Certificate of insurance for vendors Idea

Home » Trending » Certificate of insurance for vendors IdeaYour Certificate of insurance for vendors images are available in this site. Certificate of insurance for vendors are a topic that is being searched for and liked by netizens today. You can Download the Certificate of insurance for vendors files here. Download all royalty-free vectors.

If you’re looking for certificate of insurance for vendors pictures information related to the certificate of insurance for vendors interest, you have pay a visit to the ideal site. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

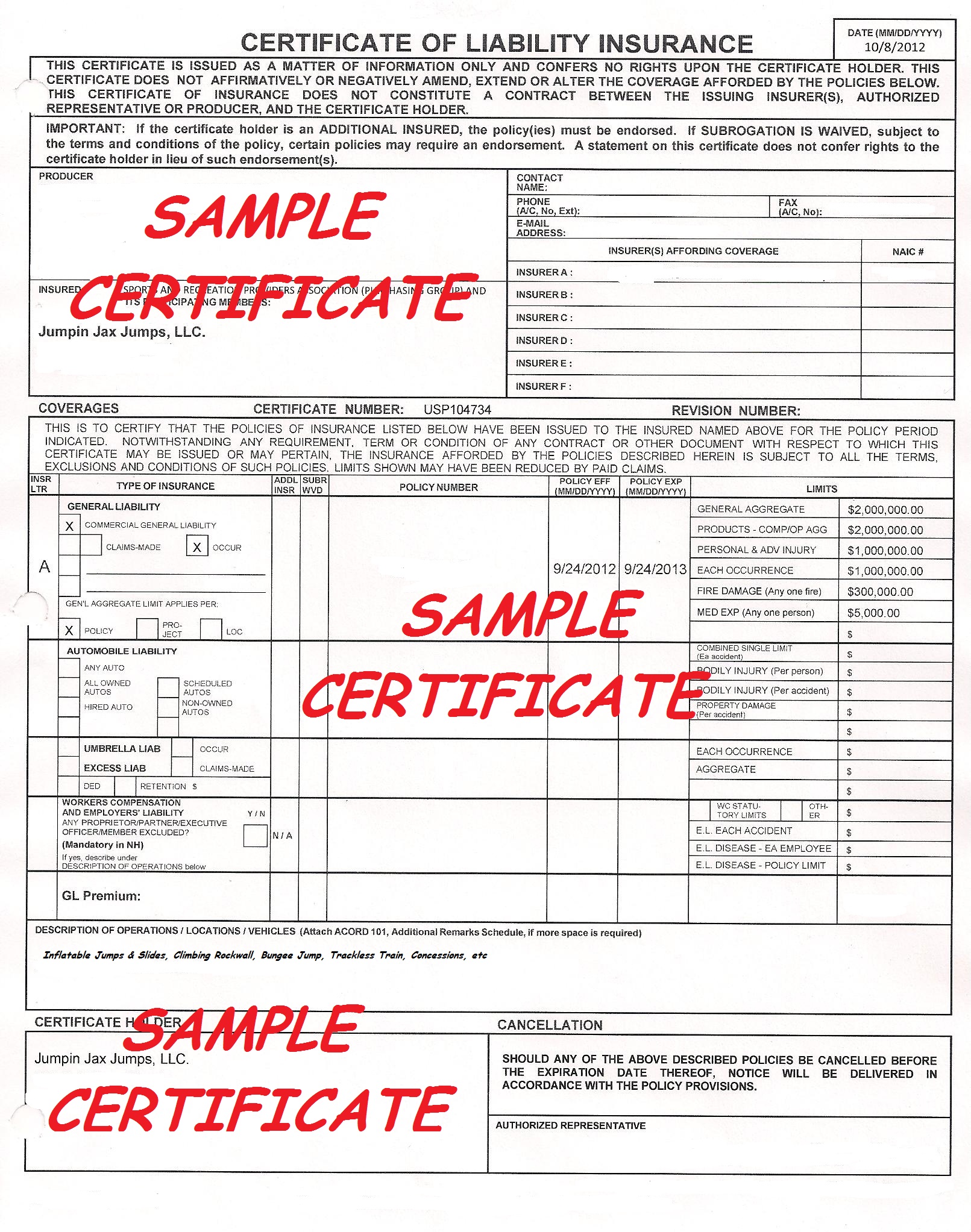

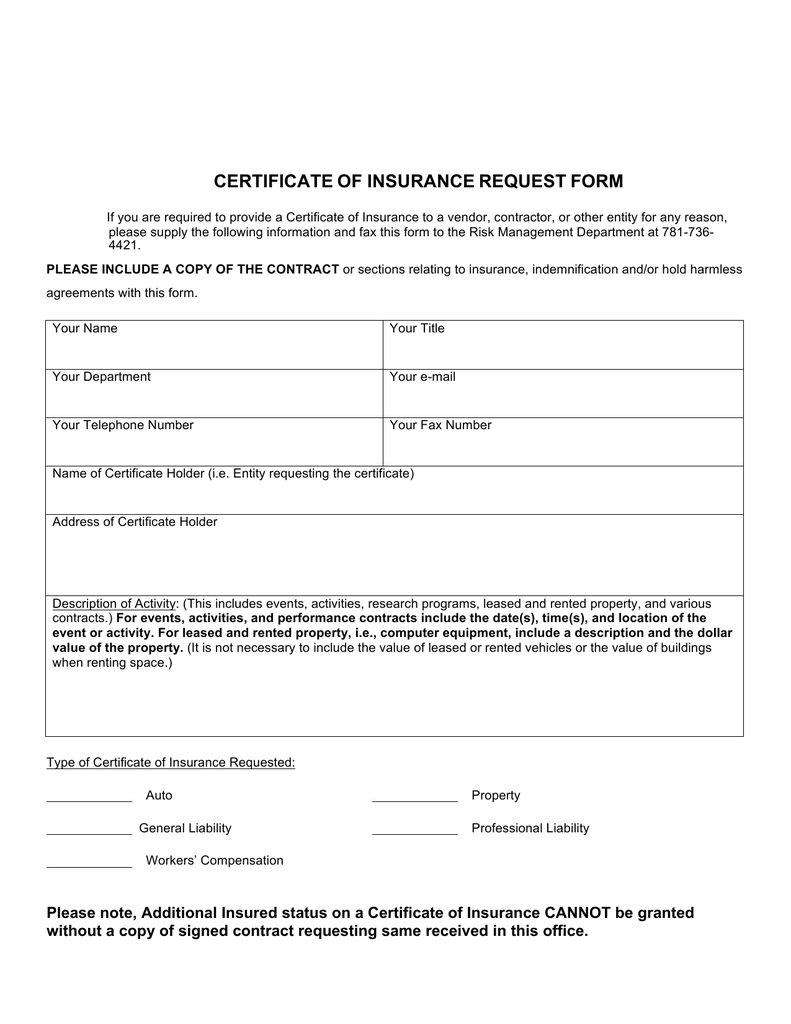

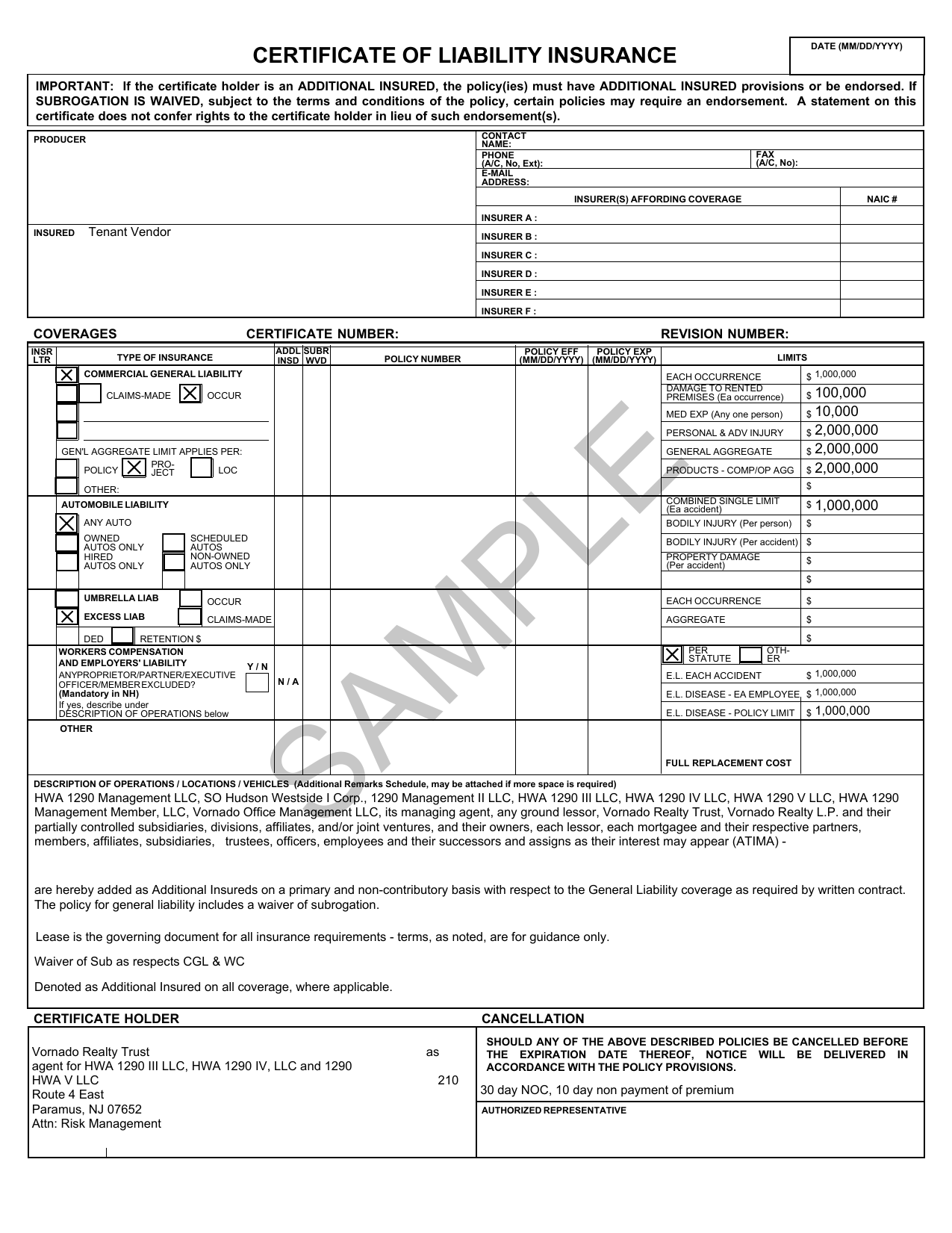

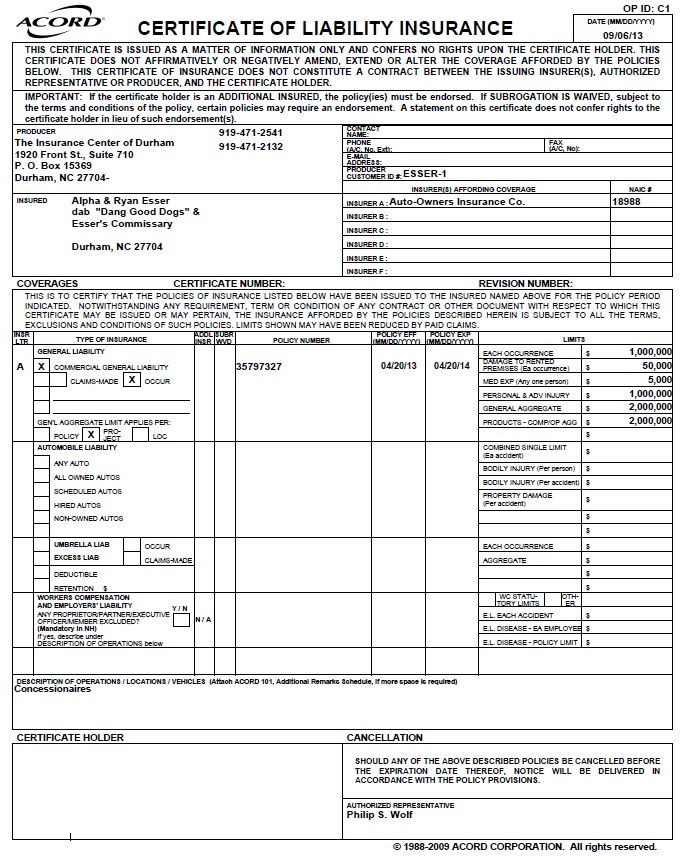

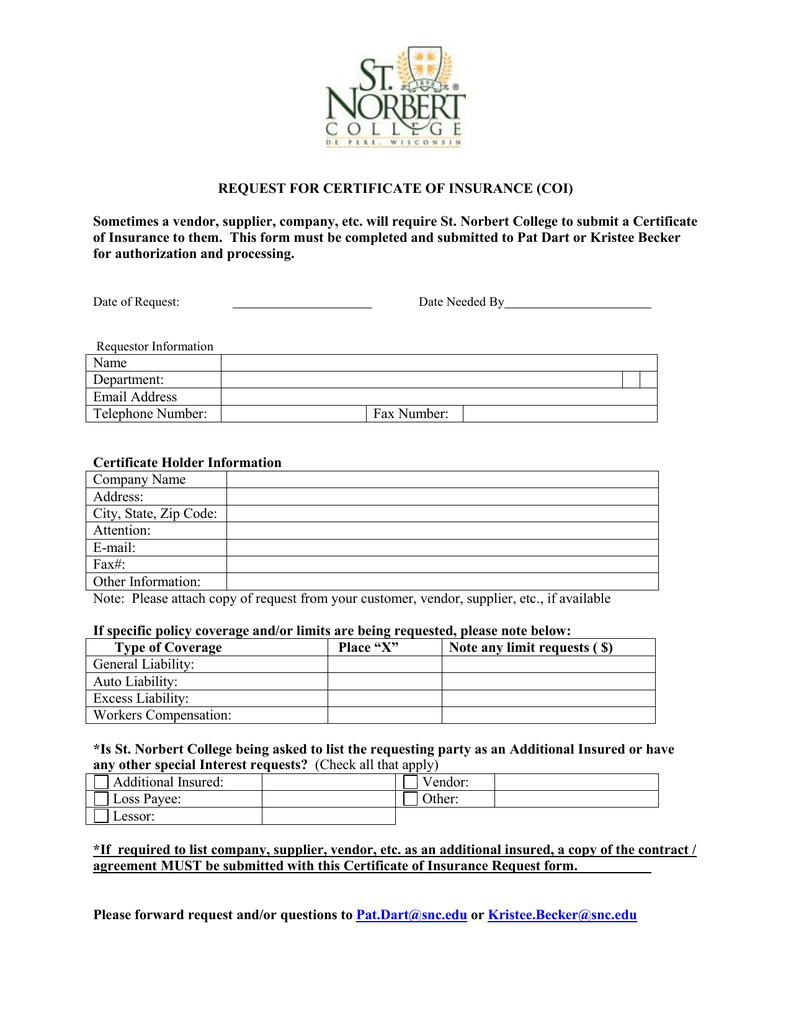

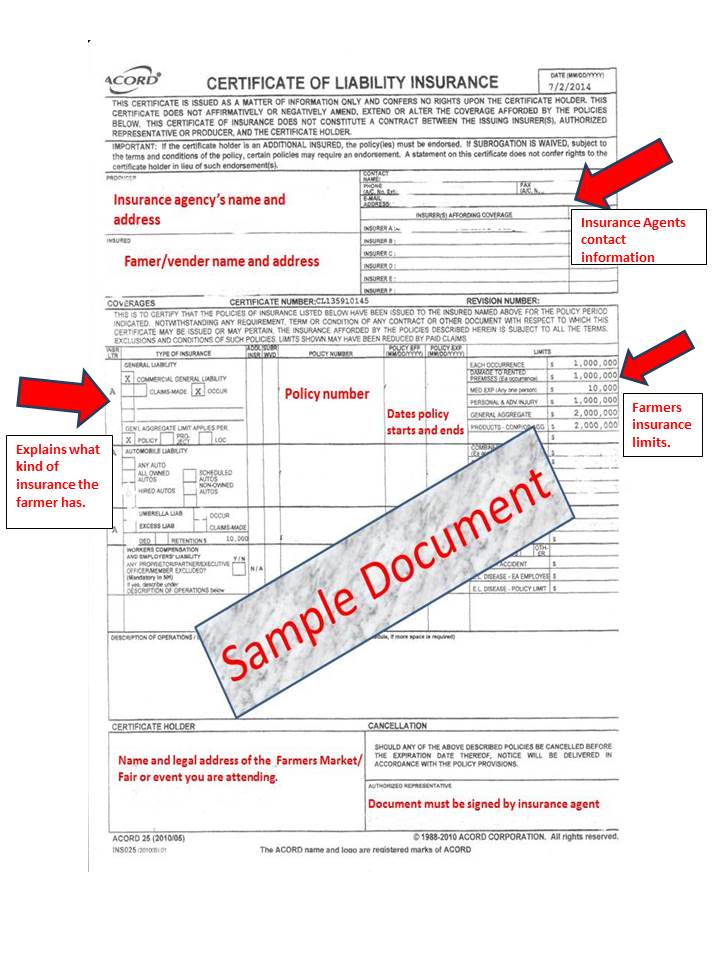

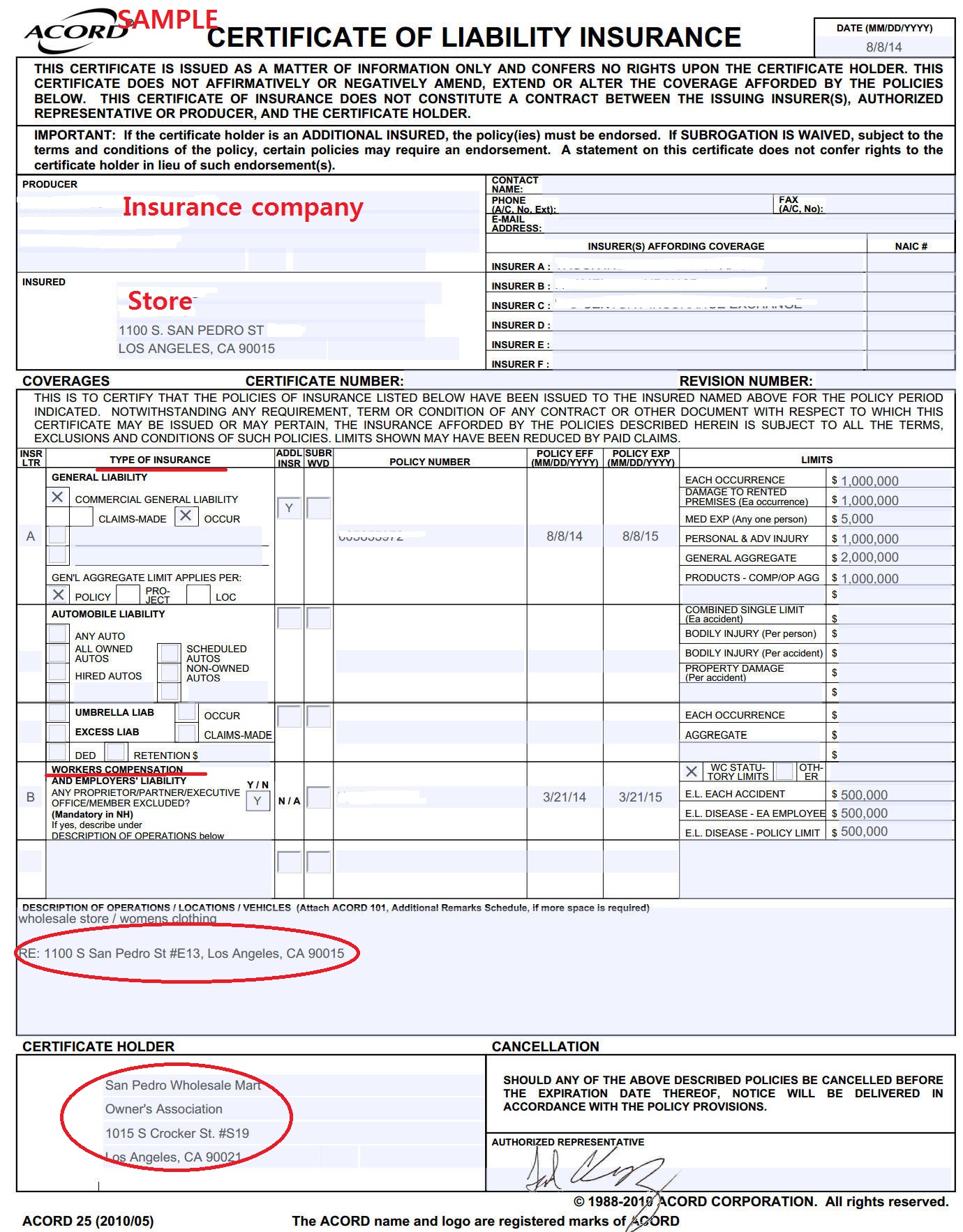

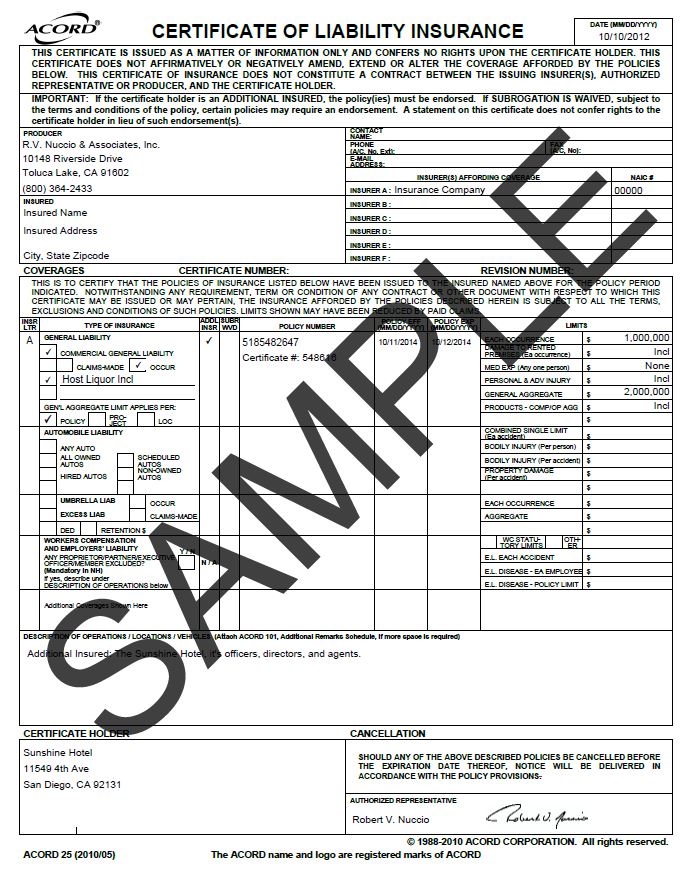

Certificate Of Insurance For Vendors. A document issued by an insurer which evidences that an insurance policy exists and provides information such as insurer, insurance agency, insured, types of insurance, policy numbers, effective dates, limits, certificate holder, cancellation procedure, special provisions, e.g., additional insured, and the name of the Roofing, electrical work, or gas plumbing. If you or your business become the subject of a financial audit, a certificate of insurance can be used to verify that a vendor was an independent contractor rather than an employee, and therefore not subject to payroll taxes. Many organizations need to limit their liability when hiring outside vendors or contractors, and a certificate of insurance helps them place liability for injuries or damages back onto the vendor.

Certificate Of Insurance Form 2020 Fill and Sign From uslegalforms.com

Certificate Of Insurance Form 2020 Fill and Sign From uslegalforms.com

Certificate of insurance is a certificate that can be asked for as proof of insurance. It is helpful in making business deals, taking new contractors into businesses, or any other kind of work, vendors, or other entities. A certificate of insurance is a document that proves a vendor, subcontractor, tenant, supplier, etc. May 7, 2021 — insurance is a means to ensure that a vendor/contractor providing certificates of insurance should be submitted with the request for a who needs it: Obtaining the certificate of insurance from all vendors can also provide an added layer of protection for yourself and your business. If a certificate of insurance is not received prior to issuance of the purchase order or is incomplete, notice should be given to the vendor indicating the certificate must be received by the contract administrator, via certified mail within 15 days or the contract will be canceled.

What is a certificate of insurance for vendors.

Certificates of insurance can be mailed or faxed to the address below: It serves as verification that your business is indeed insured. Within your contract, you should specify that a certificate of insurance showing liability, and other necessary coverages, is required before you begin conducting business with the vendor. Certificate management can be a complex task, especially if you work with a wide variety of vendors, contractors, or other parties who need liability coverage. Contractors from handymen and landscapers to photographers and djs can get a flexible policy. Roofing, electrical work, or gas plumbing.

Source: shapiroinsurancegroup.com

Source: shapiroinsurancegroup.com

The most common type of certificate is that provided for Your agreement should require the vendor/supplier to furnish a certificate of insurance prior to commencing work for your company and again when submitting an invoice for payment. One of the key requirements for all the vendors working with us is that they provide us with valid certificate of insurance (coi). Usually, an insurance company will issue a copy of the coi— the proof that the insurance exists —to the insured party, either at the time the policy is purchased or when requested. What is a certificate of insurance for vendors.

Source: myreasontobe-l.blogspot.com

Source: myreasontobe-l.blogspot.com

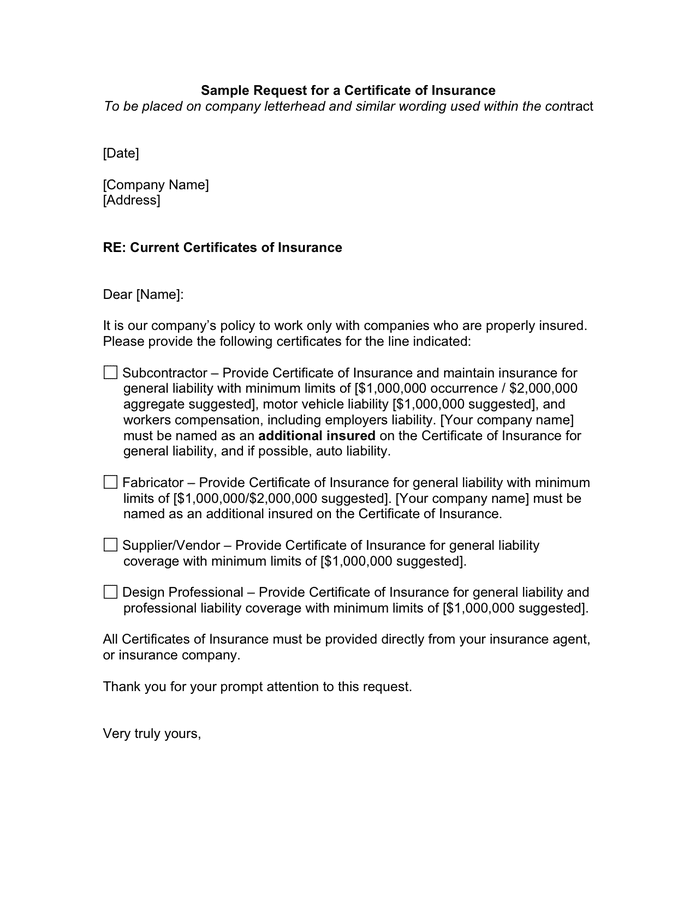

Therefore, letter requesting certificate of insurance is written by a client to a vendor asking for a certificate of insurance to avoid being responsible for liability during the duration of a service execution. It is helpful in making business deals, taking new contractors into businesses, or any other kind of work, vendors, or other entities. With the provision of this letter to vendors, it will enable the client to only work with the vendors that have insurance coverage for the. Receipt of one certificate from the vendor is all that is. That didn’t sound very simple, did it?

Source: certificatestemplatesfree.com

Source: certificatestemplatesfree.com

A certificate of insurance is a standard form issued by the insurance company evidencing the insurance information (including policy limits and types of insurance) of its policyholder. What is a vendor insurance certificate? You can also add a clause that new certificates are required annually in order to continue working together. In the world of small business especially, insurance certificate management often means a mess of email chains, spreadsheets, and confusion for all parties involved. Usually, an insurance company will issue a copy of the coi— the proof that the insurance exists —to the insured party, either at the time the policy is purchased or when requested.

Source: candosagency.com

A certificate of insurance is a standard form issued by the insurance company evidencing the insurance information (including policy limits and types of insurance) of its policyholder. One of the key requirements for all the vendors working with us is that they provide us with valid certificate of insurance (coi). A certificate of insurance is a standard form issued by the insurance company evidencing the insurance information (including policy limits and types of insurance) of its policyholder. A client, you may be working with, may ask from you to provide a certificate of insurance. If you or your business become the subject of a financial audit, a certificate of insurance can be used to verify that a vendor was an independent contractor rather than an employee, and therefore not subject to payroll taxes.

Source: uslegalforms.com

Source: uslegalforms.com

A certificate of insurance is a document issued by the insurance agent on behalf of an insurance company to a third party who has not contracted with the insurance company to purchase an insurance policy. Roofing, electrical work, or gas plumbing. Any company and/or subcontractor working for or providing services to mps group is required to submit a current certificate of insurance to mps group purchasing department prior to commencement of service. If a certificate of insurance is not received prior to issuance of the purchase order or is incomplete, notice should be given to the vendor indicating the certificate must be received by the contract administrator, via certified mail within 15 days or the contract will be canceled. Many organizations need to limit their liability when hiring outside vendors or contractors, and a certificate of insurance helps them place liability for injuries or damages back onto the vendor.

Source: dexform.com

Source: dexform.com

What is a certificate of insurance for vendors. Certificates of insurance are issued on behalf of the insured party (typically the vendor or contractor) by an insurance company. It should show the vendor’s coverage, any limitations or exclusions, and all the usual information. Certificates of insurance can be mailed or faxed to the address below: Obtaining the certificate of insurance from all vendors can also provide an added layer of protection for yourself and your business.

Source: studylib.net

Source: studylib.net

A document issued by an insurer which evidences that an insurance policy exists and provides information such as insurer, insurance agency, insured, types of insurance, policy numbers, effective dates, limits, certificate holder, cancellation procedure, special provisions, e.g., additional insured, and the name of the Collecting insurance certificates ensures those you are doing business with have their own coverage, and any claims that arise can be subrogated. You can also add a clause that new certificates are required annually in order to continue working together. As a condition of their contract with the university, such entities are required to keep on file a current certificate of insurance that meets the requirements of the university. In the event that the work to be performed is an emergency, you should inquire about the company�s general liability insurance and follow up later to recieve the certificate.

Source: slideshare.net

Source: slideshare.net

If you or your business become the subject of a financial audit, a certificate of insurance can be used to verify that a vendor was an independent contractor rather than an employee, and therefore not subject to payroll taxes. The most common type of certificate is that provided for Why request a certificate of insurance from a vendor what is a certificate of insurance? A certificate of insurance is a document issued by the insurance agent on behalf of an insurance company to a third party who has not contracted with the insurance company to purchase an insurance policy. The following minimum insurance standards shall apply to all vendors performing, selling, or distributing products and services at tufts university.

Source: studylib.net

Source: studylib.net

In the event that the work to be performed is an emergency, you should inquire about the company�s general liability insurance and follow up later to recieve the certificate. Roofing, electrical work, or gas plumbing. See sample letter shown in appendix 1. Your agreement should require the vendor/supplier to furnish a certificate of insurance prior to commencing work for your company and again when submitting an invoice for payment. Within your contract, you should specify that a certificate of insurance showing liability, and other necessary coverages, is required before you begin conducting business with the vendor.

Source: namm.org

Source: namm.org

What is a vendor insurance certificate? The following minimum insurance standards shall apply to all vendors performing, selling, or distributing products and services at tufts university. Usually, an insurance company will issue a copy of the coi— the proof that the insurance exists —to the insured party, either at the time the policy is purchased or when requested. See sample letter shown in appendix 1. Your agreement should require the vendor/supplier to furnish a certificate of insurance prior to commencing work for your company and again when submitting an invoice for payment.

Source: danggooddogs.com

Source: danggooddogs.com

May 7, 2021 — insurance is a means to ensure that a vendor/contractor providing certificates of insurance should be submitted with the request for a who needs it: With the provision of this letter to vendors, it will enable the client to only work with the vendors that have insurance coverage for the. A certificate of insurance provides proof to a third party that a vendor or other business has adequate insurance coverage. Thimble is small business insurance for over 140+ professions. Has the correct coverage, and it’s for the right amount.

Source: businesscredentialingservices.com

Source: businesscredentialingservices.com

Has the correct coverage, and it’s for the right amount. Why request a certificate of insurance from a vendor what is a certificate of insurance? Any company and/or subcontractor working for or providing services to mps group is required to submit a current certificate of insurance to mps group purchasing department prior to commencement of service. The following minimum insurance standards shall apply to all vendors performing, selling, or distributing products and services at tufts university. Usually, an insurance company will issue a copy of the coi— the proof that the insurance exists —to the insured party, either at the time the policy is purchased or when requested.

Source: studylib.net

Source: studylib.net

A certificate of insurance provides proof to a third party that a vendor or other business has adequate insurance coverage. A certificate of insurance is a standard form issued by the insurance company evidencing the insurance information (including policy limits and types of insurance) of its policyholder. Your agreement should require the vendor/supplier to furnish a certificate of insurance prior to commencing work for your company and again when submitting an invoice for payment. Vendors and service providers typically perform maintenence functions related to building upkeep. Add the certificate of insurance requirement to your contract:

Source: brucerobinson.com

Source: brucerobinson.com

If you or your business become the subject of a financial audit, a certificate of insurance can be used to verify that a vendor was an independent contractor rather than an employee, and therefore not subject to payroll taxes. Roofing, electrical work, or gas plumbing. Many organizations need to limit their liability when hiring outside vendors or contractors, and a certificate of insurance helps them place liability for injuries or damages back onto the vendor. Obtaining the certificate of insurance from all vendors can also provide an added layer of protection for yourself and your business. Certificates of insurance can be mailed or faxed to the address below:

Source: backyardriches.com

Source: backyardriches.com

The typical document is a “certificate of insurance.”. A client, you may be working with, may ask from you to provide a certificate of insurance. Certificate management can be a complex task, especially if you work with a wide variety of vendors, contractors, or other parties who need liability coverage. In the world of small business especially, insurance certificate management often means a mess of email chains, spreadsheets, and confusion for all parties involved. Certificates of insurance can be mailed or faxed to the address below:

Source: feyinsuranceblog.blogspot.com

Source: feyinsuranceblog.blogspot.com

You should request certificates of insurance from vendors every time you hire them. Contractors from handymen and landscapers to photographers and djs can get a flexible policy. Why request a certificate of insurance from a vendor what is a certificate of insurance? It is helpful in making business deals, taking new contractors into businesses, or any other kind of work, vendors, or other entities. You should request certificates of insurance from vendors every time you hire them.

Source: myreasontobe-l.blogspot.com

Source: myreasontobe-l.blogspot.com

What is a certificate of insurance for vendors. You should request certificates of insurance from vendors every time you hire them. Vendors and service providers typically perform maintenence functions related to building upkeep. In the event that the work to be performed is an emergency, you should inquire about the company�s general liability insurance and follow up later to recieve the certificate. It serves as verification that your business is indeed insured.

Contractors from handymen and landscapers to photographers and djs can get a flexible policy. Many organizations need to limit their liability when hiring outside vendors or contractors, and a certificate of insurance helps them place liability for injuries or damages back onto the vendor. The certificate has to provide proof that your business is insured against general business liability to the amount not less than $1,000,000. Why request a certificate of insurance from a vendor what is a certificate of insurance? The thimble certificate manager is free because we don’t sell compliance—we sell insurance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title certificate of insurance for vendors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea