic that is being searched for and liked by netizens today. You can Find and Download the Ceding insurer files here. Find and Download all free photos.

If you’re searching for ceding insurer images information connected with to the ceding insurer interest, you have pay a visit to the right site. Our site always gives you hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

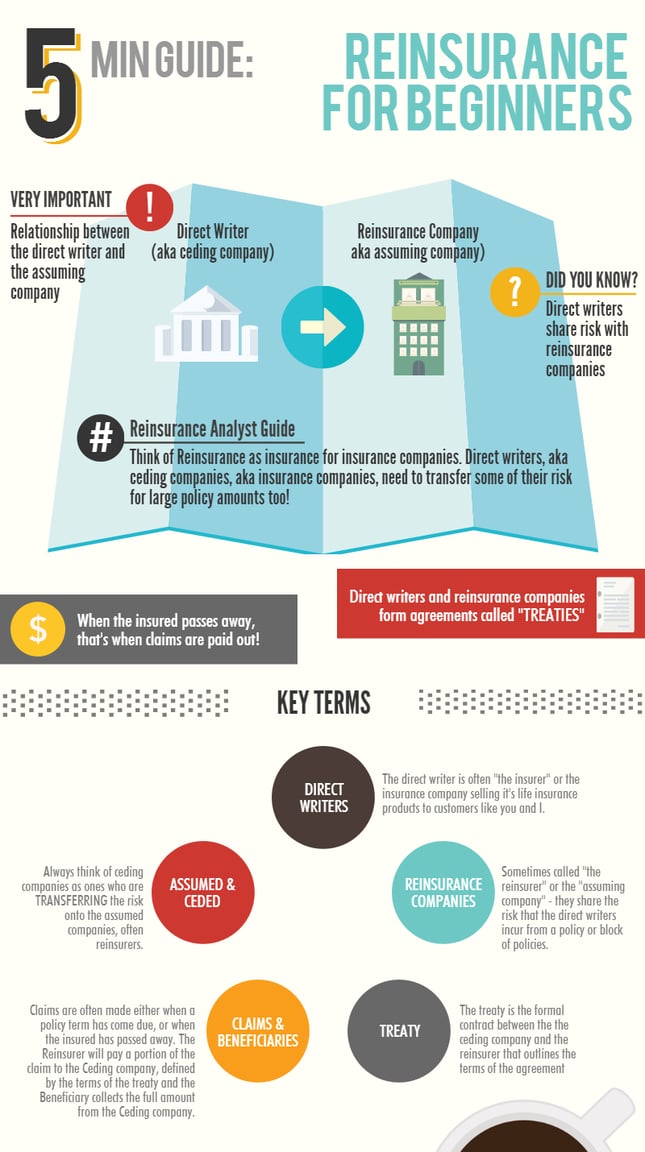

Ceding Insurer. Ceding company is an insurance company that transfers the insurance portfolio to a reinsurer. Here, only a certain portion of the ceding insurer’s original policies goes for reinsurance. A ceding reinsurer is a reinsurer that transfers (cedes) a portion of the underlying reinsurance to a retrocessionnaire. And (b) the assuming insurer with the consent of the direct insureds, has assumed such policy obligations to the payees as a replacement for the obligations of the ceding insurer.(15) 1.

Vickers Ceding companies more confident in retaining more From theinsurer.com

Vickers Ceding companies more confident in retaining more From theinsurer.com

Ceding company’s premium income is $10,000,000, and the total loss over the year is $8,000,000. Here, only a certain portion of the ceding insurer’s original policies goes for reinsurance. The transaction involves the insured assuming a guaranteed and known relatively small loss in the form of payment to the insurer in exchange for the insurer’s promise to compensate the insured in the case of a financial (personal) loss. By ceding shares of all policies or just larger policies, the net retained loss exposure per individual policy or in total can be kept in line with the cedant’s surplus. Thus smaller insurers can compete with larger insurers, and policies beyond the capacity of any single insurer can be. An insurer may seek to write a line of coverage for which it does not have any prior experience or particular expertise.

Here, only a certain portion of the ceding insurer’s original policies goes for reinsurance.

A ceding insurer or a reinsurer. A surplus share treaty is a reinsurance treaty in which the ceding insurer retains a fixed amount of policy liability and the reinsurer takes responsibility for what remains. På detta vis kan de mindre försäkringsbolagen frigöra sitt kapital för att kunna teckna fler försäkringstagare under sitt paraply. The implication of loss distribution will be as follows loss $8,000,000. Ceding company’s premium income is $10,000,000, and the total loss over the year is $8,000,000. An insurer may seek to write a line of coverage for which it does not have any prior experience or particular expertise.

Source: accountlearning.com

Source: accountlearning.com

Please use your own words even if you are using the textbook for answers and provide a citation for all of your answers. The ceding insurer should use. A ceding insurer is an insurer that underwrites and issues an original, primary policy to an insured and contractually transfers (cedes) a portion of the risk to a reinsurer. The extension of coverage for a peril that is not generally covered in a reinsurance treaty. Whereas, reinsurance is insurance that is purchased by an insurance company (the “ceding company” or.

Source: covernest.com

Source: covernest.com

Thus smaller insurers can compete with larger insurers, and policies beyond the capacity of any single insurer can be. A ceding reinsurer is a reinsurer that transfers (cedes) a portion of the underlying reinsurance to a retrocessionnaire. The extension of coverage for a peril that is not generally covered in a reinsurance treaty. Termen för ceding insurer i sverige är återförsäkringsbolag. Ceding is helpful to insurance companies since the ceding.

Source: theinsurer.com

Source: theinsurer.com

‘ceding insurer’ means an insurer or reinsurer that is counterparty to an assuming reinsurer under a reinsurance agreement; The insurer however is liable to pay the claims in the event of default by the reinsurer. Termen för ceding insurer i sverige är återförsäkringsbolag. Ett återförsäkringsbolag är ett stort försäkringsbolag som försäkrar mindre försäkringsbolag mot ekonomiska smällar. Insurance firms are vulnerable to unforeseen losses due to excessive exposure to high risk entities.

Source: blog.ccr-re.com

Source: blog.ccr-re.com

A ceding insurer or a reinsurer. A surplus share treaty is a reinsurance treaty in which the ceding insurer retains a fixed amount of policy liability and the reinsurer takes responsibility for what remains. A ceding company is an insurance company that passes a portion or all of the risk associated with an insurance policy to another insurer. The implication of loss distribution will be as follows loss $8,000,000. By ceding shares of all policies or just larger policies, the net retained loss exposure per individual policy or in total can be kept in line with the cedant’s surplus.

Source: investopedia.com

Source: investopedia.com

På detta vis kan de mindre försäkringsbolagen frigöra sitt kapital för att kunna teckna fler försäkringstagare under sitt paraply. A ceding insurer is an insurer that underwrites and issues an original, primary policy to an insured and contractually transfers (cedes) a portion of the risk to a reinsurer. For example, ‘abc’ is a reinsurance company that agrees to provide $10 million of the original insurer’s fire insurance policies. Ett återförsäkringsbolag är ett stort försäkringsbolag som försäkrar mindre försäkringsbolag mot ekonomiska smällar. By ceding shares of all policies or just larger policies, the net retained loss exposure per individual policy or in total can be kept in line with the cedant’s surplus.

Source: irmi.com

Source: irmi.com

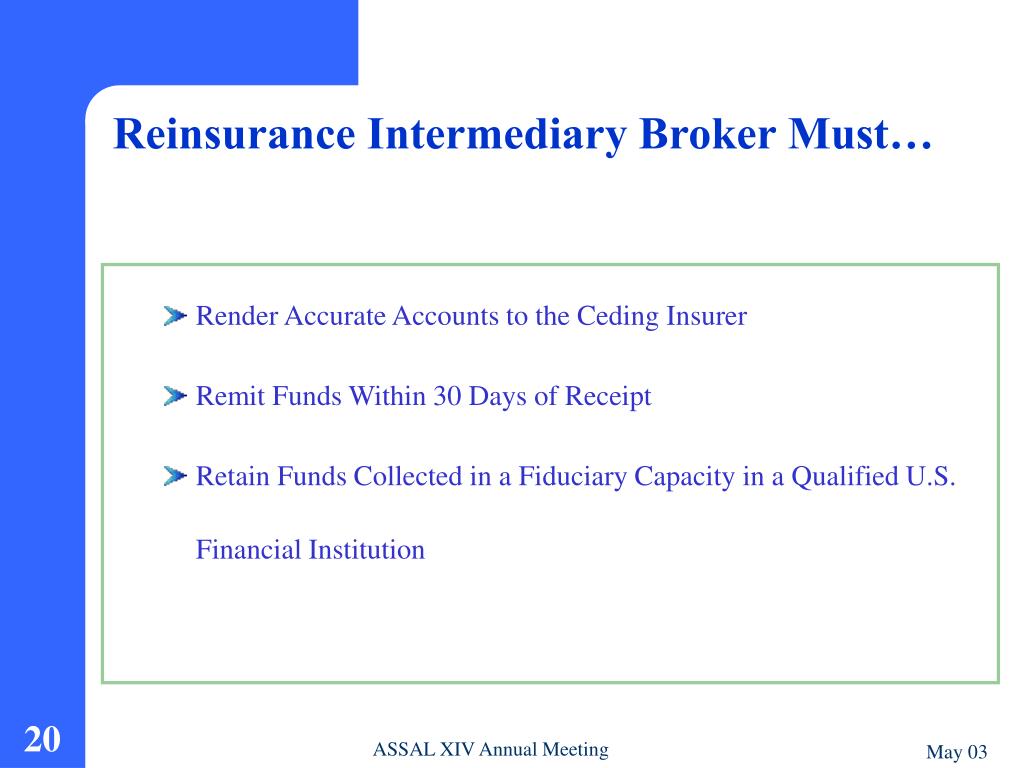

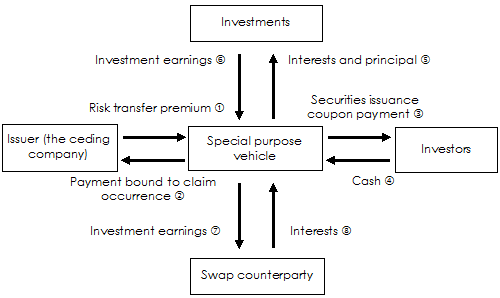

Ceding insurer means an insurance company, approved by the commissioner and licensed or otherwise authorized to transact the business of insurance or reinsurance in its state or country of domicile, that cedes risk to a special purpose financial captive insurance company pursuant to a reinsurance contract. Whereas, reinsurance is insurance that is purchased by an insurance company (the “ceding company” or. And (b) the assuming insurer with the consent of the direct insureds, has assumed such policy obligations to the payees as a replacement for the obligations of the ceding insurer.(15) 1. Treaty reinsurance is insurance acquired from another insurer by an insurance business. A ceding insurer or a reinsurer.

Source: theinsurer.com

Source: theinsurer.com

Icy limits while maintaining a manageable risk level. The implication of loss distribution will be as follows loss $8,000,000. The insurer however is liable to pay the claims in the event of default by the reinsurer. If the policies go beyond the set limit, the company won’t cover it. As compensation, the ceding company pays a premium to the reinsurance company.

Source: taire.com

Source: taire.com

(for certified reinsurers in florida, the collateral deferral only applies to losses resulting from a named hurricane.) as with all insurance licensing, reinsurers must apply for certification in each state. Treaty reinsurance provides additional protection for the ceding insurer’s equity and more stability in the case of exceptional or significant occurrences. Please use your own words even if you are using the textbook for answers and provide a citation for all of your answers. (for certified reinsurers in florida, the collateral deferral only applies to losses resulting from a named hurricane.) as with all insurance licensing, reinsurers must apply for certification in each state. After the ceding insurer posts its initial reserve for the loss.

Source: investopedia.com

Source: investopedia.com

Firm posts rs 311 crore net income; A ceding insurer or a reinsurer. The ceding insurer should use. For example, ‘abc’ is a reinsurance company that agrees to provide $10 million of the original insurer’s fire insurance policies. A ceding company is an insurance company that passes a portion or all of the risk associated with an insurance policy to another insurer.

![Overview Reinsurance [PPT Powerpoint] Overview Reinsurance [PPT Powerpoint]](https://static.documents.pub/img/1200x630/reader011/image/20181222/544cd479b1af9f310b8b4b72.png?t=1606962226) Source: documents.pub

Source: documents.pub

A surplus share treaty is a reinsurance treaty in which the ceding insurer retains a fixed amount of policy liability and the reinsurer takes responsibility for what remains. The ceding insurer should use. Insurance firms are vulnerable to unforeseen losses due to excessive exposure to high risk entities. A ceding insurer is an insurer that underwrites and issues an original, primary policy to an insured and contractually transfers (cedes) a portion of the risk to a reinsurer. Treaty reinsurance provides additional protection for the ceding insurer’s equity and more stability in the case of exceptional or significant occurrences.

Source: accountlearning.com

Source: accountlearning.com

Treaty reinsurance provides additional protection for the ceding insurer’s equity and more stability in the case of exceptional or significant occurrences. A ceding insurer is an insurer that underwrites and issues an original, primary policy to an insured and contractually transfers (cedes) a portion of the risk to a reinsurer. Any plagiarism will result in a grade of zero for all students involved. The transaction involves the insured assuming a guaranteed and known relatively small loss in the form of payment to the insurer in exchange for the insurer’s promise to compensate the insured in the case of a financial (personal) loss. The ceding insurer or (b) where the assuming insurer with the consent of the direct insured or insureds has assumed such policy obligations of the ceding insurer as direct obligations of the assuming insurer to the payees under such policies and in substitution for the obligations of the ceding insurer to such payees.

Source: slideserve.com

Source: slideserve.com

Ceding insurer means an insurance company, approved by the commissioner and licensed or otherwise authorized to transact the business of insurance or reinsurance in its state or country of domicile, that cedes risk to a special purpose financial captive insurance company pursuant to a reinsurance contract. Insurance firms are vulnerable to unforeseen losses due to excessive exposure to high risk entities. As compensation, the ceding company pays a premium to the reinsurance company. A ceding insurer or a reinsurer. Termen för ceding insurer i sverige är återförsäkringsbolag.

Source: theinsurer.com

Source: theinsurer.com

A ceding insurer is an insurer that underwrites and issues an original, primary policy to an insured and contractually transfers (cedes) a portion of the risk to a reinsurer. A ceding company is an insurance company that has shared or passed risks on to another company in a transaction called reinsurance. For example, ‘abc’ is a reinsurance company that agrees to provide $10 million of the original insurer’s fire insurance policies. Any plagiarism will result in a grade of zero for all students involved. (for certified reinsurers in florida, the collateral deferral only applies to losses resulting from a named hurricane.) as with all insurance licensing, reinsurers must apply for certification in each state.

Source: slideserve.com

Source: slideserve.com

Ceding company’s premium income is $10,000,000, and the total loss over the year is $8,000,000. The reinsurer agrees to indemnify the For example, ‘abc’ is a reinsurance company that agrees to provide $10 million of the original insurer’s fire insurance policies. This is 80% of the gross premium, and therefore, reinsurers come into the picture to keep this ‘loss ratio’ down to a predetermined 70%. Thus smaller insurers can compete with larger insurers, and policies beyond the capacity of any single insurer can be.

Source: slideserve.com

Source: slideserve.com

And (b) the assuming insurer with the consent of the direct insureds, has assumed such policy obligations to the payees as a replacement for the obligations of the ceding insurer.(15) 1. Please answer each of the following and all parts of your answers must be in your own words. Treaty reinsurance provides additional protection for the ceding insurer’s equity and more stability in the case of exceptional or significant occurrences. A ceding insurer is an insurer that underwrites and issues an original, primary policy to an insured and contractually transfers (cedes) a portion of the risk to a reinsurer. The ceding insurer or (b) where the assuming insurer with the consent of the direct insured or insureds has assumed such policy obligations of the ceding insurer as direct obligations of the assuming insurer to the payees under such policies and in substitution for the obligations of the ceding insurer to such payees.

Source: theinsurer.com

Source: theinsurer.com

Special acceptance requires the creation of a separate agreement between the ceding. Ceding insurer means an insurance company, approved by the commissioner and licensed or otherwise authorized to transact the business of insurance or reinsurance in its state or country of domicile, that cedes risk to a special purpose financial captive insurance company pursuant to a reinsurance contract. ‘ceding insurer’ means an insurer or reinsurer that is counterparty to an assuming reinsurer under a reinsurance agreement; A surplus share treaty is a reinsurance treaty in which the ceding insurer retains a fixed amount of policy liability and the reinsurer takes responsibility for what remains. På detta vis kan de mindre försäkringsbolagen frigöra sitt kapital för att kunna teckna fler försäkringstagare under sitt paraply.

Source: atlas-mag.net

Source: atlas-mag.net

After the ceding insurer posts its initial reserve for the loss. The ceding insurer or (b) where the assuming insurer with the consent of the direct insured or insureds has assumed such policy obligations of the ceding insurer as direct obligations of the assuming insurer to the payees under such policies and in substitution for the obligations of the ceding insurer to such payees. For example, ‘abc’ is a reinsurance company that agrees to provide $10 million of the original insurer’s fire insurance policies. Termen för ceding insurer i sverige är återförsäkringsbolag. The ceding insurer should use.

Source: investopedia.com

Source: investopedia.com

‘ceding insurer’ means an insurer or reinsurer that is counterparty to an assuming reinsurer under a reinsurance agreement; The ceding insurer should use. På detta vis kan de mindre försäkringsbolagen frigöra sitt kapital för att kunna teckna fler försäkringstagare under sitt paraply. And (b) the assuming insurer with the consent of the direct insureds, has assumed such policy obligations to the payees as a replacement for the obligations of the ceding insurer.(15) 1. Whereas, reinsurance is insurance that is purchased by an insurance company (the “ceding company” or.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ceding insurer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea