Certificate of insurance for nonprofit Idea

Home » Trend » Certificate of insurance for nonprofit IdeaYour Certificate of insurance for nonprofit images are available in this site. Certificate of insurance for nonprofit are a topic that is being searched for and liked by netizens now. You can Download the Certificate of insurance for nonprofit files here. Find and Download all free photos.

If you’re looking for certificate of insurance for nonprofit images information linked to the certificate of insurance for nonprofit topic, you have pay a visit to the ideal site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

Certificate Of Insurance For Nonprofit. The median premium for directors and officers insurance (d&o) for nonprofit organizations is about $70 per month, or $855 annually. How do i purchase nonprofit insurance? Our agents at advanced insurors can assist you in finding the right company for your non profit insurance needs at a fair price. There are 6 others beyond 501 (c) organizations:

Example Of Certificate Of Liability Insurance Paramythia From paramythia.info

Example Of Certificate Of Liability Insurance Paramythia From paramythia.info

Any number from 501 (c)1 through 501 (c)27 are considered specialized nonprofits. How do i purchase nonprofit insurance? Dreamwrights theatre, sprague school district, etc.) street address of additionally insured *. Alabama alaska arizona arkansas california colorado connecticut delaware district of columbia florida georgia hawaii. The median premium for directors and officers insurance (d&o) for nonprofit organizations is about $70 per month, or $855 annually. Please fill out the form below.

_____ , (the association) a nonprofit association duly organized and existing under the national labor relations act, and that the following is a true copy of resolutions duly adopted by the officers of the association and said resolutions.

Designing the right insurance program for your nonprofit starts with a clear understanding of what your risks and coverage options are. A certificate of insurance is an accord form that shows proof of coverage. General liability, crime (bonding), property, ad&d, and directors & officers. It’s recommended (in all circumstances!) that you get a certificate of insurance from the third party. Obtaining the right insurance for your nonprofit is one way to protect your nonprofit organization from financial loss. As a nonprofit group, you will most likely be required to provide a certificate of insurance to your facility/venue where meetings and fundraisers or other activities are held.

Source: paramythia.info

Source: paramythia.info

First & last name *. It’s critical that your partners are covered as well. Coverage types nonprofit groups should consider. A certificate of insurance is an accord form that shows proof of coverage. Alabama alaska arizona arkansas california colorado connecticut delaware district of columbia florida georgia hawaii.

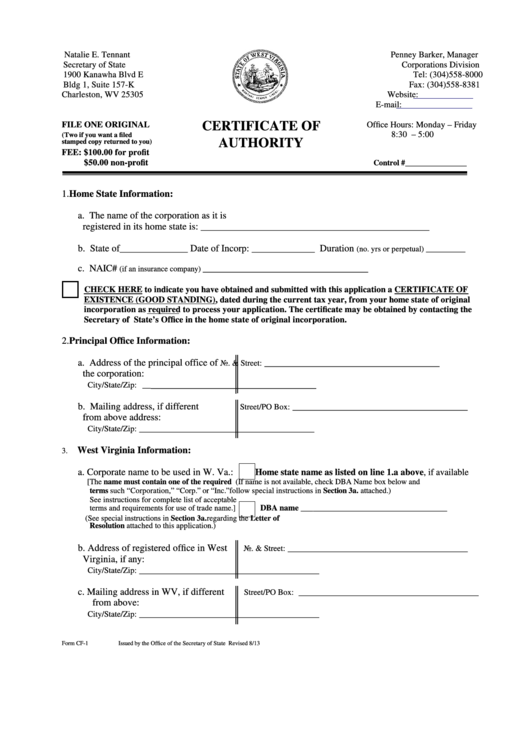

Source: formsbank.com

Source: formsbank.com

Compare general liability insurance quotes for nonprofit organizations from top us carriers with safe easy. 501 (d), 501 (e), 501 (f), 501 (k), 501 (n) and 521 (a). It’s critical that your partners are covered as well. (1) the certification by insurance broker or agent on the following page setting forth the required information and signatures; Compare general liability insurance quotes for nonprofit organizations from top us carriers with safe easy.

Source: mydabbawala.org

Source: mydabbawala.org

If your nonprofit is involved in any of the. She was exceptionally courteous and nonprofit insurance of for damages such as possible cost insurance agency located in charge per policy to lower rate of your accounts. Our agents at advanced insurors can assist you in finding the right company for your non profit insurance needs at a fair price. It is a way of transferring risk away from your organization. _____ , (the association) a nonprofit association duly organized and existing under the national labor relations act, and that the following is a true copy of resolutions duly adopted by the officers of the association and said resolutions.

Source: cdhangelball.blogspot.com

Source: cdhangelball.blogspot.com

A certificate of insurance is a document detailing the type of insurance coverage and the dates and limits of coverage. Available to purchase nationally, nonprofit chapters and clubs can quote and buy a policy entirely online or by calling and accessing one of our knowledgeable customer care specialists. Compare general liability insurance quotes for nonprofit organizations from top us carriers with safe easy. It’s recommended (in all circumstances!) that you get a certificate of insurance from the third party. Insuring your nonprofit organization can be tricky at best.

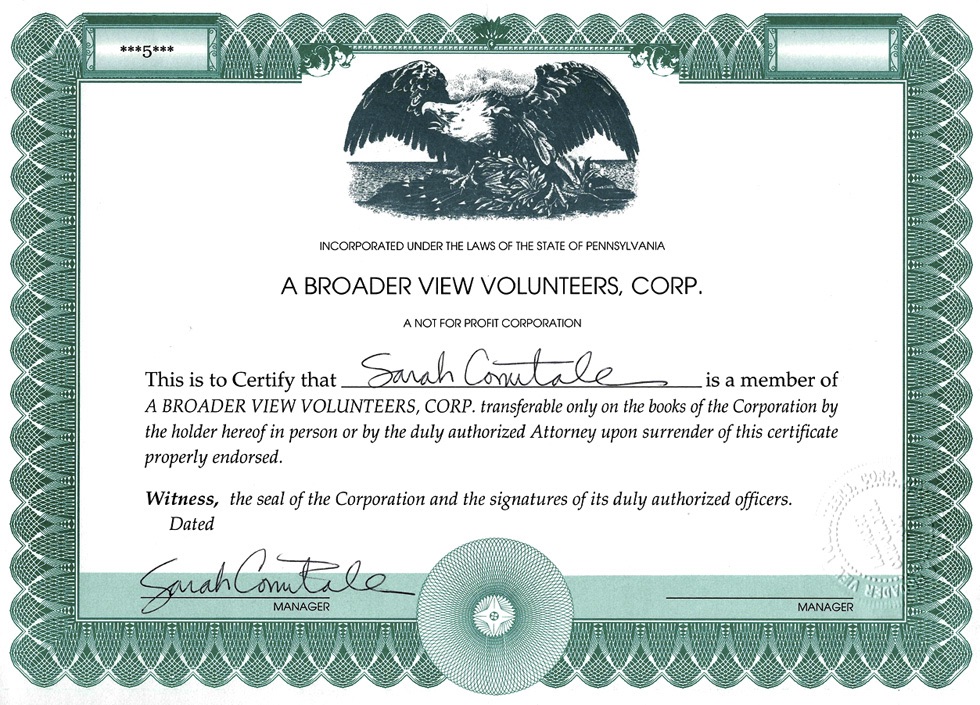

Source: abroaderview.org

Source: abroaderview.org

Obtaining the right insurance for your nonprofit is one way to protect your nonprofit organization from financial loss. _____ , (the association) a nonprofit association duly organized and existing under the national labor relations act, and that the following is a true copy of resolutions duly adopted by the officers of the association and said resolutions. How do i purchase nonprofit insurance? First & last name *. Insuring your nonprofit organization can be tricky at best.

Source: harborcompliance.com

Source: harborcompliance.com

Wedding & special event insurance for less progressive. Nonprofit organization insurance california protects your 503(c) from lawsuits with rates as low as $37/mo. Annual policies also include free, unlimited certificates of insurance. A certificate of insurance is an accord form that shows proof of coverage. That’s why we created this guide to explain in everyday terms what types of insurance are available to nonprofits and which ones your organization might want to consider.

Source: certificatestemplatesfree.com

Source: certificatestemplatesfree.com

We also offer enhancements that include international coverage, accident & health insurance for volunteers, and management liability insurance, including directors & officers liability (d&o) and employment practices liability insurance(epli) There are gaps in many of the charitable immunity laws you may not be aware of. These cover religious associations, cooperative health organizations, child care organizations, charity risk pools and farmers’ coops. The median premium for directors and officers insurance (d&o) for nonprofit organizations is about $70 per month, or $855 annually. It’s critical that your partners are covered as well.

Source: certificatestemplatesfree.com

Source: certificatestemplatesfree.com

_____ , (the association) a nonprofit association duly organized and existing under the national labor relations act, and that the following is a true copy of resolutions duly adopted by the officers of the association and said resolutions. There are gaps in many of the charitable immunity laws you may not be aware of. There are 6 others beyond 501 (c) organizations: Certificate provided the solid foundation i need for leadership advancement at my organization. Wedding & special event insurance for less progressive.

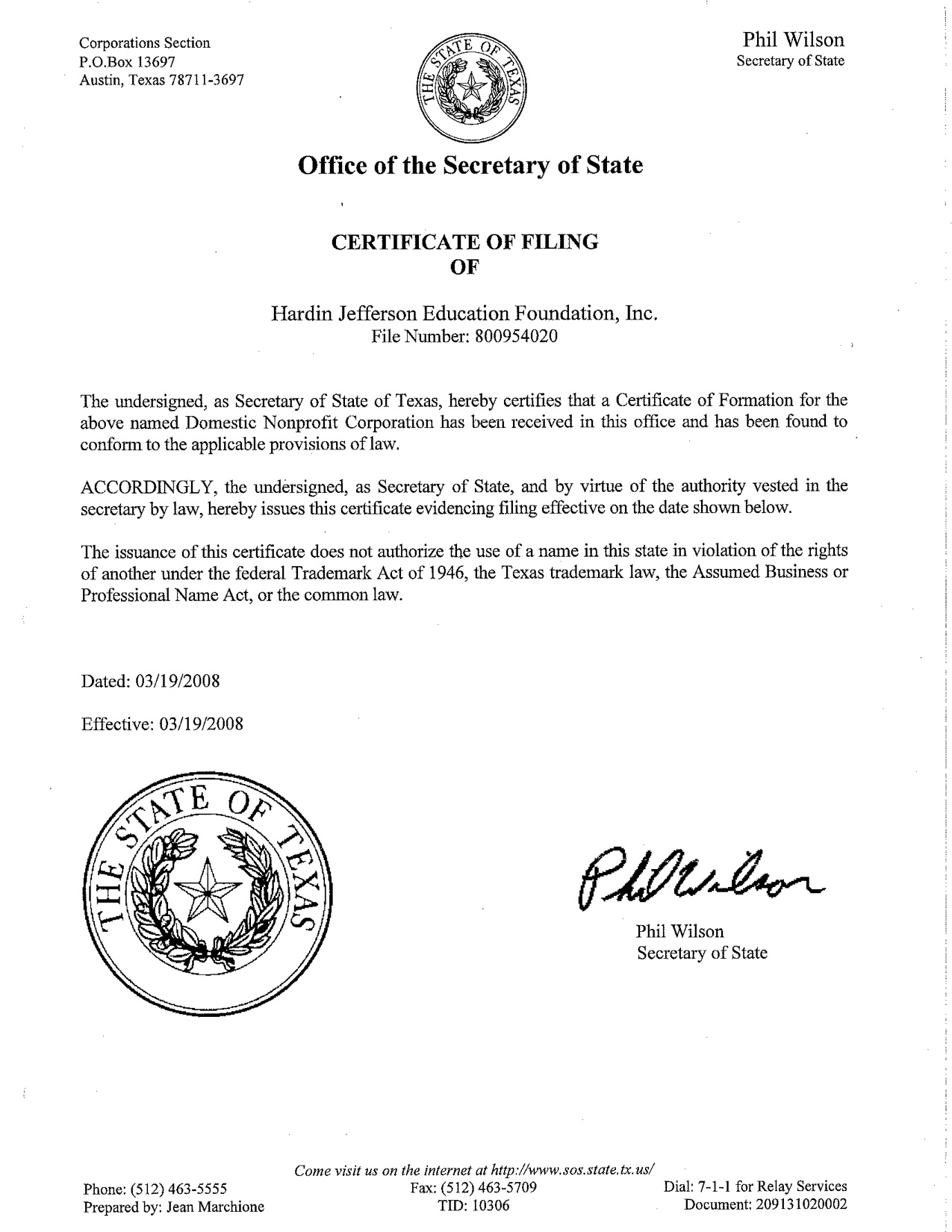

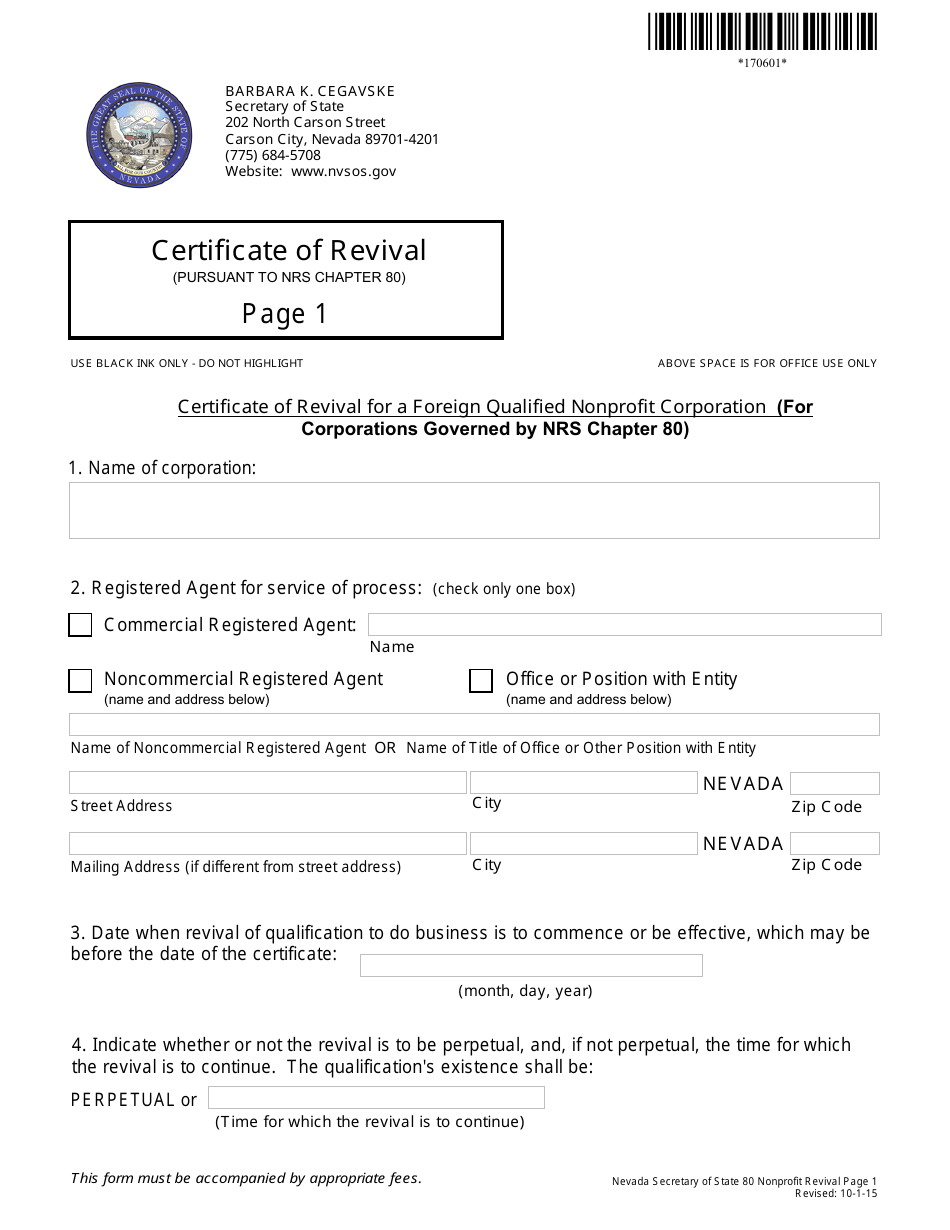

Source: templateroller.com

Source: templateroller.com

Get a fast quote and your certificate of insurance now. 501 (d), 501 (e), 501 (f), 501 (k), 501 (n) and 521 (a). Some venues request that the nonprofit provide them with a certificate of insurance to use their space for an event. Dreamwrights theatre, sprague school district, etc.) street address of additionally insured *. Compare general liability insurance quotes for nonprofit organizations from top us carriers with safe easy.

Source: chainimage.com

Source: chainimage.com

The median premium for directors and officers insurance (d&o) for nonprofit organizations is about $70 per month, or $855 annually. This policy can protect your nonprofit’s directors and officers from legal costs related to mismanagement of funds, failure to comply with regulations, or failure to perform official duties. This is particularly important when you consider that, following an incident involving a contractor or vendor, your business. Wedding & special event insurance for less progressive. Alabama alaska arizona arkansas california colorado connecticut delaware district of columbia florida georgia hawaii.

Source: supplychainsolution.co.uk

Source: supplychainsolution.co.uk

It is a way of transferring risk away from your organization. General liability insurance for nonprofits general liability insurance general liability insurance covers common business risks like customer injury, customer property damage, and advertising injury. We also offer enhancements that include international coverage, accident & health insurance for volunteers, and management liability insurance, including directors & officers liability (d&o) and employment practices liability insurance(epli) You can request a certificate of insurance from your insurance agency as needed. What space a certificate of insurance & why go i all it.

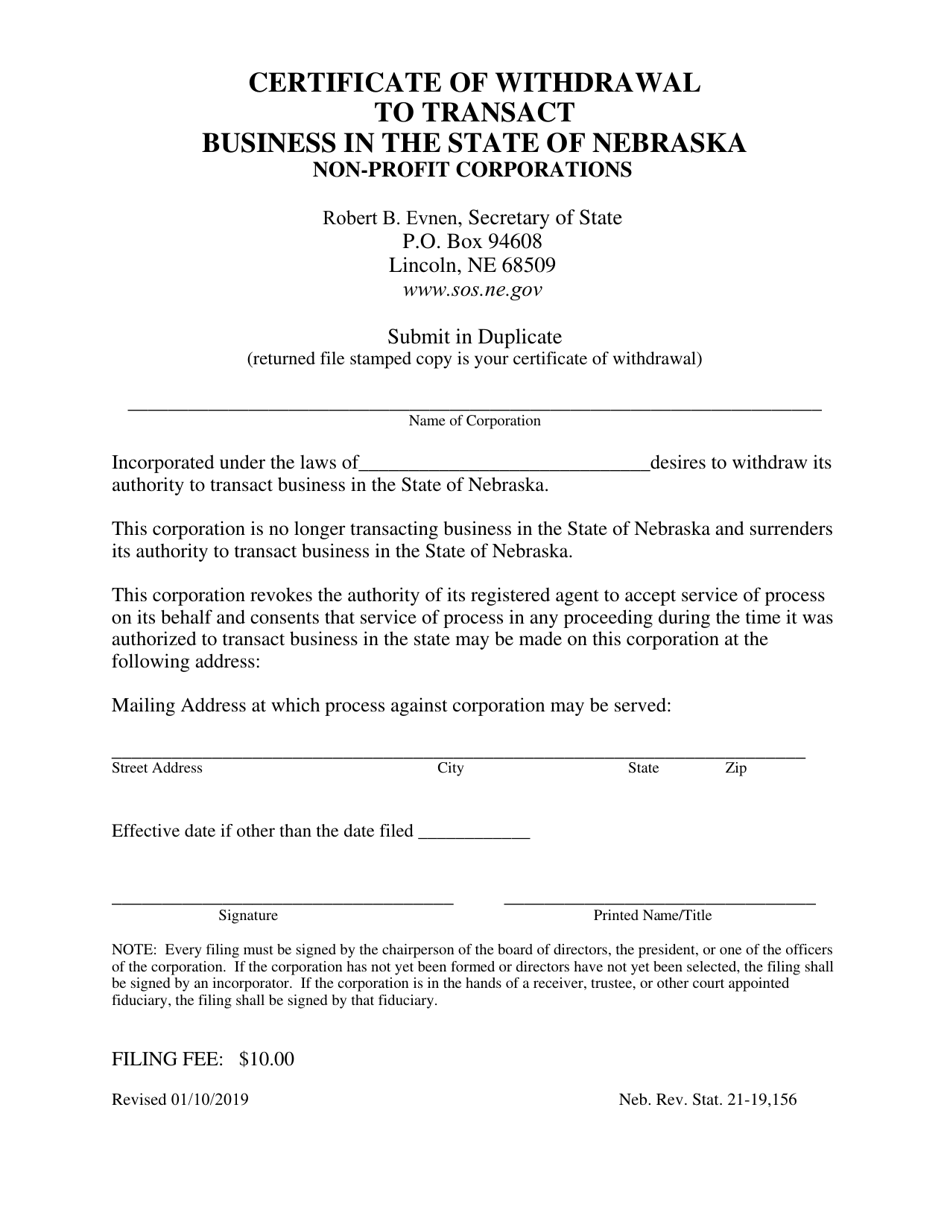

Source: templateroller.com

Source: templateroller.com

An errant lawsuit or accident could cause your organization serious financial damage, preventing you from continuing the important work your organization does for the community. 501 (d), 501 (e), 501 (f), 501 (k), 501 (n) and 521 (a). There are many types of insurance for nonprofits. Obtaining the right insurance for your nonprofit is one way to protect your nonprofit organization from financial loss. Designing the right insurance program for your nonprofit starts with a clear understanding of what your risks and coverage options are.

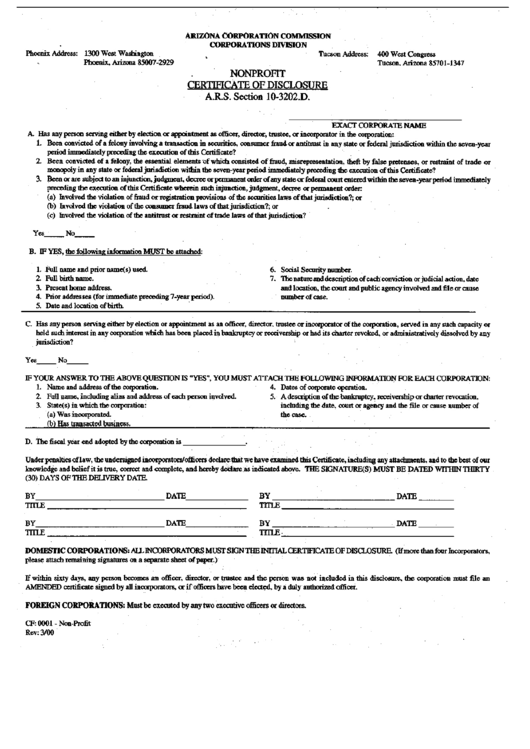

Source: formsbank.com

Source: formsbank.com

If any policy is not available at General liability insurance for nonprofits general liability insurance general liability insurance covers common business risks like customer injury, customer property damage, and advertising injury. Typically, they require a minimum of general liability insurance before entering into an agreement. Our comprehensive package policy includes property , inland marine, crime, automobile, and workers compensation insurance. Warehouse receipts, insurance policies, certificates of deposit, other evidences of indebtedness.

Source: eminem-sara12.blogspot.com

Source: eminem-sara12.blogspot.com

_____ , (the association) a nonprofit association duly organized and existing under the national labor relations act, and that the following is a true copy of resolutions duly adopted by the officers of the association and said resolutions. Annual policies also include free, unlimited certificates of insurance. General liability, crime (bonding), property, ad&d, and directors & officers. That’s why we created this guide to explain in everyday terms what types of insurance are available to nonprofits and which ones your organization might want to consider. (1) the certification by insurance broker or agent on the following page setting forth the required information and signatures;

Source: prestodirect.com

Source: prestodirect.com

There are many types of insurance for nonprofits. If any policy is not available at Although it does not remove the risk, it limits the financial impact of any insurable risk to the cost of your insurance premium and any deductibles or coinsurance. There are gaps in many of the charitable immunity laws you may not be aware of. Nonprofit organization insurance california protects your 503(c) from lawsuits with rates as low as $37/mo.

Source: sec.gov

Source: sec.gov

A certificate of insurance is a document detailing the type of insurance coverage and the dates and limits of coverage. This is particularly important when you consider that, following an incident involving a contractor or vendor, your business. It is a way of transferring risk away from your organization. Unlimited certificates of insurance can be easily added and printed instantly through our online policy management system. It’s recommended (in all circumstances!) that you get a certificate of insurance from the third party.

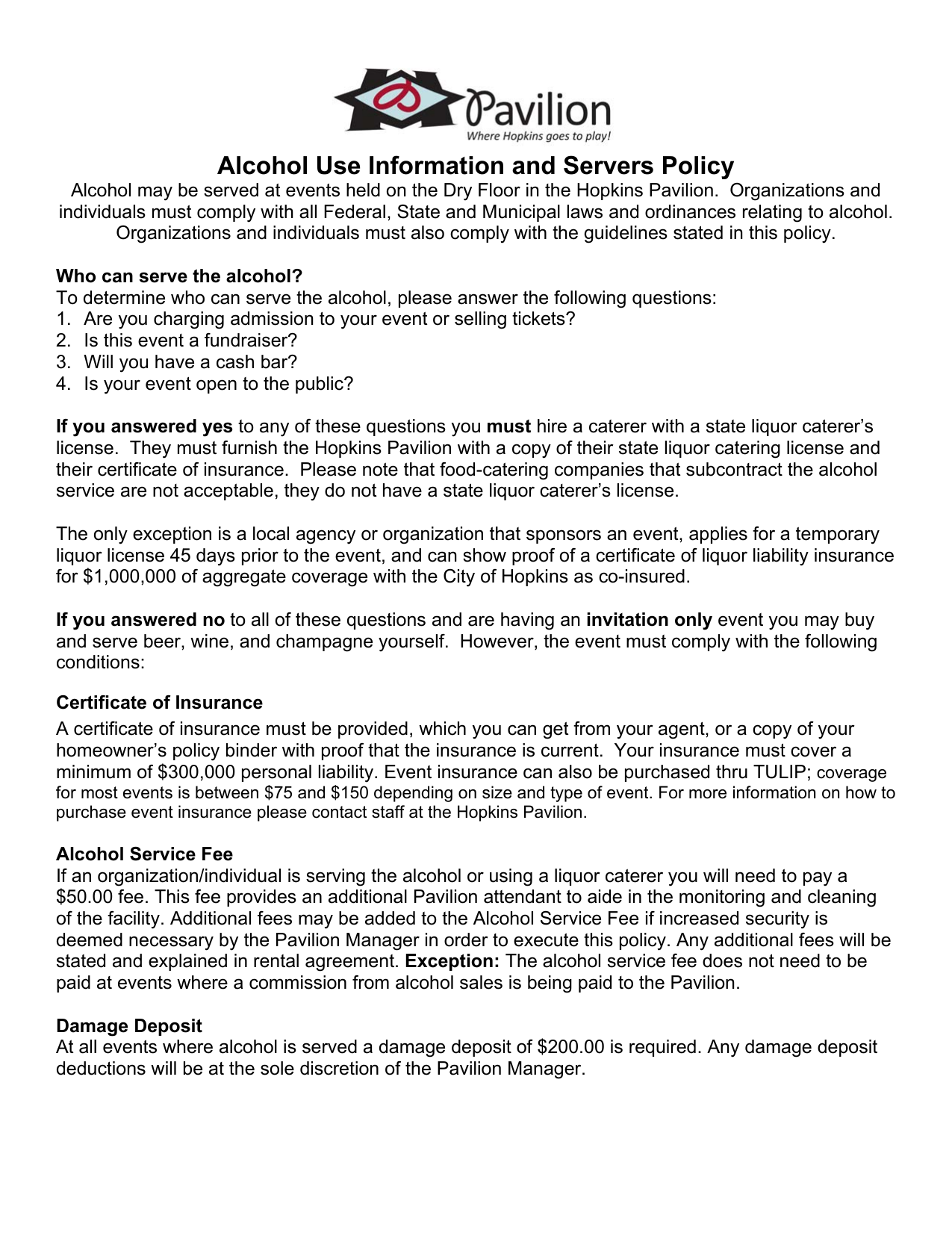

Source: sweetpeafestival.org

Source: sweetpeafestival.org

We also offer enhancements that include international coverage, accident & health insurance for volunteers, and management liability insurance, including directors & officers liability (d&o) and employment practices liability insurance(epli) What is a certificate of insurance ? _____ , (the association) a nonprofit association duly organized and existing under the national labor relations act, and that the following is a true copy of resolutions duly adopted by the officers of the association and said resolutions. Types of insurance nonprofits should consider. As a nonprofit group, you will most likely be required to provide a certificate of insurance to your facility/venue where meetings and fundraisers or other activities are held.

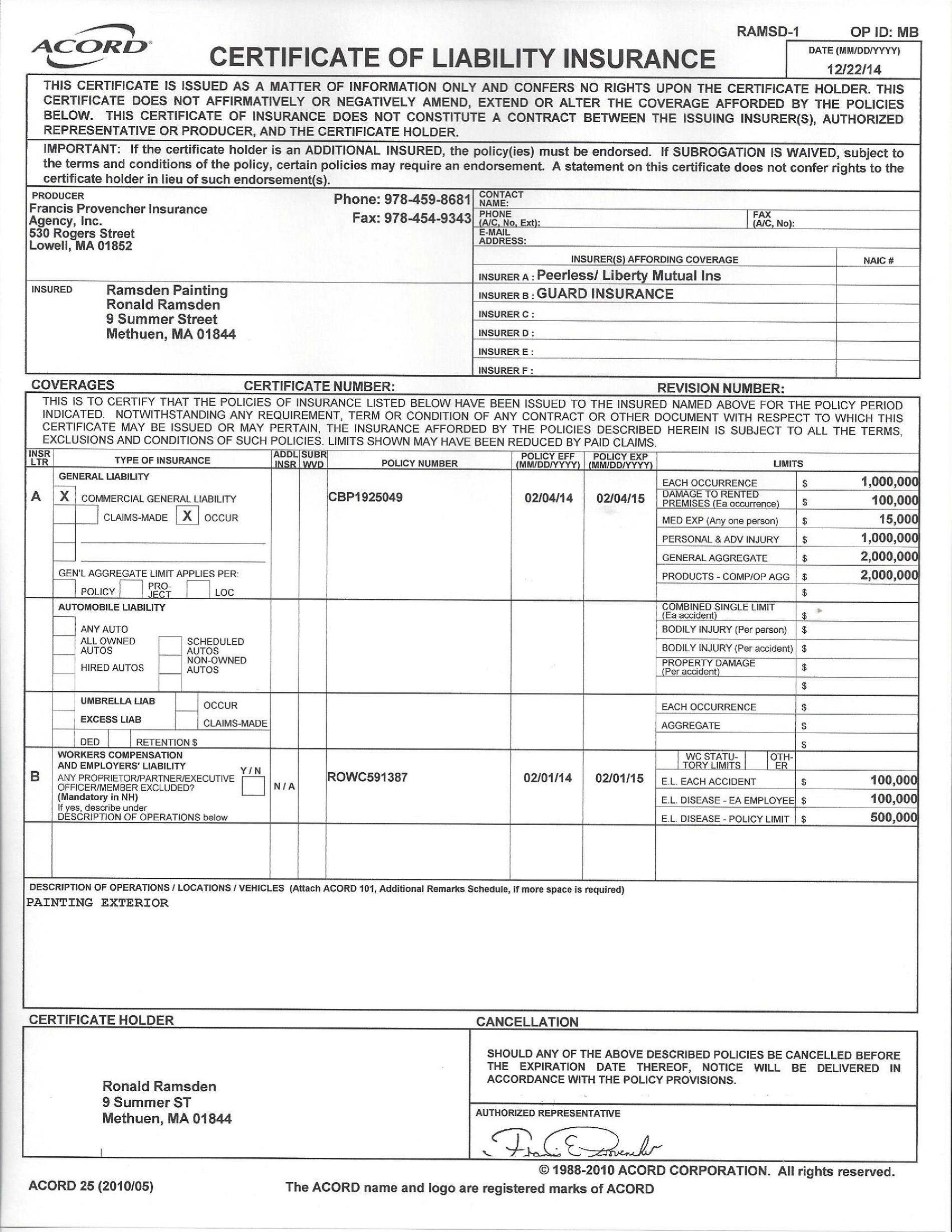

Source: ramsdenpainting.com

Source: ramsdenpainting.com

When accounting for risks related to contracted work, securing your own insurance is not always enough. Insuring your nonprofit organization can be tricky at best. It’s critical that your partners are covered as well. First & last name *. Obtaining the right insurance for your nonprofit is one way to protect your nonprofit organization from financial loss.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title certificate of insurance for nonprofit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information