Certificates of insurance for subcontractors Idea

Home » Trending » Certificates of insurance for subcontractors IdeaYour Certificates of insurance for subcontractors images are ready. Certificates of insurance for subcontractors are a topic that is being searched for and liked by netizens now. You can Download the Certificates of insurance for subcontractors files here. Get all free photos.

If you’re looking for certificates of insurance for subcontractors images information connected with to the certificates of insurance for subcontractors keyword, you have pay a visit to the right blog. Our website always gives you hints for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

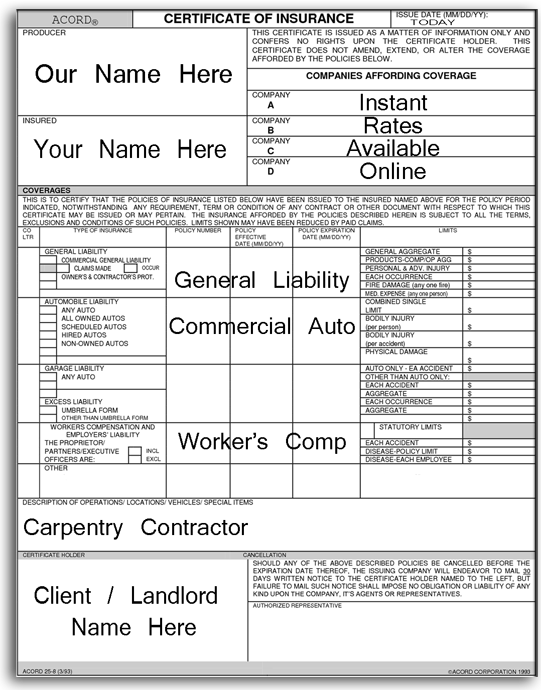

Certificates Of Insurance For Subcontractors. All subcontractors are required to have an �approved certificate of insurance� on file with us prior to a certificate of insurance is a slip of paper (a digital or printed document), proving you have insurance coverage. This certificate is issued to the city of chicago in consideration of the contract entered into with the named insured, and it is mutually understood that the city of chicago relies on this certificate as a basis for continuing such agreement with the named insured: Once you’ve done that, you can request a certificate of insurance. For this purpose, software helps contractors collect, track, and.

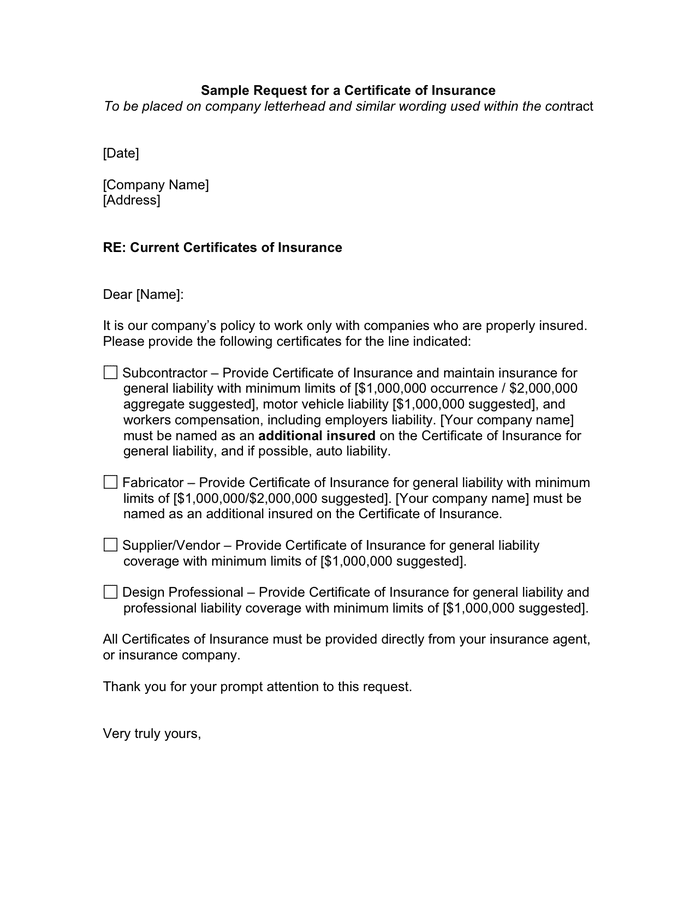

Sample request for a certificate of insurance in Word and From dexform.com

Sample request for a certificate of insurance in Word and From dexform.com

Contractors, subcontractors and insurance certificates. Following are guidelines, sample letters and checklists to assist you in managing subcontractor certificates of insurance. Why does a contractor need a certificate of insurance: When accounting for risks related to contracted work, securing your own insurance is not always enough. Ask them if they have any open or, unreported claims. Most people won’t hire you to work on their homes or businesses without one.

Ask them if they have any open or, unreported claims.

All cois should be reviewed carefully to avoid fraud. Don’t compromise on this step. A certificate of insurance is a legal document that proves you�re insured. Certificates of insurance (coi) are an essential part of managing liability in an organization. All subcontractors are required to have an �approved certificate of insurance� on file with us prior to Ask them if they have any open or, unreported claims.

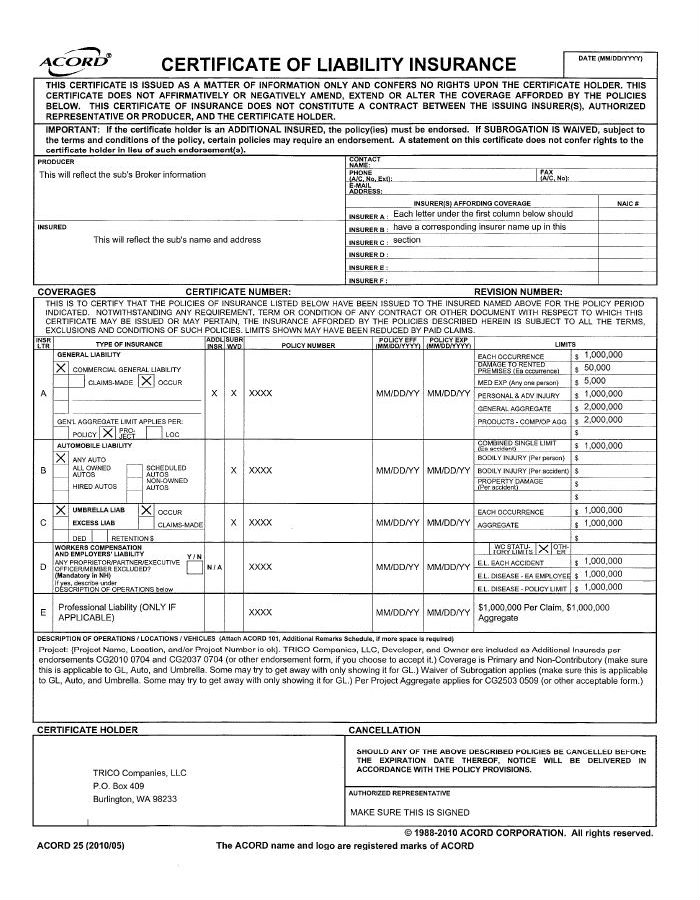

Source: tricocompanies.com

Source: tricocompanies.com

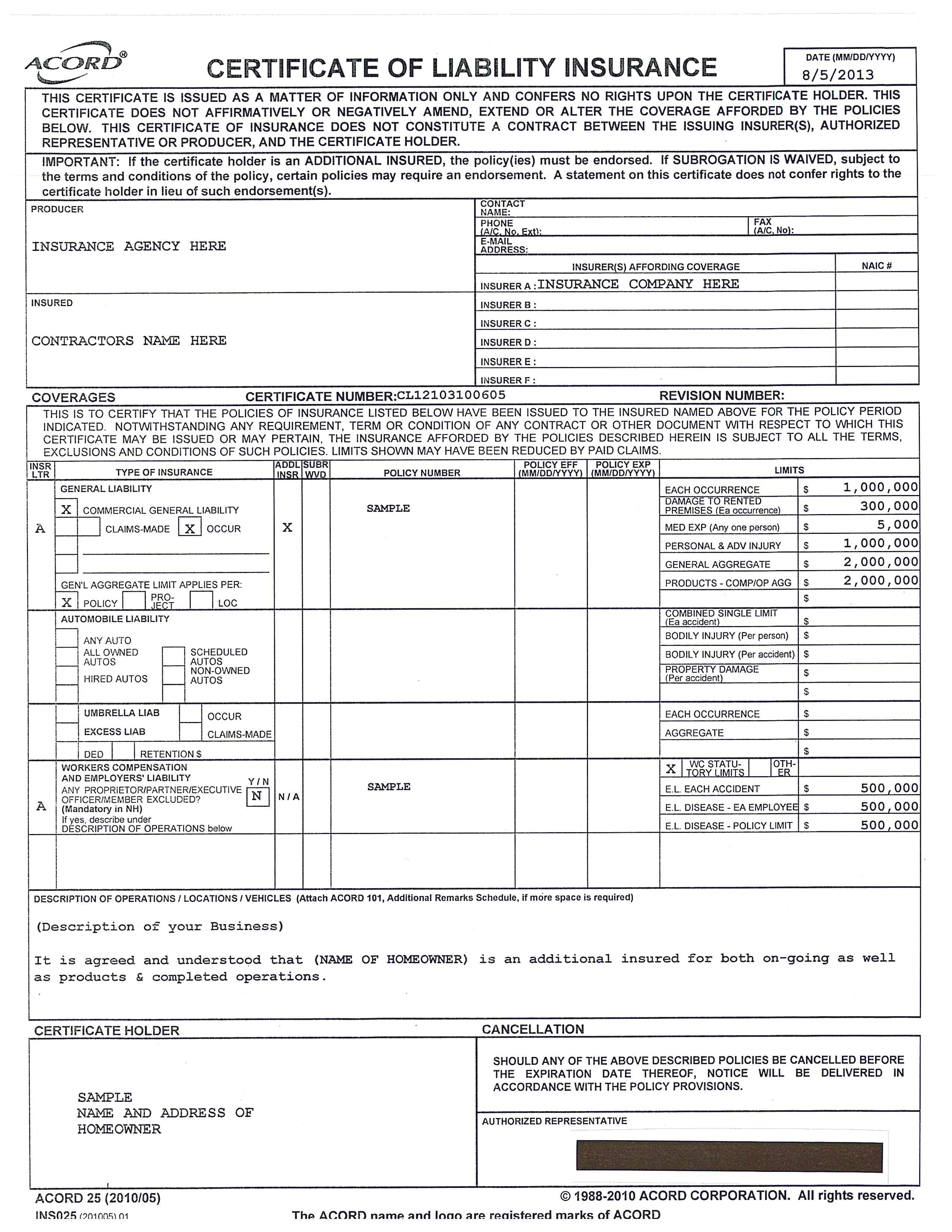

If you employ subcontractors, independent contractors or casual labor, check to make sure they have active workers� comp coverage. This certificate is issued to the city of chicago in consideration of the contract entered into with the named insured, and it is mutually understood that the city of chicago relies on this certificate as a basis for continuing such agreement with the named insured: Certificates of insurance (coi) are an essential part of managing liability in an organization. Require certificates of insurance when you hire subcontractors or other vendors. Many states’ laws allow an employee to “climb the ladder” until they find coverage.

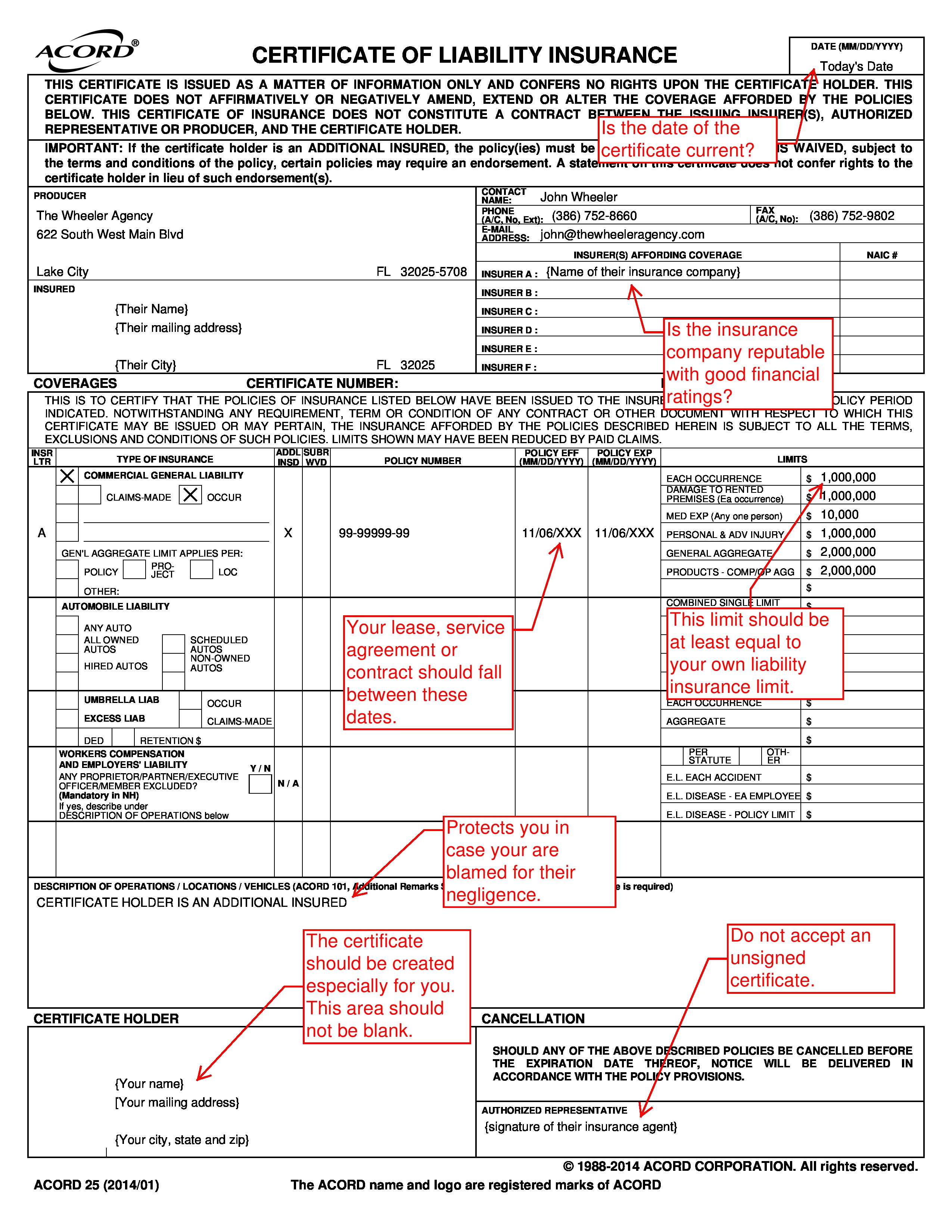

Source: thewheeleragency.com

Source: thewheeleragency.com

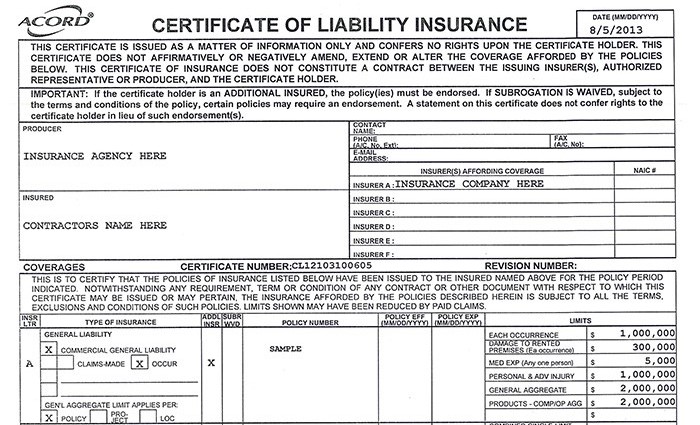

Common subcontractor insurance requirements certificates of insurance. A certificate of insurance is a legal document that proves you�re insured. In order to get a certificate of insurance for your contractor business, you need to first purchase an insurance policy. Require certificates of insurance when you hire subcontractors or other vendors. When your company hires subcontractors, it is extremely important to get a certificate of insurance from each subcontractor working for you.

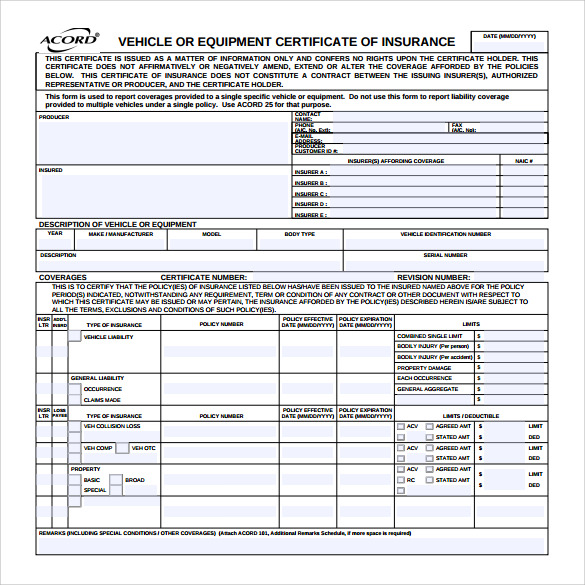

Source: sampletemplates.com

Source: sampletemplates.com

Many employers will also ask to see a certificate of insurance (coi) proving that insurance coverage is in place. Be aware of what your policy does and does not cover. Always obtain certificates of insurance for subcontractors. Contractors, subcontractors and insurance certificates. Many states’ laws allow an employee to “climb the ladder” until they find coverage.

Source: dexform.com

Source: dexform.com

How to monitor subcontractor insurance certificates in quickbooks. A certificate of insurance is a legal document that proves you�re insured. When the insurance expiration dates are passed, every time you try to transact with the subcontractor, you will receive this warning message and a suggestion to contact. You need to forward this to your insurance agent. Usually, you will need to call your insurance agent or send an email, and they’ll then mail you a hard copy.

Source: sampletemplates.com

Source: sampletemplates.com

Certificate of insurance collection and tracking software helps keep contractors from being responsible for a subcontractor’s workers when there is an accident on a job site. All subcontractors are required to have an �approved certificate of insurance� on file with us prior to a certificate of insurance is a slip of paper (a digital or printed document), proving you have insurance coverage. For this purpose, software helps contractors collect, track, and. When your company hires subcontractors, it is extremely important to get a certificate of insurance from each subcontractor working for you. Why does a contractor need a certificate of insurance:

Source: certificatestemplatesfree.com

Source: certificatestemplatesfree.com

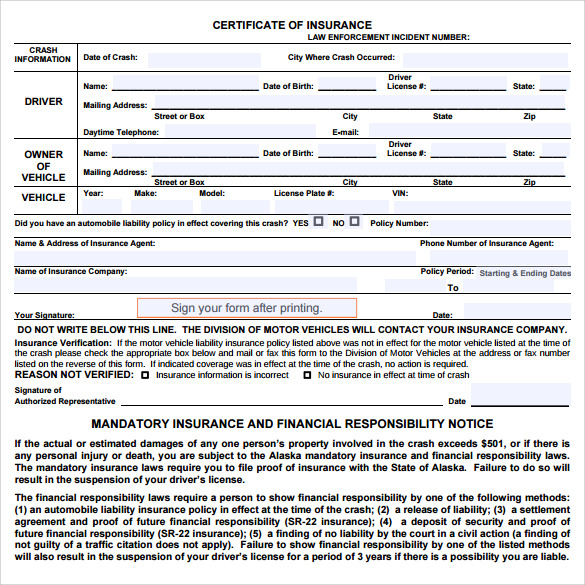

If you employ subcontractors, independent contractors or casual labor, check to make sure they have active workers� comp coverage. As it turns out, waiting for a renewal certificate of insurance might have avoided you being held liable for a loss that isn’t covered under your policy. Usually, you will need to call your insurance agent or send an email, and they’ll then mail you a hard copy. This includes information like coverage type, carrier information, important policy dates and policy limits. An new jersey certificate of insurance is a document that�s standard in the contracting business.

Source: businesscredentialingservices.com

Source: businesscredentialingservices.com

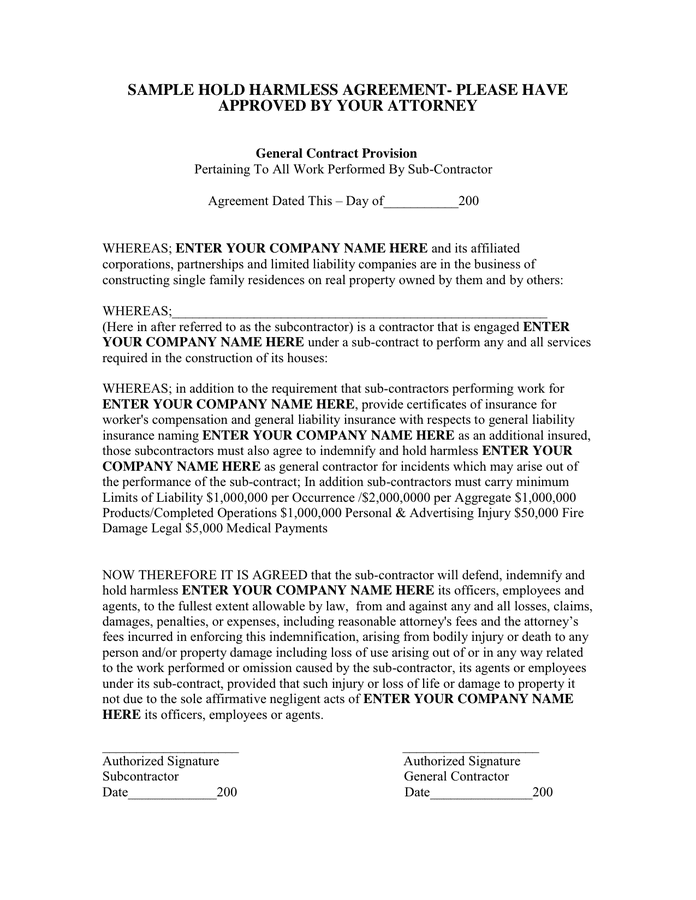

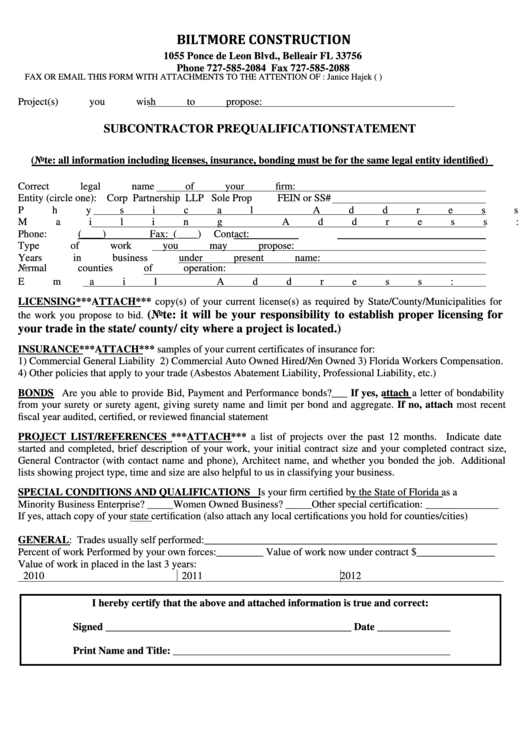

Pages 2 and 3 are excerpted from paragraphs 28, 29, and 30 of the subcontract. Subcontractor insurance requirements pdg construction services, inc., requires all subcontractors to provide a certificate of insurance for each project they are working on prior to commencement of any work, and as a precedent of payment. Pages 2 and 3 are excerpted from paragraphs 28, 29, and 30 of the subcontract. When your company hires subcontractors, it is extremely important to get a certificate of insurance from each subcontractor working for you. Certificates of insurance (coi) are an essential part of managing liability in an organization.

Source: log-cabin-connection.com

Source: log-cabin-connection.com

When the insurance expiration dates are passed, every time you try to transact with the subcontractor, you will receive this warning message and a suggestion to contact. Always obtain certificates of insurance for subcontractors. How to monitor subcontractor insurance certificates in quickbooks. If you bring on uninsured subcontractors, you run the risk of accepting liability for injuries or damages they cause. It’s critical that your partners are covered as well.

Source: stekelbeeslochristi.blogspot.com

Source: stekelbeeslochristi.blogspot.com

Failing to properly obtain, inspect, and update these documents can lead to risk transfer from contractors and increased exposure to unforeseen liabilities. When your company hires subcontractors, it is extremely important to get a certificate of insurance from each subcontractor working for you. Contractors, subcontractors and insurance certificates. It is essential and a policy condition that you obtain certificates of insurance from all subcontractors, hired to perform work on your behalf, which meet specific minimum insurance requirements. Any entity can be exposed to risk when using the services of outside independent contractors, subcontractors, service providers, vendors or any other organization who may supply materials or services.

Source: pinterest.com

Source: pinterest.com

To combat this, many subcontractors carry their own workers’ compensation insurance. Be aware of what your policy does and does not cover. A certificate of insurance is a legal document that proves you�re insured. Certificates of insurance (coi) are an essential part of managing liability in an organization. Certificate of insurance requirements this page is a brief summary of the insurance requirements.

Source: certificateof.club

Source: certificateof.club

Once you’ve done that, you can request a certificate of insurance. If you employ subcontractors, independent contractors or casual labor, check to make sure they have active workers� comp coverage. This certificate is issued to the city of chicago in consideration of the contract entered into with the named insured, and it is mutually understood that the city of chicago relies on this certificate as a basis for continuing such agreement with the named insured: In order to get a certificate of insurance for your contractor business, you need to first purchase an insurance policy. Why you should get certificates of insurance for subcontractors.

Source: formsbank.com

Source: formsbank.com

Certificates of insurance (coi) are an essential part of managing liability in an organization. Certificate of insurance collection and tracking software helps keep contractors from being responsible for a subcontractor’s workers when there is an accident on a job site. Following are guidelines, sample letters and checklists to assist you in managing subcontractor certificates of insurance. It is highly recommended that you only hire subcontractors who can provide a coi. You need to forward this to your insurance agent.

Source: sadlerco.com

Source: sadlerco.com

It is essential and a policy condition that you obtain certificates of insurance from all subcontractors, hired to perform work on your behalf, which meet specific minimum insurance requirements. It is essential and a policy condition that you obtain certificates of insurance from all subcontractors, hired to perform work on your behalf, which meet specific minimum insurance requirements. Most people won’t hire you to work on their homes or businesses without one. Common subcontractor insurance requirements certificates of insurance. A certificate of insurance (coi) is simply a standard form issued by the subcontractor’s insurance company summarizing the coverage he or she carries.

Source: sampletemplates.com

Source: sampletemplates.com

Certificates of insurance (coi) are an essential part of managing liability in an organization. As a contractor, require certificates of insurance from subcontractors as a contractor , you know the value of providing your customers with a certificate of insurance (coi). When the insurance expiration dates are passed, every time you try to transact with the subcontractor, you will receive this warning message and a suggestion to contact. Certificate of insurance collection and tracking software helps keep contractors from being responsible for a subcontractor’s workers when there is an accident on a job site. It’s critical that your partners are covered as well.

Source: contractor.idealchoiceinsurance.com

Source: contractor.idealchoiceinsurance.com

Following are guidelines, sample letters and checklists to assist you in managing subcontractor certificates of insurance. Failing to properly obtain, inspect, and update these documents can lead to risk transfer from contractors and increased exposure to unforeseen liabilities. Contractors, subcontractors and insurance certificates. When accounting for risks related to contracted work, securing your own insurance is not always enough. In order to get a certificate of insurance for your contractor business, you need to first purchase an insurance policy.

![]() Source: ideas.sybernews.com

Source: ideas.sybernews.com

All subcontractors are required to have an �approved certificate of insurance� on file with us prior to a certificate of insurance is a slip of paper (a digital or printed document), proving you have insurance coverage. A certificate of insurance is a legal document that proves you�re insured. Why you should get certificates of insurance for subcontractors. As it turns out, waiting for a renewal certificate of insurance might have avoided you being held liable for a loss that isn’t covered under your policy. To combat this, many subcontractors carry their own workers’ compensation insurance.

Source: paramythia.info

Source: paramythia.info

When your company hires subcontractors, it is extremely important to get a certificate of insurance from each subcontractor working for you. Many states’ laws allow an employee to “climb the ladder” until they find coverage. A certificate of insurance is a legal document that proves you�re insured. It is essential and a policy condition that you obtain certificates of insurance from all subcontractors, hired to perform work on your behalf, which meet specific minimum insurance requirements. Be aware of what your policy does and does not cover.

Source: neckerman.com

Source: neckerman.com

In order to get a certificate of insurance for your contractor business, you need to first purchase an insurance policy. Once you’ve done that, you can request a certificate of insurance. This certificate is issued to the city of chicago in consideration of the contract entered into with the named insured, and it is mutually understood that the city of chicago relies on this certificate as a basis for continuing such agreement with the named insured: Certificates of insurance (coi) are an essential part of managing liability in an organization. An new jersey certificate of insurance is a document that�s standard in the contracting business.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title certificates of insurance for subcontractors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea