Cgl meaning insurance information

Home » Trending » Cgl meaning insurance informationYour Cgl meaning insurance images are available in this site. Cgl meaning insurance are a topic that is being searched for and liked by netizens today. You can Get the Cgl meaning insurance files here. Download all royalty-free vectors.

If you’re searching for cgl meaning insurance pictures information linked to the cgl meaning insurance keyword, you have come to the ideal blog. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

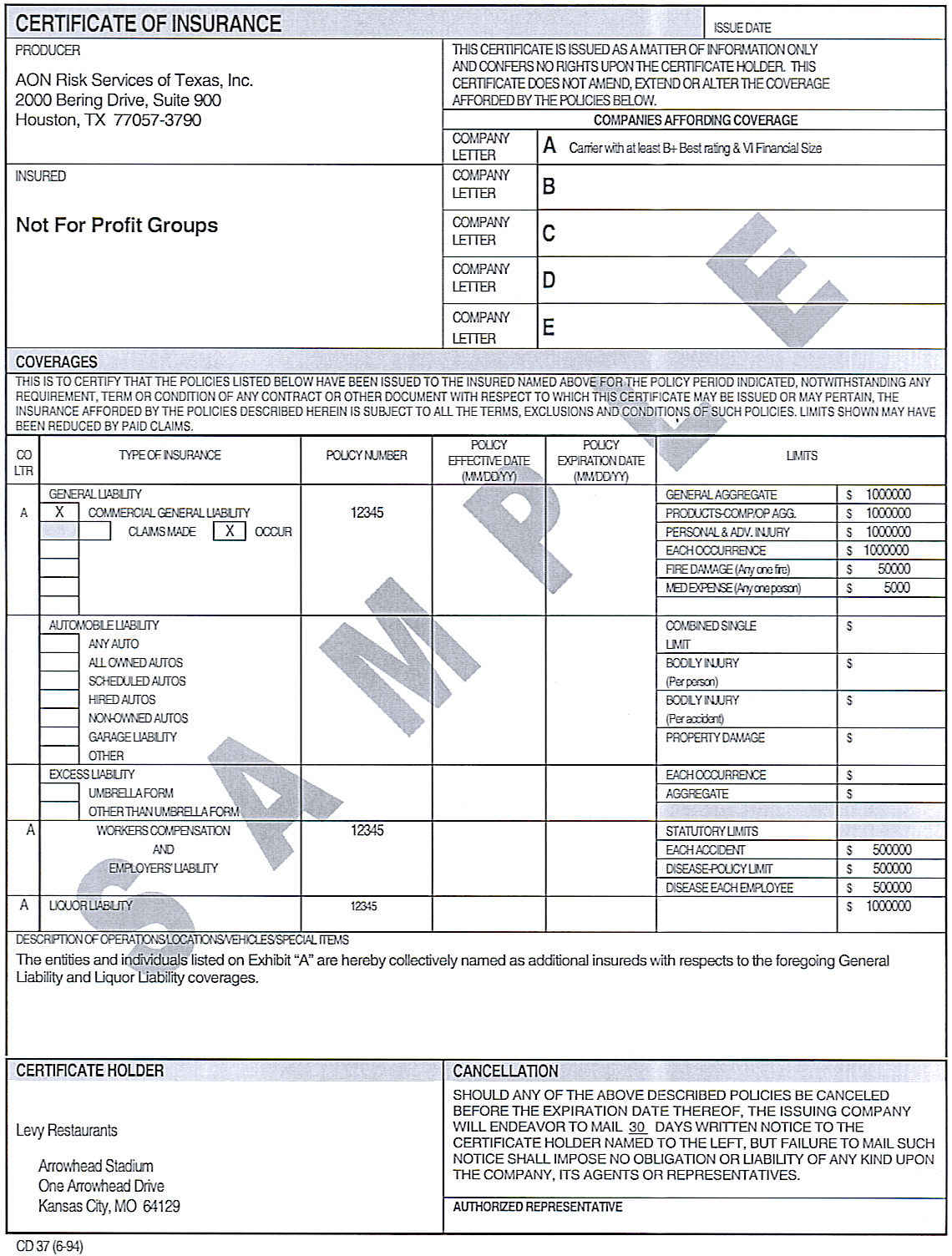

Cgl Meaning Insurance. It means, if your company, product, your work or anything associated with your business causes injury to someone like your client or their property, you could. Cgl insurance cgl (commercial general liability) insurance will protect your small business from financial losses. Most common cgl abbreviation full forms updated in february 2022 Commercial general liability (cgl) insurance cover your third party legal liability in respect of personal injury and property damage arising out of or in connection with operation or your business activities, cgl usually includes public liability, product liability, completed operation, workmen compensation, employers liability, automobile liability, umbrella, excess.

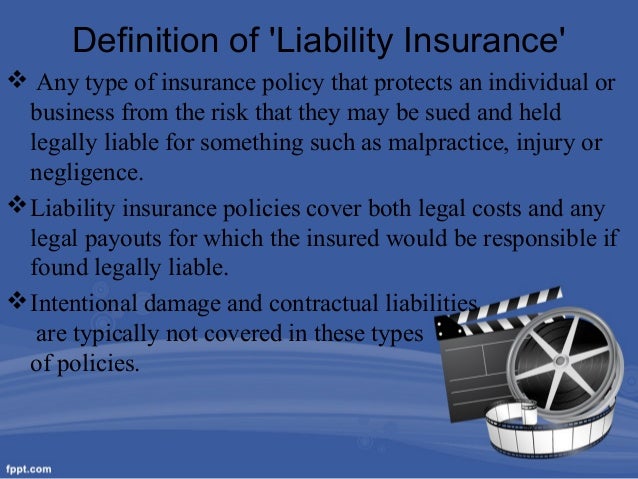

Film Liability insurance From slideshare.net

Film Liability insurance From slideshare.net

It safeguards business owners from the any property damage or bodily injury claims that individuals may file against an organization. Cgl insurance generally includes 3 types of insurance, bundled together into one package. This coverage is also known as general liability insurance or business liability insurance. Commercial general liability (cgl) policy — a standard insurance policy issued to business organizations to protect them against liability claims for bodily injury (bi) and property damage (pd) arising out of premises, operations, products, and completed operations; Working out this protection is the most important first step in […] What does cgl abbreviation stand for?

Cgl insurance stands for commercial general liability insurance.

Cgl insurance cgl (commercial general liability) insurance will protect your small business from financial losses. Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. Is an occurrence the bodily injury or property damage? accessed april 27, 2020. Commercial general liability (cgl) insurance covers your business from claims of bodily injuries and property damage as they relate to your business operations. What commercial general liability insurance covers. Hazard insurance policy means, with respect to each contract, the policy of fire and extended coverage insurance (and federal flood insurance, if the manufactured home is secured by an fha/va contract and such manufactured home is located in a federally designated special flood area) required to be maintained for the related manufactured home, as provided in section.

Source: enpam.blogspot.com

Source: enpam.blogspot.com

Working out this protection is the most important first step in […] List of 181 best cgl meaning forms based on popularity. Cgl insurance generally includes 3 types of insurance, bundled together into one package. The commercial general liability (“cgl”) policy is the standard policy of insurance issued to businesses and commercial organizations to insure against third party liability for, among other things, bodily injury andproperty damage that arising out of the course of the insured’s business Cgl is listed in the world�s largest and most authoritative dictionary database of abbreviations and acronyms the free dictionary

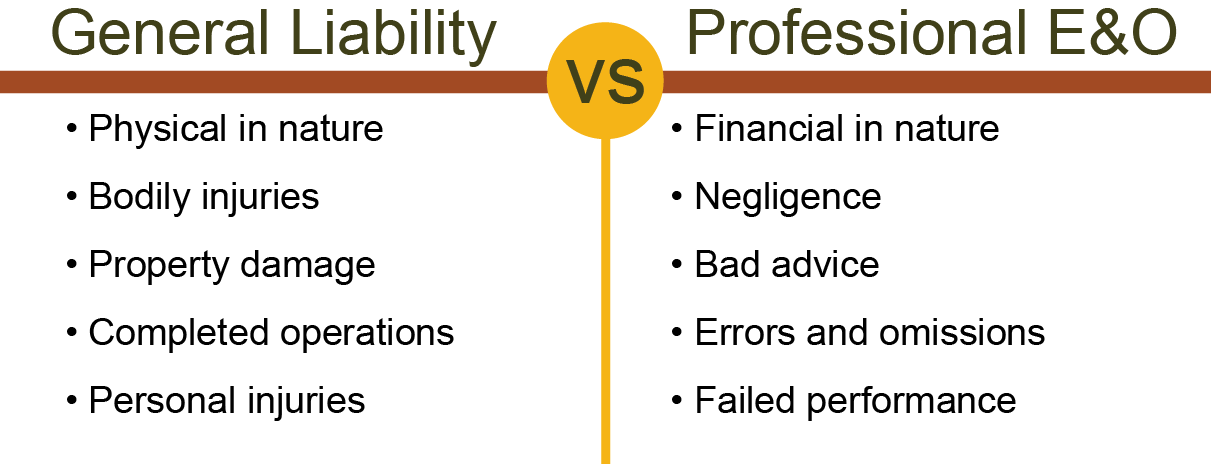

Source: generalliabilityshop.com

Source: generalliabilityshop.com

Cgl insurance cgl (commercial general liability) insurance will protect your small business from financial losses. Most common cgl abbreviation full forms updated in february 2022 Cgl is listed in the world�s largest and most authoritative dictionary database of abbreviations and acronyms the free dictionary Commercial general liability (cgl) insurance covers your business from claims of bodily injuries and property damage as they relate to your business operations. What commercial general liability insurance covers.

Source: canonprintermx410.blogspot.com

Cgl is the name for the overall community, ddlg is the part/kink. Cgl insurance cgl (commercial general liability) insurance will protect your small business from financial losses. This unique policy offers financial protection to the companies against public liability and product. General liability insurance definitions can get confusing. Cgl insurer means the debtor cgl insurers, the usopc insurers, and the karolyi insurer, each of which is identified in the schedule attached as exhibit a hereto.

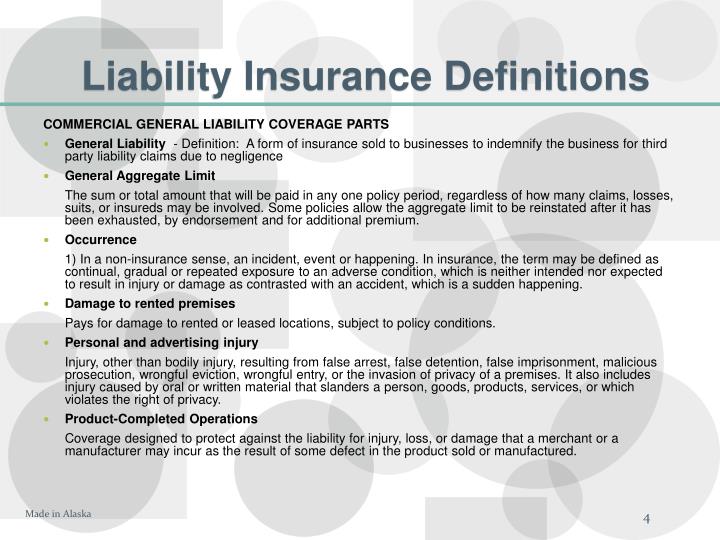

Source: slideserve.com

Source: slideserve.com

And advertising and personal injury (pi) liability. Cgl is the name for the overall community, ddlg is the part/kink. Working out this protection is the most important first step in […] A policy provides coverage to a business for bodily injury, personal injury, and property damage caused by the business. This coverage is also known as general liability insurance or business liability insurance.

Source: smemaxx.com

Source: smemaxx.com

And advertising and personal injury (pi) liability. This unique policy offers financial protection to the companies against public liability and product. The number of occurrences under a cgl policy. Cgl is the name for the overall community, ddlg is the part/kink. Commercial general liability (cgl) insurance cover your third party legal liability in respect of personal injury and property damage arising out of or in connection with operation or your business activities, cgl usually includes public liability, product liability, completed operation, workmen compensation, employers liability, automobile liability, umbrella, excess.

Source: honigconte.com

Source: honigconte.com

Cgl insurance cgl (commercial general liability) insurance will protect your small business from financial losses. Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. This coverage is also known as general liability insurance or business liability insurance. Commercial general liability insurance (cgl insurance) helps protect your business from claims that it caused bodily injury or property damage to another person’s belongings. Commercial general liability (cgl) insurance covers your business from claims of bodily injuries and property damage as they relate to your business operations.

Source: slideshare.net

Source: slideshare.net

Commercial general liability (cgl) is a form of comprehensive insurance that offers coverage in case of damage or injury caused by a business’s. These can range from property damage, lawsuits, advertising injury, or any other liabilities your company might have which relates to personal loss for a client or employee. A policy provides coverage to a business for bodily injury, personal injury, and property damage caused by the business. Cgl insurance cgl (commercial general liability) insurance will protect your small business from financial losses. The number of occurrences under a cgl policy.

Source: theandrewagency.com

Source: theandrewagency.com

Is an occurrence the bodily injury or property damage? accessed april 27, 2020. Cgl insurance generally includes 3 types of insurance, bundled together into one package. It’s a popular business insurance policy for small business owners and independent contractors. Commercial general liability (cgl) policy — a standard insurance policy issued to business organizations to protect them against liability claims for bodily injury (bi) and property damage (pd) arising out of premises, operations, products, and completed operations; This coverage is also known as general liability insurance or business liability insurance.

Source: uscaptiveinsurancelaw.com

Source: uscaptiveinsurancelaw.com

A cgl insurance policy will usually cover the costs of your legal defense and will pay on your behalf all damages if you are found liable—up to the limits of your policy. What commercial general liability insurance covers. Most common cgl abbreviation full forms updated in february 2022 Cgl coverage is one of the most important insurance products, due to the negative impact that a lawsuit can have on a. It was introduced in 1986 and still provides canadian companies with coverage against any surmountable financial loss that might result.

Source: insuredclaims.blogspot.com

Source: insuredclaims.blogspot.com

General liability insurance definitions can get confusing. These can range from property damage, lawsuits, advertising injury, or any other liabilities your company might have which relates to personal loss for a client or employee. Incurred by a third party from your routine business operations. Commercial general liability (cgl) is a form of comprehensive insurance that offers coverage in case of damage or injury caused by a business’s. Here�s what everything stands for:

Source: tokio-hotel-the-darkest-angels.blogspot.com

It safeguards business owners from the any property damage or bodily injury claims that individuals may file against an organization. What does cgl abbreviation stand for? What commercial general liability insurance covers. Commercial general liability insurance (cgl), also known as business liability insurance or simply general liability insurance, is a type of insurance policy that is specifically designed for businesses. Cgl insurance generally includes 3 types of insurance, bundled together into one package.

Source: pinterest.com

Source: pinterest.com

What is the meaning of cgl in insurance? Here�s what everything stands for: These can range from property damage, lawsuits, advertising injury, or any other liabilities your company might have which relates to personal loss for a client or employee. Hazard insurance policy means, with respect to each contract, the policy of fire and extended coverage insurance (and federal flood insurance, if the manufactured home is secured by an fha/va contract and such manufactured home is located in a federally designated special flood area) required to be maintained for the related manufactured home, as provided in section. The number of occurrences under a cgl policy.

Source: quotesgram.com

Source: quotesgram.com

Cgl insurance and the question of intent. accessed april 27, 2020. Cgl insurance stands for commercial general liability insurance. Hazard insurance policy means, with respect to each contract, the policy of fire and extended coverage insurance (and federal flood insurance, if the manufactured home is secured by an fha/va contract and such manufactured home is located in a federally designated special flood area) required to be maintained for the related manufactured home, as provided in section. A commercial general liability (cgl) insurance policy is designed to protect businesses against any legal liability that involves paying compensation for damage or injuries. The commercial general liability (“cgl”) policy is the standard policy of insurance issued to businesses and commercial organizations to insure against third party liability for, among other things, bodily injury andproperty damage that arising out of the course of the insured’s business

Source: lisbonlx.com

Source: lisbonlx.com

Commercial general liability (cgl) is a type of liability insurance for businesses. It was introduced in 1986 and still provides canadian companies with coverage against any surmountable financial loss that might result. Hazard insurance policy means, with respect to each contract, the policy of fire and extended coverage insurance (and federal flood insurance, if the manufactured home is secured by an fha/va contract and such manufactured home is located in a federally designated special flood area) required to be maintained for the related manufactured home, as provided in section. What does cgl abbreviation stand for? Cgl insurance stands for commercial general liability insurance.

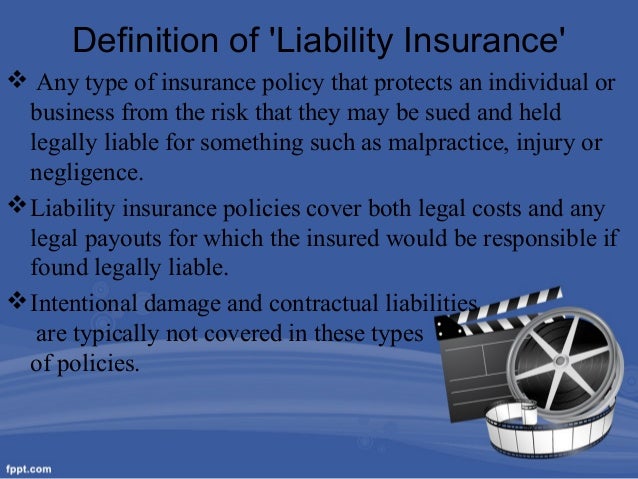

Source: slideshare.net

Source: slideshare.net

Here�s what everything stands for: Working out this protection is the most important first step in […] The number of occurrences under a cgl policy. What is the meaning of cgl in insurance? It’s a popular business insurance policy for small business owners and independent contractors.

Source: tokio-hotel-the-darkest-angels.blogspot.com

Source: tokio-hotel-the-darkest-angels.blogspot.com

Invest in direct mutual funds & new fund offer (nfo) discover 5000+ schemes. It was introduced in 1986 and still provides canadian companies with coverage against any surmountable financial loss that might result. List of 181 best cgl meaning forms based on popularity. Commercial general liability (cgl) insurance covers your business from claims of bodily injuries and property damage as they relate to your business operations. Commercial general liability (cgl) is a form of comprehensive insurance that offers coverage in case of damage or injury caused by a business’s.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Is an occurrence the bodily injury or property damage? accessed april 27, 2020. Commercial general liability coverage form, page 11. General liability insurance definitions can get confusing. Commercial general liability (cgl) is a type of liability insurance for businesses. Hazard insurance policy means, with respect to each contract, the policy of fire and extended coverage insurance (and federal flood insurance, if the manufactured home is secured by an fha/va contract and such manufactured home is located in a federally designated special flood area) required to be maintained for the related manufactured home, as provided in section.

Source: tokio-hotel-the-darkest-angels.blogspot.com

Source: tokio-hotel-the-darkest-angels.blogspot.com

Commercial general liability (cgl) is a form of comprehensive insurance that offers coverage in case of damage or injury caused by a business’s. Commercial general liability (cgl) insurance covers your business from claims of bodily injuries and property damage as they relate to your business operations. List of 181 best cgl meaning forms based on popularity. Commercial general liability insurance (cgl insurance) helps protect your business from claims that it caused bodily injury or property damage to another person’s belongings. A commercial general liability (cgl) insurance policy is designed to protect businesses against any legal liability that involves paying compensation for damage or injuries.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cgl meaning insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea